Sun Summit Minerals Corp. (SMN:TSX.V; SMREF:OTCQB) announced assay results from the first drill hole of its 2025 campaign at the JD Project in the Toodoggone Mining District of British Columbia, returning one of the strongest gold intervals drilled to date in the Creek Zone. Drill hole CZ-25-007 intersected 78.0 meters grading 3.72 grams per tonne (g/t) gold starting from 30.0 meters downhole. Within this broader interval were several high-grade sections, including 12.0 meters of 8.55 g/t gold and 19.1 meters of 7.50 g/t gold. The zone also contained individual assays of 31.84 g/t gold over 1.0 meter and up to 98.80 g/t gold over 0.5 meters.

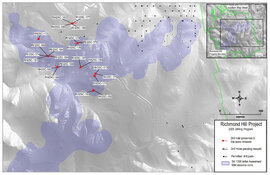

This hole was collared in a previously undrilled area 75 meters north of hole CZ-24-004 and 100 meters west of CZ-24-005, establishing what may be a parallel trend of mineralization north of the main Creek Zone. The mineralized intercept was hosted in intermediate volcanic and volcaniclastic rocks of the McClair Member and associated with epithermal-style quartz-carbonate veins and sulfide-cemented breccias. Multiple intervals showed visible gold.

According to Niel Marotta, CEO of Sun Summit Minerals, in the company news release, "The first hole of this year's drill program at our JD Project ,. . . represents the best hole drilled to date at the Creek Zone." He added that the presence of high-grade intervals from shallow depths "supports the high-grade gold potential of the Creek Zone."

Hole CZ-25-007 is part of a larger 11-hole (3,700 meter) program at the Creek Zone. Results from the remaining 10 holes are still pending. The drill program was designed to test both lateral and vertical continuity across approximately 800 meters of strike and over 200 meters of down-dip extent.

Precious Metals Sector Remains Resilient Amid Global Shifts

Silver demand has seen notable growth worldwide, with Australia emerging as a key contributor. According to a September 4 report by Stockhead, Australia recently became the fourth-largest physical silver market, surpassing China and Canada. The article, citing a Metals Focus study commissioned by the Silver Institute, linked the rise to increased superannuation investments and favorable tax conditions. The report also noted that silver holds particularly strong appeal among Australian retail investors when compared to gold.

On September 5, Kitco News quoted Sameer Samana, head of Global Equities and Real Assets at Wells Fargo Investment Institute, who stated that "gold and silver should outperform even a hot equity market in a lower-rates environment." Samana attributed this outlook to the U.S. Federal Reserve's shift in focus from inflation control to labor market support, a move that has increased pressure on fixed income markets while improving the outlook for precious metals. He further emphasized gold's historical role in periods of uncertainty and highlighted institutional demand for diversification away from the U.S. dollar.

That same day, GoldMoney's Alasdair Macleod identified macroeconomic drivers impacting the gold and silver markets, including potential changes in G7 currency relationships and reduced physical supply in central bank vaults. Macleod noted that silver reached US$40.77 per ounce, pointing to heightened activity on the Comex exchange and characterizing the move as consistent with bull market conditions.

By September 8, Reuters reported that gold had surpassed US$3,600 per ounce for the first time, supported by softer U.S. labor data and increased expectations of a rate cut by the Federal Reserve. Spot silver also climbed to US$41.29 per ounce, its highest level since 2011. The report attributed the upward trend to central bank buying, lower bond yields, and a weakening U.S. dollar. Gold prices had gained 37% year-to-date following a 27% increase in 2024, according to the article.

Analysts Highlight Exploration Momentum and Regional Positioning

In a June 30 research note, Ron Wortel, senior mining analyst at Couloir Capital, assessed Sun Summit Minerals' CA$6 million exploration program at the JD Project. The initiative includes 5,000 meters of diamond drilling supported by geophysical and geochemical surveys. Wortel focused on the Creek and Finn zones within the 4.5-kilometer mineralized corridor, noting that these targets offer grades that are comparable to or exceed other zones in the region.

Wortel reported that the program was fully funded following a private placement completed in June that exceeded both the company's initial target and its then-current market capitalization. He highlighted increased exploration activity across the broader Toodoggone District, estimating that total investment in the region for 2025 would surpass CA$100 million. According to Wortel, this uptick has been driven by new copper-gold discoveries and earn-in agreements with major mining firms, including Freeport-McMoRan, which he cited as a sign of growing interest in the district.

In his evaluation, Wortel described Sun Summit's leadership as well-positioned to advance exploration efforts. He referenced CEO Niel Marotta's background in capital markets and mergers and acquisitions, and characterized the company's current trajectory as "a promising inflection point." He also noted that infrastructure in the region — such as road access and proximity to hydroelectric power — adds to the project's potential within a district that continues to attract capital.

In a July 18 update, Jay Taylor of Hotline stated that drilling had commenced at the JD Project, with the first hole targeting the northwestern extent of the Creek Zone. According to Taylor, up to 3,000 meters of drilling were planned for the area, aimed at testing the continuity of near-surface, high-grade, and bulk-tonnage gold mineralization.

Brien Lundin, writing in the July 31 edition of Gold Newsletter, described the 2025 summer drill program as having "the potential to deliver some high-grade hits to the market, along with wide intervals of bulk-tonnage gold mineralization." Lundin also remarked on the project's timing within a supportive precious metals environment and stated that he was moving Sun Summit back to a "Buy" rating.

On August 28, Lundin offered an updated quote on the company, stating, "Given the significant gold and silver grades that Sun Summit Minerals Corp.'s Creek and Finn zones have produced in past drilling, they have a chance to deliver good results to the market this fall. The company is a Buy at current levels."

Next Steps in a Rapidly Expanding District

Sun Summit's 2025 exploration campaign is fully funded through a CA$10 million private placement completed in May 2025 and is backed by a five-year exploration permit. The company has already completed over 3,700 meters of diamond drilling across 11 holes at the JD Project, with the Creek Zone prioritized for follow-up based on recent intercepts. According to the company's presentation, the 2025 program will include up to 5,000 meters of drilling, soil geochemistry, geophysics, and surface mapping.

Located in the Toodoggone District of British Columbia, the JD Project sits within a region characterized by both high-grade epithermal and bulk-tonnage porphyry mineralization. The district has drawn increasing interest from larger companies, with nearby exploration and development activity by Thesis Gold, TDG Gold, and Centerra Gold.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Sun Summit Minerals Corp. (SMN:TSX.V; SMREF:OTCQB)

Sun Summit's ongoing work at the Creek Zone complements historical drilling in the Finn Zone and other targets, which together span approximately 4.5 kilometers of mineralized strike. The company's stated exploration goal is to scale up JD toward a potential mineral resource estimate, following the February 2025 release of an initial resource estimate at its Buck Project, also in British Columbia.

The Creek Zone remains open in multiple directions, and step-out drilling is planned to further define the extent of mineralization. The company indicated that results from the remaining 2025 drill holes, along with surface sample assays, will be released as they are reviewed.

Ownership and Share Structure

According to SEDI filings, 5.9% of Sun Summit Minerals Corp is owned by management and insiders.

Sun Summit has a market cap of CA$42 million with 213.9 million free float shares and a 52-week range of CA$0.065 to CA$0.340.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Sun Summit Minerals Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Sun Summit Minerals Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sun Summit Minerals Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.