Northern Shield Resources Inc. (NRN:TSX.V; NSHRF:OTC; N9SA:FSE) is a Canadian explorer that builds its own projects in the right rocks and lets the geology lead the work.

The team is known for model-driven, grassroots exploration in under-explored belts across Canada. Its wholly owned subsidiary, Seabourne Resources Inc., focuses on epithermal gold and related systems in Atlantic Canada.

Northern Shield's strategy is simple: start in terranes that can host large systems, then prove the model step by step.

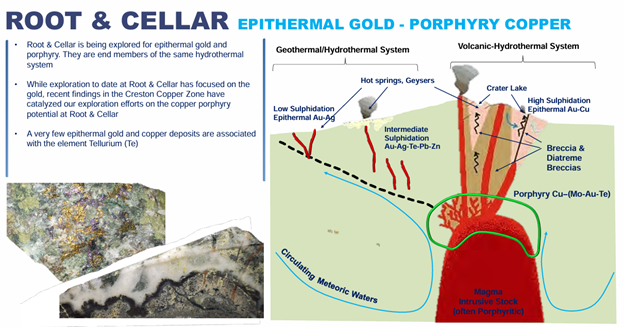

That mindset led to Newfoundland's Burin Peninsula and to Root & Cellar, where the work points to an alkaline-related epithermal gold system perched above a porphyry-style copper center, two ends of the same hydrothermal system.

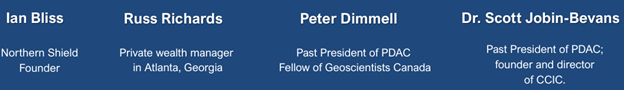

Management

Ian C. Bliss, President & CEO. Founder and field-oriented geologist with decades in Greenland, Norway, and Canada. Known for a hypothesis-first approach that drew majors into earlier Ni-Cu-PGE concepts, now applied at Root & Cellar.

Christine Vaillancourt, Chief Geologist. B.Sc. (Geological Engineering), M.Sc. (Earth Sciences). Former Ontario Geological Survey; deep expertise in magmatic systems and Ni-Cu-PGE deposits; past President of Professional Geoscientists Ontario (2017–18).

Sam Legg, CFO. Chartered Accountant with operating experience across small and mid-size companies in North America, Europe, South America, and Asia.

Board. Chair Russ Richards; directors Peter Dimmell (50+ years in exploration; past PDAC president) and Dr. Scott Jobin-Bevans (past PDAC president). James O'Sullivan (Dentons) serves as Corporate Secretary.

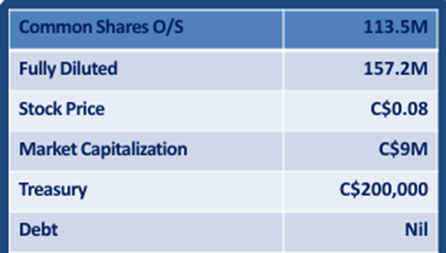

Share Structure

Basic shares outstanding: ~113.5 million

Fully diluted: ~157.2 million

Deck price reference: ~CA$0.08 (implied ~CA$9 million market cap at that time)

Treasury: ~CA$200,000

Debt: Nil

Management has indicated a roughly CA$1 million private placement to fund near-term work. The structure remains tight for a discovery-stage name.

Project Driving the News: Root & Cellar, Newfoundland

Location and Access

Root & Cellar sits on the Burin Peninsula, a three-hour drive from St. John's and minutes from a deep-water port.

That's unusual for early-stage copper–gold systems, and matters if the project advances; it also broadens potential European interest given the Atlantic setting.

Why the model hangs together, the property preserves "top-of-system" textures, sinter and hot-spring sediments, at both Conquest (gold) and Creston (copper). Preservation high in the epithermal column is exactly what you hope to see before stepping down into potentially higher-grade parts of the system.

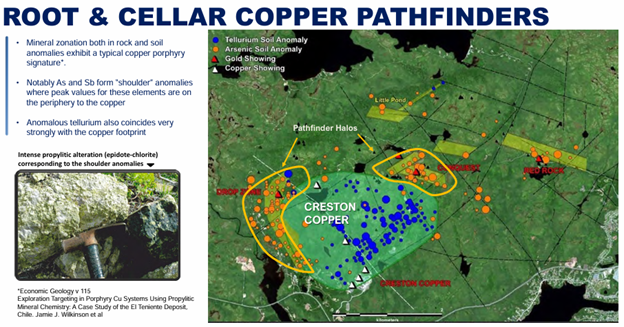

On the copper side, Creston shows a ~2 km copper anomaly in soils and rocks, a broad propylitic halo, and newly exposed diatreme breccia pipes, efficient conduits and traps in many porphyry and high-sulphidation systems.

Conquest (Gold)

2025 drilling.

Hole 33: ~24–25 m averaging ~0.6 g/t Au (broad, moderate grade; open to depth).

Hole 34: ~4.5 m at ~3.4 g/t Au within colloform/banded quartz with ginguro (boiling-zone) textures.

Tellurium vectoring. The team moved to a lower-detection assay package for tellurium (Te). Te increases as you approach structures and is proving useful for vectoring. Visual krennerite and the Au-Ag-Te association fit the alkaline-related model and help narrow the source of the 111 g/t Au boulder field roughly 100 m east of Hole 34 (near Hole 6).

Work plan. Define shallow, continuous shoots along north and south feeders identified in recent IP; then step down dip.

Creston (Copper)

Surface evidence. Quarry faces expose diatreme breccias with chalcopyrite and bornite along pipe margins; hydrothermal breccia veins carrying pathfinders (As, Mo, Te, Pb-Zn) at the very top of the system; and fragments with classic porphyry quartz-vein textures (A and D veins; possibly B). Multiple intrusive phases are present in the outcrop.

Geochemistry & Alteration. A ~2 km copper anomaly in soils and rocks is flanked by arsenic–antimony "shoulders," with an extensive propylitic (epidote, chlorite, carbonate) halo, the textbook porphyry environment.

Concept. An intact epithermal "lid" perched above a porphyry copper center. Local faulting/telescoping may have lifted the porphyry level, explaining strong copper at surface.

Programs and Catalysts are the Result of Exploration

Permitting: ~14 drill pads in process.

Geophysics: Targeted IP lines to sharpen porphyry vectors and confirm north–south feeders at Conquest.

Drilling: Focused ~1,200–1,500 m from pit edges on firm ground, making late-fall / early winter drilling feasible.

Tellurium

Tellurium shows up at Root & Cellar both as a geological clue and a potential by-product metal. The gold at Conquest carries an Au-Ag-Te signature (including tellurides like krennerite and hessite), and the team's switch to a lower detection-limit assay is already using Te as a vector; levels rise as you approach structures, helping narrow the source of the 111 g/t Au boulders and frame the copper target at Creston.

That's consistent with big epithermal porphyry systems globally, where tellurium often "leaks" toward surface above the source. In the real world, tellurium is prized for high-performance materials: cadmium telluride thin-film solar panels, certain semiconductors, and specialty alloys. It's also scarce, roughly eight times rarer than gold, and most supply is recovered as a by-product of copper refining, with the majority coming from China.

For Northern Shield, the near-term value of Tellurium is as a pathfinder that shortens the hunt; longer term, if a deposit is outlined, tellurium could modestly improve project economics alongside gold and copper.

Recent Third‑party Acknowledgment (Hydra Capital)

Malcolm Shaw at Hydra Capital recently shared his thoughts on the company, saying, "Northern Shield recently reported assays from its summer drill program from the Root and Cellar project in Newfoundland. Results are indicative of the upper reaches of a copper porphyry system, which appears to be related to the 2-kilometer diameter Creston copper anomaly on the property. The results, combined with newly exposed diatreme breccia pipes exposed at surface, have led NRN to prepare a 14‑hole drilling program to test the porphyry potential at depth. Drilling is expected to begin in November after NRN completes a $1 million private placement for which it already has indicative interest from investors. This is a high‑priority target which offers long‑tail upside potential on this $5 million market cap minnow."

Technical Picture

Northern Shield is approaching what could be its Point of Recognition (POR). After an 18-month base capped by back-price resistance around CA$0.10–CA$0.12, shares have compressed into a descending wedge with higher lows off the 2023 trough.

A decisive upside break and hold through CA$0.10–CA$0.12 would mark the POR and open a fast-move zone created by the 2021–22 air-pocket decline ("same way down, same way up").

Momentum and Structure

Trend structure: Price is coiling beneath CA$0.10–CA$0.12 after several failed tests; the pullbacks are shallower — constructive base behavior.

Moving averages: The 50-day remains below the 200-day but is curling up; a reclaim of CA$0.10–CA$0.12 would likely pull the 50DMA through and confirm a trend change.

MACD: Stabilizing near the zero line; a turn up with price through resistance would provide confirmation.

RSI: ~45 neutral and not overbought, leaving room for expansion if a breakout triggers.

Volume: Accumulation spikes cluster near the CA$0.10–CA$0.12 band. A resolution should be accompanied by >3x ADV to clear stale supply.

Price Targets

First Target: CA$0.16

Aligns with prior congestion and a measured move from the wedge. Hitting CA$0.16 would confirm the base transition.

Second Target: CA$0.20

A round-number shelf and secondary supply zone from early 2024. Reaching it would validate momentum beyond the initial breakout.

Third Target: CA$0.50

Represents the upper boundary of the 2021 "air-pocket" zone. If the porphyry/gold narrative gains traction, this is a logical magnet in a re-rating.

Big Picture Target: CA$0.75

Maps to the larger weekly structure and a common 1.618 extension of the base. This requires follow-through from the drill program and broader buying interest.

Triggers and Risk Markers

Bullish Trigger: Daily close above the wedge top, then through CA$0.12 on expanding volume.

Support / Risk: CA$0.050–CA$0.045 at the wedge base. A weekly close < CA$0.045 would negate the setup and put the 2023 floor back in play.

Tactical Plan: Accumulate on weakness against support with tight risk; add size only after a confirmed breakout > CA$0.12.

The daily chart (updated October 22, 2025) shows a pullback within a larger base after testing back‑price resistance near CA$0.10–CA$0.12. The setup is straightforward: a decisive break of the descending wedge followed by strength through prior congestion opens the path to CA$0.16 (first target), CA$0.20 (second), CA$0.50 (third), and a big‑picture target of CA$0.75 if drilling validates deeper epithermal shoots at Conquest or confirms a porphyry center at Creston.

Risks: As with any explorer, outcomes depend on drill execution and funding cadence. This is early stage and high risk, position sizing matters.

Why Now?

We're seeing the "top of the system" right at surface, hot-spring rocks, bits of sinter, and even visible gold. That's a good sign before you drill deeper. On the copper side, there's a 2-kilometer zone in soils and rocks, with the right trace elements and copper showing up in the quarry breccias, exactly what you expect near a porphyry center. Also, tellurium keeps appearing with the gold and silver; it's rare, but here it's mainly useful as a pathfinder that helps point the drill in the right direction.

Northern Shield controls the ground in a road-accessible Atlantic Canada jurisdiction.

Conclusion

Northern Shield Resources Inc. (NRN:TSX.V; NSHRF:OTC; N9SA:FSE) offers two clear ways to win at Root & Cellar:

- Near-surface epithermal gold now showing boiling-zone textures with grade; and

- A developing porphyry copper target marked by diatremes, pathfinder halos, and porphyry-style vein fragments within a 2-kilometer copper footprint.

With an intact system, real infrastructure, and a defined drill plan to test depth targets, this fits a speculative buy at the current price of CA$0.08 for investors who understand early-stage exploration risk and want exposure to a potential Atlantic seaboard discovery.

Investors wanting more information can find it on their website here: northern-shield.com.

| Want to be the first to know about interesting Copper and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Northern Shield Resources Inc.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.