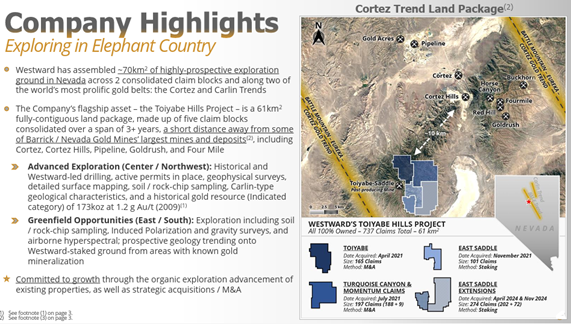

Westward Gold Inc. (WG:CSE; WGLIF:OTC; IM50:FSE) is a Nevada-focused exploration company with ~70 km² across two projects on the Cortez and Carlin trends.

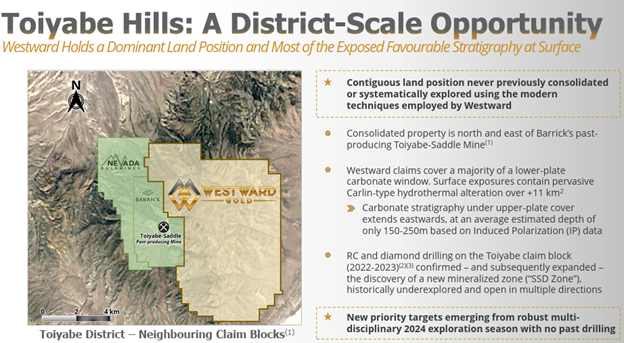

Its flagship is the fully contiguous Toiyabe Hills Project in the heart of the Cortez district, just a short distance from Barrick Mining Corp. (ABX:TSX; B:NYSE) and Nevada Gold Mines' Pipeline, Cortez/Cortez Hills, Goldrush, and Four Mile deposits.

Toiyabe Hills carries a historic Indicated resource of 173 koz at 1.2 g/t (2009) and multiple greenfield targets generated by modern mapping, geochemistry, and geophysics — work that has never been applied systematically to this now-consolidated land package.

Why Now?

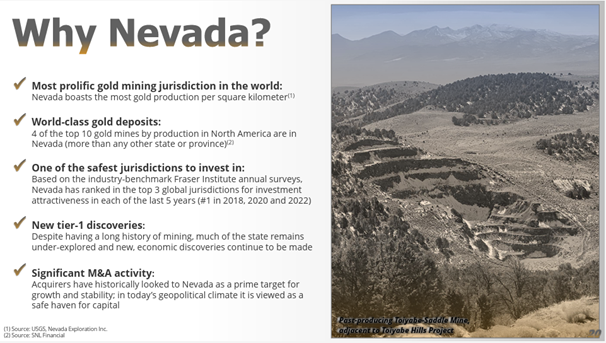

The company has stitched together a fragmented land position and completed district-scale surveys, including soil and rock-chip sampling, gravity, ZTEM (inherited from previous operators), and detailed geological surface mapping. This effort defined the Campfire Target Complex, a 1.5 × 3 km structural and alteration corridor interpreted as a potential feeder to the known near-surface gold at both Toiyabe Hills and the adjacent past-producing Toiyabe-Saddle Mine. Target depths begin as shallow as 150 m, with room to step down-plunge into the system.

Crucially, the project sits in a Tier-1 jurisdiction where the neighbors have mined tens of millions of ounces, underscoring the discovery potential if drilling confirms the geologic model.

Management Depth

Westward's leadership blends discovery experience, operating know-how, and capital markets expertise. Westward Gold is backed by one of the deepest benches in the junior mining sector.

At the helm is Colin Moore (CEO), a mining engineer and former private-equity and banking professional who has worked with Pacific Road, Waterton, and BMO.

He's supported by Andrew Nelson (CFO), a CPA with a decade of corporate finance and banking experience, and Robert Edie (VP Exploration), a Nevada Carlin-type specialist with direct discovery experience at Dark Star and operational leadership at Jerritt Canyon.

Guiding strategy is Dr. Quinton Hennigh (Chairman), an internationally recognized geologist credited with several major discoveries and the identification of Toiyabe as the missing piece of the Cortez system.

The board and advisory team bring heavyweight credibility. Directors include Kelly Cluer, co-discoverer of the Ren deposit on the Carlin Trend, David Kelley, a career explorationist with success across the Americas, and Al Fabbro, who helped build Roxgold into a billion-dollar takeover. Advisors such as Steven Koehler, a senior geologist on the original Cortez Hills discovery team, Richard Bedell, co-founder of AuEx Ventures (Long Canyon discovery, later acquired for US$2.3B), and veteran financiers like Terry Salman and Matthew Lennox-King, add both technical depth and capital markets expertise.

Together, this team blends discovery know-how, operating experience, and financing capability, exactly the combination needed to unlock a multi-million-ounce Carlin-style gold system in Nevada.

This group combines technical discovery skills with the financial acumen to finance, advance, and ultimately monetize a major Nevada find.

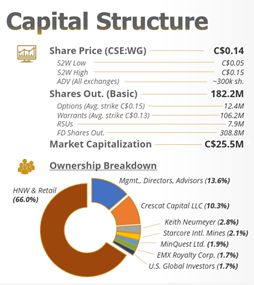

Share Structure & Market Capitalization

As of June 2025, Westward reported:

- 182.2M basic shares

- 308.8M fully diluted (12.4M options avg. CA$0.15, 106.2M warrants avg. CA$0.13, 7.9M RSUs)

- At a CA$0.14 reference price, market capitalization was ~CA$25.5M.

The Project in One Page

District Context: Westward controls most of a lower-plate carbonate "window" at surface, analogous to the host rocks of Cortez. These favorable units are shallow and continuous across the claims.

Legacy + New: A 173 koz historic resource anchors the project; modern geophysics and geochemistry now tie it into a large-scale Campfire system.

What Makes It Interesting: The combined datasets point to a large, intact Carlin-type system with shallow access and multiple target styles (stratigraphic, structural, breccia pipes, dike margins, karst).

Technical Analysis

Price Structure

The stock has completed a long basing phase that extended through 2023 and 2024. Over the past 12 months, the chart has carved out a clear sequence of higher lows, establishing a constructive uptrend off the CA$0.07–CA$0.08 support area. This is often a hallmark of accumulation ahead of a more decisive move.

The recent breakout attempt pushed the price into the CA$0.12–CA$0.15 range before pulling back to test trendline support. Importantly, the pullback has occurred on lighter volume compared with the breakout days, suggesting profit-taking rather than distribution.

Moving Averages

- The 50-day moving average has turned up and is now above the 200-day moving average, forming a positive technical alignment.

- Price is consolidating just above the rising 50-day MA, providing a short-term support level near CA$0.10.

The 200-day MA near CA$0.09 represents a key longer-term support zone.

Momentum Indicators

The MACD is in positive territory but shows a mild flattening, consistent with consolidation after an initial thrust higher. A renewed cross to the upside would be a confirmation signal.

RSI is mid-range (~50), leaving ample room for momentum expansion without entering overbought territory.

Volume Profile

The most constructive signal on this chart is the increase in volume on up days, particularly during the July–August rally.

This is typical of institutional or strategic buying interest. Volume tailing off on pullbacks adds weight to the bullish case.

Price Targets

Based on prior swing highs and technical resistance levels, the next upside objectives are clearly defined:

- First Target: CA$0.18 (near-term resistance and psychological round number)

- Second Target: CA$0.25 (mid-2022 resistance)

- Third Target: CA$0.33 (multi-year congestion zone)

- Big Picture Target: CA$0.50 (measured move potential from the multi-year base)

Risk Levels

Key support is located at:

- CA$0.10 (trendline support / 50-day MA)

- CA$0.09 (200-day MA)

Westward Gold exhibits the technical characteristics of a junior explorer emerging from a long accumulation phase. With a base established, higher lows forming, and improving volume dynamics, the technical picture favors additional upside. Sustained closes above CA$0.12 would strengthen the bullish case and open the path to the first target at CA$0.18.

From a risk-reward standpoint, the current setup offers a favorable balance, with limited downside relative to the upside potential typical of the junior miners.

Bottom Line

Westward Gold Inc. (WG:CSE; WGLIF:OTC; IM50:FSE) offers exactly what Nevada-focused investors look for: a consolidated Cortez-trend land position, modern exploration defining a genuine feeder target, and an experienced team with discovery and capital markets credentials. With a 5,000 m drill program of 10 holes set for 2025, the Campfire target represents a near-term catalyst.

Westward Gold Inc. (WG:CSE; WGLIF:OTC; IM50:FSE) is a Speculative Buy at the closing price of CA$0.13 on September 15, 2025

For more information, visit: www.westwardgold.com.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Westward Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Westward Gold Inc. and Barrick Mining Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.