By the end of this week, I will have counted (and read) over 200 emails lecturing me on why my call last Tuesday on gold and silver was so drastically off base and how I am going to lead my subscribers into "certain ruin," along with a jeopardized career destined to be dashed on the jagged rocks of precious metals revenge.

What always amazes me is the vitriol and acidity of the remarks, especially from the silver bulls. They take to the Twitterverse and the digital universe using "cancel culture" as their weapon of choice, as they scour the internet for any record of misdeeds, no matter how trivial. Back in the day, if you ran into a trader shorting one of your deals, you would meet up in a bar, order up a couple of extra-dry martinis, and have a discussion. Sometimes you could turn the seller around, but most times not, as the fairness or ugliness of the deal was back then and is today, truly in the eye of not only the beholder but also the shareholder. That is the beauty and the reality of markets. Bulls and bears see the same set of statistics yet conclude two totally separate outcomes.

Alas, I know full well how aggravating it can be when you run into an early bull that has just turned bearish two nanoseconds after you just went "ALL-IN" on some trade. It has happened to me perhaps a hundred times over the past 47 years, and while there are individuals who are calm and reserved in their being on the opposite side of the trade, there are those really annoying types who enjoy jamming it in your face as if it were a duel in the OK Coral at 90 paces. What these emotional cretins fail to grasp is that the short-term bears like me can also be allies when the particular trade runs its course.

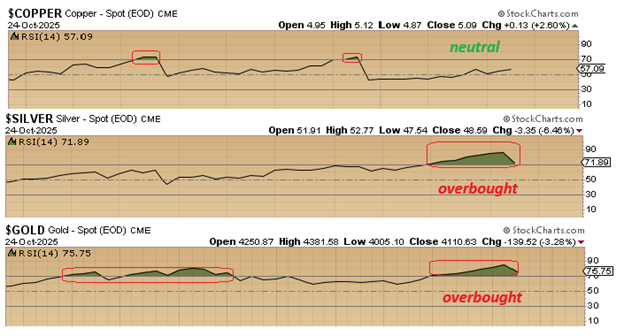

Gold and silver prices closed out the week lower than their closes last Friday, with December gold about $130/ounce below the October 17 close and with silver about $3.50/ounce below its October 17 close. As stated last in last week's missive, the outside key reversal day a week ago was merely a "signal" telling me that the topping "process" had begun.

It did not mean that gold and silver were going to crash straight through the floorboards to their 200-dma's in one fell swoop. Tops are a "process," and after the perfectly normal rally on Monday to test the highs, it was Tuesday that completed the process, where the gold and silver markets both closed below the lows of the prior Friday. It was actually a picture-perfect topping process and fit every prerequisite that I have ever used to define a top. I took advantage of the action to solidify my hedges on gold and silver stocks I own, such that a corrective phase will be a mere annoyance rather than a disaster because at my age, the latter can evoke extreme reactions.

Silver always seems to evoke the most extreme of reactions as the silver "bug" is usually far more radical than the gold "bug," but during times like this, when they both have been lashed mercilessly by the cat-o'-nine-tails of bullion bank suppression for the past fifteen years, tensions are high, to say the very least.

Silver and gold put in the first weekly red candle after nine consecutive "UP" weeks. It spent the better part of September and October in an "overbought" condition and my experience over the years teaches me that it will experience a corrective phase far longer than "two or three days" as many of the pundits have been extolling.

I get it. Silver is the most exciting of all the metals. It carries a certain luster that accompanies ownership. I love taking the 100-ounce bar set of three out of the vault (usually after a session of adult libation) and shining various lights on them within a black velvet background. It is a haunting experience but thoroughly delightful, especially if my wife is out with her girlfriends or upstairs asleep. She only caught me "admiring the precious" once in my life, and only after some attitudinal adjustment with a five-pound rolling pin did I decide to go "underground" in my worship of the shiny bars. However, I digress. . .

The first support for silver is at the 50-dma around $44.18, although below that is the more likely target of $40.66. If it really gets ugly, the 200-dma is at $36.46, but I seriously doubt we see that. While the 20-dma is rolling over, continued weakness will force the 50-dma to roll as well, so I have to default to my tried-and-true rule that says "no correction is real unless it inflicts maximum pain."

A minor pullback to the 50-dma is a minor hiccup; traders can meet that margin call by accessing credit lines. A pullback to the 100-dma means you are selling assets to cover the cash call, and a drop to the 200-dma means you have the Mercedes up on eBay looking for a "quick sale."

My guess (and that is all it is, albeit with calculation) is that the 100-dma holds at around $40, give or take a buck or so. In the meantime, it has been one helluva run in the PMs to the extent that my bank manager and margin clerk are out celebrating my newfound solvency with great gusto and well-deserved elan. . .

Never Short a Cult

"Never short a cult." was the phrase used by Steve Eisman (of "The Big Short" fame) in an interview I recently watched regarding Tesla Inc. (TSLA:NASDAQ). The most celebrated failing EV manufacturer on the planet reported an earnings "miss" this week, but what grabbed me was this:

- Tesla's net income for the quarter ending September 30, 2025, was $1.373 B, a 36.64% decline year-over-year.

- Tesla's net income for the twelve months ending September 30, 2025, was $5.085 B, a 60.65% decline year-over-year.

- Tesla's annual net income for 2024 was $7.13 B, a 52.46% decline from 2023.

- Tesla's annual net income for 2023 was $14.999 B, a 19.2% increase from 2022.

Now, the stock peaked in October 2022 at around $450 an since then has seen earnings cut basically in half, yet it went out this week at $433.72. I am the first to admit that I am no rocket scientist when it comes to the automotive industry (or any other industry for that matter), but I do know a skunk when I see one.

Everything about TSLA, since I first came across it in 2018, reeks of foul play. From Donald Trump saying "We must protect our geniuses!" to the DOJ turning a blind eye to blatant stock manipulation when he announced that he had "secured funding" to "turn Tesla private at $420 per share" back in 2018, Elon Musk is a blatant charlatan.

At best, he should be considered a phenomenal stock promoter. At worst, he should be in jail. However, in today's day and age, Elon is a Messiah that continues to deliver continual boosts to not only his ego by way of political support for the current U.S. President but also to his net worth statement by way of Tesla trading at $433 per share.

The action on Thursday was vintage Elon. They missed on the Street's earnings estimate at $.56/share and came in at $0.50 after which the stock cratered 4%. The next morning on Tuesday, the stock opened even lower and was threatening "freefall" when, for some miraculous reason, it reversed upward, closing out the session with an actual gain on the session of 2.28% to $448.98 per share. I was completely gobsmacked.

So the stock has earnings cut in half since 2022 but yet is trading at or near its all-time high?

"Never short a cult," was the advice given by the guy who pocketed a few billion by shorting the subprime market in 2007. Perhaps I should have listened to him, but I will not. I want to be the heavy metal drummer in the movie "The Big Short" (Michael Burry) who told everyone to get stuffed and walked away with billions. Without Elon, TSLA is a $50 stock (maximum). With Elon, it is the Second Coming of the Messiah.

Ignoring both, it is a pound-the-table short.

Copper

It was on July 30 that Donald Trump decided to pistol-whip we copper bulls by yanking back the tariffs on inbound "raw" copper, sending the Comex December copper price crashing down from the $6.0215/lb. to $4.4055 in a single session. Investors reacted immediately, sending blue-chip names like Freeport-McMoRan Inc. (FCX:NYSE) careening lower along with a bevy of Canadian juniors along with it.

I flattened my senior copper holdings the week before.

Not because I was clairvoyant, but because the RSI had exceeded 70 while the spread between the LME and the Comex was just too great.

(You have to be lucky to be good and vice versa, no?)

Copper has been relegated to the darkened cloakroom of investor disinterest since August 27, when Jerome Powell "hinted" at a Fed rate cut. It has been overpowered by gold and silver, where majors like Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) are ahead 112% YTD, which is unheard of for a blue-chip miner. Compare that to Wall Street darling Nvidia Corp. (NVDA:NASDAQ)up 34.93% YTD. In the absence of any real bullish narrative, copper has surpassed $5.00/pound, which was once considered impossible without the tariffs. Now we have three major copper mines either impaired or disabled (Grasberg, El Cobre, and Kakoa-Kakula), and few people care, just as was the case for uranium in 2018 and the precious metals in 2023. Copper is my number one selection in the metals universe and has been for a long time, with the exception of the June-July spike to $6.00 when I stepped aside in favor of silver and gold. Now, as a trader, I have earned the right to reverse back to copper as the first place to invest capital in 2025-2026.

In the junior space, copper names like Marimaca Copper Corp. (MARI:TSX; MC2:ASX) exploded out of mediocrity by posting impressive drill results, but are ahead 105% YTD. My top pick and largest holding Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) is up 117.65% YTD and too has posted impressive drill results and have recommenced drilling at Caballos with two rigs and a burgeoning treasury (CA$18m).

Subscribers should continue to move cash to the favored copper names but keep some in reserve for the next big one which will be launched next week. I cannot comment yet but suffice it to say, it is in Chile and the players are all very well-known to me.

With an weekly RSI at a neutral 57.09 but in a clearly-defined uptrend, copper will eventually move into the same overbought conditions that occurred with gold and silver over the past 56 consecutive days.

That will occur when the big players finally recognize the "Perfect Storm" of rapidly shrinking supply and broadly accelerating demand.

| Want to be the first to know about interesting Copper, Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tesla Inc., Agnico Eagle Mines Ltd., and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Tesla Inc. and Fitzroy Minerals Inc. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.