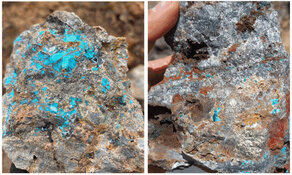

Allied Critical Metals Inc. (ACM:CSE; ACMIF:OTCQB; 0VJ0:FSE) has reported assay results from its 2025 reverse circulation (RC) drill campaign at the Borralha Tungsten Project in northern Portugal, confirming one of the highest-grade tungsten intercepts recorded in Western exploration. Drill hole Bo_RC_14/25 returned 12.0 meters grading 4.27% WO₃, including 6.0 meters at 8.39% WO₃, from 252.0 meters downhole. According to the company, these results validate earlier visual observations of massive wolframite and suggest the presence of a high-grade breccia-hosted corridor.

As of July 30, 2025, Allied had completed over 2,500 meters of drilling across nine holes, with operations temporarily paused in August due to regional fire safety restrictions. Drilling resumed on September 1 with two rigs on site. The current program targets a total of 4,200 meters, with an additional 1,528 meters now fully funded and planned for the fourth quarter of 2025.

CEO Roy Bonnell stated in the company's news release, "These initial assay results are a major step forward for the Borralha Project and a clear validation of our geological model. The exceptional tungsten grades intersected in Bo_RC_14/25 place Borralha among the most exciting undeveloped critical mineral assets in Europe."

The company also reported multiple other drill holes with visible wolframite and chalcopyrite, reinforcing the interpretation of a mineralized breccia system. Assays are pending for Bo_RC_15/25 through Bo_RC_22/25 and others. The drilling campaign is designed to support an updated Mineral Resource Estimate (MRE) and a Preliminary Economic Assessment (PEA), both targeted for later this year.

Tungsten prices recently reached US$545 per metric ton unit (MTU), marking a 40% increase over the last four months. This rise has been attributed to tightening supply from China and other non-Western sources, highlighting the strategic significance of Western tungsten projects like Borralha.

All drill samples are being processed at ALS Laboratories in Seville, Spain, with analytical procedures including ME-MS81 for fusion and ICP-MS analysis, and ME-XRF15c for over-limit tungsten values. Sampling protocols included 5% certified reference materials and 5% duplicates for quality control.

The scientific and technical information in the release was reviewed and approved by Vítor Arezes, BSc, MIMMM (QMR), Vice-President Exploration of Allied Critical Metals, and a Qualified Person under National Instrument 43-101.

In a corporate update, Allied announced that Colin Padget has resigned as director but will remain with the company in an advisory role.

Signals From the Tungsten Trade

According to an IndexBox country report published September 2, Japan's tungsten consumption and trade activity had increased year over year. The report stated that "In 2024, consumption of tungsten in Japan expanded to 674 tons, surging by 4.4% on 2023 figures," and that international imports "expanded to 689 tons, rising by 4.4% compared with 2023 figures." It also noted that the average import price "stood at $50,622 per ton in 2024, picking up by 7.7% against the previous year," while exports "reached 15 tons, rising by 2.9% on the previous year." These movements pointed to firmer end‑use pull in a mature manufacturing economy and offered a current snapshot of pricing and volumes without relying on projections. According to the same report, China was Japan's dominant supplier by volume and value, and export prices varied widely by destination, with Sweden at the high end and Mexico lower on a per‑ton basis.

On September 4, Coherent Market Insights described the carbide segment's breadth across industrial tooling and wear‑resistant parts. The release stated that the Tungsten Carbide market "holds a strong global presence" and that its research "provided a comprehensive assessment of the market," including consumption and production data as well as pricing and validated industry figures. The release also summarized how industry policies and regulatory dynamics had affected supply chains and procurement, alongside a detailed competitor and regional landscape for carbide applications in cutting tools, drilling, and heavy‑duty components. According to Coherent Market Insights, this lens had been grounded in a combination of primary and secondary research to capture current usage patterns across end markets.

The 2025 Grand View Research summary framed the recent baseline with historical data through 2024 and segment detail. The report noted that the Middle East tungsten market size "was estimated at USD 41.6 million in 2024" and that, by form, "the powder segment accounted for the largest revenue share of over 30.0% in 2024." It also reported that end uses spanned aerospace and defense, construction, automotive, mining and energy, and electronics and robots, indicating broad industrial demand for tungsten metal, powder, and carbide components. According to Grand View Research, these observations reflected recorded market shares and volumes rather than projections, anchoring the sector view in recent, realized activity. Grand View Research, Middle East Tungsten Market Size, Share & Trend Analysis Report, Report scope covering historical 2021–2023 and base year 2024.

Analyst Weighs In on Early Price Action

On August 22, 2025, John Newell of John Newell & Associates reviewed Allied Critical Metals and shared his view with Streetwise Reports. He observed that the company's shares appeared to be forming an early-stage uptrend, following a recent listing.

"Allied Critical Metals is establishing a new uptrend from a fresh listing, with clear support at higher lows and a defined initial target at CA$0.45," he noted. While the limited trading history means technical patterns are still emerging, Newell described the setup as constructive, citing "a healthy pullback to support, light-volume consolidation, and a defined uptrend line guiding price higher." John Newell then rated the company a Speculative Buy.

This CA$0.45 price target was met on September 3, 2025, and the stock closed on September 4, 2025 at CA$0.52.

How Allied Critical Metals Is Mapping the Path Forward

With tungsten designated as a critical mineral by both the European Union and the United States, Allied's Borralha Project continues to advance in alignment with strategic supply chain objectives. The company is pursuing project development in a secure jurisdiction with a legacy of tungsten production, having produced more than 10,280 tonnes of wolframite concentrate between 1904 and 1985 at an average grade of 66% WO₃.

Borralha currently holds a Mining Rights Concession License and is undergoing the Environmental Impact Assessment process, overseen by the Portuguese Environmental Agency. The project's existing resource estimate, effective March 2024, includes 4.98 million tonnes of Indicated Resources grading 0.22% WO₃ and 7.01 million tonnes of Inferred Resources grading 0.20% WO₃.

According to the company's Q3 2025 investor presentation, permitting allows for up to 150,000 tonnes per annum of mineralized material to be bulk sampled ahead of a full-scale license. Drilling costs remain low at approximately US$235 per meter, with nearby infrastructure such as roads, power, and workforce accessibility supporting operational efficiency.

Allied has also signed a letter of intent for offtake with Global Tungsten & Powders, based in Pennsylvania, and is engaged in discussions with other refineries. These commercial steps coincide with plans to commence construction of a pilot plant at its Vila Verde Project in Q4 2025. The plant is designed to process 150,000 tonnes per year with the ability to double capacity.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Allied Critical Metals Inc. (ACM:CSE; ACMIF:OTCQB; 0VJ0:FSE)

Beyond Borralha, Allied holds the Vila Verde Tungsten-Tin Project, which includes a historical resource of 7.3 million tonnes and potential for near-term processing through a pre-existing quarry.

The remaining 1,600 meters of Phase 1 drilling at Borralha are expected to refine resource classification and metallurgical understanding. These results will inform the MRE update and the upcoming PEA, positioning Allied to meet critical mineral demand at a time when Western tungsten supply remains limited.

Ownership and Share Structure

Insiders own approximately 15% of Allied, according to the company. About 25% is held by institutions and institutional investors and the rest is held by retail shareholders.

The company has 128 million common shares issued and outstanding and 134.05 million common shares on a fully diluted basis. Approximately 39.5 million are considered part of the public float and are available for trading. Its market cap is CA$38.71 million. Its 52-week range is CA$0.20–0.58 per share.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Allied Critical Metals has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Allied Critical Metals.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.