$350 billion. . .

That's the mountain of cash tech giants are pouring into AI computing facilities this year alone. It exceeds Switzerland's entire governmental operating budget.

Naturally, this tidal wave of investment has propelled AI champions like Nvidia Corp. (NVDA:NASDAQ), Broadcom Inc. (AVGO:NASDAQ), and Vertiv Holdings Inc. (VRT:NYSE) to unprecedented heights. We bow to the market deities for the gains they've bestowed upon us.

When typical investors witness tech behemoths funneling such massive sums into AI, they yell, "Market frenzy!"

They're completely mistaken.

We jumped on the Nvidia bandwagon early, suggesting it back in 2018. Yet I believe we're merely at the beginning stages of the AI infrastructure development. . .

The competition to construct a "digital god" represents the most extensive infrastructure undertaking of our era.

It surpasses both the entire Apollo program and the Interstate Highway System in magnitude, measured in 2025 currency.

I frequently hear, "Isn't this just the 1999 fiber optic bubble again?"

No. During that era, the entities making investments were cash-hemorrhaging ventures. Collectively, they were investing triple their revenue laying fiber optic networks. And a mere 2% of that fiber capacity was being utilized.

Today, the global AI investment leaders are simultaneously the globe's most lucrative enterprises. And data center capacity is fully committed months, even years, before construction concludes. Completely different scenario.

The additional reason this isn't a replay of 1999 is that a fresh AI investor has emerged. One with substantially deeper resources than even tech titans, and the capability to generate currency when necessary.

'Can't let that happen again.'

That's what governmental bodies worldwide muttered after missing the internet revolution.

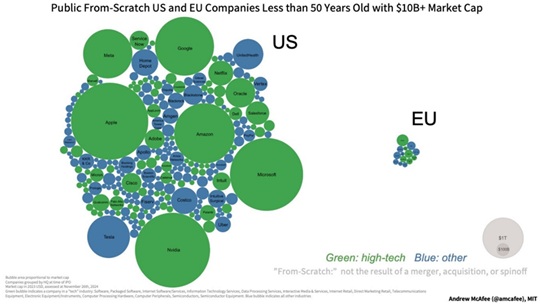

Examine this visualization depicting the quantity of $10 billion companies established in America (left) versus Europe (right) over the last five decades:

The disparity is staggering.

Most nations observed trillions in market valuation concentrated in Silicon Valley. Since then, they've existed under a form of digital subordination, compensating American corporations for cloud resources, software systems, and the digital infrastructure powering their economies.

This time around, countries are resolved not to duplicate that error. AI is too revolutionary and too closely connected to national defense to entrust to external parties. Consider operating America's nuclear arsenal on Chinese AI. Or permitting another nation's algorithms to determine your children's education curriculum. Exactly.

This explains why nations are investing billions in what Nvidia CEO Jensen Huang labeled "sovereign AI."

Sovereign AI represents a country's capability to develop and operate AI on its own computational resources, utilizing its own information, with its own citizens. Essentially, data centers are within your national boundaries.

Jensen expressed it perfectly: 'Every country will have an AI factory, just like every country has a telco.'

European nations are establishing sovereign cloud systems and national supercomputers.

The United Kingdom recently activated Isambard-AI, its most formidable supercomputer ever created.

India approved a 38,000-GPU national cluster to train AI models.

The UAE and Saudi Arabia are projected to invest hundreds of billions in constructing data centers over the next five years.

As many RiskHedge readers are aware, I recently relocated to Abu Dhabi. Every citizen received a perpetual ChatGPT subscription. I encountered one of the individuals assisting OpenAI in establishing data centers here. Coincidentally, he's Irish!

What are the essential components of every sovereign AI system?

The identical data center elements tech giants are deploying: processors, thermal management, connectivity, and networking hardware.

Sovereign AI sounds impressive. But fundamentally, it represents a massive wealth transfer from governments primarily to American AI enterprises.

Governments will construct their own computational facilities and manage their own information. But they'll purchase Nvidia processors and Arista Networks Inc. (ANET:NYSE) equipment.

I recall my colleague Louis Gave — who manages the billion-dollar investment firm Gavekal in China — remarking, "A winning strategy has been to buy whatever Xi Jinping invests in."

The identical principle applies here. Political leaders are explicitly revealing where they'll direct trillions of dollars. Investing alongside them represents one of the most straightforward market opportunities available today.

Sovereign AI propels AI expenditure to $1 trillion annually.

As disruption investors, our responsibility is to track capital flows.

Imagine your government contacts you one morning and assigns you the task of building multiple data centers.

Your first action wouldn't be phoning Jensen Huang, requesting a shipment of AI chips. You'd begin with the foundational elements.

Structures. . .

Reserve power infrastructure that converts grid electricity into usable current . . . And sequences of cooling conduits to extract heat from equipment racks that will soon operate at temperatures hot enough to liquefy metal.

Only after the concrete had solidified, power distribution was operational, and cooling systems were circulating, would you request GPUs.

That's the practical reality of "Sovereign AI." And that's where the trillion-dollar AI explosion commences.

AI will transform industries and economies for the next 10–20 years. And I believe it could prove far more revolutionary than the internet because it will influence substantially more aspects of our existence.

The primary risk lies in divesting AI stocks prematurely. Disruption rarely unfolds in neat intervals. It continues longer than most investors can envision.

If you want to become a successful investor, you need to go where the money is flowing. In my disruption-focused letter, The Jolt, I track where the investment dollars are headed next… and which stocks are best-positioned to ride the wave.

It’s free to sign up if you’d like to join me. Just go here to subscribe.

If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing.

Go here to join

Important Disclosures:

- Stephen McBride: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.