Artificial intelligence (AI) stocks are skyrocketing once again. Nvidia Corp. (NVDA:NASDAQ) has climbed 110% since April . . . GE Vernova Inc. (GEV:NYSE) has rocketed 147% . . . and Palantir Technologies Inc. (PLTR:NASDAQ) has jumped 160%.

As expected, these impressive gains have many self-proclaimed "experts" cautioning, "AI is a bubble." Some are even drawing parallels between today's AI surge and the internet collapse of 2000.

They couldn't be further from the truth.

Allow me to explain why the AI market rally has substantial momentum remaining, and how we'll capitalize on its next evolution.

We're in the Early Stages of the AI Era

Think back to 1995, when internet pioneer Netscape debuted on the stock market. Its shares exploded by +500% in just months, igniting the internet revolution.

But here's what most people overlook. The genuine investment frenzy didn't emerge until several years later. Amazon.com Inc. (AMZN:NASDAQ) didn't go public until 1997. Alphabet Inc. Class A (GOOGL:NASDAQ) wasn't established until 1998. And Pets.com didn't become infamous until 1999.

Most significantly, the Nasdaq multiplied 8X from 1995 to 2000.

Could the Nasdaq surge over 700% again from 2025 to 2030?

That's ambitious, and would necessitate a bubble forming. But that concern lies years ahead. Your primary focus now should be acquiring the finest individual AI stocks—ones that will challenge 1995 internet equities for performance.

We're Building the Digital Foundation

Similar to the mid-'90s, we remain in the infrastructure development phase.

Back then, billions poured into establishing fiber-optic networks, constructing data centers, and connecting America with broadband. That infrastructure investment created the conditions for Amazon, Google, and other internet giants to flourish.

Today, the identical script is unfolding with AI — but on a grander scale.

The wealthiest corporations in history are directing unprecedented billions into infrastructure powering AI.

Amazon will allocate $100 billion to data centers this year. Microsoft Corp. (MSFT:NASDAQ) plans to invest nearly $80 billion. Google and Meta Platforms Inc. (META:NASDAQ) aren't far behind.

Tech giants are engaged in a competition to determine who can develop a "digital god" first.

Government Support Accelerates Growth

Both current and previous administrations have clearly stated that the U.S. must "win the AI race."

What does this actually mean? It boils down to one element: massive government funding directed at the AI sector. They term it "sovereign AI."

The CHIPS Act alone will direct approximately $280 billion toward semiconductors and supercomputing. Here in Abu Dhabi, the government is similarly investing tens of billions into AI data centers. Saudi Arabia follows the same approach.

This represents merely the beginning. Every nation will aspire to become an "AI superpower."

Simultaneously, President Trump's AI Action Plan is eliminating bureaucracy, expediting data center approvals, and alerting states that non-compliance might result in lost federal funding.

That's the advantage of investing in AI today. Both governments and corporations are channeling unprecedented resources into this sector. Capitalize on this opportunity.

AI Infrastructure Investment Could Multiply 5X

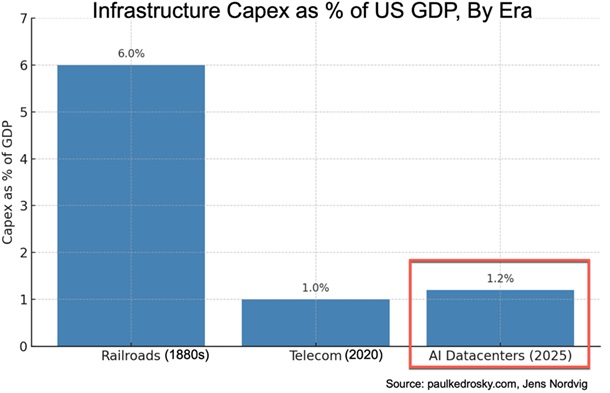

During the peak of railway expansion in the 1800s, the U.S. government invested the equivalent of 6% of GDP in establishing tracks.

That development sparked the American Gilded Age and the fortunes that followed.

Currently, AI spending represents just 1.2% of GDP — but that only encompasses data center expenditures.

This figure excludes networking equipment, cooling systems, storage infrastructure . . . and upgrading electrical grids to accommodate AI's enormous energy requirements.

By our estimates, the U.S. could eventually spend up to $1.8 trillion annually on AI infrastructure, approximately 6.3% of GDP.

When to Exit AI Investments

I refer to it as the "IPO indicator."

I'm impressed by how frequently the leading company in a hot sector has gone public and signaled "the peak."

- The AOL Time Warner merger in 2000 — still the largest ever — culminated in the dot-com collapse.

- The Blackstone Inc. (BX:NYSE) IPO in 2007 coincided with the financial markets' peak and preceded the Great Recession.

- Glencore's (GLNCY:OTCMKTS) 2011 listing marked the high point in the commodity super-cycle.

In essence, I'm watching for a prominent AI company like OpenAI or Anthropic to go public before declaring the AI market rally complete.

But I see no signs of that happening in the near future.

Naturally, you must select the appropriate AI stocks.

How to Benefit from This Phase of the AI Surge

Returning to our railway analogy from earlier, history demonstrates the greatest gains went to companies benefiting from the railway boom — not those constructing the tracks.

Why?

Because the track builders invested billions in railway infrastructure with minimal profit margins . . . while businesses utilizing the rails reduced costs, expanded faster, and enhanced their profits.

The modern equivalent is tech giants constructing digital railways upon which someone else's trains will operate.

We want to own companies creating innovative new trains to leverage the AI era, not those building the railways.

To make sure you stay on the frontlines of the next stage of the AI boom, sign up for The Jolt — my twice-weekly, free investing letter where I break down today's biggest disruptions and investing opportunities. Go here to join today.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp.

- Stephen McBride: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.