Sun Summit Minerals Corp. (SMN:TSX.V; SMREF:OTCQB) has completed its 2025 exploration program at the JD Project in the Toodoggone Mining District of north-central British Columbia. The program included 21 diamond drill holes across three key target areas (Creek, Finn, and Belle South) totaling 6,864 meters. This figure represents a 37% increase over the originally planned 5,000-meter campaign.

At the epithermal gold-silver Creek Zone, 15 holes were drilled for 5,103 meters. An early highlight from the program came from hole CZ-25-007, which intersected 78.0 meters of 3.72 grams per tonne (g/t) gold from 30.0 meters downhole, including 19.1 meters of 7.50 g/t gold. The company noted that this result expands on prior intercepts and suggests potential for both high-grade and bulk-tonnage style mineralization.

Four holes totaling 950 meters were drilled at the Finn Zone to follow up on historic drilling, including one historical intercept of 35.7 meters grading 7.26 g/t gold and 94 g/t silver. Two holes for a total of 811 meters were completed at the Belle South copper-gold porphyry target, located at the southern end of a 12-kilometer-long mineralized trend that includes the McClair Creek alteration zone.

The program also featured an extensive surface campaign, including the collection of more than 1,500 soil samples and over 120 rock samples, as well as detailed geological mapping across several target areas. A total of 58 line kilometers of induced polarization (IP) geophysical surveys were completed, including an 8.5-kilometer-long chargeability high that enhances the porphyry copper-gold potential of the project.

According to CEO Niel Marotta in the press release, "We hit the ground running in early June 2025 and shut the last drill hole down on October 6, 2025, for a total of greater than 1,670 person-days spread across four months with 10 key contractors." He added that the work was completed on time and on budget despite the addition of a second drill rig late in the season.

Core samples from the final drill holes have been sent for assay and geochemical analysis. Results will be released once received and reviewed.

Hard Assets in Demand as Gold Surges and Copper Tightens

Gold and copper are drawing renewed investor focus in October 2025, but for different reasons. Gold is benefiting from its role as a safe haven amid global uncertainty, while copper faces mounting supply constraints that are raising long-term concerns.

According to Stockhead, the XGD index on the ASX rose 1% on October 6 as gold touched a new intraday high of US$3,922 per ounce. The move came as investors sought stability in response to a U.S. government shutdown and weakening economic sentiment. The following day, Metals Daily reported that spot gold broke the US$4,000 barrier during early Asian trading, marking a rapid rise from US$3,000 just seven months earlier. Analysts described the move as a structural shift driven by concerns over sovereign debt and fading confidence in fiat currencies.

Gold's momentum has also been fueled by persistent inflation and a weakening U.S. dollar, which is down 9% year-to-date. Yahoo Finance cited additional tailwinds from Japan's new administration under Prime Minister Sanae Takaichi, who is expected to pursue stimulus-friendly policies. Nomura Securities noted that gold, silver, and Bitcoin are all gaining from this macroeconomic pivot. Meanwhile, Goldman Sachs raised its 2026 gold forecast from US$4,300 to US$4,900, pointing to steady ETF inflows and continued central bank accumulation.

Copper, by contrast, is under pressure from supply-side constraints. As reported by Investing.com on October 6, the US$54 billion Anglo American and Teck Resources merger underscores the urgency of securing long-term supply. The International Energy Agency estimates global output could fall below 20 million metric tons by 2035, while demand may approach 33 million tons due to electrification and green energy infrastructure.

Reuters, also on the 6th, detailed how recent disruptions at major mines in Indonesia, Panama, and the Democratic Republic of Congo have added near-term strain. Citigroup projects just 1.3% production growth in 2026, well below historical averages. Although copper prices have risen to about US$10,500 per ton, project development costs have climbed even faster. The IEA estimates Latin American capital expenditures are up 65% since 2020, with new capacity costing between US$23,000 and US$30,000 per ton of annual output.

The Anglo-Teck merger may provide some relief, with 175,000 tons of new capacity expected by 2030 at less than US$11,000 per ton. But such opportunities are rare, and exploration spending remains subdued. Only 14 major copper discoveries were made between 2013 and 2023. Bank of America recently raised its copper forecasts to US$11,313 per ton in 2026 and US$13,500 in 2027, citing the widening gap between constrained supply and growing demand.

Experts Highlight Drilling Progress and Surge in Regional Exploration Spending

Sun Summit Minerals' 2025 drill program at the JD Project in British Columbia continues to draw strong interest from analysts, supported by early results and rising exploration activity across the Toodoggone District. With drilling underway and results already making headlines, experts point to the project's potential and the broader uptick in regional copper-gold investment as key drivers of momentum.

Drilling at the JD Project officially began in mid-July. On July 18, Jay Taylor of Hotline reported that the first hole had been collared at the northwest extent of the Creek Zone, designed to test both high-grade and bulk-tonnage styles of near-surface gold mineralization. The initial phase was expected to include up to 3,000 meters of drilling.

Taylor followed up on September 12 after results from the first hole were announced, writing, "Sun Summit Minerals Corp. reported results from its first drill hole completed in 2025 at the JD project . . . these are obviously fabulous results, and with them I have to think this story is going to start to attract some eyeballs."

Brien Lundin has also continued to highlight the project in Gold Newsletter. On August 28, he noted, "Given the significant gold and silver grades that Sun Summit Minerals Corp.'s Creek and Finn zones have produced in past drilling, they have a chance to deliver good results to the market this fall. The company is a Buy at current levels."

Following the announcement of 78 meters grading 3.72 grams per tonne gold from hole CZ-25-007, Lundin reiterated his view. On September 19, he wrote, "Sun Summit Minerals Corp. made headlines last week with a hit of 78m running 3.72 g/t gold from the first hole completed this year at the JD project . . . I'm very interested to see what the follow-up drilling will produce, and the company remains a Buy."

He expanded on that in his October 2 update, stating, "Sun Summit Minerals Corp. made headlines with a hit of 78m running 3.72 g/t gold from the first hole completed this year at the JD project . . . follow-up drilling on this discovery is planned for this season."

Unlocking Value in One of Canada's Most Active Gold-Copper Districts

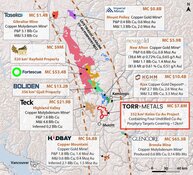

The JD Project sits within a 25,000-hectare land package in British Columbia's Toodoggone District, an area characterized by epithermal gold-silver systems and porphyry copper-gold potential. Sun Summit is targeting multiple zones with historical and recent results indicating significant scale and grade. The district has seen increased exploration activity in recent years, with nearby projects operated by companies with market capitalizations ranging from CA$300 million to CA$480 million.

The Creek Zone remains a core area of interest, with recent and historical intercepts including 122.5 meters at 2.1 g/t gold including 1.5 meters at 121.0 g/t gold, and 57.95 meters at 2.69 g/t gold including 19.5 meters at 7.31 g/t gold. The 2025 results are expected to build on this foundation and help refine targets for future drilling.

The Finn Zone has a substantial base of historic data, with more than 270 drill holes recorded. Previous results from the zone include 22 meters at 12.5 g/t gold and 45 meters at 3.0 g/t gold with 143 g/t silver. Recent drilling has aimed to verify grades and expand the zone at depth.

The Belle South area represents the company's first drill testing of the porphyry copper-gold potential in the southern portion of the JD Project. Geophysical data have outlined coincident chargeability and magnetic highs consistent with porphyry-style systems, supporting the exploration rationale.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Sun Summit Minerals Corp. (SMN:TSX.V; SMREF:OTCQB)

Sun Summit raised CA$10 million in May 2025 to fund its exploration program. The company's investor materials indicate that planning is already underway for the 2026 program, with a focus on expanding known zones and progressing toward an initial mineral resource estimate in 2027/2028.

Sun Summit reports a market capitalization of approximately CA$48 million with 216 million shares outstanding and 367.2 million fully diluted. The JD Project is fully permitted, and the company expects to release assay results from the 2025 program in late 2025 or early 2026.

Ownership and Share Structure

According to SEDI filings, 5.9% of Sun Summit Minerals Corp is owned by management and insiders.

Sun Summit has a market cap of CA$42 million with 218.17 million free float shares and a 52-week range of CA$0.065 to CA$0.340.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Sun Summit Minerals Corp is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000. In addition, Sun Summit Minerals Corp as a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sun Summit Minerals Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.