I've been writing so much about gold and silver lately, I need to cover something else.

But my quick take: as seemed likely, gold and silver have gone into one of their corrective phases. This is likely to last several months, in the humble opinion of this writer. There'll be false dawns, which catch everyone out, and false deaths too, with the overall trend being sideways.

In the event of a broader stock market correction — which is long overdue, given the scale of this rally since the Tariff Tantrum™ in the spring — gold and, especially, silver will sell off along with everything else. That doesn't mean gold isn't a safe haven. It just means there is a lot of hot money in gold, which quickly gets liquidated in a sell-off.

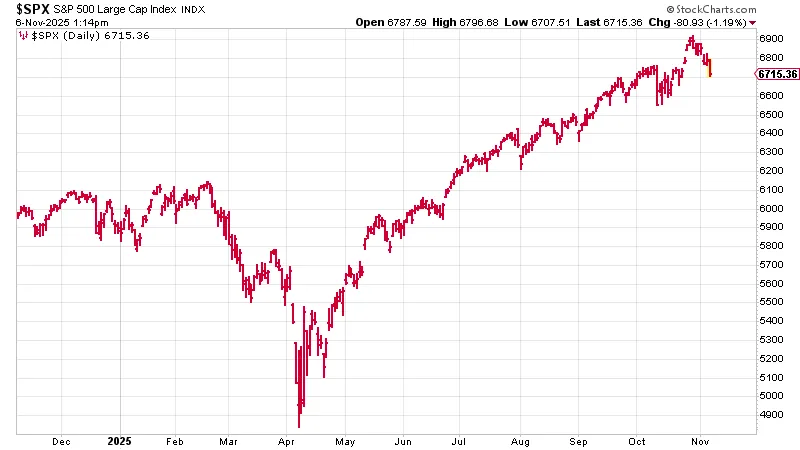

But, yes, this incredible rally we have seen in the S&P500 since the Tariff Tantrum™ is looking exhausted and seems to be rolling over.

Bitcoin is taking a hit too — although not as big a hit as the broader crypto space — and Bitcoin is what I want to look at today.

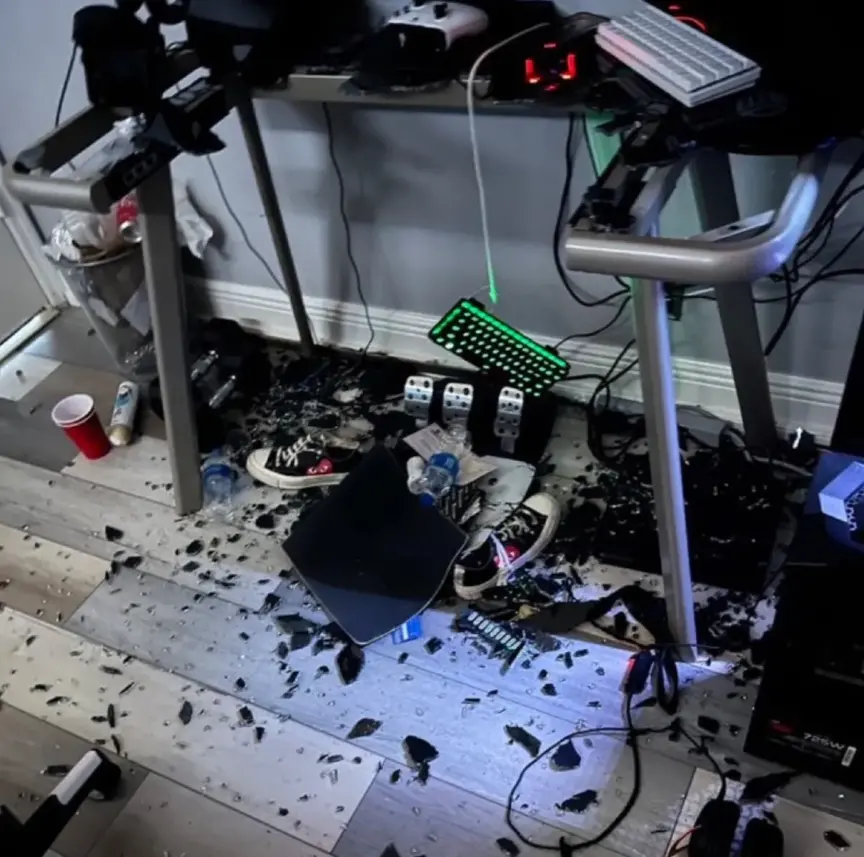

Here is one crypto trader's desk, as pictured on Twitter during last Tuesday's sell-off:

That's what happens when you use too much leverage.

What do they say about taking the emotion out of trading?

Bitcoin — What Gives?

So many things have happened this year that have blown winds in Bitcoin's favor:

-

A newly elected U.S. administration, which very pro crypto

-

A deliberately weaker dollar and the debasement trade

-

The launch of the Bitcoin ETFs in the U.S., increasing access to much larger flows of capital

-

Strength in tech stocks generally

-

A risk-on appetite

-

The halving cycle

-

And more

Yet, Bitcoin feels like it hasn't quite delivered. A new high of 'only' $125,000.

The latest narrative doing the rounds is this idea that the launch of the Bitcoin ETFs is like Bitcoin's IPO. Just as when a big tech stock IPOs, a lot of early seed money takes the opportunity to exit, so are many early Bitcoin investors — so-called OGs — now moving on. That would explain the many coins that have been moved from previously dormant wallets to exchanges over the last six months.

Maybe.

What can I say?

You can either decide that Bitcoin's time is done. It's game over. Move on.

Or you can treat this like another of the numerous shake-outs that have taken Bitcoin in the 16 years since its inception. The story was getting a bit tired. It needs a shake-out to ruffle a few feathers and purge.

The moral of every previous correction can be summed up in 4 letters: HODL. [The symbol of the Van Eck Bitcoin ETF (HODL)]

It looks like we may have got a bit of a crypto winter to get through. If the winter reflects the previous summer, then this one shouldn't be too bad. But consolidation phases can be frustrating, so the secret is to be quite zen about the whole thing and keep your eye on the bigger picture.

Bitcoin bear markets can be painful, but the beauty of them is that, unlike mining bear markets, which can go on for a decade or more, they tend to be short-lived.

Treat bear markets as opportunities. They're a good time to build positions, build businesses, and more. Go and watch some Michael Saylor videos and re-indoctrinate yourself.

But on no account lose your position. Bull markets come along when you least expect them.

Everything is looking a bit red at the moment - gold, silver, the S&P500, Bitcoin. It might be the end of this cycle. but it's not the end of the world.

I don't know when or where this Bitcoin correction ends. My guess is around $90,000, but that's nothing more than a guess. Perhaps we revisit $75,000 — which is the level we hit during the Tariff Tantrum™ earlier this year.

But it's just as possible that the dip below $100k on Tuesday was a fake-out, and the bear market is already done.

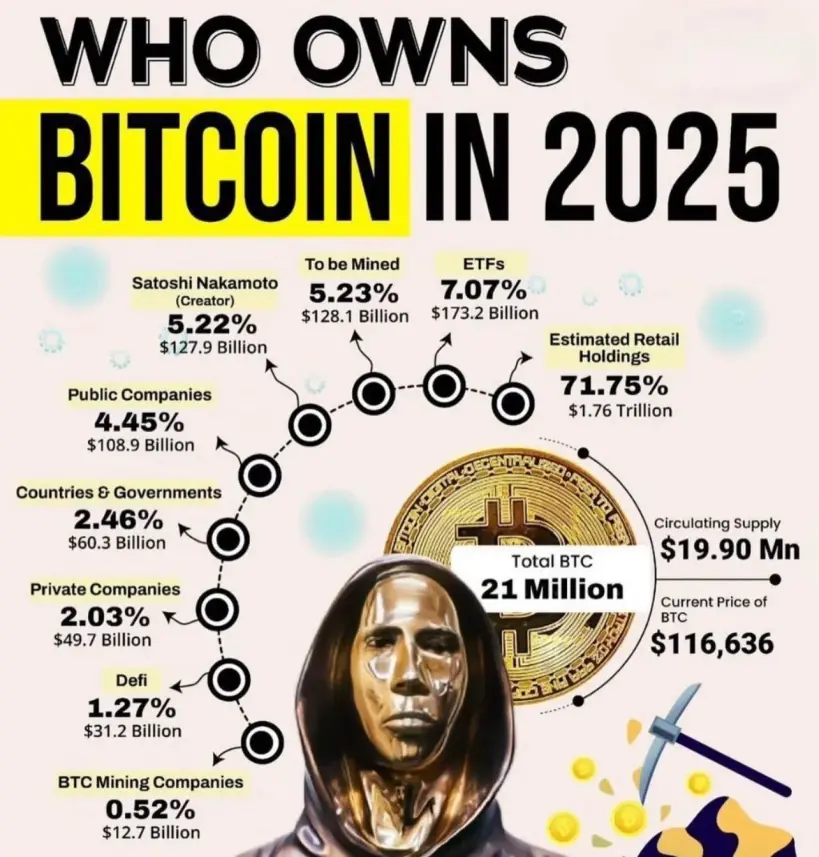

I thought this graphic was interesting.

There is plenty more room for future buying as governments and corporations try to increase their positions.

By the way, I get that some readers like Bitcoin and others don't. That's fine. Each to their own. However, if you are in the latter camp, you do not need to email me and tell me Bitcoin is not real money/quantum computing is going to destroy it/it is an invention of the deep state/ it is a scam. Please also feel no need to regurgitate Peter Schiff tweets either. (I'm fairly sure he is paid to slag Bitcoin off by the way).

Turning now to the clusterfook that is the UK

Buying Bitcoin ETFs in the UK: The Hows, Whats, and Whys

It's semantics, but you can't actually buy ETFs in the UK; you have to buy ETNs. I'm not even going to bother trying to explain it. It's regulatory bollocks and not worth wasting time or brain power over.

October 8, the date when the FCA decided UK citizens are allowed to buy Bitcoin ETNs, is now behind us, but the farce is not.

I first found out about Bitcoin in December 2010 when it was 22c. I was sent my first coins soon after. I wrote the first book on Bitcoin from a recognised publisher in 2014. Yet, this morning I just attempted to complete the FCA's form to get me approved to buy a Bitcoin ETN — so that I understand the risks — and I failed it.

The "correct" answer to their questions is actually the wrong answer. Absolute farce of an organization and accountable to no one, so it will continue.

In the U.S., meanwhile, JP Morgan is in the process of enabling Bitcoin to be used as mortgage collateral.

It's like being in Spain in 1492, the ship is setting sail to the New World, and somebody from the FCA is standing on the gangplank with a clipboard, stopping UK citizens from getting onboard.

Amongst the plethora of moronic barriers which the FCA has laid down is that Bitcoin carries the same risk as any other cryptocurrency — including the latest meme, scam, or shitcoin. Bitcoin is not fartcoin, and categorising the two together reveals the scary depths of FCA ignorance.

Meanwhile, from next year, you won't be able to buy Bitcoin ETNs in your ISA; you will have to get a special ISA. They are trying to kill us with bureaucracy, I'm convinced of it.

Which Broker and Which ETN?

In terms of enabling their customers to invest, the UK brokers have ranged from excellent — Interactive Investor, which went live on day 1, as boss Richard Wilson proudly tells me — to totally useless — Hargreaves Lansdown and AJ Bellend.

Hargreaves Lansdown, apparently trying to give the FCA a run for its brainless money, even put out the following statement.

"Bitcoin is not an asset class, and we do not think cryptocurrency has characteristics that mean it should be included in portfolios for growth or income and shouldn't be relied upon to help clients meet their financial goals … Unlike other alternative asset classes, it has no intrinsic value."

Talk about dumb.

If you want to be able to invest in these things via your SIPP or ISA, moving your account to Interactive Investor is my advice. Use this affiliate link , and you get a year for free.

I should stress that buying Bitcoin via a broker negates many of Bitcoin's uses. Yes, you get the store-of-value benefits, but you can't send and receive it; you can't use it to make payments or donations; you don't have sovereignty — the fund manager does — and so there is considerable counterparty risk — the coins could be confiscated, the fund could go bust, etc. You don't have anonymity either.

Still, it's better than no exposure at all.

But which ETN should you go for? And what about the treasury companies?

And, what indeed about Semler Scientific (SMLR:NASDAQ)?

We'll start with a list of the main sterling-denominated ETNs you can buy in the UK and their tickers.

I've listed them roughly in order of market cap with the first two being north of £1 billion now, although, with Bitcoin being so liquid, the market cap should not matter to liquidity, in theory at least.

-

CoinShares Physical Bitcoin (BITC)

-

WisdomTree Physical Bitcoin (WXBT)

-

Fidelity Physical Bitcoin (FBTG)

-

iShares Bitcoin (IB1T)

-

Invesco Physical Bitcoin (BTIP)

-

21Shares Bitcoin Core ETP (CBTC)

-

Bitwise Core Bitcoin (BTC1)

Coinshares, at 0.25%, carries the highest charges. Bitwise, at 0.05%, carries the lowest, though this rises from next April to 0.2%. 21 Shares is 0.10%.

Were I to buy one, I think Wisdom Tree is probably best, as there is the safety of its market cap, coupled with a relatively modest annual fee of 0.15%

A Final Word on Treasury Companies

The air has well and truly come out of this part of the market.

The value trap that is Semler Scientific, I am going to continue to hold. Its merger with Strive (ASST) is verging on the farcical, given the decline in the latter's share price: from $9 in September to 83c in October.

It's still unclear whether this deal is going to go through, but Semler is currently valued at less than its Bitcoin holdings, so I'm going to carry on holding until it trades at a premium, which it should do eventually. I don't feel bold enough to recommend Strive, but, as you can see from the chart above, the stock has had two huge rallies this year — one to $13, the other to $9 — there's no reason it can't get pumped again, in which case it should carry Semler with it.

In the UK, Smarter Web Company (SWC) has come down with a bump to around 50p; this was 500p at one point. And there is a new listing, B HODL (HODL), which I like the look of. I know and like the CEO, Freddie New.

I don't think we are quite at the point of buying yet. Let's see to what extent any broader market correction plays out. But some treasury companies are definitely on my shopping list when the time is right.

If you'd like to read more from Dominic, you can sign up for The Flying Frisby here.

| Want to be the first to know about interesting Cryptocurrency / Blockchain investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dominic Frisby: I, or members of my immediate household or family, own securities of: Semler Scientific. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Dominic Frisby Disclosures: This letter is not regulated by the FCA or any other body as a financial advisor, so anything you read above does not constitute regulated financial advice. It is an expression of opinion only. Please do your own due diligence and if in any doubt consult with a financial advisor. Markets go down as well as up, especially junior resource stocks. We do not know your personal financial circumstances, only you do. Never speculate with money you can’t afford to lose.