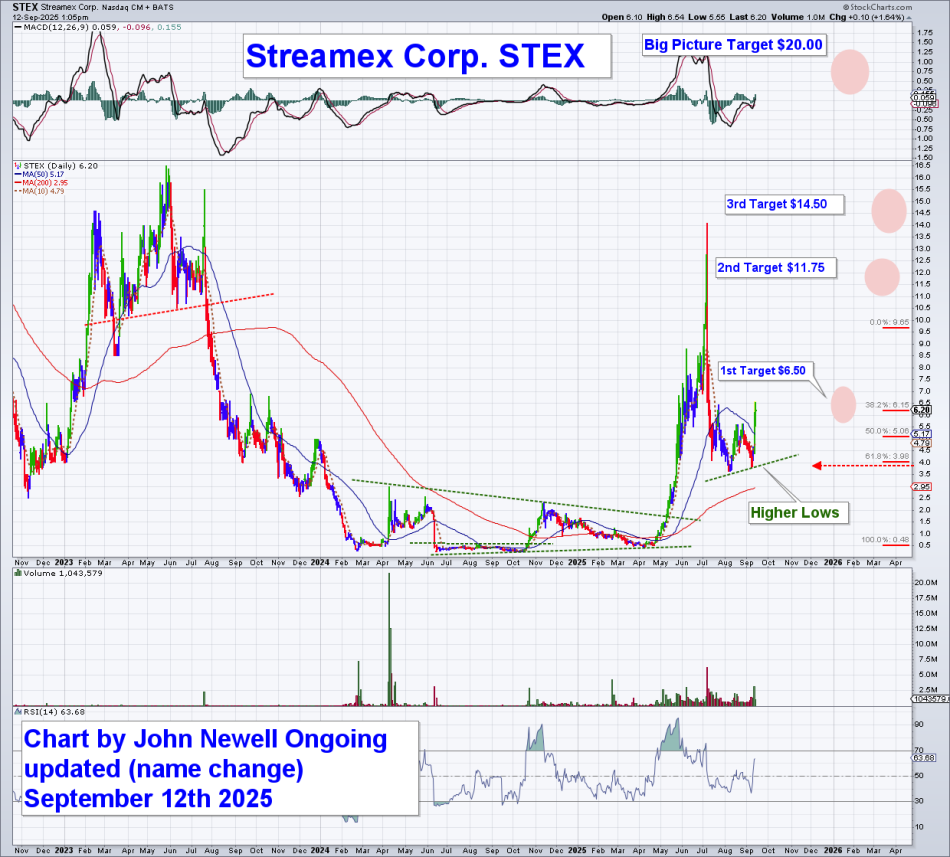

Streamex Corp. (STEX:NASDAQ), formally BioSig Technologies Inc. (BSGM:NASDAQ), continues to display constructive technical behavior following its sharp advance earlier in 2025.

The stock recently tested the 61.8% Fibonacci retracement zone of the prior rally, an area that has historically provided strong support in trending markets.

The successful defense of this level, combined with the emergence of higher lows, points to underlying accumulation and suggests the pullback phase is maturing.

Price Structure & Trend

After a prolonged basing period throughout 2024, STEX broke through multi-year resistance near US$2.50–US$3.00 in Q1 2025, igniting a powerful advance toward US$12.00.

The stock has since retraced in an orderly fashion, consolidating above its long-term moving averages while maintaining structural integrity. Importantly, the rising 200-day moving average is beginning to align with price, confirming a potential shift into a longer-term uptrend.

Momentum & Volume

Relative Strength Index (RSI) has reset from overbought levels and is now stabilizing in the mid-50 range, leaving room for upside expansion. MACD remains in positive territory despite consolidating, consistent with a bullish continuation setup.

Volume analysis shows net accumulation, with heavier buying days outweighing selling pressure during the consolidation phase, another indication that investors are supporting the stock at current levels.

Key Technical Levels

Support: Strong near-term support at the US$4.00–US$4.25 zone, reinforced by the 61.8% retracement and recent higher lows.

- First Target: US$6.50 – a measured move that coincides with prior reaction highs and Fibonacci confluence.

- Second Target: US$11.75 – retest of the summer peak and a potential recognition point for broader market interest.

- Third Target: US$14.50 – breakout extension target if momentum accelerates.

- Big Picture Target: US$20.00 – represents a full recovery toward prior cycle highs and would mark the completion of a long-term reversal pattern.

Conclusion

From a technical standpoint, Streamex Corp. appears to be in the early stages of a new uptrend following a successful retest of major Fibonacci support. The stock is carving out a bullish continuation pattern supported by rising moving averages, positive momentum, and strong accumulation.

While volatility should be expected in the near term, the risk-reward profile remains favorable for investors positioning ahead of a potential breakout toward US$6.50 and beyond.

In my opinion, Streamex Corp. remains technically attractive, and a Speculative Buy at the current price of US$6.00 at the time of this report. The company has the potential for outsized gains if it clears near-term resistance and follows through toward intermediate and long-term targets.

For more information about the company, Investors can go to their website.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.