On February 25, 1964, in my eleventh year on the planet, my older brother Donnie was an avid boxing fan who would collect empty soft drink bottles in the ditch along Airport Road in the northwest Toronto community of Malton to get enough money (50 cents) together to buy the weekly edition of "Ring Magazine."

Ever since the 1960 Olympics, Donnie had been mesmerized by the career of a young, black heavyweight from Louisville, Kentucky called "Cassius Clay" who was about to step into the ring with one of the most feared champions of all time — Sonny Liston. By the opening bell, Liston was an 8:1 odds-on favorite to win, with the Vegas side bets ranging from "first round knockout" to "Clay dies in the ring."

Back in the day, the fight game was largely controlled by the Mob, and after Liston, whom Clay had nicknamed "the big, bad bear," failed to answer the bell for the seventh round, resulting in a TKO for Clay, it began the greatest run of heavyweight title defenses in boxing history. Had it not been for the government stripping him of his title in 1967, it is doubtful anyone would have defeated him well into the late 1970s after he converted to the Nation of Islam and changed his name to "Muhammad Ali."

What made me think of "the champ" was listening to a hedge fund manager the other day talking to one of the CNBC anchors about the level of risk in today's equity markets. He remarked that "With the way every sector of the markets has advanced in recent months, there is simply nowhere to hide. . . " conjuring up memories of Liston's famous quote regarding Clay's speed and footwork, "He can run but he can't hide."

I decided that the first Clay-Liston fight was a perfect analog for today's market environment with a big, bad bear chasing the brash, young challenger around the ring but never able to corner him or threaten him as his deft footwork kept moving him out of danger. Just as all of the oddsmakers in 1964 were calling for the bear to win, they turned out to be wrong — twice — as Clay retained his title in the rematch a year later. The outcome in 1964 and 1965 is not a lot different than the outcome here in 2025, as markets, despite historical levels of overvaluation along with rampant speculation and record-high margin debt, simply refuse to buckle, mirroring the same manner in which Cassius was able to elude the bear in 1964 and eventually knock him out.

In past bear markets like 1929-1932, 1973-1974, and 1981-1982, there were sectors of the market that acted as counter-trend havens for the bearish portfolio managers. Gold and silver shrugged off the effects of depressions and recessions in the first two bear markets, while high-yield securities avoided the carnage of the latter bear. Even in the crash of October 1987, while the TSE Gold and Silver Index got cut in half the week of the crash, physical gold prices advanced from $425 to $505 in a 4-day period after the Monday crash, effectively insulating portfolios against big drawdowns.

However, here in 2025, no amount of footwork or speed of hand is going to insulate investors from the claws of the bear because every sector I cover — from gold and silver to utilities to health care — are all overbought, with some sectors "mildly overbought" and others "egregiously overbought."

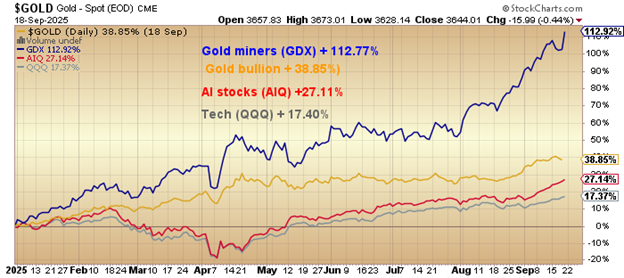

As for gold and silver being the ultimate safe haven in a bear market tempest, market commentators are telling us that gold and gold miners "are now more overbought than at any time since 1975," suggesting that they have joined the technology stocks as market darlings and are now sporting leveraged ETF's and wild-eyed speculation not unlike the last five years since the pandemic prompted obscene amounts of stimulus to be air-dropped into the margin accounts of everyone and anyone with a pulse.

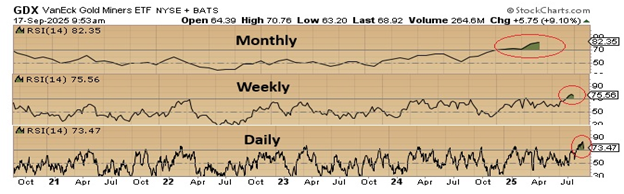

It is true that the Senior Gold Miners ETF (GDX:US) is seriously overbought as relative strength readings shown below for daily, weekly, and monthly bases are simultaneously stretched. Mind you, this condition also occurred back in April, and while many of these same gold "gurus" were spouting off with "correction" talk, the worst GDX could do was trade sideways with the ultimate resolution coming after the August 27 Jackson Hole speech by Fed Chairman Powell in which he signaled the possible arrival of another "easing" cycle.

As we all know too well by now, overbought markets can stay overbought for days and in many cases weeks, although the inevitable corrections can be nasty. As I wrote about this morning in an email alert to subscribers: "the majority of the junior gold developer/explorer names that we own are found in the TSX Venture Exchange (CDNX:TSXV) and while the more advanced names in the GDX:US and GDXJ:US have been on a tear for most of 2025, the junior explorers and developers really only started their advances last summer.

As a matter of timing, the TSX Venture Exchange moved into deeply overbought territory in July, only to correct in August, but that pullback stopped on a dime after Jerome Powell's Jackson Hole speech that signaled the likelihood of an easing cycle, resulting in an 18.4% advance to just under the 900 level.

Also, while the daily, weekly, and monthly RSI readings for the TSXV are also overbought, the duration of its advance is notably shorter than that of the seniors and intermediates. I see this as a rotational shift from the large-cap seniors to the lower and micro-cap juniors, which includes the developers and, to a lesser degree, the pure explorers. In the late 1970s, it was the massive speculative rise in the explorers that signaled the end of the bull, and thus far, we are nowhere close to that.

You have to remember that the last major bull market in commodities was 2002-2011, and that period saw gold advance from $250 to over $1,900 per ounce (nearly 7.5 times), during which period the TSXV peaked in 2007 at 3,341. That means it would need to advance 3.81 times its current level of 875 to match the move from 2002 to 2011. The junior developers have not even shifted out of first gear yet, so I restate my conviction that companies with large, economically viable resources like Getchell Gold Corp.'s (GTCH:CSE; GGLDF:OTCQB) Fondaway Canyon Gold Project and/or new, potentially world-class discoveries like Fitzroy Minerals Inc.'s (FTZ:TSX.V; FTZFF:OTCQB) Caballos copper-molybdenum Project (as well as Buen Retiro) have a great deal more upside in this current, fledgling commodities bull.

As a warning to all speculators in the world of junior resource investing.

I remember the famous words of a former E.F. Hutton technical analyst in the throes of the 1981-1982 bear market. He was discussing the merits of owning "quality stocks" during painful market periods because no matter how severe the bear market is, "quality will always bounce" whereas if you own only "garbage stocks" (the storyteller actual used a four-letter word starting with S-H instead of "garbage" but since this is a family publication, I have omitted it.), "they behave no differently than throwing a garbage bag off the top of a building; garbage bags don't bounce!"

That is particularly relevant when you are investing in the junior resource sector.

The temptation in the heat of a resource bull is to be lured by the issues making all the noise and turning all the big volumes but at the end of the day, many of these names are moving on "tape action" or "online marketing programs" only to have inferior assets and/or management teams undermining both the effort and share prices in due course.

Make no mistake; when the S&P 500 and the NASDAQ finally enter into correction mode, they will take the blue-chip S&P/TSE Index along with them, and when the Canadian stocks come under pressure, the TSX Venture Exchange will not act as a safe haven in which to ride out the storm.

However, the downside risk in the developers and the explorers is noticeably less than in the GDX:US and GDXJ:US because their uptrends have spent less time moving from gradual to vertical. Juniors with proven resources and/or discoveries will rebound after any near-term correction because their assets carry value.

Those explorers in the hunt looking to establish a resource by making a new discovery are always the orphans that get left behind, at least until they make a discovery.

Oil & Gas: A possible hiding place

One sector that has been under pressure literally all year has been the oil and gas sector.

One sector that has been under pressure literally all year has been the oil and gas sector.

Since topping out above US$92.00 per barrel, with the exception of a few countertrend rallies, the price of oil has been experiencing a series of lower highs and lower lows for the better part of two years, dating back to September of 2023.

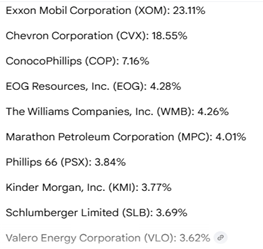

The Energy Select Sector SPDR Fund ETF (XLE:US) has traded in a $23 range during that period and is currently at the midpoint of that range paying a $2.86 dividend to yield 3.19%.

Up 6.40% year-to-date, it has already proven to be a fairly stable place to "hide" from the dangers of overvaluation.

With oil prices suffering from what appears to be soft global demand, if the world sinks into recession, it is hard to picture oil prices bucking that trend.

However, the fact that the energy stocks that comprise the top ten holdings for the XLE:US include some of the best-run companies in the world (shown above), and since it has been trading at the midpoint of its 52-week high-low range, allocating a large portion of one's liquid assets to energy might turn out to be a grand move.

On Sunday, spring arrives in the southern hemisphere, which means that the snow that has fallen in the Chilean Andes will soon be melting, allowing a number of the mid-elevation mining projects in Chile and Peru to resume activity, meaning exploration. Also, markets are soon to enter into the "Best Six Months", an anomaly first identified by Stock Trader's Almanac founder Yale Hirsch, whom I had the pleasure of meeting back in 1996 at his home in Connecticut.

October ushers in a 6-month period contrasting the dreaded "Sell in May and go away" mantra that, while possibly effective in other years, proved disastrously wrong thus far in 2025, as the markets have enjoyed the best April-October period in recent memory.

From the April 7 lows, when President Trump all but ended both the Department of Government Efficiency ("DOGE") and the tariff assault on free trade, the S&P 500 has tacked on an impressive 31.34% which is undoubtedly the first time in my career that there was a) no corrections between May and October and b) record annual and all-time highs in the same period.

Statistically, the best May-October stretch in history was in 1958, when it gained 19.2%. From May 1 of this year until tonight's close, the S&P 500 has gained 19.6% which excludes the prior three weeks that came after the "Liberation Day" lows of April 7.

Barring any sort of meltdown in October, the May 1-October 30 period for 2025 will go down as the best-performing stretch for stocks since record-keeping began.

For the record, I have been a very vocal bear on the outlook for stocks since last winter and had a great first quarter after capturing the volatility spike and stock market correction that ended last April. However, the profits from that decline have been clawed back by an intractable conviction that this bull market that began in March 2009 is today living on borrowed time. We have had pullbacks since the lows of 2009, a number of times, which included the Covid Crash of 2020, in which a peak-to-trough drop of 33% was greeted with record stimulus by both the Fed and the Treasury, turning the rout into record highs by August of that year.

As I discussed last week in the article entitled "Zimbabwe Markets," the expansion of liquidity during and after the pandemic, leading right up until the 2024 elections, has created, in my opinion, a hyperinflationary spiral in assets and mainly financial assets, including stocks. The distortion caused by such monetary and fiscal excess is why all traditional measures of market timing and analysis have been rendered worthless. The bulls out there all rant and rave about their "systems" or their "new paradigms" or their "algorithmic precision" but at the end of the day it all revolves around a torrent of magically-conjured credit and currency in such quantity (US$12 trillion since 2020) sloshing around the economic arena chasing goods and services that could not and cannot keep pace with the growth in fiat.

Luckily for me and for my subscribers, the gains in the two top holdings in the GGMA 2025 Portfolio and GGMA 2025 Trading Account have dwarfed the drawdowns in my hedges, so while my net worth statement has been only slightly affected, the wounds to pride feel somewhat "mortal.

"Now, there are still five weeks to go for the period deemed to be the "Worst Six Months" which ends on October 31 of this year but if stocks have not entered into a serious correction by the middle of October, I shall be abandoning all hedges in anticipation of the year-end rally and commencement of the "Best Six Months" that have an average annual performance rate of 7.4% versus the May 1-October 30 stretch that averages a miserable 0.8%.

The rally off the April lows has been a painful reminder for me and one that conjures up the spectre of Mark Twain when he wrote:

"It ain't what you don't know that gits ya into trouble; it's what you knows "for sure" that just ain't so."

No truer words were ever written. . .

| Want to be the first to know about interesting Oil & Gas - Exploration & Production and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.