Eguana Technologies Inc. (EGT:TSX.V; EGTYF:OTC) is a Canadian clean energy company pioneering residential and small commercial energy storage systems designed to operate at the grid edge.

Founded in 1999 and headquartered in Calgary, Alberta, Eguana has developed a fully integrated hardware-and-software platform that enables homeowners, installers, and utilities to deploy scalable, distributed energy resources.

With thousands of proprietary systems already installed in North America, Australia, and Europe, the company is positioning itself as a key enabler of the accelerating energy transition. By combining high-performance storage technology with virtual power plant (VPP) fleet management software, Eguana is targeting both utility-scale distributed resource aggregation and consumer backup markets.

By deploying on-site energy capacity directly where it is needed most, Eguana connects consumers, contractors, and utilities, providing critical solutions as electricity demand surges in the age of electrification.

About the Company

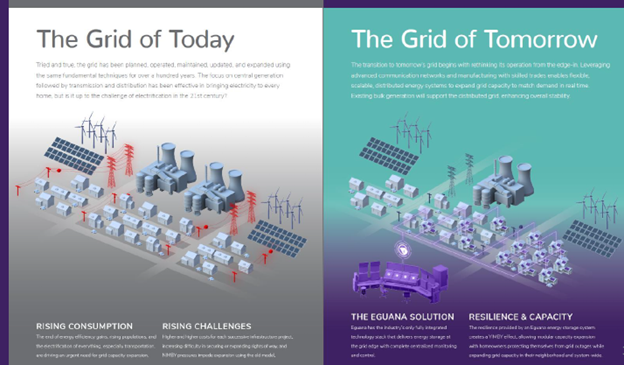

Eguana's business model addresses one of the most pressing challenges facing utilities today: how to manage rising electricity demand from electrification of vehicles, heating, and industrial systems without overbuilding costly centralized infrastructure. Its distributed energy storage systems absorb and deliver power on demand, creating flexible grid-edge capacity that supports real-time load balancing, local resiliency, and integration of renewables.

The company's systems are more than just consumer backup products; they are designed for utility-grade reliability, supporting applications such as local capacity relief, fast frequency response, and integration with virtual power plants.

Eguana has validated its technology through partnerships with global leaders including Mercedes-Benz, Duracell, and the Itochu Corporation. A recent collaboration with Itron successfully integrated Eguana's storage solutions directly into smart meters using open standards. This interoperability allows utilities to control distributed resources with greater visibility and security, opening the door to scaled adoption.

With a production capacity of over 24,000 systems annually and relationships with major North American utilities , Eguana is positioned to scale into a utility driven market projected to exceed +US$100 billion by 2030.

Management and Leadership

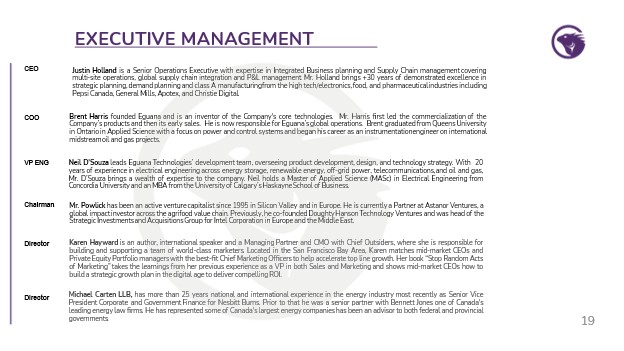

Eguana is led by CEO Justin Holland, an operations executive with over 30 years of experience in supply chain management and strategic planning across global industries. COO Brent Harris, Eguana's founder, is the architect of the company's core technologies and oversees global operations. Eguana's VP of Engineering Neil D'Souza brings 20 plus years of expertise formed in renewable, off-grid power, telecommunications, and oil and gas sectors. Eguana is also backed by a strong Board presence including George Powlick, Karen Hayward, and Founder Michael Carten.

Eguana's leadership team blends technical innovation with operational expertise:

Justin Holland (CEO) — Over 30 years of operations and supply chain management experience with global firms including Pepsi, General Mills, Apotex, and Christie Digital.

Brent Harris (COO & Founder) — Inventor of Eguana's core technologies, responsible for commercialization and global operations.

Neil D'Souza (VP Eng) — Leads Eguana's development team overseeing product development, design, and technology strategy.

George Powlick (Chairman) — Current partner at Astanor Ventures, previously co-founded Doughty Hanson Technology Ventures and was head of Strategic Investments and Acquisitions Group for Intel Capital.

Karen Hayward (Director) — Author, international speaker, and Managing Partner and CMO of Chief Outsiders. Ms. Hayward's book Stop Random Acts of Marketing takes a deep dive on building strategic growth in the digital age.

Michael Carten (Founder, Director) — Prior Senior Vice President Corporate and Government Finance for Nesbitt Burns and a senior partner with Bennett Jones, has represented some of Canada's largest energy companies along with advising federal and provincial governments.

This team has positioned Eguana to compete globally as the energy storage sector moves from niche adoption to mass-market deployment.

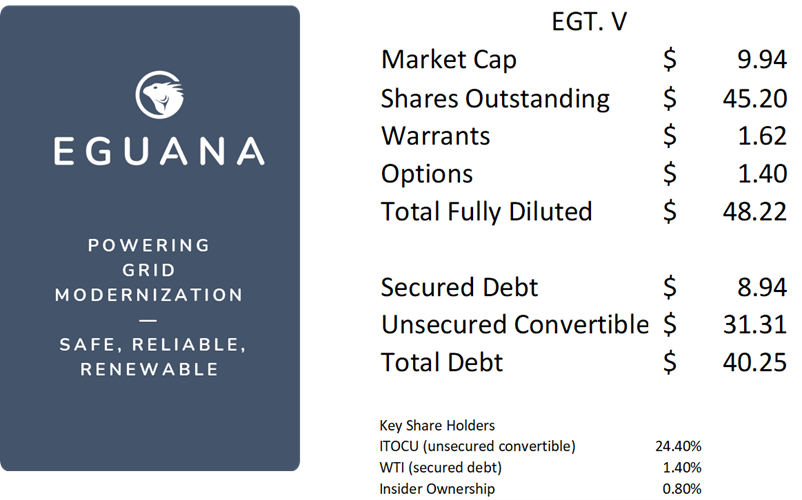

Share Structure

As of mid-2025, Eguana reported approximately 45.2 million shares outstanding and 48.2million fully diluted, with a market capitalization near CA$10 million. Secured Debt stood at about CA$9 million, with unsecured convertible debentures at CA$31 million.

Major shareholders include Itochu (24.4%), Western Technology Investment (WTI) (1.4%) , and insiders (0.8%).

Investment Highlights

- Fully commercialized hardware and software platforms validated by global partners.

- Strategic relationships with top 5 industry leading DERMS companies.

- Megawatt product roll out for demand response and feeder management in Western Canada.

- Completed product integration work with Itron, global Smart Meter company, for industry's first smart meter/smart battery combination.

- Production scale capacity exceeding 24,000 systems annually.

- Positioned in utility infrastructure market with a forecast at +US$100B by 2030.

Technical Analysis

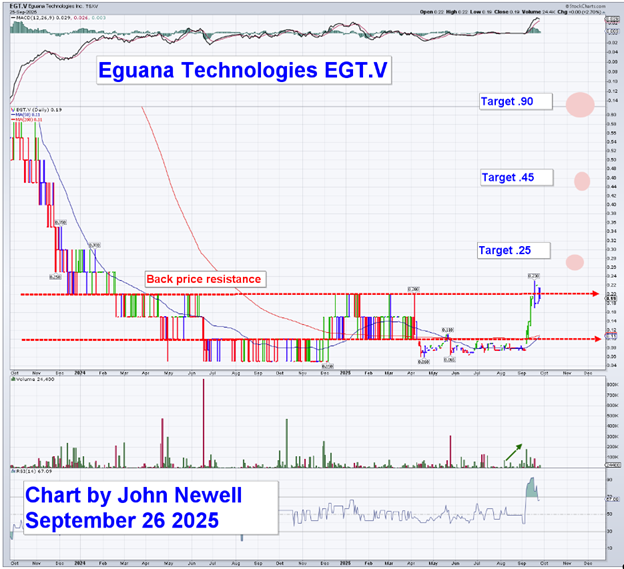

After a prolonged decline in 2023–2024, shares of Eguana built a long consolidation base throughout 2025. Recently, the stock has broken above back price resistance near CA$0.18, supported by rising volume and improving relative strength.

The first technical objective is a breakout toward CA$0.25, a level that represents the next zone of resistance. Should momentum continue, secondary targets are identified at CA$0.45 and CA$0.90, offering meaningful upside potential from current levels.

The chart suggests that investor sentiment is shifting, with accumulation patterns pointing to the possibility of a sustained recovery if the company executes on upcoming catalysts. With relative strength indicators improving and volume trends turning positive, the technical setup suggests that a sustained recovery is possible.

Conclusion

Eguana Technologies represents a speculative opportunity in the fast-growing energy storage and distributed power management sector. With strong strategic partnerships, a global footprint, proven management, and a scalable platform, the company is well-positioned to capture value as utilities, homeowners, and contractors increasingly adopt distributed storage solutions.

From a technical standpoint, the chart is constructive, showing a clear base breakout and well-defined upside targets. With fundamentals aligned to a +US$100B market opportunity and strong tailwinds from the energy transition, Eguana Technologies Inc. is ranked as a Speculative Buy at the current price of CA$0.20.

Investors can visit the company website here.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Eguana Technologies Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000. In addition, Eguana Technologies Inc. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Eguana Technologies Inc.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.