Please do not ask me how I got onto this subject, but ancient philosophy has always intrigued me, which, for many of you, may start in the 1950s, with hula-hoops, fedoras, and skinny ties, and which was also the decade in which I was born and started school. Of all the ancient philosophers, Plato (c. 428/427 – 348/347 BCE) was always the one who drew my attention. An ancient Greek philosopher who, along with his teacher Socrates and his student Aristotle, Plato is today considered a central figure in the history of Western philosophy. His work laid the foundations for much of Western thought, influencing areas from ethics and politics to metaphysics and epistemology.

Many of Plato's quotes are applicable to the world of trading. He is credited with quotes that cover a range of themes, including wisdom, knowledge, and the human condition.

Popular quotes include "The only good is knowledge and the only evil is ignorance," "An unexamined life is not worth living," and "The measure of a man is what he does with power," with the latter particularly relevant to the Trump presidency and liberal use of the power called "executive order."

Other notable quotes discuss the importance of education, the nature of love, and the consequences of civic participation, which all have a way of landing in the behavior of traders and investors the world over. Plato described the human soul as having three parts: reason (which should rule), spirit (which loves honor), and appetite (which desires bodily pleasures). Justice in an individual is achieved when these three parts are in harmony.

One particular Plato-ism is "A good decision is based on knowledge and not on numbers," and for a chap like me, schooled in finance and accounting from a highly-reputed business school like SLU, it carries impact. In the early days of my career, breaking down an income statement or dissecting a balance sheet were important tools to use in analyzing a company's investment merits. Calculating the debt-equity ratios or performing the "acid test" were important determinants for the actual decision to pull the trigger on a trade.

However, over the years, the rise in the usage of technical analysis muscled out the fundamental analysts' importance, including the highly advanced form of "T.A." known as "quantitative analysis," which is the study of historical money flow by measuring the quantity of buying and selling in any given issue over a set time frame. In this manner, knowledge in the form of experience has replaced numbers in assessing a trade set-up.

Plato further expanded on the theme of fear and greed dominating markets with this famous quote: "Human behavior flows from three main sources: desire, emotion, and knowledge." These quotes were all recorded on papyrus paper with ancient ink derived from soot (lampblack), gum Arabic, and water, a full 400 years before the birth of Jesus Christ. I find the wisdom of the "ancients" an invaluable tool for dealing with the issues confronting traders and citizens alike, with Plato carrying a distinct edge.

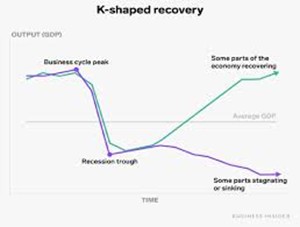

In light of political developments in the past two years around the globe, the statement made to my left is particularly relevant. The "K-Shaped economy" has the upper crust 10% elite growing their wealth while the bottom 90% are struggling to make ends meet, and this is occurring not just in the U.S. but on all continents. The United Kingdom, generally considered the birthplace of democracy with the formation of the Magna Carta in 1215, has had five leaders in the past ten years. Greece has had seven since 2007; Australia has had six prime ministers in the past eight years, while Italy has had five.

In countries where there is a wide discrepancy in living conditions, the populist movement is growing fast and wide as large swaths of needier citizens are exercising their right to vote and rejecting the policy platforms of many candidates whose campaigns were largely financed by the upper classes. The policies of the candidates financed by the elite have become almost confrontational to the interests and welfare of the needy majority, which is why the elite need to have candidates from both ends of the political spectrum that divide the lower class majority as a voting bloc in favor of meaningless issues that are not of concern to the elites.

The time is rapidly approaching where "the measure of a man" is based upon the implementation of policies designed to benefit the capitalist system as opposed to special interest groups on both sides of the aisle.

For example, Canada, until very recently, had a system of social safety nets such as free health care and unemployment insurance that softened the impact of recessions, but with unbridled immigration since the Liberals came to power ten years ago, that system is now creaking under the weight of simply too many people arriving before the increases in capacity could be achieved.

In the case of the Trudeau-Carney leadership, there has been an absence of even the most basic of planning for enhancements to social infrastructure, and this is the root of social unrest that leads to rejection of the status quo. Since the majority of voters in Canada fall into the lower-income brackets, there is a tendency for them to reject the current system (capitalism) in favor of a different, more forgiving one that includes great government guarantees of living standards, including basic necessities.

An even greater example of this fracturing is occurring in the current mayoralty race in the financial capital of the world (New York City) where the leading candidate is Democrat Zohran Mamdani, whose campaign promises include Affordable Housing (bringing down rent and freezing rent for all rent-stabilized tenants, Public Transit (investing in world-class public transit, including increased subway service and a fare-free bus system, Childcare (providing free childcare for every child up to five years old and Enhanced Public Services: (advocating for city-run grocery stores and increased investment in the City University of New York (CUNY).

- Immigrant Background: Born in Kampala, Uganda, Mamdani moved to New York City at age seven and became a naturalized American citizen in 2018.

- Identity: If elected mayor, he would be the city's first Muslim mayor and first person of South Asian descent to hold the position.

- Career Experience: Prior to running for office, he worked as a foreclosure prevention housing counselor, which he has cited as a formative experience that highlighted the systemic housing crisis.

Mamdani leads in both polls by significant margins (25 points in the Emerson poll and 16 points in the Marist poll), which is clearly the result of increased immigration. New York City's immigrant population has remained substantial since 2015, generally hovering around 3 to 3.3 million individuals, who comprise roughly 38% of the city's total population. However, the flow of new legal permanent residents (LPRs) and temporary visa holders slowed significantly due to a combination of more stringent federal immigration policies prior to the COVID-19 pandemic and mobility restrictions during it. A more recent, distinct influx has been that of asylum seekers since the spring of 2022.

With the K-shaped economy placing increased stress upon working-class households and with 38% of the NYC population being recent immigrants, the arrival of a Muslim candidate offering free perks to the working classes is an ominous departure from the elite-class candidates, such as Governor Cuomo. Needless to say, a Mandani victory will most certainly trigger watershed changes in the Big Apple. In fact, I can envision major departures of major financial services firms to friendlier locales if things go out of control.

I do not intend to make a positive or negative commentary on immigration because we North Americans are all "immigrants." My grandparents were immigrants from the U.K. after WWI, and in fact, the vast majority of the little town of Malton was comprised of English, Irish, and Scottish immigrants. The difference between 1918 and 2025 is that the volume of immigrants came to a country without a social safety net, so there was no sudden added stress upon the system.

As investors, we must heed the words of Plato when he wrote: "No man is more hated than he who speaks the truth." In a 2002 interview, Sun Microsystems CEO Scott McNealy referred to the stock's price-to-sales ratio of 10 at its peak, when shares were around $64 in early 2000. He famously explained the absurdity of this valuation by outlining the unrealistic assumptions required to justify such a price, including paying out 100% of revenues as dividends for 10 years, having zero costs and expenses, and paying no taxes.

He concluded by asking the interviewer and the audience if they would buy his stock at $64, given these ridiculous assumptions. Now, while that was most certainly not his message in 2000 before the stock peaked, he was reviled by the media and by shareholders for issuing his version of "The Emperor's New Clothes."

One wonders if that will ever be repeated by leaders like Elon Musk (Tesla Inc. (TSLA:NASDAQ)) or Jensen Huang (Nvidia Corp. (NVDA:NASDAQ)) any time soon. . .

Gold & Silver

Without mentioning any names, this past week I counted about two dozen gold bulls calling a bottom in the gold miners and more than a few dozen also doubling down on their calls for $200 silver.

Descriptives like "generational buying opportunity," "massively oversold," and "London is bare!" plastered the Twitterverse with every Tom, Dick, and Harry with a laptop and a mittful of gold and silver miners now underwater after the bona fide September buying stampede turned into a regurgitation regatta on October 17.

The period of August 27 to October 21 was a classic buying stampede, but it was by no means a "bubble" as in the 1970s version of a "bubble." The "AI" trade and the "crypto" trade are both in advanced stages of "bubbles" with the one glaring difference being that nobody in the gold camp was taking out advertising space urging the public to "sell Bitcoin and BUY gold!"

The people I know and respect in the gold mining community always compare gold to other financial (mainly "paper") assets. One often sees charts and graphs off the "Dow-to-gold ratio" or the "gold miners-to-gold bullion ratio" but rarely does one see a "Newmont Corp. (NEM:NYSE; NGT:TSX; NEM:ASX)-to-NVidia ratio" or a "Newmont-to-Bitcoin ratio" because while you can compare price earnings data or price-to-book data for both gold miners and the average S&P component, you cannot compare Bitcoin to any miner because it does not produce anything and never will.

Silver closes the week out well below the $50 breakout level, and judging from the silence of all the crazy-ass silver bugs out there SCREAMING about silver shortages and bullion bank manipulation, silver is coming off the same type of manic buying stampede that afflicted gold in September. However, when silver decides to move, the entire universe of silver bulls all recite in unison at the top of their lungs, "It's DIFFERENT this time" (followed by fifty exclamation marks) and side-by-side portraits of Eric Sprott, Rick Rule, Peter Schiff, and the premier of Bulgaria, all smiling and holding silver bars up to the camera.

In the category of "Been there, done that, got the T-shirt," I, too, was one of those wild-eyed maniacs ignoring indicators like RSI and DSI and MACD back in 1980 when I would recite "The Case for Silver" written by Harry Browne with endorsements by Doug Casey and the Hunt Brothers. It is never "different this time" nor will it ever because speculative fever in silver carries two acronyms that are so familiar to anyone who has ever owned a junior mining stock with a brand new discovery — FOMO ("fear of missing out") and YOLO ("you only live once").

Just as memories of the Crash of '29 still haunt investors around the globe (even if no one is alive today from that event), everyone over the age of seventy (like me) can recall vividly the events of January 1980 when silver topped out (intraday) above $50/ounce. One second, it was a bull market, and in the blink of a watering eye, a bear.

1980 Silver Top

After a blistering year-end rally lasting 26 days from December 12 to January 4, the 1979-1980 rally had all the same characteristics as the August-October rally this year. Line-ups at the bullion exchanges, widespread bullish sentiment, and a near-vertical buying panic that was impossible to deny, except for October 17, when $54 silver suddenly became $47 silver.

The one difference between 1980 and 2025 lies in the form of one man — Paul Volcker — the Chairman of the Federal Reserve Board. When compared to current Fed Chairman Jerome Powell, it is "nolo contendere" (no contest). Volcker decided to crush inflationary expectations with the same fervor that the last four Fed Chairpersons protected the S&P 500, only Volcker had to fight both Wall Street and the banco-politico cartel in order to accomplish his objective, and in doing so, he threw the global economy into an upward interest rate spiral and recession that led to the 1981-1982 bear market.

Mind you, he had lots of room to maneuver because in 1980, the U.S. was the world's largest creditor nation, and in 2025, Jerome Powell is navigating with the U.S. being the world's largest debtor nation — a huge difference to boot.

The $37.8 trillion debt bomb that is sitting with a lit fuse burning ever so rapidly toward explosion is the only reason why I expect the recent reversal in gold and silver to be a temporary correction to test perhaps the 100-dma and, in the worst case, their respective 200-dma levels. Powell's hands are tied, preventing him from engineering an 80s-style deflationary recession because he knows that the U.S. economy IS the U.S. stock market and vice versa. To crush inflation is to crush the S&P, which is to crush the economy.

To coin a phrase from the 1988 vice-presidential debate between Lloyd Bentsen and Dan Quayle: "Jerome, I knew Paul Volcker from the 1980s; you, Mr. Chairman, are no Paul Volcker."

Copper

Copper rebounded from the "hawkish-Fed, weak-China" narrative that caused the Thursday haircut back from $5.25 to $5.05 before going out today at $5.114/lb. There is nary a day that I pick up the paper and fail to read yet another bullish report on copper. It is like watching a Roberto Duran boxing match in the 1970s.

His left hand is copper demand, while his right hand is copper supply, and whenever he fought, both hands moved with lightning speed and terminal velocity, inflicting maximum damage upon the recipient.

Pound for pound, Roberto Duran was the best knockout puncher in the fight game for a decade, leading me to believe that copper will be the one Roberto Duran-style metal for the decade ending in 2030. The unstoppable left-right combinations of shrinking supply and escalating demand are going to make it a champion, and while all the noise is about "AI" and "BTC" and gold and silver, the one metal moving quietly into overdrive is copper.

A new copper explorer that I am now accumulating is Grafton Resources Inc. (GFT:CSE; PMSXF:OTC), whose Alicahue Copper Project in Chile is scarily close to the Caballos copper-molybdenum discovery made earlier this year by another GGM Advisory favorite Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB).

Fire me an email at [email protected] for a copy of the report covering the project. They are participating in a highly sophisticated geophysical survey later in November, followed by a deep drilling program designed to identify high-grade copper-gold porphyry targets at depth. The entire area is underexplored due in large part to a geological survey carried out by a French government group a number of years ago that essentially threw cold water on the vicinity because of what they deemed rocks that were "too young" to be considered "highly prospective."

What debunked that was the reported discovery by Fitzroy of a 200m interval of .81% Cu-Eq (copper-moly) within a perfectly preserved sulphide body of mineralization. This means the entire region carries "District-scale" potential, and with drilling having commenced at Caballos and about to commence at a second location called "Cerro las Mulas" ("Mule Hill"), the two big copper-bearing footprints at Alicahue are of great interest to me and all subscribers.

Happy Days

We close out the month to the sound of "Happy Days are Here to Stay" (sung to the tune of "Happy Days are Here Again") as all the averages closed at or near all-time highs. Excluding the precious metals, the only risk assets failing to tap new highs this week were Bitcoin , trading 13.28% off the previous all-time high, and the unweighted S&P 500 (SPXEW:US), trading 2.32% off its record high on October 2.

Since Bitcoin is closely correlated to the NASDAQ and SPXEW:US is a symbol of market breadth, I would say that this week has had a number of bearish divergences, but not enough to convince me that Santa Claus will be replaced by The Grinch this year.

| Want to be the first to know about interesting Gold, Copper and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tesla Inc. and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Tesla Inc., Grafton Resources, and Fitzroy Minerals Inc. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.