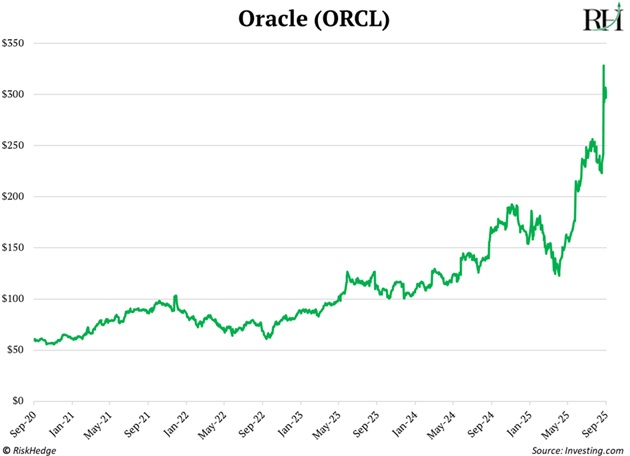

A new champion of global wealth emerged last week. Larry Ellison momentarily overtook Elon Musk as the planet's wealthiest individual. Ellison remains the most under-the-radar member of the centi-billionaire club. He established the technology powerhouse Oracle Corp. (ORCL:NYSE) in 1977 and maintains ownership of roughly 41% of the enterprise.

This explains how Ellison's fortune expanded by $100 billion within 24 hours after Oracle shares soared 36% following exceptional financial results:

An $800 billion enterprise rocketing upward like a micro-cap stock is virtually unheard of.

At least it was before the artificial intelligence (AI) revolution began. . .

Ellison astonished financial analysts during the earnings discussion.

Oracle constructs the massive information repositories where corporations store their data and operates them in its proprietary global network. Because these systems already exist in enormous computing facilities, Oracle enjoyed a competitive advantage when AI emerged.

Currently, the company leases out enormous GPU clusters — imagine 100,000+ Nvidia Corp. (NVDA:NASDAQ) processors connected together —enabling AI companies to develop and deploy their systems.

Oracle revealed that its AI computing backlog exploded from $138 billion to $455 billion in just one quarter, representing future processing power it has effectively pre-sold.

During the call, Larry stated: "We have signed significant cloud contracts with the who's who of AI . . . The company that called us said, 'We'll take all the capacity you have that's currently not being used anywhere in the world. We don't care.' And I've never gotten a call like that."

This represents major technology firms banging on Oracle's doorstep.

Microsoft Corp. (MSFT:NASDAQ), Alphabet Inc. Class A (GOOGL:NASDAQ), OpenAI, they're essentially all conveying the same message: "Provide us with every available server you possess."

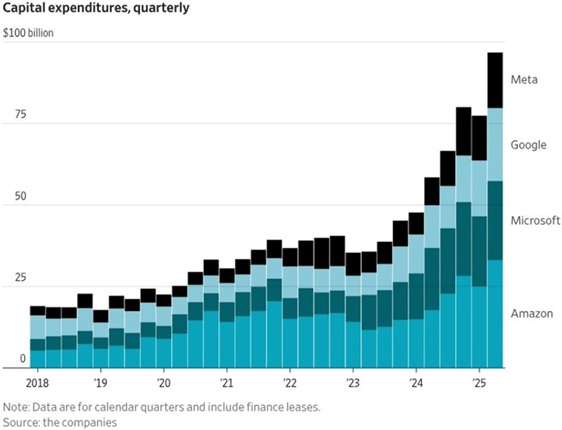

Major technology corporations will invest over $300 billion in constructing their AI data centers this year.

RiskHedge chief analyst Stephen McBride says the competition to create a "digital deity" represents the largest infrastructure development of our generation.

In a single year, AI infrastructure investment has grown to match the entire Apollo program or the Interstate Highway System, adjusted for 2025 dollars.

The AI buildout is so massive, it's functioning as a kind of private economic stimulus package for the American economy.

The reason behind Oracle's surge — and why major tech firms are allocating all this capital — is because utilization of AI platforms like ChatGPT and Gemini has skyrocketed.

More than 700 million individuals now access ChatGPT weekly. That's equivalent to two United States populations! It's the most rapidly adopted product in history.

Google's Gemini is keeping stride.

In May, it handled 480 trillion tokens (segments of text or images) monthly. By June, this figure had already doubled to nearly 1 quadrillion tokens. And this week, it became the top downloaded application on the App Store.

The tech industry's preferred sophisticated term for AI usage is. . .

"Inference."

In simple terms, when you pose a question to ChatGPT and receive an answer, that's inference.

When discussing AI infrastructure, people typically refer to thousands of GPUs working intensively for weeks to develop a massive model. That's the "training" stage.

We've invested years training exceptional AI models, and now everyone is utilizing these models constantly. We're entering the "inference" era.

When questioned about what was driving Oracle's $455 billion backlog, Larry Ellison explained: "There is a huge amount of demand for inferencing. And if you think about it, in the end, all this money we're spending on training is going to have to be translated into products that are sold, which is all inferencing."

Welcome to Stage 2 of the AI revolution.

Stephen says, Stage 1 centered on processors. Nvidia provided the essential tools that powered the initial wave.

That alone generated a $300+ billion annual spending surge. Major tech firms will invest more in AI this year than Switzerland spends on operating its government.

We appreciate the profits they've delivered to us.

Stage 2 focuses on AI infrastructure. The essential components that allow this technology to expand effectively.

Networking equipment to transport vast amounts of data at incredible speeds . . . Cooling technology to prevent massive data centers from overheating... And energy infrastructure. Because AI facilities consume 10X–50X more power than conventional ones . . .

Oracle's 36% single-day leap demonstrated the potential returns from owning Stage 2 winners.

But numerous smaller companies will benefit even more significantly.

Consider Credo Technology Group Holding Ltd. (CRDO:NASDAQ), for instance.

Credo develops ultra-high-speed networking components that connect GPUs together. Their technology enables processors to communicate at extraordinary speeds.

Without firms like Credo, those Nvidia chips would essentially be expensive paperweights.

Credo's revenue nearly quadrupled over the past year thanks to robust AI demand. Its stock has performed impressively as well.

Congratulations to our Disruption_X subscribers who recently secured a "Free Ride" after CRDO jumped 108%.

Many more similar opportunities await.

Remember this statement when investing in AI.

The renowned economist John Maynard Keynes once remarked, "The market can remain irrational longer than you can stay solvent."

Three years into the AI revolution, I notice many people already experiencing investment exhaustion. They behave as if the AI boom has already concluded.

I would remind them that transformative megatrends persist for decades. The greatest challenge in profiting from megatrends isn't purchasing—it's maintaining your position and staying engaged.

Stephen's adaptation of Keynes' observation: "Winners can keep on winning longer than you can stay curious."

Invest accordingly.

We write about big trends like AI every week in The Jolt, our free disruption-focused letter. If you’re not already on the reading list, sign up here.

If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing.

Go here to join

Important Disclosures:

- Chris Reilly: I, or members of my immediate household or family, own securities of: Microsoft. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.