"Someone is going to lose a phenomenal amount of money."

That quote is from Sam Altman — the CEO of OpenAI, the company behind ChatGPT — who's been cautioning about inflated expectations in artificial intelligence (AI).

Mark Zuckerberg suggests a "collapse" is "definitely a possibility."

Ben Inker, managing investments at the $60 billion fund GMO, notes he's witnessing "bubble-like behavior" across AI investments.

The Bank of England has likened present AI stock valuations to the zenith of the internet boom.

Chris Reilly here, substituting for Stephen today. Virtually everyone appears to concur that AI is experiencing a market bubble. Even Stephen Colbert devoted a comedy bit to the topic.

When comedians start repeating the same warnings as financial experts and tech billionaires, we've entered unusual times.

Financial publications adore predicting market bubbles. Fortunately, their track record isn't great.

But the consensus here is what's remarkable. From central bankers to late-night television, the message is surprisingly consistent.

Recently, my mother mentioned AI in conversation. She's not an investor. She's not particularly tech-oriented. But she inquired with my sister about accessing ChatGPT.

When your parent is curious about something, you know it's reached mainstream adoption.

Thirty-six months ago, it was apparent — at least to those watching closely — that AI would demand extraordinary, unprecedented computing resources.

You didn't need to forecast which AI assistant would dominate among ChatGPT, Claude, or xAI. You simply needed to invest in the firms constructing the hardware, facilities, and processors that enable AI.

That's precisely what RiskHedge members have benefited from. Regular readers know we've held positions in Nvidia Corp. (NVDA:NASDAQ) since 2020 in our primary Disruption Investor portfolio, and that we've captured gains twice during its ascent.

Subscribers have more than doubled their investments in networking equipment provider Arista Networks Inc. (ANET:NYSE), power infrastructure company Vertiv Holdings Inc. (VRT:NYSE), and semiconductor manufacturer Taiwan Semiconductor (TSM:NYSE), among numerous other successful positions.

That's the advantage of early participation, of identifying a genuine technological revolution before widespread recognition.

But that period has passed.

Today?

Everyone recognizes the potential of AI infrastructure stocks.

Consider this fact: The introduction of ChatGPT — the catalyst for the current enthusiasm — happened three years ago.

One moment, we were searching Google and browsing multiple results; the next, we were interacting with a novel system capable of programming, clarifying complex physics, and creating business strategies.

ChatGPT became the most rapidly adopted application ever, attracting 100 million users more quickly than TikTok or Instagram.

The integration of AI has already surpassed the internet, mobile devices, and every significant technological transformation preceding it.

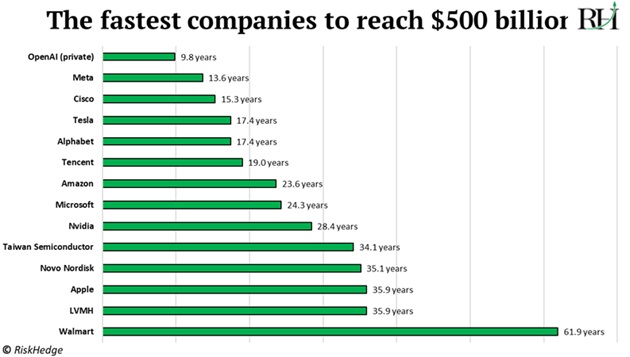

And OpenAI has now become the quickest company ever to reach a $500 billion valuation:

Throughout these three years, complete sectors have begun restructuring around AI. Regulatory bodies have hurried to establish guidelines. Financial backers have directed trillions toward anything seemingly connected to AI.

It represents a generational shift — the type of adoption curve that transforms economic fundamentals.

But this also indicates we're no longer in the early phase.

That's what makes this juncture so crucial.

Three years ago, investing in AI infrastructure companies resembled buying organizations building internet infrastructure in 1996. It didn't require exceptional insight—you simply needed to act before mainstream awareness developed.

Today, mainstream awareness has fully developed.

Every executive discusses their "AI initiatives." Every product claims to be "AI-enhanced."

This doesn't diminish the revolutionary nature of the technology. But as an investment narrative, it has progressed. The straightforward, evident stage — when merely backing the infrastructure providers was the correct approach — has concluded.

When every investor, business leader, and television personality reaches consensus . . . that's precisely when you should consider alternative perspectives.

The AI boom is far from over, but the "easy money" trade is. In The Jolt, we’ll show you how to profit from the less-obvious opportunities driving the next phase of the AI megatrend. Go here to join us today.

| If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing. | Go here to join |

Important Disclosures:

- Chris Reilly: I, or members of my immediate household or family, own securities of: Taiwan Semiconductor. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.