Terra Clean Energy Corp. (TCEC:CSE; TCEFF:OTC; C900:FSE) announced it has finalized definitive agreements with independent parties to acquire up to a 100% interest in the Wheel Anne and Green Vein Mesa claims, both located in Emery County, Utah.

"The swift execution of these agreements underscores the company's dedication and enthusiasm for these assets, which complement our already substantial portfolio of low-risk uranium assets in globally recognized uranium basins," Chief Executive Officer Greg Cameron said. "We plan to have our team on the ground in Utah in the coming weeks, working closely with our local partner."

To secure its interests in the Wheel Anne and Green Vein Mesa claims, the company will need to make specific cash payments, issue common shares, and incur exploration expenditures on the respective claims, as detailed in the tables at left.

The definitive agreements to acquire interests in the Wheal Anne and Green Vein Mesa claims are contingent upon receiving all necessary regulatory approvals, including the nod from the Canadian Securities Exchange, the company said. Any securities issued as part of these agreements will be subject to a hold period of four months plus one day from the issuance date, in line with applicable securities laws.

Co. Announces Contracts

Terra Clean also announced its engagement with Green Crescent Capital (GCC) to design and produce marketing and advertising materials, as well as to develop and distribute digital content aimed at raising awareness within the investment community, for a one-time payment of US$5,000, Terra Clean said. The agreement is for a one-month term.

Additionally, the company has engaged OTCWagon (OTCW) for a 38-day market awareness program. OTCW will be compensated with a one-time fee of CA$7,500.

Details of Claims

The Green Vein Mesa and Wheal Anne claims offer access to uranium projects in the U.S. with significant potential in a historically important uranium district. Terra Clean has noted that the strategic acquisition of these claims was based on the belief that additional minable uranium resources exist. These claims have a history of production and are conveniently located near primary and secondary roads, with access to power and water.

Historically, mining operations concentrated on ore located at or near the surface, where oxidation resulted in the formation of various secondary uranium minerals. Recent policies enacted by the Trump Administration aim to boost nuclear power and uranium mining activities in the country.

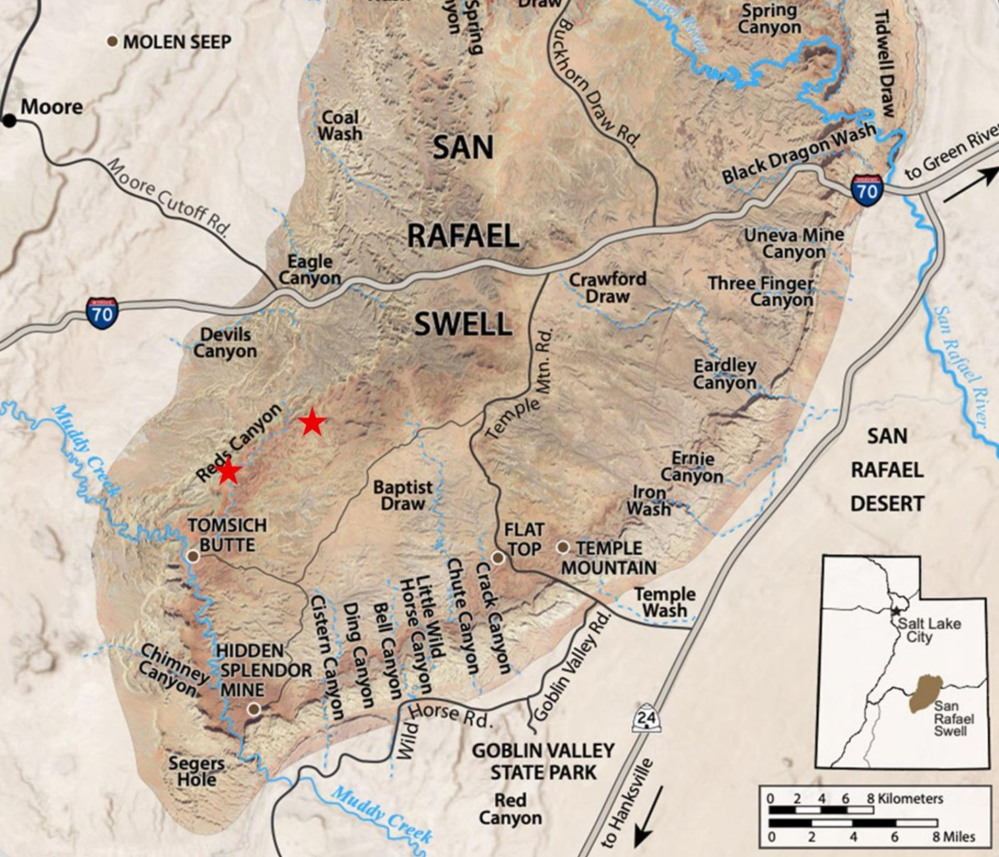

"This initial project in San Rafael Swell offers significant upside as it is clear that these old mines were abandoned in the 1970s due to a uranium market collapse, not because they ran out of uranium to mine," Cameron said.

Vice President of Exploration Trevor Perkins added, "We believe strongly that we can expand on the previous work through modern exploration technologies like 3D modeling."

The San Rafael Swell is a large, uplifted, doubly-plunging anticline in east-central Utah, contrasting with the surrounding flat-lying rocks of the Colorado Plateau, a significant uranium mining district in the Western United States, the company said.

Historical uranium production occurred in the region from the late 1940s into the 1970s, with no significant work completed in the past 50 years.

It is widely believed that volcanic ash is the source of uranium for many deposits in the swell, Terra Clean noted.

The two groups of claims are located 10 kilometers apart. The Wheal Anne Claim Group, situated to the southwest, covers about 130 hectares and includes the former Lucky Strike Mine along with related uranium occurrences. Discovered in 1949, the Lucky Strike Mine produced over 10,000 tons of ore with grades of 0.22% U3O8 and 0.09% V2O5. The Green Vein Mesa Claim Group, located to the northeast, spans approximately 300 hectares and encompasses the former Payday Mine, Hertz Mine, and the Green Vein group of mines. Although specific production figures for these mines are not available, the Hertz Mine reportedly had local samples with up to 1% U3O8.

'Robust' Drilling Plans

Several analysts and commentators have expressed positive views on Terra Clean Energy Corp. and its initiatives, particularly in light of the company's recent and planned drilling activities.

On April 7, Fundamental Research Corp. highlighted the results of the company's winter drilling campaign, noting, "Six out of seven holes of a recently completed drill program by Terra Clean Energy Corp. at the South Falcon East project intersected uranium mineralization. The company is planning a summer drill program."

Subsequently, HoldCo Markets issued a research note on April 30, expressing optimism about the company's valuation prospects, stating, "Given Terra Clean Energy Corp.'s robust near-term drilling plans, the risk remains on the upside for a material valuation rerate . . . seeing that the deposit remains open in numerous directions, additional work spend may lead to an increase in both grade and resource size."

Adding further insight, Jeff Clark of TheGoldAdvisor.com wrote on May 1, "Terra Clean Energy Corp.'s 2,500-meter summer drill program at South Falcon East will test an area highlighted in winter drilling that is defined by an intersection of three prospective alteration types . . . the program budget for exploration is substantial."

The Catalyst: Reliable Domestic Supply Needed

The uranium sector is currently navigating complex supply-demand dynamics shaped by evolving policy priorities and structural demand growth. According to the World Nuclear Association, global mine production satisfies about 90% of uranium needs, with the rest coming from secondary sources such as recycled materials and stockpiles.

While spot uranium prices saw a recovery from 2003 to 2009, they have remained low since then. The association noted that "the price cannot indefinitely stay below the cost of production."

Their 2023 Nuclear Fuel Report forecasts a 28% rise in uranium demand from 2023 to 2030, driven by the long-term nature of nuclear power generation, which is less affected by short-term economic changes.

Utilities are increasingly prioritizing securing reliable domestic supply, especially as demand from data centers and artificial intelligence continues to grow.

Forbes published an article on September 2 highlighting that robust demand and supply disruptions have reignited investor interest in uranium, which has outperformed most other commodities over the past month and could continue to rise, the American Nuclear Society (ANS) noted on September 3.

"Revived interest in nuclear power as a source of clean energy is providing the demand while operational problems at two of the world’s biggest uranium mines [are] crimping supply," the Forbes piece said.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Terra Clean Energy Corp. (TCEC:CSE; TCEFF:OTC; C900:FSE)

According to Forbes, Cameco anticipates a production shortfall at its McArthur River mine, while Kazakhstan’s Kazatomprom has lowered its production estimates for next year. Additional signs of a tight uranium market include "heavy speculative activity by commodity investment funds and a squeeze on small miners [that] have signed long-term supply contracts but might be forced into the short-term market to cover their contracts," the ANS wrote.

According to the article, Morgan Stanley predicts uranium prices will reach US$87 per pound before the end of the year, as reported by Forbes; and Citi forecasts a price of US$80 per pound by year-end, with an increase to US$100 per pound next year, and a potential peak of US$125 per pound "if a bull market develops, returning uranium to a level not seen since the boom year of 2007."

Ownership and Share Structure

Insiders and management own about 12% of the company and institutions owned 20%, the company said. The rest is in retail.

Terra Clean Energy has 36.33 million outstanding shares and its market cap is CA$5.11 million. Its 52-week range is CA$0.07–0.36 per share.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Terra Clean Energy Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Terra Clean Energy Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.