Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB; FSE: X7W) announced that drilling at its Sherridon Project in the Dryden Gold District, Ontario, intersected several wide zones of anomalous gold mineralization. The initial three-hole program, guided by revised structural interpretations and comprehensive assaying, tested approximately 350 meters of a 5-kilometer geophysical anomaly within an east-west trending deformation corridor. According to the company, this marks the second regional discovery of its 2025 exploration program and represents a different mineralization style than that observed at its Gold Rock Camp.

Highlights from the program included 1.28 grams per tonne (g/t) gold over 19.00 meters, including 36.40 g/t gold over 0.50 meters in hole DSH-25-001, and 0.40 g/t gold over 39.00 meters, including 1.82 g/t gold over 7.00 meters in a second structure. Each of the three holes intersected an extensive zone of anomalous mineralization up to 136 meters thick.

Trey Wasser, CEO of Dryden Gold, stated in a company news release, "These new gold assays indicate broad zones of mineralization with a different alteration style than we see at Gold Rock or Hyndman. The geology team is excited about the potential for a completely different deposit model with potential bulk-tonnage scale at Sherridon."

Dryden Gold also purchased two 2% net smelter return (NSR) royalties covering certain Sherridon claims for CA$20,000 in cash. These royalties were acquired from two private individuals and originally pertained to claims purchased from Manitou Gold Inc. (MTU:TSX.V), a wholly owned subsidiary of Alamos Gold Inc. (AGI:TSX; AGI:NYSE), in March 2025. The remaining 1% royalty is held by Alamos Gold, half of which can be bought down for CA$500,000. All other mining claims at Sherridon remain royalty-free.

Sherridon's geology features ultramafic dykes, interpreted as indicators of deep-rooted structures capable of accessing mineralized mantle rocks. The project lies roughly one kilometer north of granitic intrusions thought to have influenced fluid movement and metal remobilization. The site's structural complexity and its position along a second-order structure tied to the Manitou-Dinorwic deformation zone are believed to enhance its potential for mineral accumulation.

The company's geology team has initiated resampling of historical drill core adjacent to the new holes to fill gaps in historical data. Additional geochemical results are pending, which the company noted will aid in identifying the distribution of elements such as arsenic and tellurium, key indicators for targeting higher-grade sections within the mineralized zones.

Dryden Gold's management team will be presenting its exploration progress at several upcoming industry events, including the New Orleans Investment Conference (November 2–5, 2025), the Central Canadian Mineral Exploration Convention in Winnipeg (November 3–4), and the 121 Mining Investment Conference in London (November 17–18). The company will also participate in the Swiss Mining Institute event in Zurich on November 20–21.

Gold's Record Run Driven by Central Banks and Global Shifts

Gold's remarkable surge in October reflected a convergence of global uncertainty, monetary policy shifts, and renewed confidence in tangible assets. On October 6, spot gold climbed past US$4,000 per ounce for the first time in history. Analysts described the breakout as both "structural and symbolic," noting that investors were seeking stability amid fading trust in fiat currencies and sovereign debt. The sharp advance, much of which occurred during Asian trading hours, was seen as a sign of growing economic influence in the East and a repricing of global financial risk.

According to the same analysis, central banks were a major force behind the move. Official sector buying remained strong as nations prioritized security of reserves over yield, with many moving holdings back within domestic borders. By 2023, roughly 68% of gold-buying central banks held their reserves at home, compared with 50% in 2020 — a trend expected to continue through the decade.

On October 9, Jeff Clark of The Gold Advisor noted that Dryden was "off the radar but starting to get more attention," pointing to support from high-profile investors including Centerra Gold, Rob McEwen, Eric Sprott, Bob Quartermain, and Alamos Gold.

A subsequent report by Bruno Venditti on October 8 highlighted a major shift in global reserve management. For the first time since 1996, foreign central banks collectively owned more gold than U.S. Treasuries.

Nearly one-fifth of all gold ever mined is now held by central banks, the report noted, with sustained buying in 2022, 2023, and 2024 pushing the metal above the US$4,000 level. The milestone underscored a gradual rebalancing away from dollar-based assets toward physical stores of value.

In an October 10 article, Anthony Keane reported that gold had gained 123% over the previous two years, outperforming most other asset classes. Analysts attributed the rise to lower interest rates, geopolitical instability, and demand for finite resources. Capital.com's Kyle Rodda explained that "the supply of money grows at a much faster pace than we can pull gold out of the ground," while pointing to conflict and trade tensions as additional catalysts. Tony Catt of Catapult Wealth added that "gold is an asset class where there is a lot of central bank buying," a pattern that may persist in times of uncertainty.

A research note from UBS described broad optimism across the market, stating it was "hard to find anyone who isn't a gold bull." However, data from Dimensional Fund Advisors offered historical balance, showing that gold's returns have been positive in just over half of all calendar years since 1980.

Analysts Highlight Exploration Success and Growing Market Attention

Chen Lin of What Is Chen Buying? What Is Chen Selling? shared early impressions following a June site visit, stating that the trip helped him understand the scale of Dryden's land package and its multiple high-grade targets. In July, he pointed to the company's LIFE (Listed Issuer Financing Exemption) raise at CA$0.20 per share as a compelling entry opportunity. On August 22, Lin highlighted a notable intercept of 8.68 grams per tonne (g/t) gold over 9.4 meters, followed by another commentary on September 15 after the company reported 55.34 g/t gold over 3.5 meters, noting that the share price had responded positively. On October 3, Lin commented more broadly on the sector, noting that "other juniors [are] doing well, Dryden Gold Corp. on new discoveries."

Jeff Clark of The Gold Advisor also weighed in on multiple occasions. On August 14, he commented on Dryden's upsized non-brokered financing, which had increased from CA$7 million to CA$7.8 million, stating that the added capital would allow for continued drilling across key targets. In an August 21 update, Clark reiterated that ongoing drill programs could drive near-term news flow and described Dryden as one of his overweight positions. He followed up on September 11, citing a bonanza-grade intercept of 379 g/t gold over 0.5 meters within a broader interval of 55.34 g/t over 3.5 meters at the Gold Rock project's Gap Hole target. On September 25, he remarked that while shares had moved higher, they still presented better value compared to peers that had already seen significant gains.

Clark provided further commentary in October, emphasizing both investor backing and long-term potential. On October 2, he stated, "In my opinion, Dryden Gold Corp. will be multiples higher a couple of years from now, not so much because of the gold price (though that obviously helps) but because the company's in the middle of proving up the next gold district in the Red Lake area."

He added that the company is expected to join The Gold Advisor portfolio in the current quarter. On October 9, he noted that Dryden was "off the radar but starting to get more attention," pointing to support from high-profile investors including Centerra Gold, Rob McEwen, Eric Sprott, Bob Quartermain, and Alamos Gold.

Brien Lundin of Gold Newsletter offered his view on October 2, calling Dryden a "Buy" following the company's most significant hole to date at the Gold Rock target area. Lundin pointed to Hole DGR-25-018 at the Gap Hole target, which intersected nine stacked gold-bearing structures across 540 meters of drilling. He concluded, "I think the company's turn in the spotlight is coming up."

*John Newell of John Newell & Associates added to the analyst commentary on August 28, issuing a "Speculative Buy" rating. Newell cited Dryden's experienced leadership, favorable geology, and strong technical setup. He noted the company's fully permitted and 100%-owned land position of more than 70,250 hectares in northwestern Ontario, highlighting ongoing work at the Gold Rock, Sherridon, and Hyndman projects. Newell also underscored the importance of Dryden's focus on testing periodicity within a 20-kilometer corridor at Gold Rock, calling it a defining characteristic of large-scale gold systems.

Expanding a District-Scale Gold System

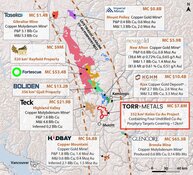

Dryden Gold's 2025 exploration program emphasized district-wide discovery potential, targeting both high-grade and bulk-tonnage gold systems across its 702-square-kilometer land package. With over 23,000 meters of drilling planned under its fully funded CA$5.95 million exploration budget, the company is continuing its two-pronged approach: advancing the high-grade Elora Gold System within the Gold Rock Camp and evaluating new deposit models at regional targets such as Sherridon and Hyndman.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB; FSE: X7W)

Its investor presentation highlighted four key catalysts for 2025: expanding mineralized structures at Gold Rock, proving periodicity along the Mud Lake trend, and pursuing new discoveries at Sherridon and Hyndman. Sherridon, in particular, was identified as a priority regional target characterized by ultramafic and gabbro-hosted mineralization linked to deep structural conduits. The company's exploration strategy integrates continuous core orientation and full-core assaying to refine its geological models and improve targeting efficiency.

Dryden Gold's leadership team, which includes President and Qualified Person Maura Kolb and CEO Trey Wasser, continues to emphasize data-driven exploration across a region that remains underexplored relative to its proximity to established mining camps like Red Lake.

Ownership and Share Structure

According to the company, management and insiders own 6.41%, with strategic entities owning 53.82% of Dryden.

Centerra Gold Inc. (CG:TSX; CADGF:OTCPK) holds 9.99%, with Alamos Gold Inc. (AGI:TSX; AGI:NYSE) holding a 11.97% stake in it. Euro Pacific Asset Management LLC owns 3.80%. There are 192 million shares outstanding.

Its market cap is CA$61 million, and it trades in a 52-week range of CA$0.395 and CA$0.105.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dryden Gold is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dryden Gold.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the John Newell article published on August 28, 2025

- For the quoted article (published on August 28, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,000.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.