Picture yourself back in 2020, making two brilliant predictions: Artificial intelligence would explode onto the scene, and semiconductor companies would fuel this revolution.

Spot on! You're thinking like an investment legend!

Then comes the misstep.

You invest in what was once the world's most dominant chip manufacturer, the company whose processors powered nearly every server and personal computer for decades.

Not Nvidia Corp. (NVDA:NASDAQ). . .

But Intel Corp. (INTC:NASDAQ).

Once America's semiconductor champion, Intel has watched its share price collapse by 50% since the AI revolution began in 2021. Meanwhile, Nvidia transformed into the face of AI computing, its value multiplying 20 times over.

This scenario isn't theoretical. It's precisely what happened to countless savvy investors during the past five years.

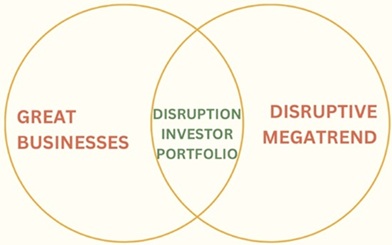

And it exemplifies exactly the kind of investment pitfall our Disruption Investor Venn diagram is designed to help you avoid.

Intel has been occupying my thoughts recently.

The company made headlines when the federal government acquired a 10% position valued at $8.9 billion.

Intel essentially created the chipmaking industry and dominated semiconductors for generations.

The most valuable lesson from Intel's story is that no disruptive company remains on top forever.

Intel once epitomized innovation and agility. Today, it's a sluggish corporate behemoth requiring government assistance to attempt catching up with rivals like Taiwan Semiconductor (TSM).

Last year brought Intel's worst performance since its 1971 IPO, with shares plummeting 61%.

How could the semiconductor industry's former leader miss the largest chip boom in history?

Disruption Investor subscribers understand the answer lies in this straightforward illustration, our Disruption Investor Venn diagram.

The diagram's first circle represents exceptional enterprises. Organizations that steadily expand revenues while generating substantial profits.

The second circle symbolizes transformative megatrends. Rapidly expanding, world-altering developments.

The intersection creates the "sweet spot:" Outstanding businesses capitalizing on megatrends. That's where significant wealth accumulates. Only companies landing in this central zone merit investment consideration.

This methodology keeps our approach disciplined. It prevents chasing companies like Intel simply because they appear connected to a trend. Instead, it guides you toward enterprises that not only participate in accelerating megatrends but also possess the business fundamentals to benefit substantially.

Intel seemed like the logical semiconductor boom investment. But applying the Venn filter revealed obvious weaknesses.

For decades, Intel consistently produced the most advanced, highest-performing chips. Then, about ten years ago, they stumbled and surrendered their technological advantage to Taiwan Semiconductor.

These fundamental issues didn't surface in their financial statements until 2021. But attentive observers recognized trouble was developing.

That's why I recommended Nvidia in 2018.

Like Intel, Nvidia manufactures semiconductors.

Unlike Intel, Nvidia also operates a superior business model.

No clairvoyance was required to recognize this distinction. You simply needed to examine its rapidly accelerating financial performance.

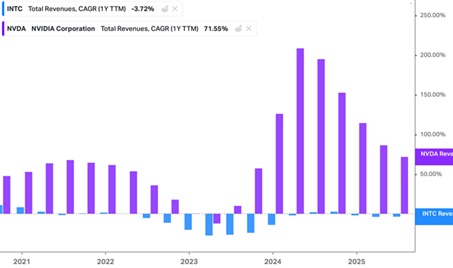

Here's how Nvidia and Intel's revenue growth compared over five years.

Consider that some investors reviewed this data and still selected Intel:

Nvidia has rocketed up 1,260% since joining our Disruption Investor portfolio. It perfectly demonstrates the wealth-creation potential when investing in companies within that sweet spot.

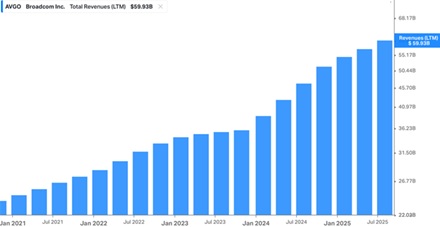

Broadcom represents another "sweet spot" disruptor.

Congratulations to Disruption Investor members who purchased shares last week before its 20% post-earnings surge.

Broadcom Inc. (AVGO:NASDAQ) is another American semiconductor company headquartered roughly 15 miles from Intel's Santa Clara campus. Yet their recent trajectories couldn't be more divergent.

Broadcom capitalized on the AI revolution, while Intel largely watched from the sidelines.

Broadcom leads globally in networking semiconductor solutions. Their chips function like digital traffic management systems, ensuring data flows correctly from origin to destination at the extraordinary speeds required for AI operations, without misdirection.

Technology giants including Amazon.com Inc. (AMZN:NASDAQ), Alphabet Inc. Class A (GOOGL:NASDAQ), and Meta Platforms Inc. (META:NASDAQ) frequently deploy Broadcom's Tomahawk switch chips to connect their expansive AI processing clusters.

It's history's least-recognized trillion-dollar enterprise. Yet it stands among the biggest beneficiaries of "Phase 2" in the AI infrastructure buildout.

Observe how its revenue consistently steps higher as the AI boom accelerates. This progression appears almost too perfect to be authentic:

Next time you're considering an investment in a transformative megatrend, ask yourself. . .

"Am I simultaneously investing in an exceptional business?"

Intel serves as a cautionary example of correctly identifying the megatrend but completely missing the company selection.

Until four years ago, Intel maintained its position as the semiconductor industry's most valuable company. Today, it ranks 15th in market capitalization among global chip manufacturers.

Our Disruption Investor Venn Diagram would have protected you from Intel's decline. And it would have directed you toward Nvidia, Broadcom, and other genuine wealth-compounders of the AI era.

Print the Venn Diagram and keep it visible at your workspace. Evaluate every potential investment through this framework. If a company doesn't qualify as both an excellent business and a participant in a megatrend, move on.

I created The Jolt to help readers spot the big disruptions before they go mainstream—and avoid the investing traps so many others fall into. If you’re not on the reading list yet, you can sign up here for free.

| If you enjoyed this, make sure to sign up for the Jolt, Stephen McBride's twice-weekly investing letter-where innovation meets investing. | Go here to join |

Important Disclosures:

- Stephen McBride: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.