Today marked the day when Federal Reserve Board Chairman Jerome Powell finally buckled under the weight of in-house dissenters and a hostile U.S. President. Old Jay threw up the white flag and turned turtle as he handed the Wall Street traders an end-of-summer treat in the form of a "wink, wink, nudge, nudge, say-no-more, say-no-more" indication that monetary policy is going to undergo a "dovish" metamorphosis come September.

With stocks, gold, silver, Bitcoin and most other asset classes within a hair's breadth of all-time highs and the cost of living squeezing the breath out of the average family, Powell succumbed to the whining and bitching of the elitist 1% investor class and made sure that assets owned almost exclusively by the mega-rich stayed well out of the reach of the not-so-rich whose dreams of upward mobility are like mirages in the desert. He basically told his Wall Street masters that they could throw out any notion that "price stability" and/or "maximum full employment" are the Fed's true mandates. The Dow, S&P, and NASDAQ responded by launching themselves to a 1.92%, 1.53%, and 1.51% bid-fest with revelers and cheerleaders dominating the social media narrative and CNBC commentary. It once and for all capsulized the Fed's true mandate — asset prices.

Far more important than the explosion in asset prices on Friday, ask yourself one very important question. With the latest "core" consumer price index coming in at a slightly elevated 3.1% annualized and with producer prices followed right behind with a .9% reading against expectations of a 2% "core" reading, what is the Fed seeing?

In other words, PPI has told Chairman Powell that the impact of the tariffs looms ominously on the horizon and may have huge inflationary implications, and yet, he speaks of "weakness". You all recall the Powell presser of a month ago when, in response to a reporter's question about the U.S. economy threatening to fall into "stagflation", Powell dismissed it, saying that he could not see the "stag" nor could he identify the "flation" components. I would beg to differ as an 8.1% annualized increase in producer prices very much does reveal the "flation" component, or at least a risk thereof. So, I ask you, Chairman Powell, "What exactly is it that you see that warrants a rate cut?"

With the U.S. economy definitely slowing, it is possible that the ADP survey or some metric other than those provided by the Bureau of Labor Statistics has him spooked, forcing him to overlook the scary PPI number and focus on the labor market. That would make sense because if labor begins to experience shorter work weeks and declining average weekly wage growth, then real drops in hiring are going to lead to layoffs.

Since none of the banks are in any widely publicized scandals or balance sheet blow-ups, I contend that whatever Powell sees forcing him to execute a policy shift is not going to be positive for assets. A shrinking labor market is bearish for growth, and without growth, earnings go either "flat" or "lower," and with P/E multiples stretched and the Case-Schiller P/E two standard deviations from the norm and the Buffett Indicator in the same dystopian state, stocks are not priced for earnings contraction and most certainly unprepared for recession.

As such, I advised subscribers to "Fade This Rally!" and that is exactly what I did last week and intend to continue doing this week, especially if the Wall Street-programmed algobots take them higher. Dovish policy shifts come with storm clouds, not breaking daylight.

Getchell Gold

Also responding to the Fed's dovish signal were the metals, particularly the precious metals , with gold up 1.09% but silver up 2.56% to $39.05. Copper was a good deal more muted, gaining a mere .35% while risk barometer Bitcoin clawed its way back out of "correction" territory, rising 2.34% to $116,110. GLD:US closed out the week at $310.58, which is still a long way from the April record high of $317.63. Senior gold miner ETF (GDX:US) hit a record high of $60.68, while the Junior gold miner ETF (GDXJ:US) also hit a record high of $76.94.

The senior and junior gold miners are paving the way for a serious upside surge in the shares of the junior gold developers, with top-ranked and desperately undervalued Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) also registered a new 52-week high on Thursday at CA$.395 (and up 166.67% YTD).

Despite its robust performance YTD, it is still down over 50% from the 2022 high of CA$.83. GTCH/GGLDF received the "thumbs up" nod from junior gold miner specialist Jeff Clark ( www.goldadvisor.com ) whose report this past week essentially mirrors the same thing I have been discussing since 2020.

Their Fondaway Canyon project has a large, economically-viable gold deposit while being located in the premier mining jurisdiction in the U.S. — Nevada.

As I told subscribers this week, "I have refrained from writing about Getchell for most of this year due to frustration caused by the market's inability to recognize an undervalued asset after their PEA was released earlier this year." I am relieved to see that my opinion on Getchell is finally gaining validation.

However, what is important is that there are literally dozens of junior gold developers out there with worthy projects containing significant rerating potential that are only now just beginning to gain any traction. Unfortunately, the Fed's actions on Friday have once again solidified its lock on the new generations of technology junkies who feel like they have been thrown a well-deserved lifeline after a month of churning. What the junior gold developers and explorers need is for the intravenous drip of free money and consequence-free borrowing to be ended. Then and only then will investors abandon the narcotic of central bank stimulus and migrate to the safety of sound money and hard assets provided at terrific valuations by the miners, most of whom are still astonishingly "cheap".

There is also a group of explorer-developers that is poised to be the most sought-after group in the history of modern finance. Many investors and money managers interviewed on the premier financial news networks like CNBC and Bloomberg are all raging on breathlessly about the changes to the human condition soon to be brought about by "artificial intelligence," which includes robotics. Also seated in the mainstream narrative are stories about these mega-tech giants like Microsoft and Amazon, who are building gargantuan data centres next to gas fields in places like Oklahoma and northern Canada because of their dire need for energy — specifically, electric energy that can provide the billions and billions of megawatts needed to run these data farms effectively. In other words, the "AI" industry is beginning to vertically integrate itself, creating a chain of businesses all designed to service the data farms.

Natural gas, uranium for nuclear power, and lithium and lead for storage have all been the recipient of investor interest in the past five years. Patriot Battery Metals Inc. (PMET:CA) advanced from CA$.24 in November 2021 to a mania-driven peak of CA$17.69 by February of 2023 only to crash and burn, bottoming last April at CA$1.84.

PMET became the poster child for the lithium addicts.

A number of the uranium developers had sensational moves in late 2024 including NexGen Energy Ltd. (NXE:TSX; NXE:NYSE.MKT) which peaked at $12.51 in November 2024 and resides today at $9.80 despite robust uranium prices.

However, the group that is largely overlooked are those developer-explorers that are the next generation providers of the one metal that transmits all of the electricity that will be required to power those massive "AI" data farms. And that group is the copper developer-explorers.

It took a move in gold prices from $1,450 in 2015 to $3,534 in 2025 — a ten-year stretch — for the new generation of investors to recognize the latent value contained in the junior developers that had decent resources but were without the catalyst to drive the flow of funds their way. With copper, the Trump Tariff Tantrums have distorted market sentiment due to the 25% drop, which came after President Trump clawed back tariffs on raw copper at the end of July. Forgotten is the 127% advance in copper since 2021 and even more forgotten is the amount of copper estimated to be consumed once these data farms are in full construction and operation.

Companies like BHP and Antofagasta have gone record as stating that no new mines will pass feasibility with copper prices below US$15,000/metric tonne (US$6.80/lb.) and what that means is that junior developers with economically-robust projects now are going to become extremely sought-after along with the explorers making new discoveries even more sought after as demand and price rise in tandem. By the time prices have risen to levels creating comfort for the nascent new producers, the companies with established resources or new discoveries will have stolen the limelight.

The kiddies can run out and buy Nvidia Corp. (NVDA:NASDAQ) at nearly thirty times sales and 56 times earnings, and probably do well, but from where I sit, those companies positioned to meet the appetites of the mega-tech electricity consumers are where I prefer to be.

Now, if you find a company with both an economically viable resource and a new big discovery in a favorable jurisdiction, you get the best of all possible worlds. Such is GGMA favorite Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) whose Buen Retiro Copper Project is about to embark upon a PEA after completing a large drill program in 2025, which gives them standing in the "economically-viable" category, but their initial discovery of 200m of .81% Cu-Eq at Caballos (including 42m of 2.1% Cu-Eq) leaves them with infinite blue sky potential, which is precisely where I want to be. Both projects are in mining and copper-friendly Chile.

Like many of the copper names since the Trump Tariff reversal in late July, FTZ/FTZFF has corrected sharply as profit-taking has been both normal and healthy given its terrific performance but this author (and shareholder) has held firm his entire position on the basis that the one-two punch of Buen Retiro and Caballos will enable a half a billion dollar market cap in due course — a 10-bagger from current levels.

Silver

The famous British leader and historian Sir Winton Churchill when asked about Russia replied: "I cannot forecast to you the action of Russia. It is a riddle wrapped in a mystery inside an enigma."

The not-so-famous author of this publication would substitute the word "silver" for the word "Russia" in Sir Winnie's famous quote, and with good reason. Followers of my work over the years would acknowledge my respectable track record for gold and copper, and to a somewhat lesser degree for timing major corrections in the S&P 500, but for some mysterious, ungodly reason, I find silver to be incorrigible. I deem it to be at once a riddle, a mystery, and an enigma all rolled into one giant ball of confusion (with respect to The Temptations' 1970 hit single).

Yet, despite all of my protestation, I have loved silver in the same way I loved watching Secretariat in his 1973 demolition of the entire field as it screamed to victory by a mind-boggling 31 ½ lengths or Montreal Canadiens legendary superstar Maurice (Rocket) Richard scoring five goals in a 5-0 playoff win over my beloved Maple Leafs back in 1944. Silver is the one commodity that can bring tears to your eyes from either unbridled elation or debilitating misery, depending on one's timing and/or directional choice.

I have been a participant in two silver manias in my long and book-worthy career. The first was in the late 1970s as gold was dominating the narrative after stocks endured a sixteen-year performance coma (1966-1982) that saw silver move with the subtlety of a stealth bomber into the driver's seat of public attention. The youngsters all laugh at me telling these stories but when they start chortling on about Bitcoin and Eleutherum and stablecoins and how much they own and how far ahead they are, it is no different than the mania-chasers of my era that were lined up by the hundreds outside the doors of Scotia Mocatta (Toronto's only physical gold and silver dealers) with only one thing in mind: BUYING SILVER!!!!!!!

I wrote several months ago that I thought that silver was eventually going to break out above the US$35-36 resistance and rocket into the US$42-45 range as a minor "smoke break" before heading to all-time highs above US$50.

I still hold that view.

However, let it be known that as a tape-reader that will never bet against my "gut feel" when it comes to sensing "shenanigans", I have never felt such trepidation as I do right now in my assessment of the short-term silver outlook. I want nothing more as a shareholder of two silver explorers in Canada's Yukon and Peru's Southern Silver Belt that my jangled nerves are nothing more than occupational jitters in advance of the seminal event.

I recall with great fondness the ecstasy of the move in 2011 from $20 to $50 in literally weeks as the traders at JPM decided to throw in their interventionalist towels and stand aside. When the invisible hand of billion-dollar bank interference finally leaves the platform, we will get our just rewards.

Timing it, as Sir Winston would explain, can be an enigma. However, it is better to be "long and fearful" than "out and complacent" when silver decides to win the Belmont. . .

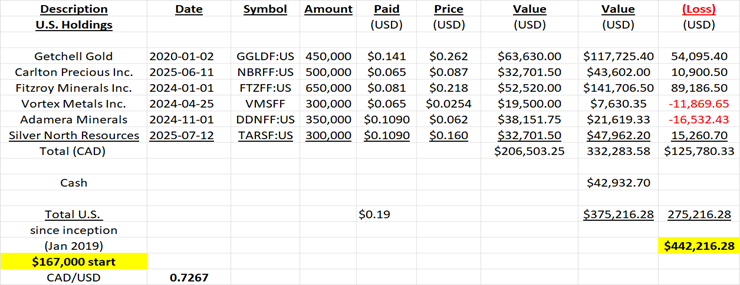

GGM Portfolio Account

The move in Getchell Gold moved the portfolio account to a net positive position with only two losers on the books (Adamera Minerals Corp. (ADZ:TSX.V) and Vortex Metals Inc. (VMSSF:OTCMKTS; VMS:TSX; DM8:FSE) both of which are struggling and which I will suggest now should be switched to Prisma Explorations Inc. (PMS:CSE) which will soon be getting its U.S. listing symbol on the US OTC QB (just like Getchell and Fitzroy).

I paid $.095 for VMS and $.15 for ADZ , and while I really thought that management could resurrect them, I fear that there has been so much wealth destruction in the past few years that it will take a miracle to revive them.

With PMS, it is the same group that run Fitzroy that are guiding the company. As I indicated with the private placement offering a few weeks ago at $.30, there are only 9.7m shares issued and outstanding post-financing and that means we have phenomenal leverage in terms of market cap.

In the GGMA 2025 Portfolio Account:

- SELL all VMS @ $.03

- SELL all ADZ @ $.075

- BUY (with proceeds of sale) PMS @ $.50 limit.

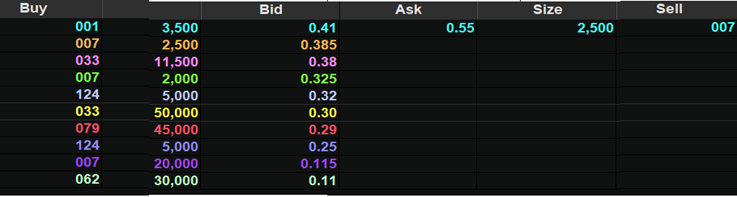

There is literally nothing for sale but if you post a bid, perhaps someone will hit it. Meanwhile, the private placement shares are still over four months away from release. A LOT can happen in four months.

GGMA 2025 Trading Account:

Not a lot went on last week other than the Getchell Gold move taking it to profitability (finally) and the add of 3,000 SQQQ:US to the previously established 6,000 share position. I really did not expect to see that kind of a move last Friday but nothing makes sense when the world is drunk with greed and FOMO. I remain a staunch bear on everything but gold, silver, and copper. If you did not buy any of the TLSZ:US or the SQQQ:US, do not be fearful. They should be BOUGHT.

| Want to be the first to know about interesting Battery Metals, Gold, Silver and Copper investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., Fitzroy Minerals Inc., Adamera Minerals Corp., and Vortex Metals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.