Democracy has its roots in the Magna Carta, a historic document sealed by King John of England in 1215 under pressure from his rebellious barons. Written in Latin, the "Great Charter" established that the monarch was not above the law and documented the liberties of "free men," forming a foundation for individual rights in English and, later, American law. After his predecessor's expensive wars, King John faced financial difficulties. He imposed heavy taxes and abused the feudal system to extort more money from his barons. This alienated the barons, who, after John suffered further military and financial losses in France, rebelled against him and took control of London in 1215. With civil war looming, John was forced to negotiate and sealed the charter at Runnymede meadow.

The transfer of power from the monarchy to the citizenry was the first instance of democracy around the world. This is exactly what the inhabitants of the Big Apple experienced this week. In effect, it was a revolution of sorts with all of the attendant characteristics of the Storming of the Bastille in 1789, France, after Marie Antoinette said in reference to the underclasses, "Let them eat cake." The Wall Street power brokers who ride to work each morning in limousines should take heed of what happened to Marie and her king shortly thereafter. It was far worse than losing an election to a Ugandan national.

The point I make is that the stock market can choose to ignore watershed moments like this for only so long.

With the election of Uganda-born Zohran Mamdani to the office of Mayor of New York City this week, the elite class of New York financiers felt a shift in the "force" that has governed the financial capital of the world for the past 80 years. It was shortly after the Bretton Woods Agreement of 1944 that the baton was passed from London to New York, allowing the U.S. dollar to replace the British Pound as the world's reserve currency. Since then, almost every international transaction has had to pass through the New York institutional community before landing at its final destination abroad. With the election of a foreign-born, Islamic socialist to the office of the mayor, the once-capitalist-dominant landscape is now firmly in the hands of the underclasses (at least politically). They have been forced to sit idly by as Congress and the Fed have bailed out the banco-politico elite time after time after time, opting to save the NASDAQ and S&P 500 from bear market declines at the cost of runaway inflation, while the average citizen can barely afford lodging, let alone partaking of the record highs in stock prices.

The Talking Heads over at CNBC were quick to remind the viewers that "socialism has been tried before and it doesn't work," citing Venezuela and Cuba as examples of failed communist experiments. What they fail to mention are the legions of tent cities, encamped underpasses, and parks around the nation as examples of "failed capitalism" at its very worst.

As a die-hard capitalist, I was absolutely outraged by the bailouts back in 2008, where Congress opened up the cash drawer and handed the Wall Street banks billion upon billions of taxpayer dollars without as much as one senior bank executive missing their year-end bonus or (God forbid) winding up in jail. What is laughable is that the Wall Street crowd shrugged it off while failing to notice the legions of people rifling through dumpsters and lined up at the food banks while celebrating with MAGA hats that have "Dow 50,000!" on them. The hubris with which these "laissez-faire capitalists" thumb their nose at the plight of the working (and non-working) classes while crying massive crocodile tears at the insertion of a socialist immigrant as mayor is beyond comprehension and worthy of a vintage Monty Python skit.

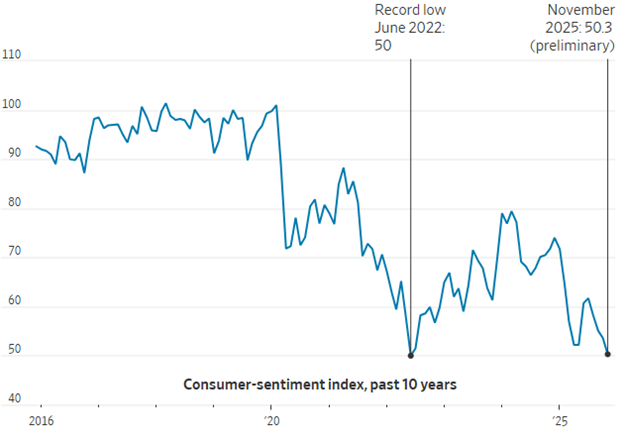

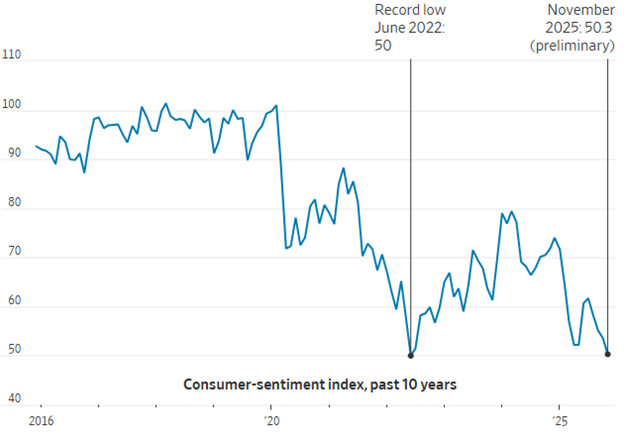

The University of Michigan report on consumer sentiment reflects the least amount of optimism since mid-2022, when inflation was running at 9%. Here we are three years later, and sentiment is once again in the tank with inflation running at somewhere around 3%. It seems that the rapidly approaching tsunami of job replacement by the AI robots has consumers terrified about future employment (or lack thereof). Of course, the survey could not have had many stock market investors polled, as sentiment for stocks has never been higher. Margin debt is through the roof, and dip-buyers prevail everywhere, such as Friday afternoon, when a 75-point plunge in the S&P turned into an 8.48-point gain in the very last hour.

Mamdami wants to have the municipal government take over grocery stores in order to make food more "affordable" and he wants the city to provide "free day care" and "free subway" and "free this" and "free that" and when asked how the City of New York will pay for these gifts for the underclasses, he proposed "tax increases on the billionaires" which means only one thing: the new financial capital of the world will soon be in Miami Beach where South Beach will be far more alluring than Manhattan or the Bronx.

"Money moves to where it is best treated" is an old horse chestnut that was drilled into me decades ago, and that is exactly what is going to happen in NYC. The only salvation possible is if the most powerful New York resident of today's day and age decides to invoke an "executive order" that supersedes the Constitution and vetoes everything that Mamdani tries to legislate. If that happens, there are over 3.5 million "new arrivals" (immigrants) that might take a page out of the January 6 playbook.

In any event, the election of Zohran Mamdani is a "bearish omen" for the markets.

Gold

I called the top in gold the week before it executed a sublime "blow-off top" in the move to the intraday high above US$4,400, after which it plunged over US$400 per ounce. It was not a secular top by any stretch of the imagination and was never purported (by me) to be anything other than a run-of-the-mill correction brought about by spending 56 days in overbought territory. I went from "hero" to "zero" inside of a week of calling that top, after which every Twitter SuperPersonality decided to take pock shots at me for the call, for which I make zero excuses. I have been trading gold since most of these fuzzy-cheeked armchair technicians were being breast-fed, so their tweet bombs serve to dissuade me in not one way, shape, or form.

Gold and silver are in long-term, secular bull markets. They will resume their uptrends in due course, but not within four days of the key outside reversal day that occurred on October 17. What needs to happen is a classic "flush" in which all the late longs get "flushed" down the drain with one final capitulatory plunge that scares the knickers off the newbies and restores the market to technical health.

I have circled the 100-dma for December gold as my re-entry point. That number is $3,617, and every week that passes, it rises. The 45° angle at which it is ascending is taking it toward the week's lows around $3,950 very quickly, but to play it properly, one needs true patience.

I have been watching with great and growing interest the "spin" that is leaking out of my former top blue-chip holding in all of the markets,Freeport-McMoRan Inc. (FCX:NYSE), a wonderfully-managed copper-gold producer that has treated me and my subscribers beautifully over the years.

I had held a core position in it since 2019, while coming away thoroughly impressed with the highly consistent "forward guidance" that rarely failed me since the Covid Crash that took this wonderful company's share price down to the unimaginable price of $4.87 in 2020.

Blessed with world-class deposits the world over, FCX enjoyed the dual bullish impacts of both gold and copper, two metals which I have interchanged as "top metals picks" since the pandemic lows. However, a few months ago, the spread between the tariff-created spread between London Metals Exchange prices and COMEX prices widened to what I considered an "unsustainable" level, so I issued a "Sell" on FCX north of US$45 per share and dumped my entire legacy position with great angst and tensile trepidation.

A month later, the mighty Grasberg Mine Complex suffered a "mud rush" that crippled the block cave and took the stock down to the mid-$30's, and since then, management has been desperately trying to regain market respect and confidence with repeated conference calls and analyst interviews. While Grasberg is not the bulk of their earnings and cash flow, it is significant and a key component of the global supply story for copper and gold. From what the market is hearing, it might be a lot longer than originally thought before Grasberg gets back to full operating capacity and output, which comes as a function of the extreme complexity of operating a block caving operation in any environment, let alone one with extreme precipitation like Indonesia. Without Grasberg, the supply chain gets severely impaired, affecting both copper and gold, and while gold has little sensitivity to the supply side, copper, by contrast, does get seriously impacted due to other supply impairments such as Kakula-Kamoa and El Cobre, where either ground or political conditions have curtailed production of the singular most critical metal of the Electrification Movement.

Copper remains my #1 metal on both a technical and fundamental basis, in contrast to the constant cheerleading over alleged silver shortages in London and on the Comex, neither of which I currently subscribe to. Contrary to what podcast rockstars would have you believe, there is no shortage of silver anywhere in the world but I guess if you keep repeating the narrative long enough over the dozens upon dozens of podcasts and interviews, you will eventually corral enough of the Millennials and Gen-Exers through sheer spin bombardment to make them all believe that silver actually does not reside in bountiful abundance in the slag heaps of the gargantuan base metal producers like Glencore and BHP and Antofagasta or in silver-bearing regions like Peru, Chile, and Mexico. In podcast after scintillating podcast, these social media celebrities mention silver at $100, $200, and $300 per ounce, failing at once to tell the salivating audiences that at those prices, supply in the form of both scrap and slag heaps will come pouring over the dam and into the crosshairs of the bullion banks.

However, there is no such case for copper. The red metal enjoys the very rare position of having no such supply upon which to draw. There are no slag heaps of copper, and there is no paucity of demand. In fact, copper sits in the most bullish demand-supply configuration of all the metals dating back to uranium in 2017. As the world ramps up the electrical grid to facilitate EVs and AI data farms, it will need to increase the ability to transmit that electric current, which means millions of miles of wiring , and unless those monetary mavens can think of silver filling that void, then the only metal left is copper.

My biggest holding in the junior resource space (by a wide margin) is Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB), led by a truly superior team of managers, which includes Chairman Campbell Smyth, who has assembled a truly unique team of seasoned professionals skilled at both the geological and financial levels. They came out of nowhere and landed in 2024 when I met the team at PDAC in Toronto, where I was impressed with the groundswell knowledge base of President Merlin Marr-Johnson, along with the extensive experience of COO Gilberto Schubert. (Management CVs can be viewed here.)

As a corporate finance executive in my past life, I have interviewed thousands of executives in the mining business, and I can state unequivocally that this is the best team of mining professionals that I have met in my 47 years in the industry. When I say that, I mean "in the field" because when it comes to outright promotion of the story, they are certainly not the utmost in terms of "abundant news flow". In fact, they could take a page out of Michael Saylor's Strategy Inc. (MSTR:NASDAQ) deal that is now seriously challenged but trades at a US$69 billion market cap with interviews, podcasts, and newsletter pumps arriving every other day with nauseating rapidity.

Their only claim to fame is their ownership of Bitcoin, and insofar as they have zero earnings or cash flow, it is their debt levels that threaten to derail them. By contrast, the Fitzroy team knows little of the artistry used by Michael Saylor or Elon Musk in selling dreams to their unsuspecting public. All these chaps understand is grade and width in the drill cores, and that is far more trustworthy than listening to Elon talking about his company's share price, which promises everything and delivers nothing except its reliance on his cult-like following and a Fed-driven bubble. The Fitzroy team also understands how to finance their exploration activities, having raised over CA$20,000,000 since February 2023, no small feat over that challenging time period. Fitzroy Minerals is set to release assays on three projects, with some coming from Buen Retiro and a number of critical ones from Caballos.

Make no mistake: I am seriously "talking my book" but after over four decades covering the space, I am not wrong. With a dearth of new supply on the immediate horizon, any new discoveries are going to be ferociously coveted, and I believe that the number one way to access this unprecedented surge in copper demand with above-average leverage is through Fitzroy Minerals Inc..

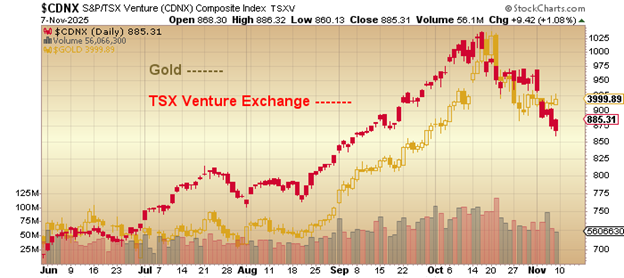

TSX Venture Exchange

Speaking of the junior mining space, I have always maintained that the TSX Venture Exchange inhales and exhales with the volatility of gold. The chart shown below is proof positive of the reliance of the Canadian junior resource market to gold prices. The TSX Venture Exchange got its cue from the Jackson Hole speech by Fed Chairman Jerome Powell, after which it advanced from 775 to over 1,000, a milestone it last breached in August 2021, which ironically matched the peak in gold the very same month.

It is not as if every TSXV-listed company is a gold explorer, developer, or producer; in fact, as of May 2025, only approximately 58% of the companies listed on the TSX Venture Exchange (TSXV) were resource-related (specifically mining and energy companies). However, rising gold prices tend to feed and fan the flames of unbridled speculation in the juniors, which is why I have tended to adjust allocations based upon my outlook for gold. Mind you, back in the day (1990s), there were so many new discoveries of gold, copper, nickel, and diamonds that it was the excitement of discovery that drove the animal spirits. Over the balance of the decade, I believe that as the world population grows and resources become less abundant, exploration by the junior resource sector is going to replace this infatuation with artificial intelligence and data farms. When the bloom finally comes off the technology rose, these new generations of "action-addicted" investors are going to migrate into exploration by the juniors, and when the trillions of dollars start chasing drill hole plays instead of CAPEX build-out plays, there will not be enough of them to fill the demand.

This new generation got a brief taste of the excitement of the junior resource sector when they started ramping up allocations during the gold and silver melt-up from August through October but trust me when I tell you that moves like we just witnessed pale in comparison to the mania of early ‘90's Great Canadian Diamond Rush or the Voisey's Bay Nickel play spearheaded by billionaire Robert Friedland into a $4.3 billion takeover of Diamondfield Resources that four years earlier was struggling to raise $500,000 for exploration. Once the AI and tech bubbles burst, I see massive capital inflows moving to the resource space as mineral after mineral is swept up into the "critical metal" designation by the U.S. government, just as copper and rhenium were last week.

The junior resource space is taking the same breather that gold and silver are taking, and as this correction runs its course, you want to be accumulating those junior explorers and developers with high-level teams and highly-prospective projects.

2026 and beyond will be the "Era of Exploration," and if it comes within a fraction of what happened in the 1990s, it will make AI look like AT&T.

| Want to be the first to know about interesting Gold and Copper investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Fitzroy Minerals Inc. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.