Gold has been in corrective mode since October 21, when it double-topped at about $4380, and investors are asking. . .

What are the drivers of this pullback? Well, from a technical standpoint, oscillators were overbought, and sentiment was a bit frothy.

The big catalyst was sudden concern about the prospect of more rate cuts from the Fed. The "good news" for gold bugs is that job growth appears to have turned negative, and that makes a December cut more likely than it was just days ago.

Also, the U.S. Supreme Court ruling on Trump's tariffs is upcoming. If the court kills the tariffs, there could be a huge stock market rally . . . initially.

If Trump folds on his tariffs from that point, money managers will begin to focus on the government's horrific debt situation again. It's been papered over since Musk left DOGE, and there has been hope that the tariff revenues could help with the debt.

A renewed focus on the debt would be very positive for gold.

On the other hand, if Trump pushes ahead with new tariffs to make up for the cancelled ones, this could create more uncertainty, and of course, uncertainty is good for gold!

Here's a look at a key daily chart for this fantastic monetary metal:

Stochastics is finally overbought and close to a buy signal, after experiencing one of its longest overbought situations ever. $3900 is becoming support, and a big rally appears imminent.

Here's a look at the weekly chart, which is stunning:

It's possible (and arguably probable) that this current correction is going to create a huge bull flag that targets the $6500 area for gold. That was my original long-term target for gold.

It's a target I've since revised to $15,0000-$20,000 due to the global loss of confidence in all fiat money.

What about the miners? Well, here's an interesting chart of the important GDXJ ETF:

Bullish Stochastics is doing battle with a pesky H&S top pattern.

Elliott Wave analysis would suggest this has been a minor five-wave decline, and a significant rally probably would have started today if the U.S. jobs report had been released.

The bottom line: The computer age created millions of jobs, and AI may destroy them even faster than they were created!

It's a time to begin averaging into GDXJ and SGDJ, and into their component stocks.

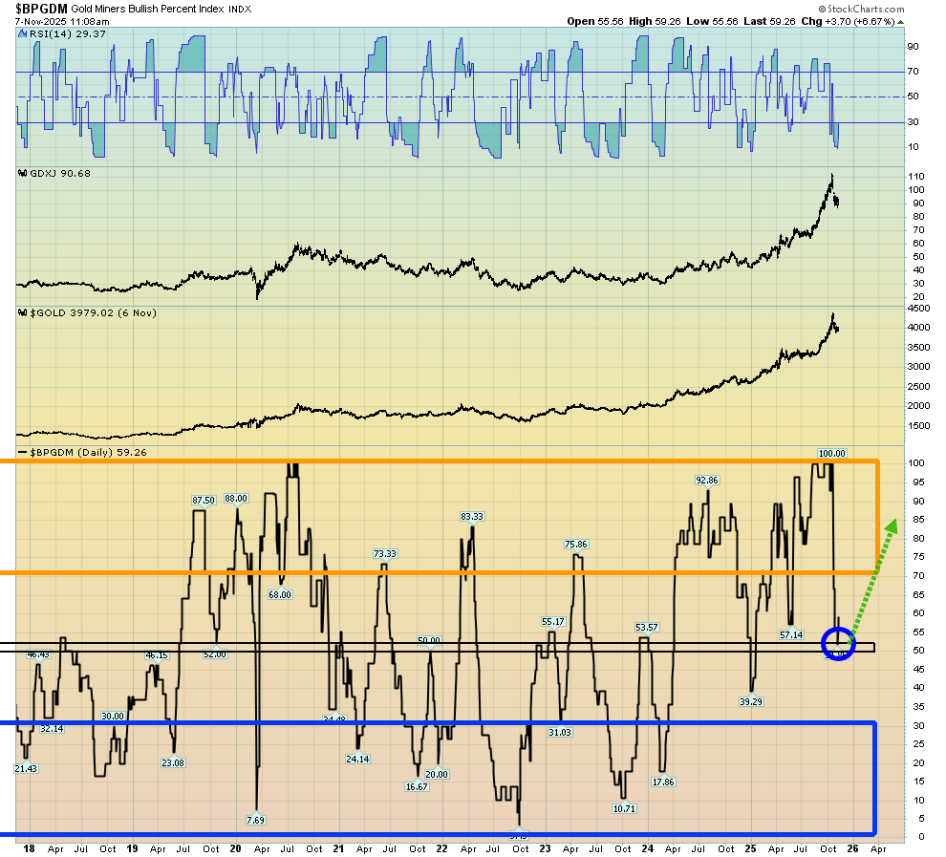

Sentiment? Here's a nice sentiment chart, the BPGDM:

It's bouncing off the 50 line, where momentum-oriented rallies often begin.

CDNX-listed junior stocks are the darling of many Western gold bugs. Finding gold is a difficult task, and when the going gets tough, the tough must get going!

One exciting explorer that is ignoring the pullback in the CDNX is Searchlight Resources Inc. (SCLT:TSXV; SCLTF:OTCQB). Here's a snapshot of this Saskatchewan-focused high-risk and high-potential-reward junior stock:

Here's an enticing chart:

The key to investor success in a correction is to keep the mood "peppy." A huge saucer bottom is in play for Searchlight, and a blast into resistance at 25 cents seems highly likely to be the next order of business for this stock.

To sum up the overall market, there could be a bit more corrective price action for the miners over the next six to eight weeks, but now is the time to average into those of interest and get ready for "multi-bagger" fun in the year 2026!

Special Offer for Streetwise Readers: Please send me an Email to [email protected] and I'll send you my free "GDXJ: It's Time For Buy-Side Play! report. I highlight some of the most exciting component stocks in this incredible index, with winning buy and sell tactics included for investors! Junior mine stock investing isn't for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! I write my junior resource stocks newsletter 2-3 times a week, and at just $199/12mths it's an investor favourite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I'll get you onboard. Thank-you!

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Stewart Thomson: I, or members of my immediate household or family, own securities of: GDX. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?