The planet's wealthiest individual has outdone himself, yet again.

Last year, Elon Musk and his xAI squad transformed a vacant facility spanning the equivalent of 13 football fields into the globe's biggest artificial intelligence (AI) computational hub in merely 122 days.

The typical American household requires 234 days to construct. Elon and xAI engineered an AI stronghold the dimensions of a modest community in roughly half that timeframe.

Nvidia Corp.'s (NVDA:NASDAQ) CEO Jensen Huang said that such constructions typically demand three years!

But Colossus 1 was simply the preliminary phase. As I write this, Elon and his team are constructing Colossus 2, which is scheduled to become the fresh global leader in AI computational facilities.

Colossus 2 will expand to approximately half a million AI processors when fully established. It will devour as much electrical power as the entire metropolitan area of Miami.

For the previous two years, everyone in the AI sector was fixated on processors. Elon Musk quipped that GPUs were "harder to get than drugs."

But the constraint in AI isn't processors anymore. . .

It's electrical power.

Everything circles back to the AI principle I shared with Disruption Investor members in 2020.

The larger the AI system, the superior the outcomes.

That's the reason AI systems continue growing increasingly massive.

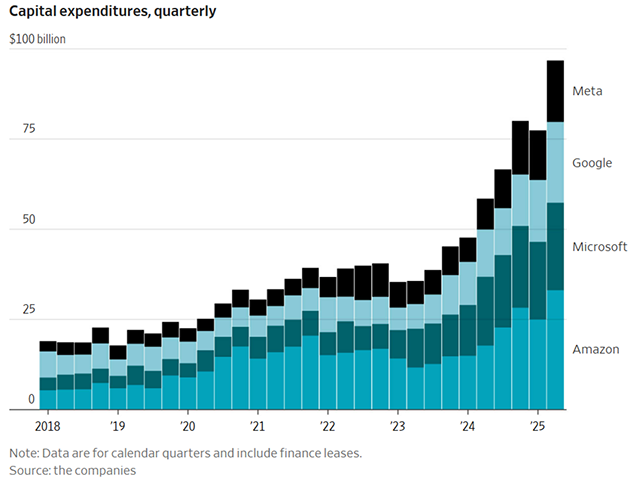

And during this year alone, major technology corporations will invest $350 billion+ establishing new AI computational facilities.

Within a single year, AI infrastructure expenditure has grown to match the complete Apollo program or the Interstate Highway System, when adjusted for contemporary dollars.

Back in 2006, Alphabet Inc. Class A (GOOGL:NASDAQ) invested $600 million on its initial major computational facility in Oregon. At that moment, it was a significant development.

Fast-forward to today. OpenAI, Oracle Corp. (ORCL:NYSE), and SoftBank are investing nearly 100 times that amount — $500 billion — on their "Stargate" initiative. Stargate will consume enough energy to supply a metropolitan area the size of New York!

Yesterday's massive projects were highways and dams. Today's massive projects are digital metropolises of silicon and steel, nourished by streams of electrical power.

Microsoft Corp. (MSFT:NASDAQ) incorporated two nuclear power facilities worth of capacity last year.

That was merely to maintain AI operational.

It also secured an agreement to help restart a reactor at the iconic Three Mile Island facility in Pennsylvania.

Meta Platforms Inc. (META:NASDAQ) advanced even further. It's launching its own energy trading division to manage the power expenses of its enormous computational facility footprint.

At this magnitude, there's no alternative. To sustain AI functionality, major technology corporations must construct, acquire, or control their own power.

I wouldn't be astonished if Microsoft, Meta, Google, and Amazon.com Inc. (AMZN:NASDAQ) transform into some of America's largest utility providers within a decade.

This is how disruption functions. It redefines entire sectors. Oil corporations evolved into refiners and gas station operators. Railroad companies transformed into real estate giants. AI corporations are becoming power companies.

And as investors, we want to possess the corporations enabling this disruption.

For years, they were the most unexciting stocks in the marketplace. . .

Utilities.

For decades, they were unexciting, slow-growth enterprises. The "anti-disruption" stocks.

But during the past year, America's largest utility stocks have been soaring.

NRG Energy, Inc. (NRG:NYSE) . . . up 82%.

Vistra Corp. (VST:NYSE) . . . up 70%.

And Talen Energy Corp. (TLN:NASDAQ) . . . has increased 116%.

All three are outperforming Nvidia (44%) over the identical timeframe.

These "unexciting" power suppliers are ascending because AI corporations are desperate for power.

Power is such a limitation these days, the sole reason Elon was able to get Colossus established was because he brought his own power.

xAI arranged natural-gas turbines on-site in Memphis. Then it obtained a decommissioned power facility in nearby Mississippi to get temporary approval to operate them without a permit.

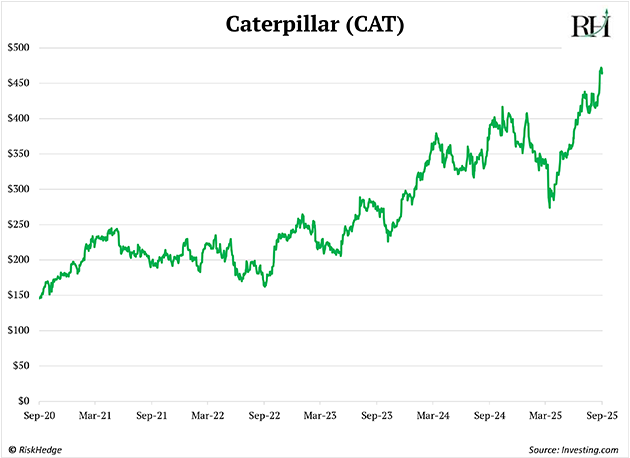

Caterpillar Inc. (CAT:NYSE) epitomizes an unexciting stock.

But have you examined its performance lately?

Historic peaks. Tripled in the previous five years:

Most individuals recognize Caterpillar for excavators and backhoes. But it's also the world's foremost manufacturer of backup power systems for computational facilities. Its Electric Power business sells the substantial yellow generator assemblies ("gensets") computational facilities depend on to never go dark.

That division has silently become Caterpillar's fastest-expanding business. And it's transformed mundane CAT into an AI stock.

AI is the trendiest and most "appealing" technology, but. . .

It doesn't operate without concrete, steel, and ordinary power.

The limitation has shifted from processors to electricity. That's fueling the subsequent wave of winners.

"You're telling me Caterpillar's an AI stock?"

In 2025 . . . absolutely!

I’ve been tracking the different ways AI will reshape old industries — and create entirely new ones — in my investing letter The Jolt. If you’re not already on the reading list and would like to hear more about these opportunities, join here for free.

| If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing. | Go here to join |

Important Disclosures:

- Stephen McBride: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.