Running over 1,000 kilometers from southern British Columbia to the Yukon border, the Quesnel Terrane (also known as the Quesnel Trough) is one of Canada's most prolific mineral belts. Defined by Triassic-Jurassic volcanic, sedimentary, and intrusive rocks, it is the backbone of British Columbia's copper-gold production.

This corridor hosts several of the country's most significant porphyry deposits, including Highland Valley Copper, Mount Polley, Mount Milligan, and Copper Mountain. These large, bulk-tonnage systems typically offer long mine lives and low operating costs, making them especially attractive for both major producers and explorers.

Importantly, the region is supported by strong infrastructure and decades of geoscientific research. A major survey in 2007 by Geoscience BC and the BC Geological Survey created one of the most comprehensive regional geoscience databases in North America, dramatically boosting exploration efficiency. Today, the Quesnel Terrane continues to attract interest for its scale, accessibility, and established endowment.

Cassiar Gold District: Revival in the North

Northwest of the Quesnel belt lies the Cassiar Gold District, a historically rich area originally known for its placer gold deposits. In recent years, attention has shifted to hard rock exploration targeting structurally controlled, high-grade, and bulk-tonnage gold systems.

Geologically, Cassiar is situated within a complex tectonic setting, largely influenced by the Northern Cordilleran Volcanic Province. Intrusive events and regional faulting have created favorable conditions for long-lived mineralizing systems, particularly those hosted in Late Triassic to Early Jurassic rocks.

The district is seeing a resurgence in modern exploration, supported by increased infrastructure, improved road access, and favorable community relationships. With both near-surface and deeper gold potential, Cassiar has emerged as one of British Columbia's most compelling frontier regions for new discoveries.

Wels District: Emerging Opportunity in the Yukon

Located in west-central Yukon, the Wels District is an underexplored but increasingly promising region for gold and copper exploration. Although the area lacks the long production history of other belts, it shares many of the same geological hallmarks: structurally complex terranes, mineralized intrusions, and high-grade occurrences near surface.

According to the Fraser Institute's Annual Survey of Mining Companies 2024, the territory ranks third in Canada for overall investment attractiveness. Yukon scored especially well in categories like geoscience data, policy perception, and permitting, making it a strategic destination for early-stage exploration.

As activity in Wels increases, the region is beginning to reveal its potential. With a supportive regulatory environment and high geological prospectivity, it represents a frontier with growing relevance in Canada's north.

From the established deposits of the Quesnel Terrane to the emerging targets in the Cassiar and Wels Districts, exploration across western Canada is gaining momentum. Several junior companies are leveraging modern geoscience, improved infrastructure, and favorable policy conditions to advance highly prospective projects throughout these mineralized belts. The following four explorers, each focused on distinct parts of the region, offer a snapshot of the renewed excitement across Canada's copper-gold corridors.

K2 Gold

K2 Gold (KTO:TSXV; KTGDF:OTCQB) is a North American mineral exploration company focused on precious metals projects in the Southwest United States and the Yukon. Headquartered in Vancouver, K2 Gold holds a portfolio of three active projects, including its flagship Mojave Project in California.

The company is advancing exploration at Mojave, a large land package that previously hosted U.S. and Canadian military testing and is now being assessed for near-surface, oxide gold potential.

As part of its operational buildout, K2 Gold recently announced the appointment of Jessica Van Den Akker as Chief Financial Officer and Corporate Secretary.

Van Den Akker brings over 20 years of experience in finance and governance, having held senior positions at Kore Mining, Hive Blockchain, and Fiore Management.

According to Executive Chairman John Robins, her addition aligns with K2's preparation for what he described as "the most comprehensive exploration program in the company's history." Her background includes more than CA$200 million in completed financings, spinouts, and corporate restructurings.

To support its presence in the public markets, K2 also retained ICP Securities to provide automated market making services using ICP's proprietary algorithm. The four-month agreement, announced in early September 2025, is designed to help correct temporary imbalances in the supply and demand of the company's shares. ICP, an arm's length third party, will not receive stock options or other incentive-based compensation under the terms of the engagement.

K2's flagship Mojave Project is located in a geologically favorable region with historical exploration data from Newmont Corp. (NEM:NYSE; NGT:TSX; NEM:ASX) and BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK).

The company's 2025 plans include geophysical surveys and surface mapping to refine drill targeting. According to its latest corporate presentation, K2 is prioritizing shallow, open-pittable oxide gold targets that have returned high-grade channel samples in previous campaigns. The project is road accessible, with proximity to infrastructure and a favorable jurisdiction for permitting and development.

In addition to Mojave, K2 continues to review and advance its other two projects: the Si2 Project in Nevada, located near AngloGold Ashanti Ltd.'s (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) Silicon Project, and the Wels Project in the Yukon. With a focus on early-stage discoveries and disciplined capital deployment, the company is positioning itself within some of North America's most prospective but underexplored gold regions.

According to Refinitiv, 8.11% of K2 Gold is held by management and insiders. The rest is retail. K2 Gold has 148.88 million free float shares, a market cap of CA$46.45 million, and a 52-week trading range of CA$0.09 to CA$0.45.

White Gold Corp.

White Gold Corp. (WGO:TSX.V; WHGOF:OTCQX; 29W:FRA) is a Canadian gold exploration company operating exclusively in the White Gold District of west-central Yukon.

With a land position spanning over 350,000 hectares, approximately 40% of the district, White Gold holds the largest contiguous claim package in the region.

Its flagship White Gold Project includes four near-surface deposits with a combined 1.73 million ounces of gold in the Indicated category and 1.27 million ounces in the Inferred category, based on an updated mineral resource estimate released in August 2025. These resources are primarily located within open-pit designs and remain open along strike and at depth.

The updated resource followed reinterpretation and optimization work on the Golden Saddle and Arc deposits, which led to greater geological continuity and expanded tonnage.

According to Vice President of Exploration Dylan Langille, the improved modelling has "more effectively and efficiently captured mineralization," contributing to the 44% increase in Indicated ounces compared to the previous estimate.

The updated estimate was prepared by Arseneau Consulting Services and will support further technical work, including a preliminary economic assessment. CEO David D'Onofrio noted that the near-surface nature of the deposits and their expansion potential support the company's efforts to demonstrate economic viability at scale.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

White Gold Corp. (WGO:TSX.V; WHGOF:OTCQX; 29W:FRA)

White Gold's 2025 exploration program includes drilling of untested zones in the footwall and hanging wall of the Golden Saddle deposit, resampling of historical core, and down-dip expansion drilling at Arc. Additionally, resource growth is being targeted through parallel mineralized structures along the Ryan's Trend and Chris Creek Trend, where limited past drilling has yielded notable grades. The company also continues systematic work on regional discoveries such as the Betty Ford zone, where past drill intercepts included 50 meters of 3.46 g/t gold and 18.29 meters of 8.94 g/t gold.

Outside analysts have also taken note. Renowned geologist Dr. Quinton Hennigh, a consultant to Crescat Capital, praised the project's geological continuity. "The geology that I saw at White Gold resembles a couple of mines in the southwest U.S. and northwest Mexico . . . they are the absolute replica of one another," he said in a recent interview with Bob Moriarty of 321Gold. Moriarty also highlighted the company's valuation appeal and strategic position, noting, "White Gold has a 2Moz resource already, which means they've got a mine effectively , , , and at a $60 million market cap that gives them $30 is incredibly cheap".

Dr. Hennigh agreed on the significance of the resource footprint, stating, "What these guys have done is outline a very large gold resource that has a lot of potential for expansion . . . you're looking at something that could be two to three million ounces very quickly".

In an August 2024 report, Haywood Securities reiterated its Buy rating on K2 Gold Corp., stating: "We view K2 as a deeply undervalued gold explorer with a project located in a highly prospective district." The analysts noted that "K2's stock currently trades at an EV/oz of $3.29/oz versus a peer average of $33.05/oz, making it an attractive value proposition."

Highlighting upside potential, Haywood added: "Our $0.65/share target price is based on a 0.5x NAV multiple of the PEA-stage Mojave Project." The firm cited permitting momentum, upcoming drilling, and strong gold prices as key catalysts, writing: "We believe a re-rating is likely as K2 delivers continued exploration success and advances Mojave through de-risking events.

Strategic ownership by Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) and Kinross Gold Corp. (K:TSX; KGC:NYSE) provides financial and technical support, with the two companies holding 19.7% and 15.8% equity stakes, respectively. White Gold is also advised by prospector Shawn Ryan, credited with assembling much of the district-scale land position and contributing to major discoveries across the region.

In addition to its core gold assets, White Gold holds several early-stage projects with potential for critical minerals, including copper, molybdenum, tungsten, and bismuth. These targets are located in the Dawson Range and are under review for possible advancement through a separate critical minerals initiative. Infrastructure developments in the Yukon, including federal funding for road upgrades and grid connectivity, further enhance the long-term accessibility of the company's district-scale exploration pipeline.

According to Refinitiv, 19.02% of White Gold Corp. is owned by management and insiders. Institutions hold 4.76%, while strategic entities, including corporations such as Agnico Eagle Mines Ltd., which owns 19.80%, account for 38.82%. The remainder is held by retail investors. White Gold has approximately 120.9 million free float shares and a market capitalization of CA$107.6 million. The company has a 52 week trading range of CA$0.11 to CA$0.61.

Cassiar Gold Corp.

Cassiar Gold Corp. (GLDC:TSX.V; CGLCF:OTCQX; 756:FRA) is a Canadian exploration company advancing a district-scale gold project in northern British Columbia. Its 100%-owned Cassiar Gold Property spans two main zones: Cassiar North, which hosts the bulk-tonnage Taurus Deposit, and Cassiar South, known for high-grade epizonal quartz vein systems and historical underground production.

In June 2025, the company announced an updated mineral resource estimate for the Taurus Deposit, outlining 410,000 ounces of gold in the Indicated category and 1.93 million ounces Inferred, using a 0.4 g/t gold cut-off grade. The resource model was based on more than 46,000 meters of drilling and reflects significant increases over the previous estimate, particularly in the Indicated category.

The updated model indicates strong geological continuity and near-surface mineralization, with 91% of gold ounces located within 150 meters of surface. Company management noted that the resource is open laterally and at depth, with opportunities to expand through additional drilling and exploration of adjacent targets.

The company also announced a CA$5 million non-brokered private placement to support ongoing and future exploration programs, including the 2025 field campaign and technical studies tied to a broader geological and geochemical domain model expected later this year. According to Cassiar, the Taurus footprint represents less than 0.5% of the property's mineral tenure, highlighting the scale of remaining exploration potential.

Cassiar South contains historical underground workings that produced over 315,000 ounces of gold at head grades between 10 and 20 grams per tonne. The area remains underexplored and includes targets along a 9-kilometer strike length. In addition to the Cassiar Gold Property, the company holds a 100% interest in the Sheep Creek project near Salmo, British Columbia. Sheep Creek is the province's third-largest past-producing orogenic gold district, with historical production totaling 742,000 ounces of gold at an average grade of 14.7 g/t Au. Cassiar's geological team believes there is further potential for stacked vein systems that remain untested below historical workings.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Cassiar Gold Corp. (GLDC:TSX.V; CGLCF:OTCQX; 756:FRA)

Cassiar Gold maintains a collaborative relationship with the Kaska Dena First Nations and operates in a jurisdiction with existing permits and infrastructure, including a 300 tpd mill and permanent camp facilities. Management states that this has positioned the company to advance exploration efficiently and cost-effectively. The company's leadership team includes professionals with extensive experience in geology, engineering, and capital markets. Exploration activities are focused on expanding the resource base and refining the geological model to support future economic assessments.

Jeff Clark, writing for TheGoldAdvisor, described Cassiar Gold as "an immense talent flying under the radar, awaiting the chance to reveal their greatness," following the company's updated mineral resource estimate and expansion of its 2025 drill program. According to Clark, the resource update at the Taurus Deposit "highlights both scale and accessibility," with 91% of the resource lying within 150 meters of surface and the pit shell extending to just 307 meters deep.

Clark noted that the ongoing 7,000-meter drill campaign reflects the company's "strong sense of momentum," with particular attention now shifting toward the Newcoast target near the highway. He observed that Cassiar "could be tapping into a multi-tiered mineralized package," referencing a "layer cake geology" that hints at stratigraphic repetition and stacked zones across the district.

Calling the new technical report "an expanded, robust, near-surface, pit-constrained asset with great access," Clark praised the company's leadership and drilling strategy. He disclosed a long position in Cassiar and stated, "I'm overweight the stock," pointing to 23% share price growth over the last six months and the potential for more upside once "the broader market [sees] what a robust asset lies below the soil in northern BC."

Alina Islam of Red Cloud Securities offered a "Buy" rating on Cassiar Gold Corp. in its June 2025 update, citing the company’s strong exploration results and potential for resource expansion. The report highlighted Cassiar’s 100%-owned Cassiar Gold Property in British Columbia, emphasizing both near-surface bulk-tonnage and high-grade vein potential across the project’s two main zones: Cassiar North and Cassiar South.

The analysts stated that drill results from the 2023 program continued to demonstrate the scale of the Taurus Deposit, with wide intercepts and strong continuity. They also pointed to upside from the high-grade targets at South Cassiar, noting, “This dual-exploration strategy enhances the asset's appeal to both bulk-tonnage and underground-focused producers.” Eight Capital maintained a CA$0.90 price target and projected further news flow from ongoing drilling and a future resource update.

According to Cassiar Gold Corp., insiders, comprised of board, management, and advisors, own 12% of the company, followed by HNW and retail investor holdings of 59%, and institutional investors holding the remaining 29%.

Key shareholders include Delbrook Capital, Commodity Discovery Fund, Sprott Asset Management, US Global, L1 Capital, Crescat Capital, M3SC Fund, Emerging Markets Capital, Ixios Asset Management, Myrmikan Capital, The Mancal Group, and Terra Capital.

As of June 9, 2025, Cassiar Gold has 128,731,002 shares outstanding, a market cap of CA$32 million, and a cash position of CA$4.9 million.

According to Google Finance, its 52-week trading range has been CA$0.18 to CA$0.33 per share.

Thunderbird Minerals

Thunderbird Minerals (BIRD:TSXV) is a Vancouver-based junior explorer focused on the discovery and development of precious and base metal projects in Tier 1 jurisdictions across North America.

Though incorporated in late 2022, the company has already assembled a strategic portfolio of grassroots-stage assets in British Columbia and the Yukon, targeting underexplored regions with strong geological potential and access to infrastructure.

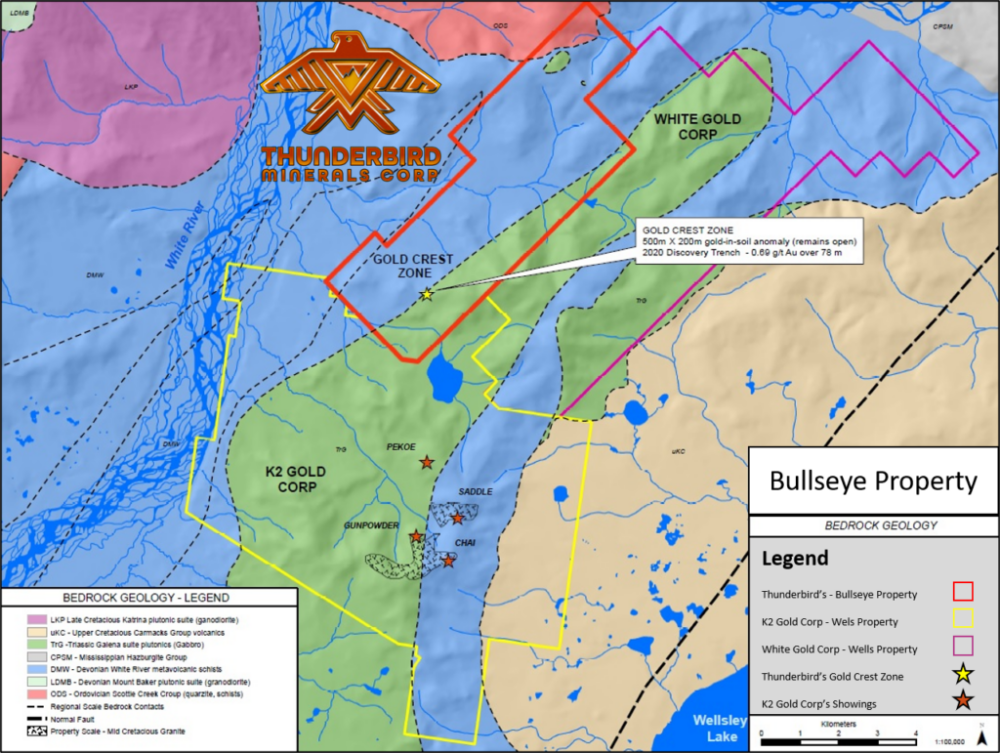

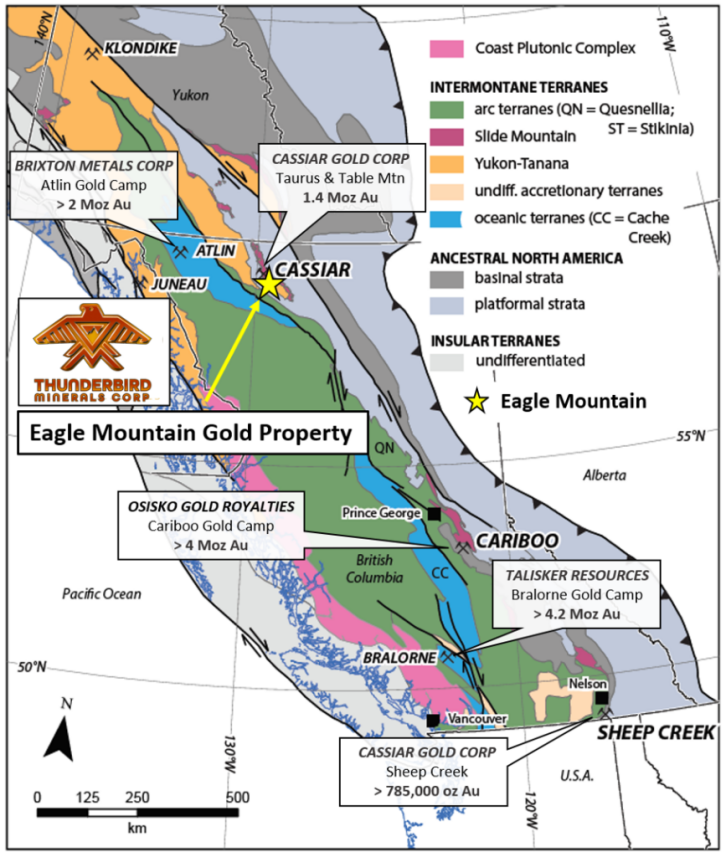

The company's exploration strategy centers on systematic fieldwork and low-cost discovery models in highly prospective mineral belts. Thunderbird's current portfolio includes three 100%-owned, drill-ready projects: the Eagle Mountain Gold Project in British Columbia's Cassiar Gold District, the Bullseye Project in the Wels District of southwestern Yukon, and the Argo Project near Quesnel, British Columbia. All three are located in established mining camps and are interpreted to host favorable structures for gold and copper mineralization.

At Eagle Mountain, mapping and sampling have outlined two distinct structural trends over a 2.5-kilometer-wide area with gold values up to 12.2 g/t Au. The project sits 30 kilometers east of Cassiar Gold's Taurus deposit and benefits from a mining-friendly jurisdiction with access via historical logging roads. Bullseye, in the Yukon, is centered on a 6.5-kilometer-long gold-in-soil anomaly within a structural corridor similar to those found at Newmont's Coffee Gold Project to the north. The Argo Project targets porphyry copper-gold systems and includes multiple untested IP targets along trend from historic workings.

To support its exploration plans, Thunderbird recently launched a CA$500,000 non-brokered private placement consisting of 10 million units priced at CA$0.05. Each unit includes one common share and one warrant exercisable at CA$0.10 for 12 months. Proceeds are intended for general working capital, exploration expenditures, option payments, and corporate development initiatives. The company also continues to evaluate additional opportunities across North America to expand its early-stage pipeline.

Thunderbird's approach to discovery is rooted in technical groundwork, regional targeting, and capital discipline. With a strong portfolio, experienced technical leadership, and active project generation underway, the company is positioning itself as a nimble explorer ready to capitalize on new mineral discoveries in proven but underexplored belts.

7.06% of Thunderbird Minerals Corp. is owned by individual investor John Newell. The remainder is held by retail investors. Thunderbird has 13.95 million free float shares and a market capitalization of CA$0.76 million. Its 52-week range is CA $0.00 - CA$0.065

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Thunderbird Minerals and Agnico Eagle Mines Ltd.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.