Good day to you from Kilkenny, Ireland, where I am appearing at Kilkenomics 2025,

What a lovely place, and what a splendid event.

Dr. John Wolstencroft has put his head above the parapet today. Worried about a UK fiscal crisis — aren't we all? — he's diversifying away from sterling into global stocks, commodities and dollar-denominated investments.

But first, ICYMI, here is this week's mid-week commentary.

So, over to you, Dr John.

Is it Time to Get Out of the UK?

I took this photograph in Lewisham last year when I was doing some work at Goldsmiths, part of the University of London, near New Cross station. Remarkably, it's about 12 minutes by train to the City, the financial heart of London and epicenter of Britain's wealth.

Of course, there are poor areas in London — there always have been — but as someone who's first wife grew up in Peckham, a pretty poor place that I visited regularly in the 80s, and who lived in London for over 10 years in the 80s and 90s, I can assure you it was not always like this, even in the less well-off areas people (of all ethnicities and cultures) still worked and took pride in their local environment.

In fact, I managed to find a photo of Peckham from the mid-80s, when I was at university in London, and one from today:

Guess which is which. And why is this important?

By now, it should be manifestly clear to all that a large proportion of the wealth generated by those parts of UK that still excel at innovation and creativity — including Cambridge, Oxford and parts of London, which is without doubt an economic powerhouse — is going to have to fund those parts of the UK in seemingly terminal decline — economically, socially, and culturally with increasing crime and state dependency.

This is possibly going to end badly. In the short term, higher taxes will damage entrepreneurship and productivity, and it seems clear that in the longer (or even medium) term, there are increasing chances of a fiscal crisis.

It might not end this way — sensible politicians on all sides are realizing that our entrepreneurial economy is being strangled by the demands of the "welfare economy," and the UK just might be saved.

However, right now, the 30-year UK debt is yielding 5.25%. Let's be clear, the UK government is not paying 5.25% because it issued bonds at much lower levels of interest. But when it has to refinance those debts as those bonds mature, it's going to have to pay higher rates than it currently does.

The "fiscal death spiral" will be when governments have to issue debt at such high interest rates that they have to issue even more debt at even higher rates, as confidence continues to be lost, simply to pay the interest on the debt they already issued at high rates. Eventually, the market realizes the debts simply cannot be repaid; the currency collapses, and after a bout of hyperinflation, political soul-searching, welfare cuts, and general chaos, the debt is inflated away, and the economy bounces back.

Many will blame profit-seeking "bond vigilantes" when this happens. I even saw an article that, as all bond sales are currently successful, it simply shows faith in the UK government(???). Let's be clear, everything has its price, but selling a bond at a high yield is a sign that you're not seen as a particularly attractive proposition. The sad truth is that markets can invest anywhere, and if UK debt isn't attractive on a risk-reward basis, the price will fall (and bond yields rise) until it is. Unfortunately, for the ones that were right (and, generally, they are on the right), "I told you so" won't do much good.

As Investors, How Can We Prepare for This?

The natural first responses are (a) sell the British pound because currencies generally fall in a fiscal crisis and (b) buy real assets such as gold (and, despite me, wrongly, never being a fan, Bitcoin).

But if we are selling something, we have to buy something else, and the question is, what, when gold and Bitcoin are at or near all-time highs?

Developed Europe has similar fiscal problems, as does the U.S.A., but, whatever you think of Trump, it's undeniable that in the U.S.A., they both acknowledge there is a problem with vast swathes of society becoming unproductive, and are attempting to do something to fix it. The U.S. is still a growing economy, unlike the UK where GDP per capita increases are barely moving at all. The U.S. does have massive fiscal deficits, but its currency has already fallen this year and, being the global reserve currency, is as good a fiscal get-out-of-jail-free card as it gets. And the state is so much smaller over there (36% of GDP compared to 45% in the UK).

How to Diversify

The easiest way to "sell the pound" is to invest in assets that are not pound-denominated or that generate income in non-pound currencies. These would include global companies and global bonds. All UK-based readers out there will almost certainly be over-exposed to the UK economy by having a house in the UK or pensions obligations that pay out in GBP. Let's not forget, though, that much of the FTSE 100's earnings are globally-oriented and U.S. dollar-based, so it's not all bad investing in stocks on the LSE.

For safety, if you want to park money, but not in pounds, you might look at some ETFs that invest in U.S. treasuries, such as the ishares US treasury 1-3 year (IBTS:LSE). It has a reasonable yield of over 3% and will move up (or down) in tandem with any depreciation (or appreciation) in the pound. Dealing spreads and annual charges are small. Investing in this is tantamount to selling the pound and buying the dollar.

An old favorite of mine, Volta (VTA:EURONEXT) invests in European and American high-risk debt, so we are selling the pound to buy debt issued by companies denominated in EUR and USD. It's up a lot this year as the discount has narrowed. The yield is still good, so it might still be worth considering — if you believe we are in for a fiscal as opposed to an economic crisis, because in an economic crisis, there will be defaults and high-yield debt will fall in value.

If you are braver, you can take negative pound positions (versus the yen, U.S. dollar or euro, Australian or New Zealand dollars, for example) on spread-betting platforms, if you are UK-based, or CFDs otherwise. That is, sell the pound and buy, for example, the yen. These are very highly leveraged, so even small changes in exchange rates can cause massive losses or profits. These types of "investments" really are not for the faint-hearted. Please don't forget that the vast majority of leveraged investors on these platforms lose money, and often very quickly.

To Other Markets

Real commodity-based assets — apart from oil — have been on a tear recently (I now have about 12% of my net worth in gold and gold shares, up from about 5% a couple of years ago, and I've really not bought much).

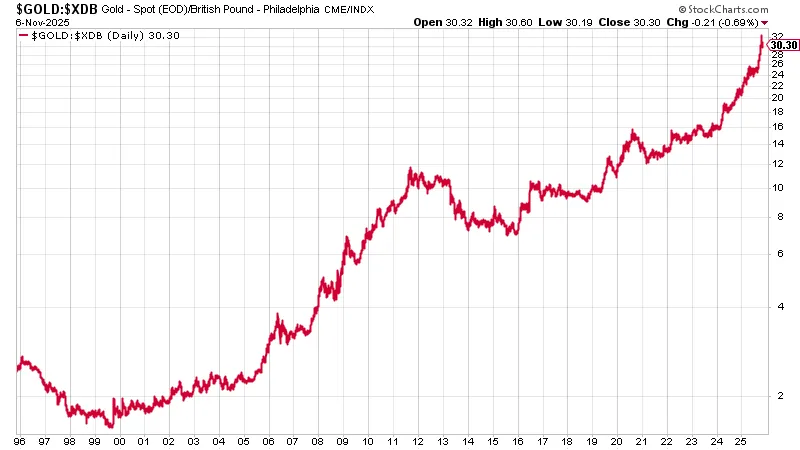

I'm hesitant about buying gold at these levels, but to any long-term investor, it should be clear by now that we all should have some gold exposure when one looks at the gold price in Sterling:

Oil is behaving very strangely — I am currently short oil to offset my very long oil equity positions — as all technical indicators point to it falling in price, so I suspect that it is maintaining value for reasons other than fundamental supply and demand. Oil, in terms of gold, is at its cheapest it's ever been apart from during COVID. Despite all the momentum precious metals are having, the long-term investor part of my brain tells me oil is a better investment now than gold, and it certainly will be if it gets into the 50s.

As an aside, and related to commodities pricing, the price of financial assets in the short term is simply set by the price people are willing to buy and sell. The costs of mining new gold or Bitcoin, or producing oil, will always bear some relationship to the price, but most of the time, with financialized assets, it is narratives that drive the price. The narrative causes people to want to invest and makes them prepared to buy at higher prices.

This has been very evident in platinum, for example, which was in the doldrums for many years despite very strong supply-demand and production-cost technical fundamentals. Recently, the real-assets narrative has taken hold, and platinum has piggybacked onto gold, which was unexpected by almost all analysts.

The London Bullion Market Association stated at the start of 2025, "The forecasts for platinum reveal low expectations, with an average price forecast of $1,022.31 — just $67 greater than the actual price average for 2024. This reveals a similar bearish sentiment to last year's forecast survey." When narratives become entrenched, fundamental value based on resource extraction cost and market price can disconnect massively. Platinum is over $1500 as I write.

Real assets include property and infrastructure, but I think investing in non-UK property is too complex, and infrastructure trusts have had a torrid time recently. The NAV issue has finally materialized, and investors simply don't believe NAV valuations anymore. Recently, Aberdeen Diversified (ADIG:LSEG) announced a sale of a bunch of private-market assets at a discount of about 30% to NAV. I think there is value in some parts of this sector, but that's another story.

Mining shares — as a proxy for the types of real assets that you can't easily buy physically or in ETFs — in general have done very well this year, but I think they still represent reasonable value. Many of their share prices are still lower than they were a few years ago. Personally, I am increasing my exposure to mining stocks. Black Rock World Mining (BRWM:LSE) is, I think, a good choice. As is the Van Eck global mining ETF (GDIG:LSE). If you are worried that these generalist mining vehicles have too much gold exposure, then a non-gold-company heavy ETF such as the VanEck Green Metals ETF (GMET:AMEX) might be worth a look.

I am maintaining my gold, silver, and platinum exposure, but from here I will sell into any rises. I still can't bear to buy Bitcoin; sorry, Dominic, can't say you were wrong, though.

I am increasing exposure to global stocks — especially dividend-paying stocks in Asia, an area that doesn't suffer from the same fiscal problems as the West. Aberdeen Asian Income (AAIF:LSE) is one of my larger holdings.

But, overall, I am increasing cash exposure outside the pound.

One mustn't forget that businesses, especially in the West, can still thrive through all the government incompetence of fiscal ineptitude, poor state-run productivity, and wasted money through woke-ism. But sooner or later, incompetent governments do impact the real economy. Many western governments are in a similar mess to the UK, but the UK is in a uniquely weak position due to not being in the Eurozone and having one of the truly worst governments one could imagine. Like Dominic, I am British, and I love my country, so it makes me very sad.

I am holding on to oil. It's not been a good year for oil, but I think we are close to the nadir. I will talk about oil next time.

Until then,

Have a lovely week,

Dominic and John.

If you'd like to read more from Dominic, you can sign up for The Flying Frisby here.

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dominic Frisby: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Dr. John Wolstencroft: I, or members of my immediate household or family, own securities of: ishares US treasury 1-3 year ETF, Volta, Aberdeen Diversified, Black Rock World Mining, Van Eck global mining ETF, Aberdeen Asian Income.. My company has a financial relationship with:None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Dominic Frisby Disclosures: This letter is not regulated by the FCA or any other body as a financial advisor, so anything you read above does not constitute regulated financial advice. It is an expression of opinion only. Please do your own due diligence and if in any doubt consult with a financial advisor. Markets go down as well as up, especially junior resource stocks. We do not know your personal financial circumstances, only you do. Never speculate with money you can’t afford to lose.