"I see dead people."

That memorable line from The Sixth Sense ranks among the most recognizable movie quotes ever.

Well, to brazenly borrow that phrase . . . "I see dead stocks."

And I'm spotting them in some of today's most sizzling industries, including nuclear, robotics, and drones.

Folks rushing to grab shares in these sectors are committing a massive blunder.

- Drones are revolutionizing warfare right in front of us.

More than 70% of casualties in Ukraine stem from lethal airborne machines.

That's partly why drone manufacturer AeroVironment Inc. (AVAV:NASDAQ) has jumped over 100% during the past five months.

Drones = game-changing?

Yes.

Drone stocks = smart investment?

No.

AeroVironment's aerial vehicles are cumbersome with fixed wings. They're designed for an outdated era when unmanned aircraft primarily conducted long-range surveillance. And each Switchblade unit runs upwards of $50,000.

Meanwhile, the flying gadgets reshaping Ukrainian battlefields are compact quadcopters priced as low as $1,000.

Upstarts like Neros and Flyby Robotics are crafting drones that are tinier, more affordable, and more intelligent. They can operate in groups, navigate autonomously, and be mass-produced at significantly lower costs.

I've been fortunate to speak with founders leading this next wave of drone ventures. Many have already deployed their technology in Ukraine and beyond. These conversations quickly reveal that established manufacturers like AeroVironment are doomed.

Inexpensive, adaptable drones represent the future. That's what military forces will purchase.

- Some of today's most popular stocks are . . .

Companies that are developing a fresh category of compact nuclear reactors (SMRs).

AeroVironment Inc. (AVAV:NASDAQ) has soared threefold this year. NuScale Power Corp. (SMR:NYSE) has increased twofold.

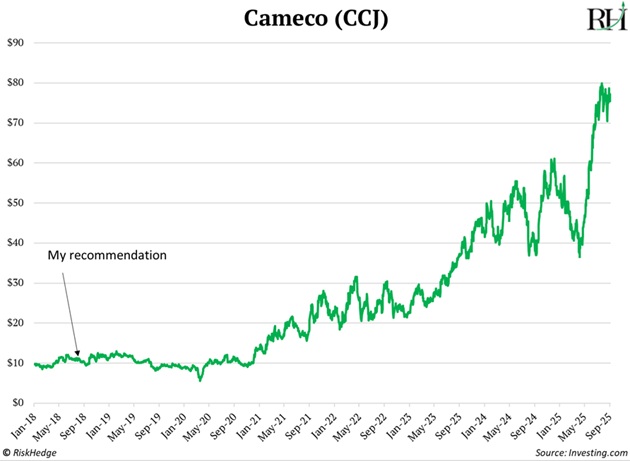

You won't encounter a stronger advocate for nuclear energy than me. I initially wrote about capitalizing on nuclear back in 2018, suggesting Cameco Corp. (CCO:TSX; CCJ:NYSE).

The stock has rocketed 580% since then:

Microreactors from Oklo and NuScale are pioneering nuclear energy's future. They'll enhance the world's safest, cleanest, most dependable power source even further.

Oklo, NuScale, and NANO Nuclear Energy Inc. (NNE:NASDAQ) may be the only publicly traded SMR businesses. But they won't emerge victorious in the SMR competition.

During the last year, I've toured facilities of several prominent microreactor startups, including Valar Atomics and Aalo Atomics. I've conversed with numerous other founders.

These agile newcomers will thoroughly outperform the more sluggish Oklo and NuScale.

Where's the evidence?

NuScale's flagship development in Idaho was supposed to be the world's inaugural SMR. But it collapsed last year after expenses nearly doubled to $9.3 billion. This followed burning through 2 million engineering hours and $500 million solely on licensing documentation.

Meanwhile, Valar, Aalo, and others are rushing to activate America's first SMR by Independence Day, 2026.

- Something always seemed "strange" about robotics investments.

I'd constantly hear robots were conquering the world and appearing everywhere. . .

Yet, examining the financial statements of major robotics corporations revealed minimal growth.

Strange, right?

Robotaxi pioneer Waymo recently achieved the landmark of 100 million fully self-driving miles on American roadways.

Aerial delivery startups like Zipline are transporting burritos (and everything else) to satisfied customers nationwide.

Amazon.com Inc. (AMZN:NASDAQ) now utilizes more robots than human workers in its distribution centers!

You can acknowledge robotics is transforming industries while simultaneously recognizing that investing in industrial automation giants like ABB Ltd. (ABBNY:OTCMKTS; ABB:ST), FANUC Corp. (FANUY:OTCMKTS), and Yaskawa Electric Corp. (YASKY:OTCMKTS) is misguided.

These represent the largest robotics enterprises globally. By default, they're viewed as industry leaders.

But when conversing with startups at robotics' cutting edge, you discover a little secret:

These are industrial fossils.

The genuine future is being constructed by ventures creating artificial intelligence (AI)-native machines.

Units that master tasks in hours, not months. And that can "upgrade" similar to your iPhone.

Once these robotics newcomers scale production, the old guard will be flattened.

- "Fine, Stephen. So which shares should I acquire?"

To quote Kenny Rogers, "You've got to know when to hold 'em, know when to fold 'em."

The premier drone, nuclear, and robotics organizations aren't publicly listed yet.

And that's beneficial.

These are early-phase ventures that shouldn't need to worry about continuous public market scrutiny.

But if you possess legacy investments across these disruptive sectors, I suggest folding 'em.

These stocks might continue rising as investors grow enthusiastic about drones, robotics, and nuclear reshaping our world.

But they're not the enduring champions.

I see dead stocks.

P.S. A lot of investors get stuck looking back at stocks that have worked well in the past.

But in The Jolt, I look to the future . . . and the promising companies making technologies that will move markets over the next decade.

If you'd like to join me, you can sign up here to start receiving The Jolt for free.

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp.

- Stephen McBride: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.