Hey there, Chris Reilly here. . .

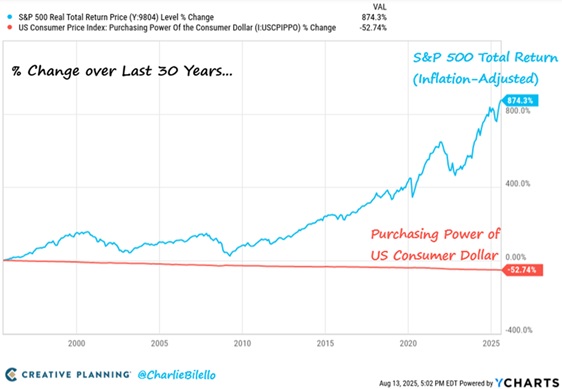

I want to share an eye-opening chart, courtesy of Charlie Bilello, who serves as Chief Market Strategist at Creative Planning.

This chart perfectly demonstrates why savings accounts alone won't build your fortune.

You must invest.

Looking at the chart, you'll notice the dollar's purchasing strength (represented by the orange line) has diminished by more than 50% during the previous three decades.

In contrast, the S&P 500 (shown by the blue line) has climbed 874% over that identical timeframe. That's an annual return of 8% . . . after accounting for inflation.

Certainly, savings are the cornerstone of financial security and are essential before investing. Without setting aside funds, you'll never have capital to purchase equities.

However, eventually, your money needs to generate returns for you.

As our Chief Analyst Stephen McBride frequently reminds us. . .

Simply exchanging hours for dollars probably won't make you wealthy.

Diligence and frugality are necessary components. But they're typically insufficient alone. Acquiring ownership in thriving enterprises — essentially what stock ownership represents — remains the primary wealth-building avenue accessible to everyone.

If you're hesitant about entering the stock market, now's the moment to take action.

Overcome inertia and begin investing. No more delays.

For beginners, I recommend initially looking at index funds that encompass numerous stocks. This approach gives you fractional ownership across hundreds of companies.

Subsequently, consider exploring disruptor stocks, which represent our specialty at RiskHedge.

So how can you identify premier disruptive companies?

According to Chris Wood, who co-edits Disruption Investor with Stephen, it comes down to a three-word formula.

Here's more from Chris Wood. . .

***

Have you realized that metal braces have become increasingly rare?

Not long ago, it seemed every other adolescent endured uncomfortable metal fixtures attached to their teeth.

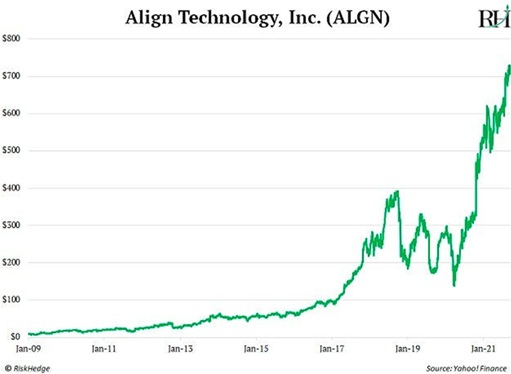

Then Align Technology Inc. (ALGN:NASDAQ) introduced an innovation. They developed an improved method of essentially creating braces from plastic. Called Invisalign, these aligners straighten teeth just like traditional braces.

However, your smile remains metal-free — because they're constructed from transparent plastic.

Invisalign can also correct alignment more rapidly than conventional braces (one to two years versus three years).

Between 2009 and 2021, Align's stock value jumped from $8.52 to $737.45, delivering maximum returns of 8,555%.

Remember planning vacations in the pre-internet era?

What a hassle. The only method to discover airline routes involved telephone calls. It was tremendously inconvenient.

Then, digital innovator Priceline now Booking Holdings Inc. (BKNG:NASDAQ) emerged. With minimal clicks, you could evaluate any flight or accommodation worldwide. Simply put, Priceline transformed travel into something considerably easier and more affordable — and its stock soared dramatically.

From 2001 through 2021, BKNG delivered peak gains reaching 29,000%:

Notice the three-word pattern in both examples?

BETTER. FASTER. CHEAPER.

That's the blueprint for identifying the next exceptional disruptive investment. Naturally, discovering these companies requires effort...

But history's greatest disruptors made significant advances in all three categories.

Alphabet Inc. Class A (GOOGL:NASDAQ) wasn't the pioneer in search engines . . . but it vastly outperformed alternatives.

Google's PageRank algorithm delivered substantially superior search results compared to any competitor, propelling its popularity.

Consequently, it became one of the era's top-performing investments.

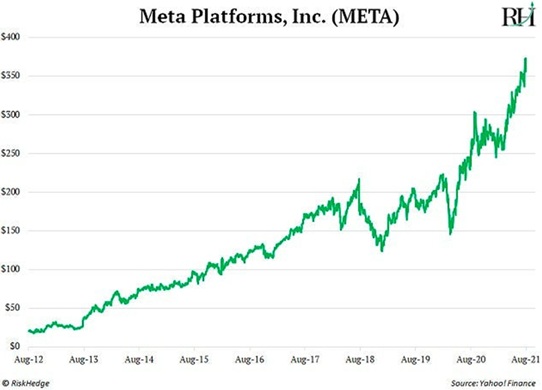

Meta Platforms Inc. (META:NASDAQ) wasn't the first social networking site. But it innovated much more rapidly than rivals, thanks to exceptional engineering talent.

Its stock climbed 1,688% from August 2012 to August 2021:

Consider also Illumina Inc. (ILMN:NASDAQ). . .

Scientists have understood for decades that DNA contains our health blueprints. The challenge was that reading DNA previously required enormous expense and time.

The Human Genome Project, completed in April 2003, consumed 13 years and $2.7 billion to sequence one individual's DNA. Then Illumina, the dominant manufacturer of DNA mapping equipment, created a breakthrough.

A single Illumina machine — the NovaSeq X — accomplishes that entire task within hours for $200.

Illumina anticipates reducing whole-genome sequencing costs to just $100 within several years. That's approximately 130,000,000th of the cost just two decades ago . . . or 99.999997% less.

Illumina's technology has consistently made DNA sequencing more affordable. This led to its widespread adoption in healthcare and impressive stock performance:

And we mustn't overlook Amazon.com Inc. (AMZN:NASDAQ) . . .

Nearly everything Amazon creates focuses on being better, faster, and cheaper. This approach transformed Amazon into one of history's most remarkable investments.

When researching potential stocks, ask yourself: Is this company delivering solutions that are better . . . faster . . . and/or cheaper than competitors?

If you answer "yes" to one criterion, you're heading in the right direction. If all three apply, you've likely discovered a promising investment opportunity.

For more insights, subscribe to our investing letter, The Jolt.

We publish fresh research and analysis on today’s big disruption investing opportunities.

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Chris Reilly: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.