Have you checked Western Union Co.'s (WU:NYSE) stock performance recently?

It's plummeted 70% in value since 2021.

If financial collapse had a visual representation it would be the below.

Western Union was once the go-to method for international money transfers. Countless immigrant workers utilized it monthly to send their earnings back to family members.

Visit a location, complete paperwork, pay a substantial commission, and hope your funds reach their destination within days.

But Western Union has become the newest victim of a straightforward yet revolutionary advancement in cryptocurrency.

Stablecoins represent a multi-trillion-dollar transformation in progress. And there's an uncomplicated way to benefit from this trend.

I frequently execute international money transfers. "Painful" perfectly describes interactions with banking institutions.

You must complete extensive documentation, shell out $30, and occasionally need to contact your bank to dispatch funds.

When customer experiences remain frustrating for extended periods, it typically indicates one thing: The commercial framework is vulnerable to disruption.

Stablecoins transform money transfers into something more efficient, speedier, and more economical.

A stablecoin functions as a digital representation linked to a real-world currency, most frequently the American dollar.

These virtual dollars can be transmitted anywhere globally, continuously without interruption. No banks. No intermediaries. It's financial transactions at internet velocity.

Stablecoins provide the exclusive capability to transmit $10,000 across continents instantaneously from your mobile device for less than a cent.

Banking systems primarily function effectively in Western nations. This cannot be claimed for countries such as Argentina, where my spouse and I previously resided.

Residents would rush to exchange their pesos for American dollars immediately after receiving payment. After experiencing inflation's consequences repeatedly, they queued at "cuevas" (underground exchange operations) to trade pesos for physical dollars.

Currently, they simply launch an application and purchase digital dollars. More specifically, they employ cryptocurrency channels to transform their devalued pesos into stablecoins.

For numerous individuals worldwide, stablecoins represent the first genuine alternative to a failing national currency.

They function similarly to maintaining a U.S. bank account in virtual space.

People frequently discuss cryptocurrency replacing American currency. If anything, stablecoins reinforce dollar supremacy. However, I'm confident they'll supersede the 100+ worthless currencies globally.

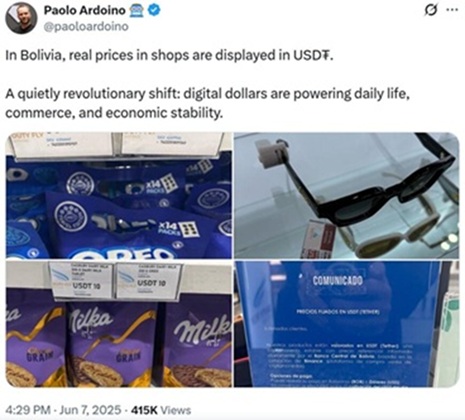

In Bolivia, certain grocery retailers already display prices in USDT, the most widespread stablecoin.

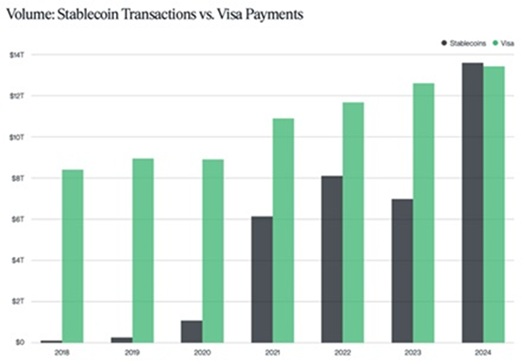

In 2024, stablecoin transactions reached $14 trillion, exceeding Visa Inc.'s (V:NYSE) $13 trillion for the first time ever:

A cryptocurrency innovation nonexistent a decade ago now processes more financial transactions than the planet's largest payment network.

Currently, $300 billion worth of stablecoins circulate internationally. And now, the biggest names in finance and technology are entering the arena...

Stripe recently introduced a service allowing any business to send or receive stablecoins effortlessly. A café in Lisbon can now compensate a supplier in Manila instantaneously. Transferring dollars has become as straightforward as sending electronic mail.

SpaceX has discreetly accepted stablecoin payments for years.

Visa utilizes stablecoins like USDC to finalize transactions between partners more rapidly and affordably than conventional methods.

And North Dakota recently revealed plans to follow Wyoming's example to become the second American state issuing its own stablecoin.

The trajectory toward $1 trillion is unmistakable.

You might be wondering, "Why now?" It boils down to a single factor. . .

Washington finally approved.

Congress recently enacted the GENIUS Act. It represents America's first dedicated stablecoin legislation. It provides issuers with regulatory clarity. More importantly, it welcomes major participants like banks, financial technology companies, and prominent corporations to join the market.

It's the authorization that stablecoins have been anticipating to transition from a peripheral status into mainstream adoption.

One significant casualty of this development is Western Union.

Currently, migrant workers transmit approximately $150 billion annually to their homelands and forfeit a substantial portion to intermediary fees. With stablecoins, these expenses nearly vanish, and funds transfer instantaneously.

Mark my words: WU faces extinction. Perhaps that's evident. Less apparent is the fact that stablecoins will disrupt "fintech" enterprises like PayPal Holdings Inc. (PYPL:NASDAQ), too.

PayPal continues operating on an outdated banking infrastructure that imposes fees, delays settlement, and ceases functioning on weekends.

Stablecoins move money immediately, without interruption, and are practically free. PayPal's restricted network resembles a toll highway adjacent to a free expressway.

So, how can disruption investors capitalize on stablecoins?

Don't pursue stablecoin issuers like Circle Internet Group Inc. (CRCL:NYSE).

Profit margins already remain extremely thin. And competition will intensify as giants like Stripe, Alphabet Inc. Class A (GOOGL:NASDAQ), and Amazon.com Inc. (AMZN:NASDAQ) enter the marketplace.

The actual winners are the infrastructure — the foundation making all this possible.

There's approximately $300 billion worth of stablecoins circulating today.

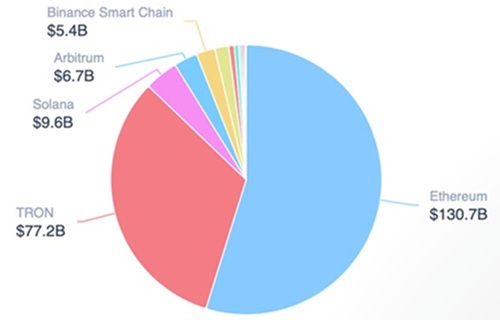

Over 60% of these transactions occur on Ethereum's (ETH) blockchain and its Layer 2 networks:

Each time you utilize Ethereum's blockchain, you pay a commission.

During the past two years, stablecoin transactions alone have generated $288 million in revenue for Ethereum.

Now that stablecoins have achieved legal status and volumes steadily increase, expect revenue from fees to escalate. That's advantageous for Ethereum and Ethereum holders, who can earn a portion of these fees by staking their tokens.

The world's financial system is being rebuilt in real time — and most investors aren't clued in on the different ways they can profit from this disruption.

By joining The Jolt — my free, twice-weekly investing letter — you can learn how to stay ahead of this shift… and the best ways to position your portfolio as money moves on-chain. Sign up here.

If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing.

Go here to join

Important Disclosures:

- Stephen McBride: I, or members of my immediate household or family, own securities of: Etherum. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.