Many years ago, when I was struggling mightily to understand the very complicated and intimidating world of finance, a wise man told me to never try to explain the movement of gold prices. He went on to explain how gold is the one asset class that marches to its own drummer and that only long after gold makes its move up or down will you know why it moved. That is because gold is a harbinger of future geopolitical and/or economic events that only reveal themselves with the passage of time.

"Gold is a wonderful barometer of the condition of man in that it forecasts change as opposed to conditions."

As I listened to the CNBC anchors all trying in vain to explain the move in gold today, I had to laugh out loud when they used "U.S. dollar weakness" and "central bank buying" as reasons for gold's $42 pop. After all, with the U.S. dollar index down a paltry 0.07%, that could never be a reason for the move to challenge record highs, now, could it?

And central banks have been accumulating gold for the past decade, and only since the Americans confiscated the Russians' $350 billion in dollar reserves as punishment for their invasion of Ukraine have central bankers been jettisoning their dollar reserves and moving into gold. They have been stepping up their purchases. They were so obsessed with the Nvidia Corp. (NVDA:NASDAQ) earnings call that they were still chirping about "AI" this morning while it was getting clubbed for a 3% drop, taking the NASDAQ down 288 points or 1.22%.

For the week and the month, the NYSE proxy for gold prices, the SPDR Gold Shares (ARCA) ETF (GLD:US), broke out to a record high and while December futures are still some $70 per ounce shy of their April 22 high at $3,585.80 that is only because an overnight electronic access session allowed a rogue spike to take the futures up but by the time the NYSE opened on April 22, gold was already back under $3,500.

The only market that really counts for North American investors is the NYSE, and the only ETF that anyone follows that tracks physical gold is the GLD:US. Ergo, to register a new all-time high in August and on the final trading session of what is typically a dull month for gold was absolutely spectacular. Now, conspiracy theorists would have us believe that there is no actual gold in the GLD:US and that it has already been rehypothecated fifty times over, and if you own it, you will wake up one morning and find it trading at $00.00. That being said, for now at least, the GLD:US has a bid-ask of $318.00-318.05, and at last glance, it traded 15,635,713 shares today, so it might be logical to assume that somebody believes that the gold is there. And that's all that matters.

For nigh on 30 years, I have used the last two weeks of the summer to add to my junior miners and that has as its rationale two powerful reason: 1. Prices tend to do better after Labor Day and 2. For the first 10 years of my career, I would lose 50% of my capital trying to bottom-fish the miners in the summer.

In case you had not yet noticed, the miners are finally and at long last on fire. Portfolio values are screaming higher, led by the senior and intermediates, but with the junior developers finally kicking into gear, the leverage plays that I have owned since 2020 are now major contributors to portfolio values. While it can be deemed to be "about time" and "not a second too soon" for many of we long-suffering advocates of the "small fry" juniors, I must confess that this type of tape action has the "crazies" coming out of the woodwork. Many are like dehydrated souls crawling out of the desert, having been handed a wineskin of fresh water. I guess I cannot blame them but if there is one thing for which I always look out, it is complacency.

I recall the summer of 1987 when my junior mining portfolio was clipping along like we have just experienced here in 2025, having advanced from $300,000 in May to $500,000 by the end of August, and I was "livin' the life" giving seminars on how to profit from the junior miners and landing more clients every day. I was so self-enamoured that I forgot to renew my hedge positions in the OEX put options in September as I was too busy trading the junior miners, which were (like today) on fire. I also neglected to remember that I was carrying $100,000 in margin debt in order to "enhance returns through leverage," a seemingly great idea at the time.

By the end of October of that fateful year, the pit traders were sending ghoulish jokes up to the trading desk like "How do you get your broker out of a tree? Answer: Cut the rope!" or " What do you call fifty stockbrokers at the bottom of Lake Ontario? Answer: A good start!"

Since the juniors were all trading on the old Vancouver Stock Exchange, when the NYSE crashed 23.7% in one day, the old VSE was immune at first and barely budged. However, by the time the week was out and the margin clerks had finished blowing out anyone that had a penny of debt in their accounts, my lovely portfolio was worth — and this is not an exaggeration — $16,000 Canadian loonies.

As I was sitting in front of my old "Quotron" quote screen (I saw one in the museum the other day) looking at all of the collateral damage brought about by "The CRASH," I remember Sir John Templeton being interviewed by Louis Rukeyser on the PBS channel's famous "Wall Street Week" telling the world that " the Great Bull Market of 1982-1987 is a thing of the past but worry not, there will be more bull markets although they may be years away." As a young man with a newborn at home, it was as if I were "gut-shot."

As the years went by, I swore that I would never allow myself to be fully exposed to either the long or short side of these insane markets. In that crash of '87, the insanity came in the form of "decoupling". For the prior nine years in the business, gold mining shares had always moved in tandem with the price of gold. During the week of October 19 to October 24, gold moved from $425/ounce to $505/ounce and yet the TSE Gold and Silver Index dropped 50%. For the first time in history (which includes the Great Depression of 1929-1932) gold stocks ignored rising gold prices and ,crashed. Gold stocks "decoupled" from gold bullion.

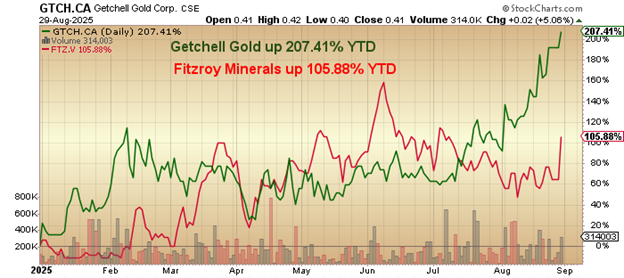

So, here in the late summer of 2025, I move into the month of September with a shockingly-impressive P&L for my primary trading account, brought about by some fortuitous trades earlier in the year that bet against "American Exceptionalism" (not that I have ever doubted it) and in due course to my two primary juniors Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) (up 207.41% YTD) and Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) (up 105.88%) that comprise an inordinate allocation within my net worth statement.

The portfolio is eerily similar to the one I owned 38 years ago. However, the only difference between then and now is the cynicism of the person who owned them. Had I remained hedged in 1987, after writing the miners down to zero, I would have had a portfolio worth $1.3 million. I wasn't, and I didn't, and that is of which I speak of this weekend.

As you crack open that fine vintage this weekend and are bent upon patting yourself on the back over a glass of celebratory libation, remember my story. Markets are closed until Tuesday morning at 9:30 a.m., but when they open, I do not care what your "financial advisor" is telling you; go out and buy some portfolio insurance on the assumption that even if you lose it all, it will allow you to sleep at night knowing that your miners are on the right path.

The best vehicles for hedging are the volatility ETF's which include the UVIX:US (2 times long VIX futures) and/or call option contracts on the VIX:US , which peaked over 60 back last April when the White House decided to "nuke" DOGE and pause the tariffs sparking the current insane rally in stocks.

Also on my "hit list" is the mighty Tesla Inc. (TSLA:NASDAQ), which is a complete disaster as an EV manufacturer and an as yet unproven producer of economically viable robots and an equally-unproven provider of "robo-taxis" promoted and marketed as "self-driving" in the same vein as their EV's were several hundreds of billions of market cap ago. As the California AG has written, "You cannot market your car as "self-driving" but then defend the countless deaths and accidents as being "driver-assisted." Total hypocrisy and a call to action.

Tesla is a "Strong Sell."

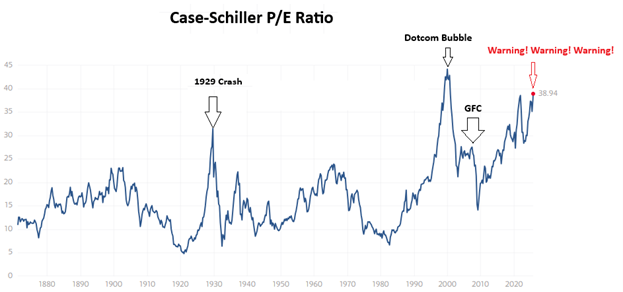

Ladies and gentlemen, the last time we had as much as a 20% correction that was not rescued by the Wall Street-governed central bank or U.S. treasury was in 1987.

Ladies and gentlemen, the last time we had as much as a 20% correction that was not rescued by the Wall Street-governed central bank or U.S. treasury was in 1987.

We had severe drawdowns in 2001 and in 2008, and again in 2020, but all of these were met with massive inflationary policy moves by both the U.S. Fed and the U.S Treasury, with directives issued to the Bank of England, Bank of Japan, as well as their Asian counterparts.

If you crush stocks, you crush the illusion that the global economy is in good shape, and if you suck the confidence out of the central bank boardroom, then markets are doomed.

While that is my fear, they have been successful in kicking the can down the road to avoid the eventual "Day of Reckoning," so I am cynical enough to believe that with such gargantuan stakes "on the line" they will do anything and everything to maintain the illusion of "non-inflationary growth" but we all know that is a total pipe dream.

Nonetheless, I suggest that you all go out and buy some portfolio protection on Tuesday morning.

If I am wrong, then you lose a fraction on your hedges; if I am right, I am suddenly at once like the "Four Stages of Tequila. . . "

Fitzroy's COO

I try not to write about the chaps that run companies that I own due to that old horse chestnut of "talking your book" but when it comes to truly outstanding executives, I always like to look to the back of the room and away from the Chairman or the CEO/President to see who really is responsible for success (in the event there IS any). Many times the mantle of reward falls into the lap of a geologist, engineer, geophysicist, or geochemist who has labored for decades to hone his/her skills, and it is with that in mind that I point to Fitzroy Minerals' COO, Gilberto Schubert.

From the company's website:

"Gilberto Schubert is a professional geologist with over 30 years of experience in industry including early to late-stage exploration, economic and financial evaluation of projects, planning, development, and mining operations in Brazil, Peru and Chile. From 1992 to 2013 he worked for Vale, culminating in eight years as Country Manager, Chile. Gilberto holds a BSc and an MSc in Geology from the Universidade Federal do Rio de Janeiro; an MBA from Fundação Dom Cabral, Belo Horizonte; a Diploma in Mineral Economics from Universidad de Chile, Santiago; and an MSc in Mining Economics from Curtin University of Technology, Perth."

Now, I have a double major in finance and marketing from one very fine private Jesuit institution in St. Louis called Saint Louis University. I took me many hours of agony studying courses like Accounting Basics and Econ-101 until I decided that marketing was basically a study in "guilt-free lying" and found my passion in finance. Gilberto has five degrees. All in the study and knowledge of rocks. He has 21 years of field experience as "country manager for Vale" covering every imaginable facet of the mining business.

When I met this gentleman in 2024, during a luncheon, he grabbed my pencil and my linen napkin and proceeded to draw a geological schematic of his model at one of Fitzroy's many prospects. It was at this exact moment that I recognized the "jewel" in their operation. Mind you, they have extremely competent players in capital markets and corporate strategy in Chairman Campbell Smyth and CEO/President Merlin Marr-Johnson, but at the end of the day, it is always the person who delivers the asset that deserves the accolades.

As I have told everyone, this is the best team I have worked with in 47 years in the industry. Truly and totally professional and decent human beings, Mr. Schubert and Co. have delivered both Caballos and Beun Retiro and are lining up a few more for consideration.

The stock had a great day today and wound up closing with a 25% gain on 820,000 shares volume on the last day of the worst month of the year for the juniors.

Hail to the Chief!

Gold & Silver Moves

The move in gold today was a statement. It is a signal to the markets that the "gold trade" is far from over and one that may just replace crypto and "AI" as the "GO TO" trade for the balance of 2025.

Silver also chimed in with a statement of its own, closing above $40 basis September and going out at $40.26 for an impressive 2.73% advance. With the HUI up 3.33%, silver up 2.73%, and gold up 1.20%, the shares are outperforming both metals, and silver is outperforming gold, and in my world, that is "Paradise Revisited."

Life is good; birds are chirping; kids are happy. Now protect your insufferable contentment.

September is coming. Hedge your holdings.

| Want to be the first to know about interesting Gold, Silver and Copper investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- [COMPANY] is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, [COMPANY] has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Getchell Gold Corp. and Fitzroy Minerals Inc. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.