Eminent Gold Corporation (EMNT:TSXV; EMGDF:OTCQB) has mobilized for the next phase of diamond core drilling at the Otis target within its 100%-owned Hot Springs Range Project (HSRP) in Nevada. The company has engaged True North Drilling, a Nevada-based contractor with experience in Great Basin mineral systems, to carry out the program.

This next stage of drilling follows a completed project-wide gravity survey, which is currently under interpretation. Eminent expects to announce the final drill targets and official commencement shortly, pending the results of this analysis.

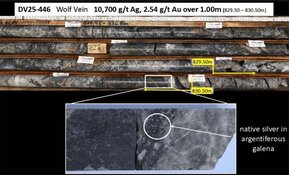

The Otis target is one of three high-priority areas within HSRP, alongside Eden and Sitka. The project is located across a basin from Nevada's Getchell Trend, a prolific gold-producing district with a legacy of high-grade deposits. While not directly adjacent, HSRP shares regional structural similarities with this trend. According to the company, the maiden drill program confirmed a new gold-bearing system in previously untested terrain. Highlights included intercepts such as 0.5 meters of 8 grams per tonne (g/t) gold within a broader zone of 3.9 meters grading 2.4 g/t gold and 0.9 meters of 4.4 g/t gold within a 4.6-meter interval grading 1.4 g/t gold.

The company's technical team believes the northeast structure at Otis may represent a feeder system, potentially consistent with Carlin-type mineralization models. In total, three core holes have been drilled to date, all intersecting gold mineralization and confirming structural continuity over approximately 150 meters of strike length. These intercepts remain open along strike and at depth.

Paul Sun, President and CEO, stated in the news release: "This next phase of drilling is a critical step toward advancing the Otis discovery, where we believe the northeast structure may be the source of mineralization intercepted earlier, potentially indicative of a Carlin-style deposit."

Gold Holds Ground as Market Uncertainty Grows

The gold sector remained resilient through August and into early September, as investors continued to navigate a complex economic environment marked by rising debt, inflationary pressure, and volatility in global equity markets. In an August 27 report from Stockhead, Phoebe Shields noted that the ASX 200 posted a 0.28% gain, supported by a 2.48% rise in the ASX All Ordinaries Gold Index and a 1.42% increase in the broader materials sector. Shields attributed part of this performance to gold's ability to hold above the US$3,300 level, providing stability amid concerns around U.S. monetary policy and broader geopolitical risks.

In a September 3 Market Rundown video, commentator Vince Lansing emphasized a longer-term bullish outlook for gold, despite what he described as near-term trading noise. "You don't want to trade this. You just want to be long it now," Lansing said, while reviewing shorter-term chart patterns. He acknowledged the potential for market fluctuations but described the setup as favorable, stating, "This is week one . . . it's starting to look like it." Lansing also pointed to high open interest at the 3,500 strike level and referenced an exotic knock-in option that activates based on the London PM fix, suggesting that near-term consolidation could be influenced by structured derivatives activity.

On the same day, Stockhead's Eddy Sunarto reported that gold had reached a new high above US$3,530 per ounce. The metal's continued climb contrasted with weakness in broader equity markets, as the ASX 200 declined 0.8% by midday with losses across all 11 sectors. Technology stocks led the downturn, in line with rising U.S. bond yields. Sunarto highlighted that some global central banks are now favoring gold over U.S. Treasuries, a trend not seen since the 1990s, which he described as "a vote of no confidence in Uncle Sam."

Goldman Sachs analysts suggested that gold could rise to nearly US$5,000 per ounce in a tail-risk scenario where the U.S. Federal Reserve's independence is compromised. In a September 4 note titled "Diversify Into Commodities, Especially Gold," the firm outlined a range of potential outcomes for the metal, with a baseline forecast of US$4,000 by mid-2026 and an upper-bound estimate near US$5,000 if just 1% of privately held U.S. Treasury holdings were reallocated into gold.

"A scenario where Fed independence is damaged would likely lead to higher inflation, lower stock and long-dated bond prices, and an erosion of the dollar's reserve-currency status," the report stated. "In contrast, gold is a store of value that doesn't rely on institutional trust."

The report comes as gold continues to outperform other major commodities, driven by central bank buying and expectations of rate cuts. Spot gold recently traded near US$3,540 per ounce after touching a record above US$3,578 earlier in the week. The note did not detail specific developments at the Fed, but referenced broader investor concerns, including efforts by President Donald Trump to exert influence over central bank leadership.

Strategic Drilling and Veteran Leadership Highlighted in Analyst Coverage

On August 25, The Gold Standard publication spotlighted Eminent Gold Corp.'s approach to aligning exploration activity with favorable commodity pricing, noting the company's strategy of maintaining 100% ownership across a pipeline of gold projects in Nevada. Analyst Julian Cruz emphasized Eminent's experienced management team, referencing a "proven track record of delivering shareholder value through major discoveries and successful exits." Chief Geologist Daniel McCoy's previous work at the Esaase (5 million ounces) and El Barqueno projects — both later acquired by major producers — was cited as a key credential.

The Hot Springs Range Project was described as a potential flagship asset. Drilling is currently underway at the Otis target, where the company is testing a structural model informed by regional geophysics and soil geochemistry. In a January 2025 update, CEO Paul Sun noted that "we did not cross the main structure, which will be drilled in our next hole, [but] we did intersect key faults feeding off the structure and observed great alteration and the presence of fluids in the rock." The company's exploration thesis aims to replicate mineralization patterns consistent with the nearby Getchell Trend, which hosts approximately 50 million ounces of gold.

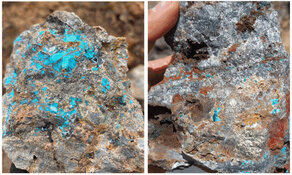

The Gilbert South Project also received attention in the report for its high-grade vein potential. Surface sampling has returned results as high as 30.7 grams per tonne gold. Analysts noted that visible gold, combined with historic mining infrastructure and underexplored vein feeder systems, supports the case for Gilbert South as another valuable project in Eminent's portfolio.

Mapping the Faults, Advancing the Thesis

Eminent Gold Corp.'s exploration strategy centers on validating a geologic model at the Hot Springs Range Project (HSRP) that parallels the ~50 million ounce Getchell Trend in Nevada. Geophysical and geochemical indicators, including pathfinder elements like arsenic and antimony, as well as mapped thrust faults, point to the presence of Carlin-style mineralization. A robust conductivity anomaly identified through controlled-source audio-magnetotellurics (CSAMT) further supports the concept of vertical feeder structures intersecting shallow dipping faults, a model known to host significant gold deposits in Nevada.

According to the company's September 2025 investor presentation, the Otis target remains the company's primary drill focus, with the Eden and Sitka targets identified as follow-up priorities. The Otis structure lies beneath post-mineral basalt and sediment cover, which may have concealed the system from past exploration efforts. Drill intercepts to date have returned gold mineralization in all holes, supporting structural continuity over a 150-meter strike length and remaining open along strike and at depth. In the near term, the company expects to complete the interpretation of its recently finished gravity survey at HSRP, which will refine target prioritization and lay the groundwork for a resumed drill program focused on the main structure believed to be the source of mineralization observed in the first phase.

Additional short-term activity includes claim enhancements at both HSRP and the Celts project, with the company working in strategic coordination with Kinross at HSRP and responding to recent staking activity by Barrick near Celts. Drilling is set to begin on targets that share structural and geophysical similarities with AngloGold Ashanti's Silicon deposit, once permitted. The fourth quarter of 2025 is expected to bring key drill results from Otis that could confirm a major gold system within this emerging district. Also during that period, the maiden drill program at Celts is scheduled to commence with two holes testing a structure beneath the steam cap, which the company believes may host a Silicon-style oxide gold system.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Eminent Gold Corporation (EMNT:TSXV; EMGDF:OTCQB)

Looking ahead into early 2026, Eminent anticipates receiving drill permits and launching a maiden program at Gilbert South, where surface sampling has returned values up to 30.7 g/t gold across a 2.5-kilometer strike. That program will test the feeder structures underlying what is believed to be a large high-grade epithermal vein system. Additional drilling at HSRP is expected to continue in parallel, as the company advances its broader thesis of a district-scale discovery potential in this previously underexplored region of Nevada.

Eminent holds 100% ownership of HSRP, which spans 419 federal lode claims covering over 3,500 hectares. The company is also advancing Celts and Gilbert South, both of which are situated within major gold-endowed corridors and offer distinct styles of discovery-driven value.

Ownership and Share Structure

According to company filings, 10.0% of Eminent Gold Corp. is held by management and insiders. Strategic entities hold 9.9%, all of which is attributed to Kinross Gold Corp. An additional 32.0% is held by technical personnel and close associates.

The rest is retail.

Eminent Gold has a market cap of approximately US$27 million. The company has 77.87 million shares outstanding and a fully diluted share count of 103.54 million.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Eminent Gold Corp

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.