Metalpha Technology Holding Ltd. (MATH:NASDAQ; D92:FSE) is a Hong Kong-based digital asset solutions and wealth management firm operating under both U.S. and Hong Kong oversight.

The group serves high-net-worth clients, family offices, and institutions with digital asset portfolio solutions, hedging and liquidity services, market-making, and technology infrastructure.

Its wholly owned subsidiary LSQ Capital holds Hong Kong SFC licenses for dealing in securities, advising on securities, and asset management, each covering virtual assets, which is a meaningful differentiator as regulated access becomes a priority for institutions.

Metalpha's roots include close commercial ties to Antalpha, the primary lending partner to Bitmain, the world's largest Bitcoin-mining hardware producer. That relationship positions Metalpha in the cash-flow plumbing of the mining economy while adding deal flow for its hedging and structured-product engines.

Financially, FY2025 (year ended March 31, 2025) marked an inflection: income from wealth-management services reached US$44.6 million, net profit turned positive at US$15.9 million, and adjusted EBITDA rose to US$17.7 million. Management also announced a US$5 million share repurchase program.

Management

Founder and Group CEO Adrian Wang brings a mix of traditional finance and digital-asset experience and has recruited senior leaders with deep derivatives, private-banking, and risk-management backgrounds from firms such as Goldman Sachs, UBS, Morgan Stanley, HSBC, and Edmond de Rothschild.

Xisha Hu, CEO of Metalpha Limited, runs the operating subsidiary and blends finance, technology, and digital-asset experience. She was a Director at China Construction Bank International and earlier worked as a software engineer at SAP. She's also served as an adjunct professor at Hong Kong Polytechnic University. Academically, she holds an MBA from HKUST and a BSc in Computer Science from Nanjing University. Her remit is product execution, platform reliability, and institutional client coverage.

Monique Chan leads LSQ Capital, bringing three decades in Asian private banking to Metalpha's licensed Hong Kong platform. This blend of markets experience and regulatory credibility is central to the firm's pitch to institutions.

What Is Driving the Company Now and Next?

Three forces stand out.

First, regulated access. Hong Kong has implemented a dual-licensing framework for virtual-asset trading platforms and has been uplifting SFC licenses for securities houses to include virtual-asset activities. Metalpha's Type 1, 4, and 9 licenses give it a credible, compliant way to serve Asian institutions as policy normalizes.

Second, partnerships and geographic reach. In February 2025, Metalpha formed a Middle East joint venture with Gewan Holding and Zodia Markets, an affiliate of Standard Chartered, to address regional trading and wealth-management demand. In August 2025, it announced a strategic partnership with Swiss bank AMINA to expand European solutions. These add distribution and balance-sheet partners in two key growth corridors.

Third, product performance and breadth. LSQ's Next Generation BTC-themed fund closed with a reported 375.6% NAV increase, outperforming Bitcoin by roughly 67%, which is a solid proof point for the team's derivatives-led, risk-managed approach. Beyond funds, Metalpha packages accumulators, decumulators, collars, and "airbag" structures to convert crypto volatility into defined risk-return profiles for clients.

Balance-sheet data also improved year over year, with total assets up to US$246.8 million and equity up to US$36.6 million as of March 31, 2025, providing more capacity to support client activity and partnerships.

Key risks are the obvious ones: crypto price volatility, counterparty risk, and evolving regulation. The firm's mitigants include SFC licensing, structured-product risk controls, and diversified revenue from Asia, the Middle East, and Europe.

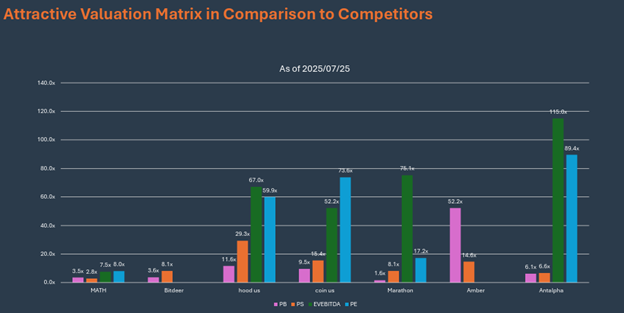

Metalpha is Attractive relative to its Peers

Technical Analysis

Metalpha Technology Holding Limited appears to be entering its Point of Recognition.

After a long base, shares cleared the ceiling and met the first and second objectives at US$2.90 and US$3.50. The third objective near US$5.20 remains open.

Price is digesting gains inside a controlled falling channel, which is a typical pause in a developing uptrend.

Momentum and Structure

Weekly MACD is positive and curling higher, consistent with consolidation rather than distribution. The 50-week moving average has turned up and sits above the 200-week, a constructive alignment that often precedes multi-month advances.

Weekly RSI has cooled into the mid-50s, supportive but not stretched. Volume expanded on the advance and has contracted on pullbacks, a classic accumulation profile.

Price Targets

Third Target: US$5.20 (open)

Matches the prior swing high from the initial breakout run. A decisive weekly close above US$5.20 would confirm an upside resolution and should attract trend followers.

Next Target: US$6.20–US$6.40

Lines up with measured-move symmetry from the recent base and intermediate Fibonacci work. It also overlaps a small pocket of prior supply.

Big-Picture Target: US$7.50

Projected by applying the depth of the base to the breakout level, and consistent with common 1.618 weekly extensions.

Extended Big-Picture Range: US$9.00–US$9.50

If digital-asset sentiment broadens and execution continues on the licensed platform, a stretch into the high single digits is possible over the longer cycle.

Conclusion

Metalpha Technology Holding Limited offers a regulated, derivatives-led gateway to digital assets at a time when institutions are demanding compliant access and risk-managed returns. FY2025 profitability, SFC-licensed operations, and new partnerships in the Middle East and Europe create a clearer path to scale.

For investors new to the name, Metalpha Technology Holding Ltd. (MATH:NASDAQ; D92:FSE) is a way to participate in digital-asset adoption without owning spot coins directly. For existing holders, buybacks, a stronger balance sheet, and expanding distribution should support the story into FY2026.

At current levels, I view the shares as a Speculative Buy at the current price of US$3.15. As always with crypto-linked equities, position sizing and risk controls matter.

Investors wanting to find out more can visit the company's website Metalpha.net.

| Want to be the first to know about interesting Cryptocurrency / Blockchain investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Metalpha Technology Holding Ltd.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.