Some investors are optimistic that a political shift in Bolivia could lead to regulatory changes, allowing access to the largely untapped lithium resources in the country, Reuters reported in a piece published August 15 by Mining.com.

Voters have propelled two pro-business candidates into Bolivia's presidential election runoff, marking the end of nearly two decades of predominantly socialist governance and potentially reshaping the nation's economic framework and its relationship with Washington, Sergio Mendoza reported for Bloomberg on August 17. With 95% of the votes counted, opposition senator Rodrigo Paz led with 32%, followed by Jorge "Tuto" Quiroga, who was president from 2001 to 2002, with 27%. Both candidates advocate for austerity measures and the renegotiation of the country's foreign debt.

Quiroga aims to attract foreign investment in oil, gas exploration, and lithium production and other mining, as Bolivia holds the world's largest lithium deposits, Mendoza reported.

The election occurred against a backdrop of fuel and food shortages and the highest inflation in over 30 years, which led to months of unrest and a decline in support for the ruling socialist party, MAS, the report noted. Bolivia's dollar bonds have surged this year, fueled by optimism that a new administration will introduce economic reforms.

Bolivia's vast salt flats hold the world's largest lithium resources, but the country has struggled to increase production or develop commercially viable reserves, Reuters noted in the August 15 piece. Russian and Chinese companies have made some progress with development proposals, but these deals have not been approved by the legislature, where the ruling party is divided and the current President, Luis Arce (who is not seeking re-election), lacks a congressional majority.

Support for left-wing and MAS-affiliated candidates is trailing the right-wing opposition, Reuters reported. The leading leftist contender, with around 6% support, is Andronico Rodriguez, 36, who was once seen as Morales' political heir but has distanced himself from MAS.

Candidate Plans to Distribute Stakes For Natural Resources

Quiroga has announced plans to distribute ownership stakes in key natural resources, such as lithium, if he wins, according to a report by Lucinda Elliott and Monica Machicao for Reuters on August 20.

The country also has reserves of other important minerals, like silver, gold, zinc, lead, tin, iron, and potash.

"Mining in Bolivia has been one of the key economic pillars of the country, intertwined with the nation's history, social fabric, and national identity," United Kingdom company Identec Solutions noted on its website. "From the beginning of the colonial period, when silver mines in Potosí fueled the Spanish Empire, to modern times, with Bolivia recognized for its wealth in minerals like tin, zinc, silver, and lithium, mining has played a major development role."

But now, Identec said the industry is "a very complex combination of large-scale operations, cooperative mining, state-owned enterprises, and informal small-scale activities that face the current challenges and opportunities of our times."

Quiroga said his initiative is part of a broader agenda for economic reform, and he has also indicated a desire to strengthen relations with the United States. At 65, Quiroga emerged as the leading conservative candidate after securing roughly 28% of the vote on August 17.

"We're going to change everything, hydrocarbons, mining, lithium, tax," Quiroga told Reuters in an exclusive interview from his home in La Paz, marking his first discussion with foreign media since advancing to the second round.

Quiroga stated that his conservative Alianza Libre, or Freedom Alliance, coalition is preparing constitutional reforms and is already forming congressional alliances to expedite legislative processes. One of his proposals includes granting Bolivians individual ownership rights over natural resources — such as lithium — through a mutual fund structure.

"The lithium will belong to each and every citizen," he said. "Not to the state, not to my government, but to individuals as shareholders."

Bolivia possesses vast reserves of lithium and other resources, but production has lagged under nearly two decades of state control, according to the report by Elliott and Machicao. Quiroga noted that the recent legislative results signify a turning point. Preliminary counts suggest that his pro-market coalition and Paz's Christian Democrat party will control 82 of the 130 seats in the Lower House — sufficient to pass laws requiring a two-thirds majority.

For some miners operating in Bolivia, the possible political changes can't come fast enough. According to a 2025 report, the country consistently ranks among the least attractive jurisdictions for mining investment due to significant policy and governance issues. In the most recent survey by the Fraser Institute, a respected global benchmark, Bolivia was ranked as one of the bottom 10 jurisdictions in the world for mining investment.

Some companies that could benefit from the changes include Andean Precious Metals, New Pacific Metals Corp., and Eloro Resources Ltd.

Andean Precious Metals Corp.

Andean Precious Metals Corp. (APM:TSX; ANPMF:OTCQX) is an expanding precious metals producer aiming to grow its presence in top-tier regions across the Americas, the company said.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Andean Precious Metals Corp. (APM:TSX;ANPMF:OTCQX)

It owns and operates the San Bartolome processing facility in Potosí, Bolivia, and the Golden Queen mine in Kern County, California. With strong financial backing, the company said it is well-positioned to pursue future growth opportunities and is dedicated to becoming a multi-asset, mid-tier precious metals producer.

On August 13, 2025, Atrium Research analysts Ben Pirie and Nicholas Cortellucci maintained a Buy rating on the stock and raised the target price to CA$6.00 from CA$4.50, indicating a 36% upside from the price at the time of writing of CA$4.42.

The analysts highlighted second-quarter financial results that exceeded expectations, driven by higher gold and silver prices and strong cash flow performance. Andean Precious Metals Inc. reported second-quarter 2025 revenue of US$73.7 million, a 6% increase year-over-year, significantly surpassing Atrium's estimate of US$64.7 million. The revenue outperformance was primarily due to higher gold and silver prices compared to the analysts' assumptions.

The San Bartolome facility in Bolivia posted US$34.8 million in revenue and US$13.2 million in operating income, compared to Atrium's estimates of US$32.7 million and US$10.6 million respectively. The facility processed 322 thousand tonnes of ore, up 18% year-over-year, producing 12.1 thousand ounces of gold equivalent, down 5% year-over-year.

Cash generation over metal was US$13.89 per ounce, while gross margin recovery per silver ounces sold was 46%. The company revised its guidance for San Bartolome's cash generation over metal to US$8.00-US$13.00 per silver equivalent ounce sold from the original US$6.50-US$8.40 range, and gross margin recovery to 35%-45% from 29%-36%.

The analysts said they increased their assumed gold price from US$2,700 per ounce to US$3,000 per ounce to better reflect the current market environment. Their model now projects US$83.5 million in operating cash flow for 2025, to which they apply a 7.0x multiple (increased from 6.5x), reflecting improving valuations across the precious metals sector.

On its website, Andean noted it has developed a unique industrial processing model at its Bolivian operation. In line with its strategy to enhance cash flow and profitability, the company has shifted away from traditional mining and processing methods.

In 2023, as its high-cost, low-grade pallacos neared depletion, the Company expedited its plan to focus exclusively on processing material from its more cost-effective fines deposit facility (FDF) and from third-party mining cooperatives and private Bolivian mining firms.

Although the transition to an industrial processing model has been gradual, the pace quickened in 2023 when the Company secured contracts for about 1 million tonnes of mill feed.

According to the company's investor presentation, insiders and management own about 54%, institutions and retail about 30%, mining financier Eric Sprott about 15%, and about 1% by ETFs.

Its market cap is CA$784.19 million with 149.33 shares outstanding. It trades in a 52-week range of CA$0.93 and CA$5.39.

Eloro Resources Ltd.

Eloro Resources Ltd. (ELO:TSX.V; ELRRF:OTCBB) on Thursday announced that due to strong investor interest, the company has increased the gross proceeds of its previously announced "bought deal" private placement from CA$10,000,400 to CA$11,000,900.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Eloro Resources Ltd. (ELO:TSX.V; ELRRF:OTCBB)

The company said it plans to use the net proceeds from the Offering for ongoing exploration and development of the Iska Iska project in southern Bolivia, as well as for general corporate purposes and working capital.

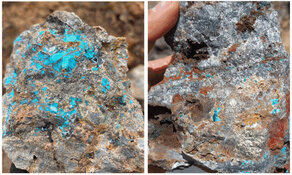

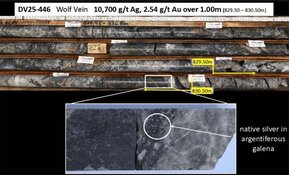

Eloro has said it found its highest-grade silver intersection to date at Iska Iska, confirming the presence of high-grade silver mineralization. The company said it continues to explore the potential of Iska Iska as a significant Bolivian polymetallic deposit.

Eloro's investor presentation outlines several key factors that could boost the economic potential of the Iska Iska project. The ongoing definition drilling program aims to elevate the current inferred resource to the indicated category, marking a crucial step toward completing a PEA.

By increasing the density of drilling, the company intends to refine grade estimates and delineate the extent of high-grade silver and tin structures. The Santa Barbara potential starter pit area remains a focal point, with recent drilling indicating that higher-grade zones extend beyond previously defined resource boundaries. Infill drilling is expected to continue converting areas classified as waste or low grade into economically viable mineralized zones.

Additionally, advancements in metallurgy are crucial for unlocking further value. The introduction of ore sorting and dense media separation (DMS) has been identified as a potential game-changer, enabling more efficient processing and cost reduction.

Preliminary metallurgical testing has shown that these methods could enhance recovery rates while reducing operational expenses, positively impacting the project's overall economics.

Eloro is also positioning Iska Iska for long-term growth. The company has identified a significant tin zone within the deposit, suggesting that Iska Iska could host two distinct world-class mineral systems. The presence of a porphyry tin system adjacent to the silver-zinc-lead mineralization could offer additional upside, especially as global tin demand continues to rise.

"With this discovery of a presumed shallow level apophysis of a tin porphyry at depth, Eloro is in a unique position of having two discernable different deposit styles juxtaposed against one another; a very large silver-zinc-lead dominant system next to a high-grade tin system," Analyst Jay Taylor noted in his August 8 Hotline newsletter. "While these two systems are likely genetically related, this means that the company may potentially have two giant deposits on the same property."

Looking ahead, Eloro said it plans to conduct further step-out drilling to test newly identified high-chargeability targets. These exploration efforts could lead to further resource expansion and refinement of the deposit's economic potential. With a continued focus on definition drilling, metallurgical testing, and resource modeling, the company is working toward establishing Iska Iska as a major player in Bolivia's mining sector.

The company is featured in a recent episode of an "off-the-beaten-path" travel documentary series called "EarthLabs Expeditions."

"This time, we're on a journey deep into Bolivia — a country with a legendary mining past and positive political change on the horizon," a release describing the episode said. "Eloro Resources is poised to be the first mover when the country's gates open again to international business."

Viewers are urged to explore the country's past as the company continues its 2025 drill program.

"Iska Iska isn't just a project; it's the potential heart of an emerging, world-class mining district," the description said. "Come along with us to understand how this massive resource of silver and tin was found and what it could mean for Eloro and Bolivia's future."

About 25% of the company is owned by insiders and management and 25% by institutions, according to the investor deck. About 50% is retail.

According to Refinitiv, top shareholders include Crescat Capital with 16.65%, Thomas Larsen with 7.56%, Francis Sauve with 2.03%, Jorge Estapa with 1.85%, and Miles Nagamatsu with 1.71%.

Its market cap is CA$107.95 million with 94.69 million shares outstanding. It trades in a 52-week range of CA$0.77 and CA$1.67.

| Want to be the first to know about interesting Critical Metals, Gold, Silver, Cobalt / Lithium / Manganese and Battery Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.