On Tuesday of this week, I told my newsletter subscribers to prepare for a fiat price dip of about 5%-10% in the price of gold.

That dip is in play now.

Gold is a supreme currency, so these types of price sales need to be bought with a level of aggression.

They are bought regularly . . . by hundreds of millions of Chinese and Indian citizens, and by a smaller number of very savvy Western gold bugs.

Here's a key chart (using the SGOL ETF) for gold:

The price surged out of a beautiful ascending triangle, and the target zone of about $35.50 has been acquired.

A dip to the breakout zone would be healthy and normal. What if that dip doesn't happen and the rally resumes from here? Well, that's why supreme money enthusiasts hold large core positions in this, the mightiest metal!

The larger miners (intermediates and seniors) tend to follow the gold price action quite closely, but many of the smaller ones can continue to rocket higher even during a substantial dip for gold.

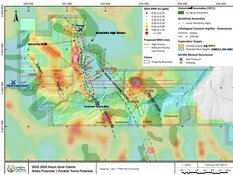

On that note, here's a look at one of them, Grid Metals Corp. (GRDM:TSXV; MSMGF:OTCQB), aka "Kid Grid":

There's inverse H&S action in play and a major trendline breakout.

The company seems to be coming alive since their TECK deal came about. The global governments' rush to protect strategic metals could also benefit investors in Grid.

While gold and the big miners pause, another interesting play is Klondike Gold Corp. (KG:TSX.V). Here's a nice view of the daily chart:

As the name suggests, it operates in the Klondike. Excitingly, the stock has the same ascending triangle pattern from April that was showcased by gold and. . .

Klondike's breakout is just occurring now.

Also, here's a look at the weekly chart:

A nice inverse H&S pattern is in play. This is definitely a "ten-bagger" candidate, and at 12 cents a share, investors are getting in on the launch pad, rather than late in the journey.

Here's a look at another interesting junior, GoldMining Inc. (GOLD:TSX; GLDG:NYSE.American):

The company operates in Peru, and this monthly chart is in rough sync with the CDNX; there are key lows, roughly in 2015, 2020, and recently.

A surge to $5+ is indicated by the large base pattern.

At this point in the junior mining cycle, my suggestion to view both the long-term and short-term charts first. . .

And then get into visiting the company's properties, studying the drill results, checking the directors, etc., and here's why I suggest that approach:

All boats get carried higher in a rising tide. It's more important right now to own many junior miners that rise with the rising CDNX index tide than rise more than the CDNX.

Aggressive stock picking is best reserved for a down market for the CDNX. It's the same mantra that can be applied to the GDX ETF; the ETF is up over 100% in 2025. Trying to make more than 100% while risking making only a little bit or nothing at all makes little sense.

For the juniors it's important to own a group of stocks that have chart patterns similar to the CDNX. It shouldn't matter whether a stock goes up 280%, 300%, or 320% if the CDNX goes up 300%.

In the current market, what's most important is that investors own a group of stocks they are comfortable with. Those stocks may or may not outperform the CDNX in the short term, but investors are sure not to be shaken out on the inevitable pullbacks and dips that will occur in the years and decades ahead.

In a nutshell, It's a gold and gold stocks bull era.

All aboard!

Special Offer for Streetwise Readers: Please send me an Email to [email protected] and I'll send you my free "CDNX: Gold Thunder & Silver Lightning!" report. I highlight some of the most exciting component stocks trading under $5. Winning buy and sell tactics included in this exciting report. Junior mine stock investing isn't for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! I write my junior resource stocks newsletter 2-3 times a week, and at just $199/12mths it's an investor favourite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I'll get you onboard. Thank-you.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Stewart Thomson: I, or members of my immediate household or family, own securities of: GDX and SGOL. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?