DroneShield Ltd. (DRO:ASX; DRSHF:OTC) could see an influx of business resulting from the recently floated idea of establishing a multilayered counter-unmanned aerial systems (C-UAS) network along the European Union's (EU's) eastern flank to detect, track, and neutralize hostile drones.

"DroneShield's shares have been on fire recently," wrote The Motley Fool in an Oct. 2 article. "Investors have been bidding its shares higher largely due to news that the European Union is looking to build a drone wall across its eastern border. The market seems to believe that DroneShield is well-positioned to benefit from this plan."

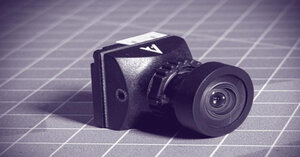

What this Australian company does is develop and sell hardware and software technology for drone detection and security.

When EU leaders met in Copenhagen on Wednesday to discuss nine priority defense and security topics, there was general but not full support of a drone wall, according to a European Council news release. About 50 heads of state or governments of the states comprising the European Political Community are attending this meeting, along with the European Council president, the European Commission president, the European Parliament president, the Council of Europe secretary general, and the North Atlantic Treaty Organization (NATO) secretary general.

"From a European perspective, there is only one country . . . willing to threaten us and that is Russia, and therefore we need a very strong answer back," Danish Prime Minister Mette Frederiksen told reporters.

NATO Secretary-General Mark Rutte said in a joint press conference earlier in the week, "We need to protect our skies. The drone wall initiative is timely and necessary, because in the end, we cannot spend millions of euros, or dollars, on missiles to take out the drones, which are only costing a couple of thousand dollars. So we need the drone wall."

European Commission President Ursula von der Leyen, who had introduced the concept a month ago, expressed urgency, saying, "Europe must deliver a strong and united response to Russia's drone incursions at our borders." She was referring to the Eastern European countries' recent escalation in violating the airspace of EU and NATO countries, specifically Poland, Romania, Estonia, Norway, and potentially Denmark and Munich. "We must move fast forward."

German Defense Minister Boris Pistorius said, "We should pay attention to manage expectations," as reported by Politico on Sept. 29. "We are not talking about a concept that will be realized in the next three or four years." He and French President Emmanuel Macron challenged the feasibility of a 1,864-mile drone wall and its effectiveness in countering the Russian threat, an AA article on Oct. 2 pointed out. Both are proponents of bolstering capabilities and capacities instead. The leaders of Greece and Italy queried what was in it for the countries on the bloc's southern border, according to an Oct. 1 Politico article.

Von der Leyen clarified at that while implementation of the wall initially would be on the EU's eastern flank because of its proximity to Russia and would involve Estonia, Latvia, Lithuania, Finland, Poland, Romania, Bulgaria, Denmark, Norway and Ukraine (excluding Hungary and Slovakia), the drone wall would be conceived "as a shield for the entire continent."

No detailed implementation plan has been put forward yet, according to Reuters on Oct. 1. Questions remain about key factors such as cost, funding, and command and control. The next EPC summit is scheduled for October 23 in Brussels.

Given the paucity of details about the drone wall, "we may witness a case of 'buy the rumor, sell the fact," Baxter Kirk, industrials analyst at Bell Potter, wrote in a September 30 email. "Nevertheless, the backing of NATO is a positive indicator that increases the chances of the initiative going ahead in a meaningful way."

Dialed in to Clients' Needs

The "EU drone wall favors radiofrequency and artificial intelligence over lasers," the technology inherent in DroneShield's products, thereby making them a good fit for this purpose, Abraham Akra, senior analyst with Shaw and Partners, highlighted in his October 1 research report. Akra gave the company a Buy rating, with a target price of AU$3.60.

In an antidrone's kill chain, the detect and assess components are the most critical and require sensors "to find, fix and track threats early," he wrote. Accordingly, DroneShield's radiofrequency-based systems align with passive detection trends in and out of conflict zones and thereby provide effective, low-power options for countering commercial drones.

Akra also wrote that DroneShield and its counterdrones are "best in class" because artificial intelligence (AI) powers threat assessment. AI reduces operator burden and false positives. Due to AI in its DroneSentry platform, for example, threat classification is fast and efficient in high-volume scenarios.

Further, the cheapest, most scalable first layer of counterdrone defense is nonkinetic disruption, and DroneShield "leads this market." He added that "DRO's portable and vehicle kits give infantry and security forces credible and rapidly exportable tools, at the point of need."

The company's counterdrone portfolio encompasses handheld, dismounted, vehicle-mounted and fixed-site solutions that fuse multiple sensors and effectors, all integrated via its software, DroneShield said. The combination of hardware and software provides "a layered defense architecture enabling operators to detect, track, identify and defeat hostile drones with speed and precision."

Still in expansion mode, the defense firm now plans to shore up its research and development and testing capabilities in the U.S., as noted in a Sept. 22 news release. This will include adding a second location to its U.S. headquarters in Virginia and more than doubling its workforce. Already, the company is adding to its production facilities in Australia and establishing a new office in the EU, reported Streetwise Reports in July.

Also this month, DroneShield passed the milestone of more than 4,000 C-UAS systems sold worldwide, when the U.S. Department of Defense awarded it two contracts totaling AU$7.9 million (AU$7.9M), the company announced on Sept. 17. Not long before, DroneShield posted record financial results in H1/25, with revenue of AU$72.3M up 210% year over year and an after-tax net profit of AU$2.1M, Akra reported in an Aug. 28 research report.

Tyson Williams of Henslow also commented positively on the company. In an exclusive quote to Streetwise Reports, he wrote, "Regarding why investors may want to look at DRO, I would say the company offers investors compelling exposure to the rapidly expanding C-UxS market, which stands to capitalize on sustained structural tailwinds driven by deteriorating global security conditions and accelerating defense expenditure. We believe DRO's strong market position, coupled with their continued commitment to technology investment, positions them well to benefit from potentially significant defense procurement programs."

Sector Having Growth Spurt

The global anti-drone market is forecasted to reach US$14.51 billion (US$14.51B) in value by 2030 from US$4.48B in 2025, reflecting a compound annual growth rate (CAGR) of 26.5%, according to Market and Markets.

The primary growth driver is escalating security concerns about "unauthorized and potentially malicious use of drones" in military, critical infrastructure, and public spaces, the report noted. Advances in detection and mitigation technologies, such as AI-powered systems, multisensor integration, and directed energy weapons, in large part are fueling the market by improving the effectiveness and reliability of C-UAS solutions.

The ground-based segment is projected to hold the biggest share of the anti-drone market in 2030 due to the equipment's versatility, ease of deployment and ability to cover vast areas with integrated sensor arrays, noted Market and Markets.

New and ongoing defense initiatives, many of them including drones and/or counterdrones, like the proposed European drone wall, and increased defense spending continue to spur sector growth.

The Catalysts

Events that could positively catalyze DroneShield's share price in the near term, the company said, include additional contracts, new hardware launches, increased software-as-a-service revenue and expansion progress.

Getting Investors' Attention

Attributed to news of a European drone wall, DroneShield's stock rose a total of 36% in the first four days of trading this week and did so, noted The Motley Fool, despite some profit taking. On October 3, the stock opened more than AU$1.50 higher than the consensus target price.

The overall rally nullified the target prices of Shaw and Partners' Akra, Bell Potter Industrials Analyst Daniel Laing and consensus by more than AU$1.50. Both analysts rate DroneShield Buy.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

DroneShield Ltd. (DRO:ASX; DRSHF:OTC)

DRO, in fact, was hot even before this week, climbing 33% in the previous four weeks alone, noted Simply Wall St reported on Sept. 29, and "making investors sit up and take notice."

Ownership and Share Structure

Recent filings reveal that Vanguard Group has become a substantial shareholder in DroneShield, holding a 5.45% stake, Fidelity Management and Research holds approximately 9.59% and State Street Corporation holds approximately 5.20%.

Management and insiders hold 1.30%, according to the company.

DroneShield has 874.72 million (874.72M) outstanding shares and 863.3M free float traded shares. Its market cap is AU$5B. Its 52-week range is AU$0.585–AU$6.25 per share.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of DroneShield.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.