As we close out the month of September and the third fiscal quarter for U.S. companies, we enter into the ominous, fright-filled month of October when memories of crashes big and small haunt only those with grey in their beards and common sense in their genes. The generation that today controls the "P" in the term "P/E" care a whit about the future course of "E" because it carries little or no relevance when governments and central banks are in total charge of the "P."

I was listening this week to a podcast with one of the prominent influencers whose bullish pivot last May was one of the first to identify the quantum shift in policy by the Trump White House from "Cut spending!" (through DOGE) to "Grow the economy!" as a preferred method of dealing with the debt monster threatening to derail to American growth engine. This latter choice of policy directive has been used before. David Stockman was in the Reagan cabinet back in 1980 when they spoke of "supply side economics" that operated on the key tenets that emphasized the willingness of producers to create goods and services as the main factor determining economic growth, contrasting with demand-side economics which focused on consumer demand. It also advocated for lower marginal tax rates, particularly income and capital gains taxes, believing such moves would encourages work, investment, and entrepreneurial activity. In supporting less government intervention in the free market and fewer regulations, it was designed to allow businesses to operate more freely and efficiently. This policy directive favoured a stable monetary policy, with some proponents that advocated a return to a gold standard to reduce currency fluctuations and potential inflation caused by central bank actions. This economic theory was also known back then as "trickle-down economics" or "Reaganomics," and it was close to the Trump-Bessent battle plan as historically possible.

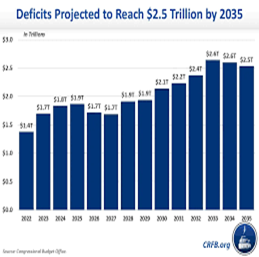

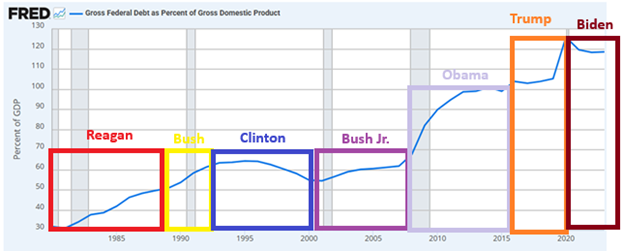

So how did that policy so wildly popular amongst stock market investors pan out for insignificant line items such as the national debt or the value of the S&P 500?

Well, the S&P 500 closed at 131.65 on January 20, 1981, the day Ronald Reagan was inaugurated as the 40th President of the United States. The S&P 500 closed at $286.63 on January 20, 1989, the day George H.W. Bush was inaugurated as the 41st President of the United States. Under "laissez-faire Reagan-omics," stock price advanced 117.72% in eight years.

The national debt was also on a tear under this "grow your way to prosperity" formula as on January 20, 1981, it stood at USD $908 billion and by the time Reagan left office on January 20, 1989, it stood at a (tongue-in-cheek) "staggering" $2.7 trillion, a 197.35% increase in that same eight-year "supply side economics" span.

It might therefore be concluded that since GDP in 1980 was $2.857 trillion and grew to $5.236 trillion by the end of 1988, tax revenues should (there's that operative word again. . .) have increased proportionately but due to Reagan tax cuts in 1988 designed to offset the impact of the 1987 market crash, there were actually fewer tax dollars received in 1988 ($412.9 billion) versus 1980 ($517.1 billion). It would appear from my advanced training in elementary school mathematics that the spending side of the equation was what caused the big jump in the deficit by the Bush inauguration in January 1989.

So the current administration decided to listen to the bond market back in April and pivot from massive spending cuts to the "big, beautiful Bill" ("BBB") that reinstated tax cuts wile increasing deficit spending on the assumption that increased tax revenues from "growth" would offset the harmful effects of the BBB.

So the current administration decided to listen to the bond market back in April and pivot from massive spending cuts to the "big, beautiful Bill" ("BBB") that reinstated tax cuts wile increasing deficit spending on the assumption that increased tax revenues from "growth" would offset the harmful effects of the BBB.

After observing the effects of the Reagan era on both the S&P 500 and the national debt, why am I not correlating the spending plans of the Trump Administration in 2025 and beyond to the spending plans of the Reagan Administration back in 1981?

The S&P 500 rallied 117% over the eight years Reagan ruled the roost.

It should, therefore, be logical to assume that similar actions under President Trump will result in a similar outcome for stocks.

Seem correct?

Well, here is where it breaks down. As stated earlier, in 1981, the U.S. was at its peak as a creditor nation, with a net international investment position of approximately $141 billion. However, by the end of 1985, the U.S. had become a net debtor nation (-$117 billion) for the first time since World War I and since then, the extent to which the U.S. has increased its "net debtor" status is mind-boggling. That figure in 2025 stands at $37 trillion and in no way, shape, or form can the American economy embark on a campaign of "supply side economics" without massive spending cuts.

Such cuts would completely gut the American economy so for Secretary Bessent and President Trump to assume that they can "grow their way out of debt" is at once both irrational and lacking historical evidence of its future effectiveness. It is also filled with megalomaniacal hubris and statistical bias of the highest degree.

There is a wonderful seen in the award-winning movie "The Big Short" where Jared Bennett played by Ryan Gosling is "pitching" Mark Baum played by Steven Carrell on the idea of shorting the credit default obligations that are underpinning the mortgage market back in 2007. He uses the board game "Jenga" to illustrate the fragility or the U.S. housing melt-up during that era. At the end of the pitch, Bennett yanks a block out of the bottom of the Jenga "tower" and the whole edifice comes crashing down.

That is exactly where the markets are today, in my humble opinion. The bulls like Darius Dale argue that because the U.S. dollar still enjoys reserve currency status, the Trump-Bessent plan will allow them to print their way out of the mess but as we have seen reported recently, for the first time since 1996, central banks now hold more gold than U.S. dollars which in my view is proof that the movement to replace the world's reserve currency is now underway.

You cannot "print" prosperity by debasing the domestic currency; 1921-1923 Weimar Germany proved that as did Hungary, Argentina, Zimbabwe, and Venezuela. That is why the U.S. equity markets are in store for a "Emperor's New Clothes" event where something or someone is going to trigger the ultimate "Come to Jesus" moment and the term "orderly exit" metamorphoses into a "disorderly exit" just as we saw in October 1987, October 2008, and March 2020. It will start in the bond pit and accelerate in the currency pit — just like '87.

This morning I was digging around to try to ascertain the last time markets failed to enjoy the wonderment of a Q4 rally. You see, every market strategist to whom I listen or whose words I have read are pointing to the reluctance of markets to correct as much as 3% in the two most volatile (meaning "dangerous") months of the year — August and September — as proof positive that we are in for a "monstrous year-end rally."

I went back to my notes from 2015 and I worked forward and lo and behold, I found the year 2018. That year, like 2025, the S&P 500 found a bottom in April and then rallied all the way until October 3 , at 2,939, posting a 15.4% gain off the lows but then entering a 20% drawdown that ended on Christmas Eve at 2,346.

Here is another interesting analog:

- The American Association of Individual Investors ("AAII") measures the percentage of individual investors who expect the stock market to rise (bullish), fall (bearish), or remain unchanged (neutral) over the next six months.

- It is conducted weekly from Thursday at 12:01 a.m. to Wednesday at 11:59 p.m..

- The results are published each Thursday morning.

- The AAII Sentiment Survey is often considered a contrarian indicator, suggesting that market trends may move in the opposite direction of extreme sentiment.

On October 4, 2018, the AAII Survey reported that 45.66% were bullish, 29.22% neutral and 25.11% bearish. The week before, the numbers were 36.22% bullish, 32.68% neutral, and 32.04% bearish. This week, the survey reported that 41.73% are bullish, 19.06% are neutral, and 39.21% are bearish placing it squarely in the middle of the September 27-October 4th sentiment range. Sentiment this week is eerily similar to where we were back in late September of 2018. Two months later, the S&P 500 was down 20.1%.

"What's past is prologue" is a famous line from Shakespeare's "The Tempest," meaning the past sets the stage or provides the context for the present and future events, much like a prologue introduces a play. While the original context was Antonio's rationalization for murder, the phrase is widely used to suggest that understanding history is crucial for navigating the present and making informed decisions for the future. Observing the action in 2018 may not provide us with a tradeable signal here in 2025 but with sentiment and investor positioning all betting and betting heavily on a year-end rally, I point to legendary investment strategist Bob Farrell's Rule # 9 which states: "When all the experts and forecasts agree, something else will happen."

Silver

Just to remind everyone reading this missive, I am by no means a "silver bug" which means I do not hold to the view that silver is in shortage conditions nor that it is superior to gold nor that silver should never be traded. I look at silver as a metal with a volatile price history that has been controlled, manipulated, and channeled by the large bullion banks since the Dawn of Creation. Any trader old enough to recall the Hunt Silver Chase back in 1978 can never forget the events of late 1979-early 1980 as the Hunts attempted to "corner" the silver market.

Actually, they did corner it beautifully but due to totally illegal changes to the SEC and CFTC rule books by regulators loyal to the banking behemoths whose short positions were threatening to bankrupt them, the Hunts were hit with outrageously high margin calls forcing them to liquidate positions sending them (and silver prices) into the tank.

At the risk of having my inbox flooded into damnation by irate silver bugs, what I am observing now on Twitter is reminiscent of the insanity of 1979 with every armchair technician, trader, AI expert, and tea-leaf-reading soothsayer offering outrageous target prices With an RSI at 77.61, it is now at levels last seen at tops in 2007, 2011, 2020, and May of 2024 after which the silver market experienced severe drawdowns. Add to that data the fact that every podcast personality and their brother is now calling for — no, SCREAMING for — $100 silver by New Year's Day — and you have the "perfect storm" for a correction.

It does not infer that I am dumping promising juniors; it simply means that I will avoid leveraged long positions in SLV:US or futures that can turn on a dime and bite you in the backside before you can say your last name.

The good, great, and wonderful news for all of the precious metals owners, followers and lovers out there is the infamous "GSR" is now in full decline having finally started its descent from the 85-90 level where it has been idling since mid-July. It closed out the week at 81.75 and appears poised to head down to the 30-35 level which would mark the range at which it bottomed in 2011.

Now, as much as the declining GSR is bullish for the entire precious metals sector, you can still have both metals declining in a corrective pattern but where the percentage decline in silver is outpaced by the percentage decline in gold. It sets up a terrific buying opportunity for both as it represents a positive divergence but unless you are actually "short" the GSR (and that is not an easy trade to make), you are forced to weather a drawdown in both gold and silver miners until the metals regroup.

The silver miners look terrific relative to the junior uranium or junior base metals (ex-copper) issues and they are actually preferred over the junior gold issues largely because there are so many more gold deals from which to select and many of them are patently garbage.

The advantage that the junior silver deals have aside from scarcity value is the millions upon millions of flag-waving, banner-flashing, fuzzy-cheeked kiddies that look upon silver in the same way they look upon Aragorn or Gandalf from the "Lord of the Rings Trilogy."

Silver has a mythical presence about it. I witnessed it in 1980 and again in 2011 and to a far lesser degree during the spectacularly inept "SilverSqueeze" attempt in 2021 that wound up nearly destroying its credibility until quite recently. Never underestimate the alure of silver. Ever. But remain very, very cautious.

Fitzroy Minerals

I had the pleasure of speaking with the Chairman of the Board of Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) Campbell Smyth last evening and as always, it was noteworthy. After a remarkable first half of 2025, the stock went quiet during the North American summer which also happens to be the Chilean winter especially when you are drilling in the mid-elevation Andes Mountains. As can be expected, not a lot of drilling gets done in that part of the world at that time of the year and in that part of the Chilean Andes. However, thanks to their diversified portfolio, there got a lot done.

The Year of our Lord 2025 has been a helluva year for this little Vancouver-based junior that has management from all over the world. Chairman Smyth lives in Perth, Australia; CEO/President Merlin Marr-Johnson hails from northwest London (U.K.), while COO Gilberto Schubert resides in Santiago, Chile after early years in Brazil. To read the resumés of these three takes three double espressos and a task-free "open" morning as the term "diversification" is an understatement. As a team, they are the best group I have encountered in over forty-five years of dealing in the junior resource space.

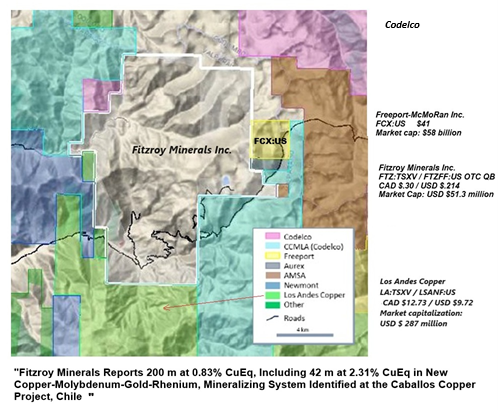

This team has raised over CA$18 million in 2025 alone on top of approximately CA$4.6m in 2024 while amassing an impressive property package (all in Chile) spearheaded by what appears to be an economically-viable oxide copper deposit (Buen Retiro) plus a brand new copper-molybdenum discovery at the Caballos Project sandwiched in the mid-range Andes between Antofagasta's Las Pelambres deposit (45m tonnes of Cu-Mo) and Anglo American's Los Bronces deposit (35m tonnes of Cu-Mo). They secured a lead order of CA$5m from Melbourne-based Tribeca Asset Management which was a watershed event having graduated from "retail wannabe" to the big leagues with one fell swoop of the underwriting brush.

Smyth and I go back to the early 2000's when he was a client of ours when I toiled with great agony in the corporate finance world for a very small Vancouver-based boutique brokerage shop cutting my teeth in a profession that is a cross between handicapping horse races at Woodbine Raceway and running a Vegas sports book. He was always the one call I saved for the very last after I grew accustomed to getting the toughest questions and most vitriolic "pushback" along with a list of "to-do's" before he would commit to an order. I would spend half a day raising 90% of the issue and then the other half answering his queries. Of course, that explained why his track record was so good and why his graduation from money manager to mining entrepreneur has been so seamless. Leave no stone unturned. . .

Marr-Johnson knows more about copper than most humans on the planet while also having an impressive working knowledge of the capital markets side of the industry. He is a professional geologist and has managed money for a number of U.K.-based funds in earlier eras of his extensive career. Above all else, his presentation skills are superb and in a world that is so capital extensive (or "capital expensive", as I like to say), that quality is a must.

The jewel in the entire collection of talent is Gilberto Schubert, who has basically "done it all" from discovering ore bodies to building mines to reclaiming the land after shutting mines down. Most importantly, he navigates the corporate boardrooms and the ranches of the Chilean elite that own and control all of the premium and not-already-spoken-for land yet to be owned by the majors like Codelco, Antofagasta (ANFGF:OTC), or BHP (BHP:NYSE). One glance at the land package at Caballos and you see the majors scattered all around them — Codelco, Newmont Corp. (NEM:NYSE; NGT:TSX; NEM:ASX), Los Andes Copper (LA:TSXV;LSANF:OTCQX), and of course, Freeport-McMoRan Inc. (FCX:NYSE), whose unfortunate "mud-rush" causing the closing of the Grasberg Mines in the Philippines this week must certainly have them looking for more organic supply from which to draw. It is COO Schubert that understands the nuances and intricacies of the Chilean mining establishment and why he is a critical component of the Fitzroy team. The path to projects is through Gilberto Schubert with the capital markets governors in Marr-Johnson and Smyth.

They must look upon me as a the "nagging little fishwife" constantly haranguing them for greater news flow in order to stimulate investor interest and propel the stock price because the only thing subscribers care about is performance and while an $18 million treasury is cause for reflection and self-congratulation, it means very little to those subscribers that wrote the cheques unless the share price reflects "money well spent." That nagging has now been met.

After my chat with Chairman Smyth I am pleased to report that the management group are going to be drilling the daylights out of both Buen Retiro and Caballos with three rigs being deployed to the "beast" Caballos and another two to Buen Retiro. Shareholders should be learning of the drilling progress over the summer at Buen Retiro "shortly" followed by two very arduously-drilled holes over the winter at Caballos. I am a huge believer in the value of "drum-rolls" that are heard loud and clear when a company announces the commencement of drilling at any project.

There is nothing more compelling than being on a call with a member of the drilling crew, talking to you from a satellite phone from under a hardhat and above the din of a whirling Sandvik DE 350, grinding away at 450 meters with gold flecks appearing at the drill collar. This is the lore that follows world class mineral discoveries and after a decade and a half of crypto and tech dominating the psyches of the global stock market speculator, it is a treat to know that we are at long last entering the final "C-Wave" speculative cycle where commodities and the associated hunt for them becomes a parlour game for the elite classes. They have had their fun and made their fortunes in Bitcoin and Nvidia Corp. (NVDA:NASDAQ); it is now time for commodities to keep them amused.

| Want to be the first to know about interesting Gold, Copper and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Fitzroy Minerals Inc. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.