Historically, precious metals markets frequently initiate a downturn coinciding with major industry conferences. The exclusive Beaver Creek gathering kicks off September 9, next Tuesday. Expect a pullback in silver and mining equities to commence shortly. They'll ascend again eventually, but these downturns are both inevitable and beneficial. Far too many enthusiasts are chattering about silver reaching US$500 per ounce imminently. That simply won't materialize. At least not by next week.

The broader equity marketplace as indicated by the DOW and S&P indices have reached unprecedented heights and similar to digital currencies, are vulnerably positioned for a dramatic collapse. If a liquidity crisis emerges, bullion will fulfill its fundamental purpose as an emergency source of capital. Markets will liquidate everything, gold and silver included. The Japanese debt situation is unraveling and might trigger the liquidity meltdown. Take caution. Precious metals will bounce back. The remainder of these speculative assets won't recover.

I published an article regarding Altamira Gold Corp. (ALTA:TSX.V; EQTRF:OTCBB) last May. Their shares traded at CA$0.11 each. Investors could acquire Brazilian gold reserves for merely US$12 per ounce in a historical placer operation zone that had yielded millions of gold ounces historically.

The company secured funding and announced drilling plans. They drilled and they hit.

Their market valuation stood at CA$22 million during May, with 212 million outstanding shares. Currently, they command a CA$66 million valuation with 265 million shares, but considering their exploration achievements, investors must now pay US$34 per underground ounce. Surveying comparable opportunities, I notice other companies demanding roughly US$67 per ounce for equivalent projects.

I believe Altamira remains undervalued.

On May 5, 2025, Altamira Gold unveiled a maiden 43-101 for their Maria Bonita prospect, one of nine porphyry targets identified thus far within their Cajueiro property. This new resource nearly doubles the total gold delineated at Cajueiro to 1.42 million ounces overall.

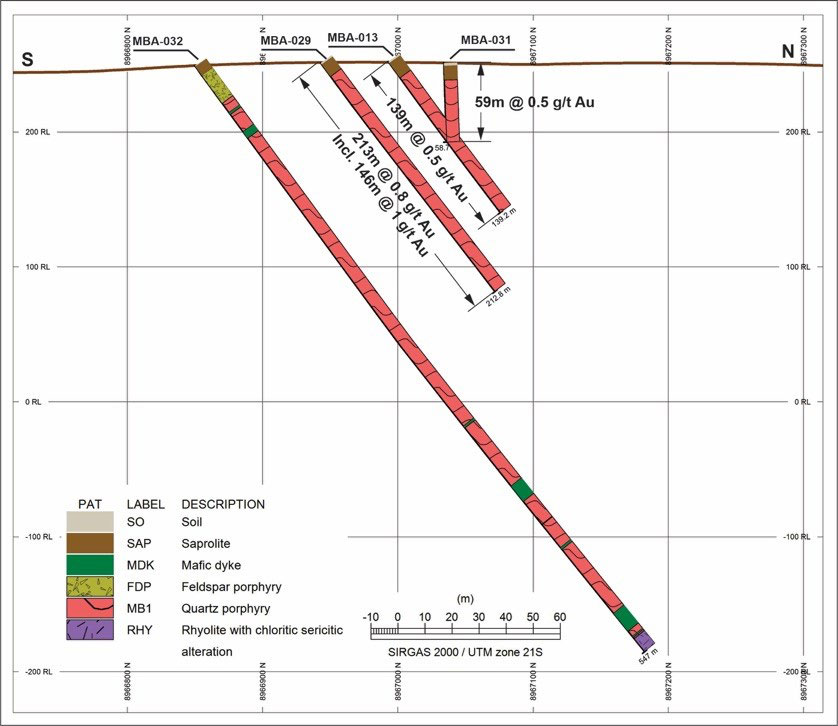

The September 2 announcement that awakened investor interest contained a noteworthy illustration showing the hole recently submitted for laboratory analysis. Hole MBA032 sits merely 100 meters from hole MBA029, which yielded 146 meters grading 1.0 g/t gold within 213 meters, averaging 0.8 g/t Au.

However, hole MBA032 revealed 500 meters from surface, containing similar geological formations as discovered in MBA029. Anticipate results within the next 14 to 21 days.

Altamira sponsors my publications. I've purchased shares through market transactions and intend to join any forthcoming private financing rounds, making me admittedly partial.

These diminutive, modestly capitalized bargain stocks potentially deliver the greatest percentage returns. I appreciated this investment at higher valuations; I'm particularly enthusiastic at current levels.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Bob Moriarty: I, or members of my immediate household or family, own securities of: Altamira Gold Corp. My company has a financial relationship with: Altamira Gold Corp. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.