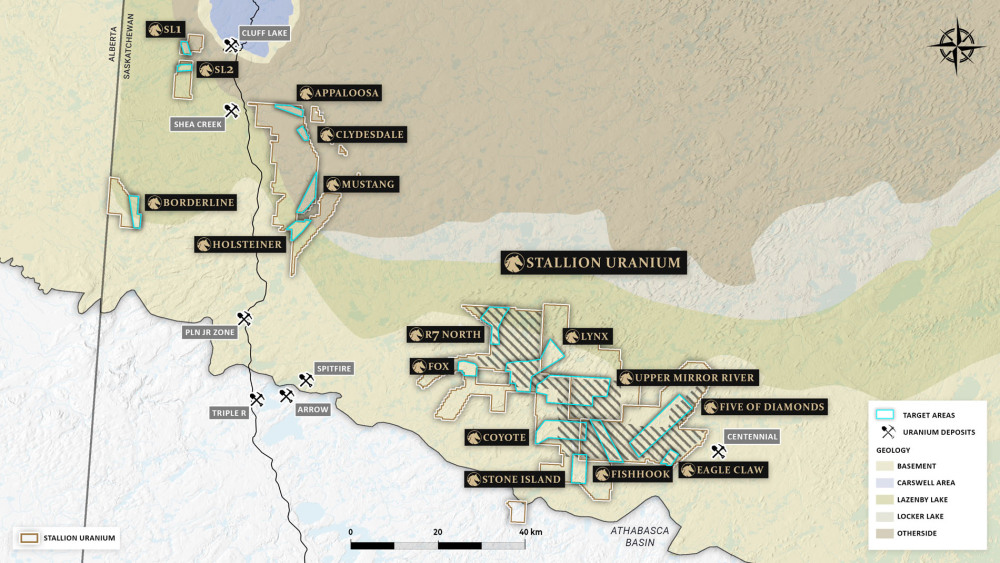

Vancouver-based Stallion Uranium Corp. (STUD:TSX; STLNF:OTCQB; FE0; FSE) is focused on powering the future with uranium by exploring approximately 1,700 square kilometers in the prolific Athabasca Basin of Saskatchewan.

The company possesses the largest continuous land package in the western part of the basin, situated right next to world-class discoveries. Stallion has assembled a team capable of creating value and maintains a well-held share structure by key stakeholders, facilitating the achievement of long-term value.

Stallion's projects are adjacent to giants like Cameco Corp. (CCO:TSX; CCJ:NYSE), Orano SA, NexGen Energy Ltd. (NXE:TSX; NXE:NYSE.MKT), and F3 Uranium Corp. (FUU:TSX) in the Basin, the company said.

The race is on for more power, including nuclear, as artificial intelligence, expanding data centers, and climate change test our aging electrical grids.

Appointed in 2024, Chief Executive Officer and Director Matthew Schwab is an exploration geologist who played a pivotal role in the discovery of the Arrow uranium deposit in the southwestern Athabasca Basin while serving as the senior exploration geologist at NexGen Energy Ltd. in 2014. He was also part of the development team at Hathor Exploration Ltd., where he contributed to the sale of the Roughrider deposit to Rio Tinto for US$654 million. More recently, he held the position of CEO at Kraken Energy Corp.

"There's not a CEO/VP team in the Basin that can say they've been part of three high-grade discoveries in 10 years," Schwab said, as company’s VP Exploration, Darren Slugoski was also involved in the discovery of the Spitfire uranium deposit and the Gemini discovery both in the Athabasca Basin. "So, it's a good thing that we're both geologists. We share that exploration mentality. He's more focused on the technical aspects, and I'm more focused on the market side of things."

The experiences, especially with industry giant Rio Tinto, showed him the importance of M&A activity the junior mining industry.

"What I like to tell people more than anything is it whet my appetite," he told Streetwise Reports. "It showed me what can be accomplished in the junior mining sector."

The experience Schwab and other management team members bring to Stallion is part of what makes the company a great story, noted Jeff Clark of The Gold Advisor on September 16.

"Both Matthew and Darren have built their careers in Athabasca and are well-equipped to look for their next discovery," Clark wrote.

Immediate Emphasis on Coyote Target

Stallion Uranium has several projects and targets, but the immediate emphasis is on Coyote, Clark noted. Located on the western side of the Athabasca Basin, Coyote is in a region where fewer discoveries have been made compared to the east. This is primarily due to the eastern side being more accessible and cost-effective to explore, not because the west is less promising, as evidenced by the discoveries at Arrow.

"In fact, Stallion’s projects are analogous to the exploration stage in the eastern Basin in the 1980s," Clark noted. "It is very underexplored yet carries high potential."

This makes it one of the most promising target areas currently under exploration in the Athabasca region. In fact, up to five industry experts, including CEOs of other uranium companies, have reviewed the technical data and believe it could be the top target in the basin at present, said Clark.

"This doesn’t guarantee a discovery of course, but it obviously is very compelling," the newsletter writer said. "Stallion plans to drill it in Q1, and it’s already fully permitted. Meanwhile, the team is doing geophysics at other targets and have identified anywhere from 3-7 that appear to have the same potential as Coyote and Arrow. This gives them some other prospective targets to explore, and these are all fully permitted, too."

Stallion currently holds CA$16 million in cash. As they continue preparations for drilling, another fundraising round is likely to build a substantial reserve for the Coyote project in January and other targets.

Before the new year, the team will continue geophysical work and refine targets at Coyote, as well as at projects named Fishhook and Lynx, Clark said. They are also conducting advanced geophysical surveys on additional targets between now and Christmas and will be ready to tackle Coyote and these other targets in the new year. Drilling in January will likely cover around 5,000 meters, followed by a Phase II program of probably another 5,000 meters.

'The Textbook Athabasca Uranium Model'

After joining the company, Schwab said he and Slugoski re-evaluated every square kilometer of ground Stallion had, deciding at the end of the day to "focus on shallower ground, shallower targets where we can better spend our shareholders' dollars."

"We ended up dropping about 1,000 square kilometers of ground," Schwab said "But at the end of the day, we have 1,700 square kilometers in more or less unexplored territory in the Athabasca Basin along the southwestern margin, which has huge potential and huge prospectivity."

One of the Tier 1 targets the company is trying to advance, they are "very, very excited about."

"It more or less fits the exact definition of the textbook Athabasca uranium model, plain and simple," the CEO said. "So then, after that, we went out and we just did this recent financing for CA$15 million."

Over the summer, the company announced results from a Stepwise Moving Loop, Time Domain Electromagnetic (SWML-TDEM) survey conducted over its high-priority Coyote Target at its Moonlite Project.

The Coyote Target, situated in the Southwestern Athabasca Basin, includes claims held in partnership with ATHA Energy Corp. (SASK:TSX.V; SASKF:OTCMKTS; X5U:FRA), as well as claims fully owned by Stallion Uranium.

"These results confirm the presence of strong basement conductors beneath the Athabasca Basin sandstone, with characteristics consistent with major uranium discoveries," Slugoski said. "Conductor - Coyote_14.25S, in particular, stands out as a high-priority drill target, supported by both strong geophysical response and a coincident gravity low; suggesting possible uranium alteration."

Slugoski added, "Coyote continues to prove one of the most promising targets in our portfolio. With strong geophysical signatures and favorable structural settings, we believe the area has potential to host a new basement-hosted uranium discovery."

Because 2026 "promises to be an eventful year for this small company," Clark from The Gold Advisor wrote that he was officially adding Stallion to the Paydirt Prospector portfolio.

"Will Stallion Uranium be a 'STUD' by this time next year? We'll find out, but the size of my investment shows I like their potential," Clark wrote.

The Catalyst: Utilities Focusing on Securing Reliable Energy

The uranium industry is currently dealing with complex supply-demand dynamics influenced by changing policy priorities and structural demand growth. According to the World Nuclear Association, global mine production meets about 90% of uranium requirements, with the remainder sourced from secondary supplies like recycled materials and stockpiles.

Although spot uranium prices experienced a recovery from 2003 to 2009, they have stayed low since then. The association pointed out that "the price cannot indefinitely stay below the cost of production." Their 2023 Nuclear Fuel Report predicts a 28% increase in uranium demand from 2023 to 2030, driven by the long-term nature of nuclear power generation, which is less sensitive to short-term economic fluctuations.

Utilities are increasingly focused on securing reliable domestic supply, particularly as demand from data centers and national infrastructure grows.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Stallion Uranium Corp. (STUD:TSX; STLNF:OTCQB; FE0; FSE)

Uranium giant Cameco Corp. saw its shares surge nearly 10% to a record high, adding about US$4.6 billion in market value in a single session, as reported by Jeff Peterson for NAI 500 on September 17. This move caps a roughly 60% year-to-date increase, driven by expectations that the United States will expand its domestic nuclear fuel stockpile.

"The rally is not just headline noise," Peterson wrote. "It plugs into a larger recalibration of nuclear supply chains away from Russia and toward North American conversion, enrichment, and mining. But price is not the same as proof. For investors, the key is whether policy, contracts, and new supply timelines line up with the enthusiasm now reflected in equity prices."

Ownership and Share Structure

Stallion said less than 10% of the company is owned by insiders and management, and there are no institutional holders. Strategic investor Matt Mason, a founder of Hathor, has about 30%, the company said.

The company's market cap is CA$58.8 million with 124.78 million shares outstanding, Refinitiv reported. Its 52-week range is CA$0.10 and CA$0.53.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Stallion Uranium Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Stallion Uranium Corp. and Cameco Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.