This was the week when most gold companies reported their second-quarter results, and we saw record revenue and earnings across the board, with companies strengthening balance sheets — most now being net-cash positive — and some buying back shares and increasing dividend payouts. Costs were mainly under control, though there were unexpected increases at some. Despite one or two individual problems — remember, to quote Robert Friedland, Murphy works overtime in the mining business — all companies reiterated full-year guidance, with many being second-half weighted. The royalty companies in particular generated massive cash flows, allowing them to make new deals while adding to cash piles.

First, though, we will discuss in some detail a company that had a strong quarter, but where the market misunderstood lower production (expected) and higher costs (temporary) and slammed the stock, creating another buying opportunity.

Fortuna Is the Rodney Dangerfield of Gold and Silver Miners

Fortuna Mining Corp. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE) released second-quarter financials mostly in line with expectations, having already released their operating results. Earnings came in a little below estimates, but this was purely due to the timing of withholding taxes. Adjusted earnings were above analyst consensus, and adjusted net income up 25% on the previous quarter. All mines are meeting expectations, and the company ended the quarter with $250 million net cash (and $537 million in available liquidity). Full-year guidance was maintained.

An apparent negative was the higher-than-expected All-in Sustaining Costs at $1,932, but this was due to temporary factors. The plans to increase production at its flagship Séguéla (as well as waste stripping at Lindero) meant increased capital costs during the quarter, which will continue for the balance of the year, with costs declining to an estimated $1,750 next year. Cash costs were a very reasonable $929.

Growth Projects To Replace Loss From Sold Mines

Séguéla's output in expected to increase to up to 180,000 oz next year, up from 140,000 this, and those ounces are low-cost. After that, further growth will likely come from the Diamba Sud project in Senegal. Fortuna announced a one-million ounce resource, with a PEA expected before year end and a production decision sometime next year. The company is also active on greenfields exploration, both in West Africa and Latin America, with an $11 million budget (excluding Diamba Sud). The total exploration budget is $51 million for the year.

These projects will replace the ounces lost with the sale of two depleting mines early in the year, as previously discussed (see Bulletins #956 and 957.) President and CEO Jorge Ganoza said these would be better quality ounces, lower cost and longer life, that the ounces lost.

Misunderstanding Sends Stock Down Sharply

Because of these mine sales, production was lower than in the year-ago quarter, as one might expect. (Output from continuing operations was up.) That, and the higher AISC, led to a 13% drop in the share price.

It makes you wonder if sentient people are doing the selling. Maybe they do not actually follow the company or maybe it is just algorithms; fire first, aim later!

The perverse stock drop was partially reversed the next day with the still stock closing Friday down almost 7% from Wednesday close. (See graph.) This is still unwarranted; it was a good quarter.

Ganoza said he had "never seen Fortuna as strong and better positioned" as it is today, and I would concur. It is also undervalued, selling at a low 4.4 times cash flow, and less than 8 times free cash flow.

Fortuna is a buy here.

Another Record for Wheaton

Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE) had a strong quarter, with better-than-expected production, revenue, and earnings. Net earnings in the quarter were almost $300 million. Production was up partly because of a drawdown of produced-but-not-delivered inventory from the first quarter; the inventory remains relatively high.

Wheaton maintained both its full-year guidance as well as its five-year outlook of GEOs to increase by 37%. In the near term, the company will benefit from the ramp up on two significant streams, Artemis' Blackwater and B2Gold's Goose Bay. With a cash balance of $1 billion, Wheaton has total available liquidity of $3 billion having extended and increased its credit facility. Wheaton is in a very strong position.

It has nearly 40% of its revenue from silver. Its major risk is the concentration of its assets, with around 37% of revenue from the Salobo mine. The stock hit $100/share for the first time.

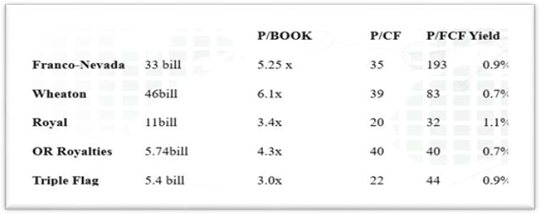

It is now the largest, and the most expensive, of the royalty companies. (See table below.) We are holding as a low-risk foundation to a portfolio.

Royal Adds Cash Flow With Another Major Deal

Royal Gold Inc. (RGLD:NASDAQ) reported financials more-or-less in line after prereleasing its streaming production. Though production was a little light, revenue and earnings hit new records. The company maintained its full-year guidance, even though the operator of Mt Milligan, is largest stream, lowered its own guidance. Cash at quarter end increased marginally to $248 million, with another million on its undrawn line of credit. However, last week it used most of its cash and credit line when it acquired a gold stream on the First Quantum's Kansanshi copper mine in Zambia for $1 billion. The complex stream deal — with ties to First Quantum's credit rating, accelerated delivery options, and laddered payments — brings immediate cash flow to Royal, a decent return rate (estimate at over 6% IRR), and upside through regional exploration coverage.

Two Large Transactions Strain but Do Not Break the Balance Sheet

Royal has negotiated an increase in its credit facility, so after the transaction has essentially no cash, and $575 million available. With annual cash flow approaching $700 million, and an estimate year-end net-debt-to-EBITDA of 1.5 times, the company is still in a good financial position, and plans to use excess cash flow each quarter to pay down the debt, though did not rule out additional transactions. Practically, however, Royal would be out of the running for any $1 billion plus deal that came along in the near future.

CEO Bill Heissenbuttel noted that transaction timing is out of Royal's control; one reason it used shares for its recently announced Sandstorm Gold and affiliate Horizon Copper acquisitions was because of the then-pending but unannounced Kansanshi stream; that stream has now closed.

The Sandstorm acquisition is expected to close in the fourth quarter. At about 9% of the company's NAV, the stream will be Royal's second largest asset after Mt. Milligan, now at 12%. The increase in current cash flow from Kansanshi complements the development-heavy Sandstorm portfolio. Though the market reacted very negatively to the Sandstorm acquisition, it reacted favorably to the Kansanshi stream, so the stock price has now erased most of its losses. See graph above.

We like Royal for the long term, but we are holding for now.

Or Sees Growth, Amid Acquisition Rumors

OR Royalties (OR:TSX; OR:NYSE) reported in-line with expectations after pre-announcing operating results. It reiterated its full-year guidance with expectations that the second half will be stronger than the first (55% to 45%), as well as five-year guidance with several development projects hitting milestones in coming months. It achieved net-cash status during the quarter after making repayments of $40 million; it ended the quarter with $50 million in cash and available liquidity up to $900 million.

OR has a higher gold exposure than the larger royalties, though its copper exposure is slowly increasing. It also has a lower political risk profile and higher margins than most. It no longer trades at a discount, however, particularly on cash flow metrics. The stock has been strong the last several months, outperforming its peers this year (though Triple Flag and Wheaton only marginally). Partly this is due to rumors in the market that the company could be acquired, set into high gear when Triple Flag's 65% owner Elliot Management announced it had acquired a small stake in OR earlier in the year.

Hold.

Triple Flag on Track, Despite One Miner Failing To Pay

Triple Flag Precious Metals Corp. (TFPM:TSX; TFPM:NYSE) reported record revenue, broadly in line with expectations, having pre-announced its operating results. The company bought back a low $8 million in shares during the quarter and announced an increase in the dividend, ending the quarter with $82 million in cash. Subsequent to the quarter end, it drew $70 million on its line of credit for the Orogen transaction, leaving it with almost $1 billion in available liquidity. It reiterated its full-year guidance.

In the call, Triple Flag said that Steppe Gold is in default of stream payments from the first quarter after a private Singapore company took a controlling interest. Steppe also failed to deliver against a prepaid gold arrangement, and TFPM has filed a claim on that. The stream represents about 7% of TFPM's NAV, but the amount owned to date is only around $8 million. Steppe is in the process of restructuring.

After a strong stock price run, we are holding. Triple Flag has slightly higher political risk than some of the other large royalty companies, reflected in lower valuations.

We are looking for opportunities to add.

Pan American Sets New Records With Escobal in the Background

Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) reported an earnings beat on lower costs, setting new records on earnings and cash flow, this despite mixed production results (down 2% on the first quarter) amid grade reconciliation issues. However, the major mine operational problems that afflicted the company in prior years are now behind it. Free cash flow was up strongly and the company increased its dividend by 20% and repurchased $11 million in shares, as it reiterated its full-year guidance which is second half weighted, with the MAG Silver acquisition expected to close before year end.

The company ended the quarter with $1.1 billion in cash and total liquidity of $1.9 billion. Although the Guatemala government continues consultations with the local people concerning the Escobal mine, with proposals put forward to address concerns raised by the Xinka parliament recently, there is no timeline or catalyst. Trading at a NAV discount to peers, any positive development on Escobal would be a catalyst for further stock price revaluation.

We are holding for now.

Orogen Continues To Execute

Orogen Royalties Inc. (OGN:TSXV; OGNNF:OTC) announced another project sale, this the Los Coyotes silver-gold project to Fresnillo, the world's top silver miner, in return for US$118,000 on signing, and $1 million on commercial production as well as a 1% royalty. Los Coyotes is currently undrilled.

This transaction is in line with Orogen's strategy of selling projects for some upfront cash and meaningful upside, and brings in another top operator. Orogen remains our top junior generator. We have been looking for a pullback following completion of the Triple Flag transaction to add to positions, but we may need to raise out limits.

For now, we'll be patient.

Another Small Asset Sale Form Barrick

Barrick Mining Corp. (ABX:TSX; B:NYSE) sold a small project in Chile for $50 million plus a 0.5% royalty to Boroo.

This is the same company that took control of Steppe and has failed to pay Triple Flag a royalty. Barrick has a number of smaller assets to focus on long-life Tier One projects.

We are holding.

Although most mining companies have now released second-quarter earnings, particularly the larger companies, we await earnings from some companies on our list, Franco-Nevada Corp. (FNV:TSX; FNV:NYSE), Altius Minerals Corp. (ALS:TSX), Metalla Royalty & Streaming Ltd. (MTA:TSX.V; MTA:NYSE American), and Orogen Royalties Inc. (OGN:TSXV; OGNNF:OTC) among the royalty companies, and Barrick among the miners. Most of these will report in the coming week.

TOP BUYS this week, in addition to above, include Lara Exploration Ltd. (LRA:TSX.V) and Midland Exploration Inc. (MD:TSX.V).

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fortuna Mining Corp., Or Royalties Inc., Triple Flag Precious Metals Corp., Pan American Silver Corp., Orogen Royalties Inc., Barrick Mng Corp., Franco-Nevada Corp., Altius Minerals Corp., Metalla Royalty & Streaming, Orogen Royalties Inc., Midland Exploration Inc., and Lara Exploration Ltd.

- Adrian Day: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Adrian Day Disclosures

Adrian Day’s Global Analyst is distributed for $990 per year by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. www.AdrianDayGlobalAnalyst.com. Publisher: Adrian Day. Owner: Investment Consultants International, Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2023. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.