Michael Burry, who gained fame from The Big Short, is forecasting a collapse in artificial intelligence (AI) stocks.

I concur with Burry that an AI downturn is imminent.

However, not the one he anticipates.

In my view, AI resembles the dot-com era revisited.

After climbing throughout the 1990s, technology stocks plummeted 80% beginning in 2000.

I don't believe that's what's about to unfold with AI stocks. I elaborate on my reasoning in our "AI Endgame" presentation — you can view the recording right here.

The more significant dot-com "crash" investors should examine was the plunge in expenses.

In the early '90s, establishing a tech enterprise required millions.

You needed proprietary servers, computing facilities, and costly software packages. A basic website could demand hundreds of thousands merely to maintain online.

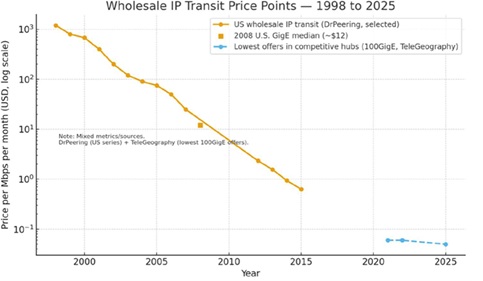

Back in 1998, transmitting information across the internet was prohibitively expensive. It cost approximately $1,200 per megabit monthly. Currently, it costs cents. The expense of pushing data through fiber has decreased roughly 10,000X:

Telecommunications companies installed 80 million miles of fiber, mostly "dark" and unutilized. This surplus triggered bandwidth prices to tumble 90%.

This cost plunge unleashed unprecedented innovation worldwide. Suddenly, you could build a billion-dollar venture from a university dormitory.

Consider the greatest internet enterprises ever. The most profitable stocks of our generation. All emerged during that period.

Netflix Inc. (NFLX:NASDAQ) — digital video streaming. Alphabet Inc. Class A (GOOGL:NASDAQ)— digital advertising. Meta Platforms Inc. (META:NASDAQ) — digital socializing.

The genuine opportunity of the internet wasn't in the infrastructure and hardware. It was in what could be created using them.

And none would have materialized without expenses first tumbling.

AI is traversing an identical trajectory.

The expense of generating AI tokens is rapidly declining.

If you're unfamiliar with AI tokens, they're the most crucial metric you've ever encountered.

When engaging with ChatGPT, it doesn't interpret your words like humans do. It fragments them into tiny segments called tokens. Each token functions like a puzzle piece that the AI examines to comprehend your inquiry.

You can envision tokens as fuel for the AI's processor. The more intricate or extensive your request, the more tokens it consumes to provide an answer.

Asking AI to create a brief pancake recipe might utilize several hundred tokens. But requesting it to program an entire website or compose a detailed research paper could consume millions.

The more tokens flowing through the system, the more chips, computational power, and electricity are being utilized to facilitate everything.

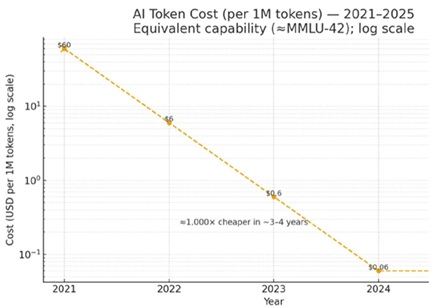

The expense of utilizing AI is diminishing by approximately 10X annually. A task costing $60 per million tokens in 2021 costs about six cents today. Operating an AI model like ChatGPT is now 1,000X less expensive than it was just three years ago!

Identical curve, identical opportunity.

During the 1990s, engineers discovered how to push additional data through existing fiber using techniques like advanced lasers and intelligent routers.

Today, AI engineers are learning to deliver more intelligence through existing hardware with superior algorithms and efficient chips.

We recognize when broadband became affordable enough. It enabled new "applications" like YouTube, Netflix, and Spotify Technology SA (SPOT:NTSE).

Now, we're producing intelligence "too inexpensive to measure." Popular AI companion application Character.AI handles approximately 20,000 queries/second and has managed to reduce expenses by 33X since 2022.

Affordable cognition will establish the Googles and Amazon.com Inc.s (AMZN:NASDAQ) of AI, companies transforming this infrastructure into pure profit.

Remember 'McBride's law.'

When expenses collapse, innovation accelerates.

It's a straightforward principle driving every major technological surge.

Bandwidth costs plummet, resulting in trillions of dollars in new internet enterprises.

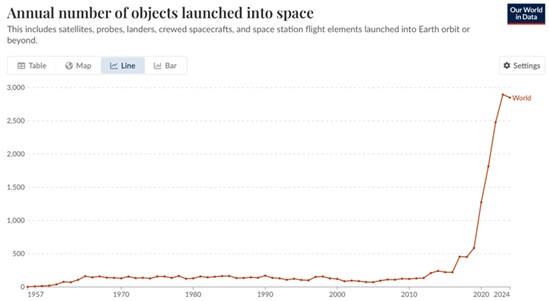

The same occurred in aerospace. Elon Musk's SpaceX reduced the cost of launching rockets into orbit by 96% over the past decade. The frequency of space launches has increased 10X since 2014.

Prepare for a surge of 'AI native' stocks.

The initial phase of the AI boom centered on infrastructure: chips, server arrays, cooling systems, and everything else comprising high-performance data centers.

Congratulations to Disruption Investor and Disruption_X members who profited from AI infrastructure stocks.

But Phase 2 belongs to AI-native companies leveraging falling AI costs to transform entire industries.

Imagine attorneys using AI to finalize contracts instantly. Biotechnology companies designing novel medications in weeks instead of years. Factories employing AI systems that optimize production without human intervention.

It's happening now.

The straightforward gains in AI infrastructure have been realized. It's time to redirect our focus to the next wave of winners.

If you're interested in learning more about this opportunity, watch the replay of my "AI Endgame" presentation.

I also discuss one of my preferred AI-native stocks in a special report.

You can access everything by clicking here.

I'll be writing more about the coming changes in the AI boom, and what it means for investors, in my free investing letter, The Jolt. You can sign up here.

| If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing. | Go here to join |

Important Disclosures:

- Stephen McBride: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.