Dolly Varden Silver Corp. (DV:TSX.V; DVS:NYSEA; DVQ:FSE) announced the latest results from directional drilling at the Wolf Vein, including a hole intersecting 1,422 grams per tonne silver (g/t Ag) over 21.7 meters.

The company said in a release that it encountered high-grade silver mineralization within a previously undrilled gap, with hole DV25-446 located 105 meters up-dip from the furthest down-plunge step-out, hole DV24-421, which was announced on January 7, 2025.

The intersection also includes gold and significant base metal grades, which are increasing at depth and nearing the projected central valley structure.

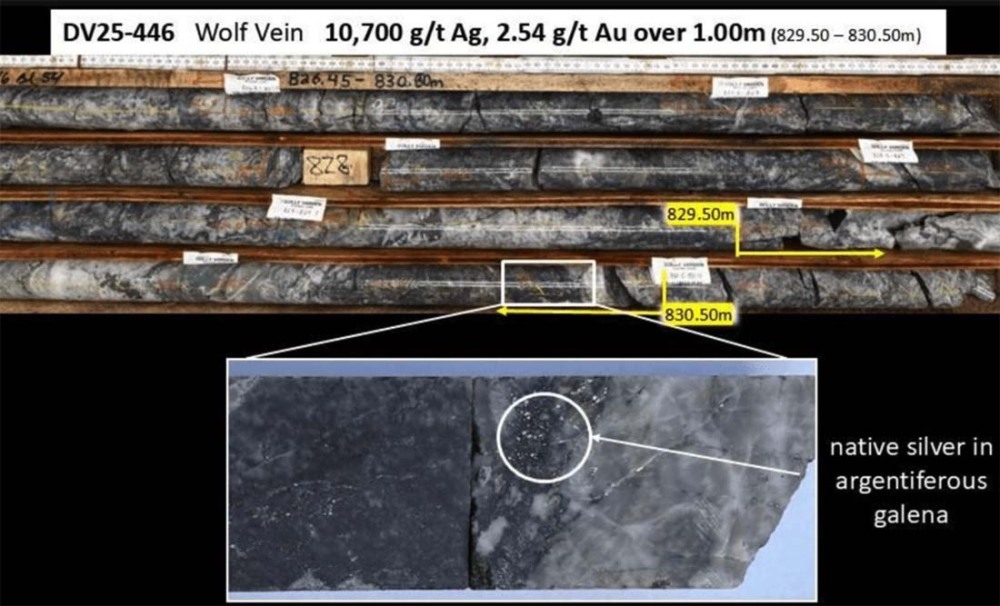

In drill hole DV25-446, results showed 1,422 g/t Ag, 0.51 g/t gold (Au), 3.05% lead (Pb), and 1.42% zinc (Zn) over 21.70 meters, with a particularly rich section of 10,700 g/t Ag, 2.54 g/t Au, 4.33% Pb, and 1.68% Zn over 1 meter. The intervals reported are core lengths, with estimated true widths varying from 55% to 65% of these lengths. Further modeling is required to determine the true widths accurately, the company said.

"These high-grade silver results over wide intervals suggest excellent continuity at the Wolf Vein," Chief Executive Officer Shawn Khunkhun said. "The mineralization in drill hole DV25-446 includes abundant native silver and is consistent with the robust style of mineralization with a significant increase in associated gold and base metal values. Additional drilling at Wolf is being prioritized for the remainder of the season."

Jeff Clark of The Gold Advisor reacted to the assays with one word: "BOOM!"

"That headline hole measures a whopping 30,857 gram-meters silver!" Clark continued. "This is one rich hole and an intercept you just don't see very often. And consider that Dolly Varden already has a 64 Moz (million ounces) silver Resource and is still getting hits like this. The Wolf Vein is clearly not done growing."

Part of the ongoing 55,000-meter drill program at the company's wholly owned Kitsault Valley Silver and Gold Project is focused on the Wolf Vein to expand and infill the high-grade silver mineralization. The deposit remains open at depth.

Five Diamond Drills Active

Currently, five diamond drills are active at the Kitsault Valley and Big Bulk Projects. The focus is on step-out and infill drilling at the Wolf Vein and Homestake Silver deposits, as well as exploration drilling of the copper-gold porphyry system at Big Bulk and other targets in the Kitsault Valley, Dolly Varden said in the release. More results will be announced as they become available and are integrated into the company's models.

The company is utilizing directional drilling technology to accurately target areas for step-out and infill work at both Wolf and Homestake Silver. Drill hole DV25-446 is a deflection hole (daughter hole) branching from the initial "mother" hole drilled from the north at the surface, with four additional holes directed from depths near the base of the sedimentary cap. The vein intercept in DV25-446 is approximately 105 meters up plunge (in-fill) from the 2024 step-out DV24-421.

Jeff Clark of The Gold Advisor reacted to the assays with one word: "BOOM!"

Dolly Varden noted that the Wolf Vein is situated within Jurassic-age volcanic rocks of the Hazelton Formation and is understood to be a structurally controlled, multi-phase epithermal vein and vein breccia system. This system is located along a southwest-plunging zone characterized by broader, higher-grade silver mineralization.

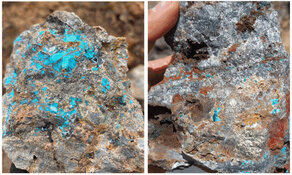

The vein hosts native silver, pyrargyrite, argentite, and argentiferous galena within multiple phases of silica and iron carbonate veins and breccias.

The mineralization extends beneath the sedimentary rock cap and the initial Wolf deposit that reaches the surface, with a plunge extent of over 950 meters at a -45-degree angle to the southwest, the company said.

'A Core Silver Holding for the Bull Market'

Clark of The Gold Advisor noted that the drill hole is located 105 meters from the previous one in the area, reinforcing the idea that the Wolf Vein has significant expansion potential. It also contains gold and strong base metal grades, which increase with depth, and the deposit remains open.

The company is currently engaged in a 55,000-meter drill program, partly aimed at expanding and infilling the high-grade silver mineralization at Wolf. The team is utilizing "directional drilling technology" to accurately target areas for step-out and infill work at both Wolf and Homestake Silver. Five diamond drill rigs are in operation. Expect more results soon and throughout the fall and winter.

Clark said the share price had risen by 5% as he wrote on September 2, which is "not surprising on this result."

"We've said it before, but it's worth repeating, especially if you're new: We consider this a core silver holding for the bull market," Clark continued. "Haywood Capital Markets just released an updated report today, too, and their 12-month price target is CA$9.60. I hold an overweight position, one I expect we'll hold throughout the bull market. Buy on dips."

The Catalyst: A Broader Precious Metals Rally?

Despite a strengthening U.S. dollar and rising Treasury yields, silver is trading at levels not seen since 2011, Ernest Hoffman wrote for Kitco News on September 2. Industry experts suggest this week's breakout could signal the start of the next phase in the broader precious metals rally.

Marc Chandler, managing director at Bannockburn Global Forex, observed that North American market participants returned to a stronger U.S. dollar after the long holiday weekend, with the greenback rising by 0.7% or more against most G10 currencies. He attributed the pressure to the bond market, noting that benchmark 10-year yields have increased by 3-5 basis points in Europe, and the 10-year U.S. yield has risen by about 5.5 basis points to just over 4.28%.

Rhona O'Connell, Head of Market Analysis for EMEA and Asia at StoneX, explained that this week's price action in precious metals was driven by silver, which has been proposed for inclusion on the list of Critical Materials in the United States, fueling its surge past US$40, Hoffman reported.

Gold followed suit in Asia, with momentum traders joining in. O'Connell noted that the U.S. dollar remains under pressure, and concerns over the White House's stance towards the Fed are intensifying. While StoneX's outlook for both metals remains bullish, O'Connell warned that silver might experience a short-term pullback after its strong performance.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Dolly Varden Silver Corp. (DV:TSX.V; DVS:NYSEA;DVQ:FSE)

The white metal is currently shining as a standout commodity, experiencing a resurgence in investor interest and strong fundamentals that have driven its prices to the highest levels in 14 years, according to a Mining.com report from July 31. Some analysts believe this upward trend is just beginning, making silver an appealing investment option, as noted in the report.

On the supply side, HSBC anticipates that silver mine production will continue to grow at a gradual pace, with their supply-demand model predicting a silver shortfall of 206 million ounces (Moz) in 2025 and 126 Moz in 2026, compared to a 167 Moz deficit in 2024, according to the report. HSBC also noted that a weaker dollar this year is favorable for silver, while ongoing discussions about Federal Reserve rate cuts and central bank strategies could impact future prices.

Ownership and Share Structure

According to Dolly Varden's Corporate Presentation, institutional investors own 50% of the company. These include Fidelity Management & Research Co., Sprott Asset Management LP, U.S. Global Investors Inc. and Delbrook Capital Advisors Inc.

Along with Hecla with 13.7%, other strategic investors include Fury Gold Mines Ltd. (FURY:TSX) with 13.5% and Eric Sprott with 9.5%. The rest is in retail.

Dolly Varden has 87.1 million outstanding shares and 90.5 million fully diluted shares. Its market cap is CA$462.15 million. Its 52-week range, according to Refinitiv, is CA$3.21–CA$5.84 per share.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dolly Varden Silver Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dolly Varden Silver Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.