West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQB; FRA:UJO) reported multiple high-grade gold intercepts from underground drilling at its 100%-owned Madsen Mine in the Red Lake Gold District of Ontario. The latest results came from a new high-grade zone in the lower portion of the Austin Zone, an area newly undergoing definition drilling. Notably, hole MM25D-12-4860-004 returned 7.75 meters grading 139.45 grams per tonne (g/t) gold (Au), including 2.00 meters at 532.25 g/t Au. Two additional holes also delivered standout results: hole -005 intersected 8.70 meters at 74.70 g/t Au, and hole -002 returned 7.45 meters at 18.31 g/t Au. These intercepts were drilled from the 12 Level, approximately 600 meters below surface, and align with the same structural trend as previously defined high-grade lenses in South Austin. The company stated that visible gold was observed in multiple holes, with mineralization associated with quartz-pyrrhotite-arsenopyrite veining and strong silicification.

According to President and CEO Shane Williams inthe release, "We are only just beginning to get the underground drills into the lower portions of the main Austin Zone and we are already being rewarded with very high-grade, broad intercepts of gold mineralization." The results form part of an underground drilling campaign exceeding 150,000 meters, designed to enhance grade continuity, inform mine planning, and support the ongoing ramp-up phase.

Positive Analyst Coverage Highlights Operational Strength

Cantor Fitzgerald analyst Matthew O'Keefe reaffirmed his Buy rating on September 12, maintaining a target price of CA$2.20, representing a 124% premium to the company's CA$0.98 share price at the time. He pointed to continued progress at the Madsen Mine, which produced 5,350 ounces of gold through June while the mill operated at 650 tonnes per day with 95% gold recovery. Trial runs at 800 tonnes per day were completed successfully, and O'Keefe noted that definition drilling now exceeded 150 kilometers. He also highlighted shaft refurbishment, cemented rock fill installation, and equipment mobilization as evidence of consistent advancement.

Financially, O'Keefe reported second-quarter revenue of CA$24.3 million, gross profit of CA$8.6 million, and net income of CA$3.5 million. Operating cash flow totaled CA$5.9 million, with West Red Lake Gold ending the quarter with CA$23.7 million in cash and CA$1.7 million in working capital. "The company was cash flow positive in Q2/2025," O'Keefe wrote, "and should continue and build its working capital position in the months ahead."

Advancing Toward Commercial Production

In a September 24 update, O'Keefe described Rowan as "a key growth project that will provide the company with a near-term path to producing over 100 Koz of gold at Red Lake," confirming that proceeds from a recent flow-through financing would support its advancement.

O'Keefe reaffirmed his Buy rating and CA$1.80 target on October 7, citing continued operational execution and progress toward commercial production. He reported that gold output for the third quarter rose 34% quarter-over-quarter to 7,055 ounces from 35,700 tonnes grading 5.4 grams per tonne gold. "WRLG continues to execute a disciplined ramp-up," O'Keefe said, noting milestones such as operational underground waste storage and the planned start of shaft skipping in November. He emphasized that the company remained on track for commercial production in early 2026 and noted a strengthened financial position following a CA$40.7 million bought deal financing.

On October 8, Red Cloud Securities analyst Taylor Combaluzier reaffirmed a Buy rating and CA$2.30 target, adjusting for dilution from the September financing. He remained positive on production developments, reporting that Madsen poured 7,055 ounces at an average realized price of US$3,456 per ounce, generating CA$33 million in proceeds. According to Combaluzier, "The company has rapidly worked to turn around the asset since acquiring it in 2023 and can now take advantage of the robust gold price environment." He added that grade reconciliation remained strong and that sill development accounted for up to 30% of milled tonnage.

Jeff Clark of The Gold Advisor offered a notably upbeat assessment of West Red Lake Gold Mines Ltd. in his October 12 newsletter, citing what he called "bonanza grade drill results from our Ontario producer." Clark referenced newly reported intercepts from the company's 100%-owned Madsen Mine in the Red Lake Gold District, emphasizing their exceptional grades and shallow depths. "Wow... that first headline number measures a whopping 1,087.7 gram-meters, a bonanza grade hit we'll rarely see," he wrote, noting visible gold and multiple high-grade intercepts from the Austin Zone. These included 7.8 meters grading 139.45 g/t gold, 8.7 meters at 74.70 g/t, and 7.5 meters at 18.31 g/t, all within 30 to 50 meters of surface.

Clark also pointed to the mine's operational performance, highlighting the Madsen mill's third-quarter output of 7,055 ounces of gold at an average realized price of US$3,456 per ounce, generating gross proceeds of CA$33 million. He described the company's drilling results as a "bank" for future production, emphasizing the consistency between modeled and actual grades. "The reconciliation between modeled and actual mined grades varied only by +/-1 g/t or less," Clark noted, calling it "key" evidence of improved precision and planning under new management.

In his recommendation, Clark maintained a Hold rating, stating, "Hold if you own it, that's what I'm doing. If you don't own it, let's wait for Q4 results in January to see how profitable Madsen will be." He added that West Red Lake Gold's improved drill spacing and resource modeling had given the team a stronger grasp of its mineralized zones — an advantage he said "virtually killed its predecessor." While taking a cautious near-term stance, Clark underscored that "as Madsen ramps up production and continues to model its ever-growing, thickening deposit, there could be significant upside."

Cantor Fitzgerald issued an additional update on October 10 following new underground drill results from the lower Main Austin Zone at Madsen. O'Keefe stated that the results confirmed multiple high-grade gold lenses at depth, comparable to those defined in the South Austin Zone earlier in the year. Highlights included 7.8 meters grading 139.5 grams per tonne gold, including 2.0 meters at 532.3 grams per tonne. "WRLG continues to unlock exploration upside at Madsen," O'Keefe wrote, noting strong continuity along a 600-meter plunge. He maintained his Buy rating and CA$1.80 target price, valuing the company at 0.4 times NAV compared to peer averages between 0.8 and 1.1 times.

John Newell of John Newell & Associates added a similarly positive perspective in a September 5 commentary, pointing to the company's strategic land position and its Madsen acquisition as catalysts for renewed investor interest. "The stock has spent years building a long base," Newell wrote, "and rising volume now points to a potential breakout."

Gold Sector Sees Record Inflows as Investors Seek Stability

Gold's 2025 rally extended into October, underscoring the metal's growing role as a global safe haven. As reported by Stockhead on October 6, the XGD index gained 1% in morning trading on the ASX following gold's surge to a new intraday high of US$3,922 per ounce. Analysts attributed the move to rising risk aversion, with investors seeking stability amid a U.S. government shutdown and lingering uncertainty over global economic conditions. The strength in gold and gold equities contrasted sharply with broader market trends, as technology stocks declined and the ASX briefly broke above the 9000 mark before edging down 0.13% by midday.

During early Asian trading hours on October 8, spot gold surpassed the US$4,000 level for the first time, a move described by Metals Daily as both psychological and structural. The milestone, reached at 03:00 BST, marked a rapid ascent from US$3,000 to US$4,000 in just seven months, signaling accelerating demand for hard assets. Analysts characterized the move not as speculative exuberance but as a rational revaluation of trust amid growing concerns over sovereign debt, fiscal sustainability, and long-term confidence in fiat currencies.

According to Yahoo Finance on the 8th, this momentum reflects growing investor demand for hard assets amid persistent inflation, deficit spending, and expanding money supply. The U.S. dollar's 9% year-to-date decline has further fueled buying interest, while political developments in Japan, including the election of Prime Minister Sanae Takaichi, viewed as a fiscal dove, reinforced expectations of stimulus-driven policy.

Analysts at Nomura Securities noted that gold, silver, and bitcoin have all benefited from this macroeconomic shift. Meanwhile, Goldman Sachs raised its gold price forecast for December 2026 from US$4,300 to US$4,900, citing steady ETF inflows and sustained central bank accumulation as long-term drivers of structural support.

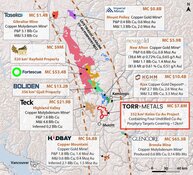

Advancing Growth Across Red Lake's High-Grade Gold Corridor

West Red Lake Gold has continued to strengthen its position in Ontario's Red Lake Gold District through disciplined development and exploration at the Madsen Mine. Since acquiring the asset in 2023, the company has executed a comprehensive turnaround strategy focused on infrastructure rehabilitation, targeted definition drilling, and preparation for sustained production growth.

By mid-2025, the Madsen mill was operating at an average rate of 650 tonnes per day with 95% gold recovery, while gold output from January through July totaled 9,550 ounces. Bulk sample reconciliations from the Austin, South Austin, and McVeigh zones demonstrated strong alignment between modeled and actual grades, reinforcing the reliability of the company's resource estimates.

The company's operational roadmap emphasizes the transition toward full commercial production, with milestones including the completion of shaft refurbishment, commissioning of the cemented rock fill (CRF) plant, and delivery of additional underground equipment. A detailed 2026 mine plan remains central to guiding grade control and optimizing production from high-grade areas such as the Austin and South Austin panels.

Exploration continues to play a key role in defining future growth potential. Ongoing drilling across the 904 complex and East Drive area is expected to total 36,000 to 40,000 meters through 2026, expanding the resource base and enhancing mine design flexibility. In parallel, West Red Lake Gold is advancing development at its Rowan and Fork deposits. The August 2025 Preliminary Economic Assessment for Rowan outlined a five-year underground toll milling plan averaging 35,200 ounces of annual production at an estimated capital cost of US$70 million.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQB; FRA:UJO)

The company's January 2025 Pre-Feasibility Study for Madsen, prepared by SRK Consulting, estimated a net present value of C$496 million at a gold price of US$2,640 per ounce and projected average annual free cash flow of C$94 million over six years. The study assumed mining of high-grade stopes averaging 8.2 grams per tonne gold, supported by an existing 800-tonne-per-day mill and established infrastructure.

West Red Lake Gold reported that tighter drill spacing and larger stope designs have already improved both tonnage and grade within key zones, including the 1099/1100 and South Austin 4447 stope complexes. As the company continues to advance the Madsen Mine toward sustained operations, ongoing drilling and engineering refinements are expected to further enhance resource confidence and operational efficiency across its Red Lake portfolio.

Ownership and Share Structure

According to Refinitiv, strategic investor Sprott Resource Lending Corp. holds about 8% of West Red Lake Gold. Institutions own about 30%, while management, insiders, and advisors hold around 10%. The remaining shares are held by retail investors.

The company's market capitalization is CA$384 million, with a 52-week stock price range of CA$0.52 - CA$1.18.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- West Red Lake Gold is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Red Lake Gold.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.