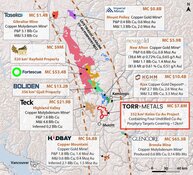

I discussed precious metals back in July while introducing readers to a small exploration company. My observation was that gold and silver were entering their traditionally strongest seasonal period. I rarely make predictions with such precision. Both metals have surged dramatically since then. Gold was hovering around $3300 while silver was lingering at approximately $37 at that time. The transformation over a quarter has been remarkable.

The corporation is GoldHaven Resources Corp. (GOH:CSE; GHVNF:OTCQB; 4QS:FSE).

They recently issued an update regarding their diamond core drilling operations at the Copecal gold project in Brazil. The enterprise initiated a 1,200-meter drilling campaign recently and has completed the initial borehole, sending samples for laboratory analysis. Preliminary visual examination indicates they appear to be targeting appropriate geological formations with heavily altered basement rock in the East Zone.

AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) invested over $1 million U.S. conducting regional exploration activities at Copecal in Brazil's Mato Grosso State between 2010 and 2016. Their efforts identified two distinct gold-in-soil anomalies associated with chargeability highs and structural intersections. GoldHaven acquired full ownership of Copecal in January this year.

I strongly advocate purchasing assets when they're undervalued and divesting when they're premium-priced. GOH maintained a market valuation of approximately $4 million when I covered them in July. They've appreciated roughly 50% since then, yet still only command $6 million today, while gold prices have climbed 33% during the same interval.

These forthcoming drilling results, expected in four to six weeks, could significantly transform this under-the-radar stock that most investors have overlooked. GOH remains substantially undervalued considering gold at $4000.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Bob Moriarty: I, or members of my immediate household or family, own securities of: GoldHaven Resources Corp. My company has a financial relationship with GoldHaven Resources Corp. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.