For the longest time, cryptocurrency's biggest obstacle wasn't technology or vision, but a dense barrier of regulatory ambiguity.

The absence of definitive guidelines in the United States channeled investments toward speculative gambles instead of backing genuine, transformative enterprises. It barred American investors from countless possibilities and restrained the surge of institutional funds waiting in reserve.

But that phase is complete. Cryptocurrency has emerged victorious in its regulatory struggle.

We've recently witnessed the enactment of the first cryptocurrency legislation. More significantly, the SEC is no longer battling against cryptocurrency — it's establishing the foundation for its prosperity.

This transforms everything.

In today's piece, I'll break down these fresh cryptocurrency regulations . . . how financial institutions are reacting . . . and what this signifies for us as investors.

Let's begin with the two most crucial pieces of cryptocurrency legislation. . .

The GENIUS Act

First is the GENIUS Act, which became law several months ago.

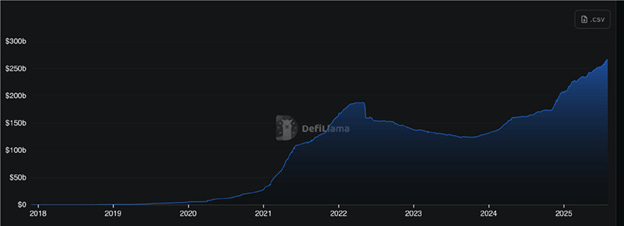

I've maintained for years that stablecoins represent cryptocurrency's initial breakthrough application. There's currently $270 billion worth of stablecoins in circulation.

This achievement is even more remarkable considering they existed in a nebulous regulatory zone in America, the financial capital.

The GENIUS Act provides America with its first legitimate stablecoin framework. This catalyst will drive stablecoin volumes to $1 trillion within the next year.

This legislation unlocks cryptocurrency's next growth phase. It will finally enable banks, payment networks, and institutional participants to embrace cryptocurrency at scale.

But a critical question remains unanswered: "Which tokens qualify as securities, and which as commodities?"

CLARITY Act

That's where the CLARITY Act enters the picture.

CLARITY establishes a boundary. If a token is decentralized — like Ethereum (ETH), for instance — it's classified as a commodity. If not, it's deemed a security.

It also grants emerging token projects three years to decentralize before facing SEC enforcement.

Alongside the CLARITY Act, the SEC has initiated "Project Crypto."

Project Crypto

Regulatory bodies often procrastinate even after laws are passed. That's been the narrative in sectors like nuclear energy and drones.

Not this instance.

"Project Crypto" represents the most optimistic regulatory shift we've ever witnessed. It implements three significant changes:

#1: Nearly all tokens are not securities

This transition allows projects to be more forthcoming about revenue and token mechanics without regulatory concerns. It permits cryptocurrency businesses to distribute revenues to users. No more pretending tokens lack value.

Additionally, it provides cryptocurrency startups two to three years to launch and evolve before confronting heavy regulation.

#2: Token launches are now permissible in the US

U.S.-based ventures can finally issue tokens without resorting to convoluted offshore structures. It also allows American investors to participate in ICOs.

#3: Self custody = fundamental American right

This clearly rejects the previous Operation Choke Point crackdown on wallets. The reformed SEC affirms your right to possess cryptocurrency.

For years, antagonistic regulators' campaign against cryptocurrency rendered this asset class untouchable for Wall Street. Now, it has received approval to proceed . . . and Wall Street's hunger for cryptocurrency is enormous.

For evidence, look no further than the Bitcoin (BTC) and Ethereum ETFs.

Bitcoin ETFs have already drawn billions and are positioned to surpass gold ETFs within the next 12 months.

Assets held in the largest ETH ETF — the iShares Ethereum Trust ETF (ETHA ) — have also tripled to $10 billion since early June.

It now ranks as the third-fastest ETF to reach $10 billion in assets behind, predictably . . . two BTC ETFs.

What About Wall Street?

My analysis suggests Wall Street's entry into cryptocurrency will follow a trajectory similar to our own.

When I initially invested in cryptocurrency, I purchased BTC. Then I progressed to ETH before acquiring some smaller tokens. You likely followed a comparable path. So too will Wall Street.

Today, it's accumulating BTC and ETH. Next, capital will flow into exceptional cryptocurrency enterprises developing tangible products.

And remember, cryptocurrency markets are minuscule. Just one corporation, Nvidia Corp. (NVDA:NASDAQ), exceeds the combined value of all cryptocurrencies. When major financial players enter, it'll resemble forcing Niagara Falls through a drinking straw.

"Professional investors" will also alter how cryptocurrency markets function.

BTC has more than doubled since the inaugural ETFs launched in January 2024. Examining BTC's chart shows growth with reduced volatility and no stomach-churning declines. You could almost divide bitcoin's timeline into two eras: BE and AE. Before ETFs and After ETFs.

The identical phenomenon is now occurring with Ethereum.

Until recently, cryptocurrency markets were dominated by individual investors. Now, most purchasers are "professionals." Think asset managers, hedge funds, endowments, and pension funds.

This fundamentally transforms the market from one ruled by short-term, speculative frenzies to one where long-term-minded money managers hold sway.

What Follows Regulatory Clarity?

Over a decade of market experience has taught me the importance of effective filtering.

As a newcomer, you attempt to absorb everything. You consume information, relentlessly seeking an advantage. But I've discovered that what you disregard is equally important as what you focus on.

The paramount consideration for cryptocurrency investors remains innovation.

What challenges is blockchain addressing? Which new products built on cryptocurrency infrastructure delight customers and demonstrate rapid growth?

Identify outstanding cryptocurrency businesses creating authentic products — and generating actual revenue — and everything else will fall into place. To succeed financially, tune out the macro "distractions."

The most insidious aspect of cryptocurrency's regulatory crackdown was prohibiting innovation. Cryptocurrency entrepreneurs received subpoenas, lost banking access, and occasionally had their residences raided by armed officials. Appalling.

Fortunately, innovators are now liberated to create.

From my deep involvement in this industry, I recognize the vast reservoir of untapped talent. Cryptocurrency represents a $4 trillion asset today. Innovation and engineers developing practical solutions will propel us to $10 trillion and beyond.

I've maintained from the beginning that I wouldn't touch 99% of cryptocurrencies. But the remaining 1% will revolutionize the world.

If you enjoyed this, make sure to sign up for the Jolt, Chris Reilly's twice-weekly investing letter-where innovation meets investing.

Go here to join

Important Disclosures:

- Stephen McBride: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.