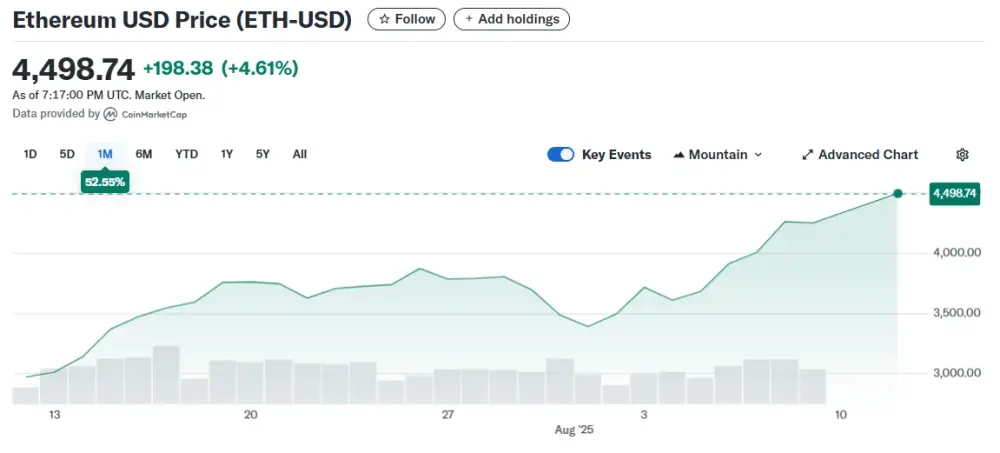

Ethereum (ETH) surged past $4,500 earlier this week.

It's now climbed 53% over the last month, even with yesterday's selloff:

ETH remains one of RiskHedge chief analyst Stephen McBride's top cryptocurrency recommendations for long-term investors. What makes it special? In essence, Ethereum functions as the "operating system of crypto." The majority of practical applications — spanning DeFi to NFTs to tokenized assets — are constructed on Ethereum's framework. Following an extended period of underperformance, interest is finally returning to this platform.

Here's Stephen's perspective:

For the past couple of years, Ethereum's development has concentrated on complex technical improvements like Layer 2 solutions.

I won't delve into the technical specifics, but the ecosystem's priorities are now shifting.

Vitalik Buterin and his development team are now prioritizing enhancements to Ethereum's primary architecture and improving its accessibility for everyday users. This represents a significant breakthrough.

Ethereum's leadership recognizes that theoretical excellence isn't sufficient. The technology must deliver practical value.

This transition is underway. The Pectra upgrade recently deployed, with additional major improvements planned throughout the next year and a half. Additionally, financial institutions are increasingly receiving regulatory approval to participate in cryptocurrency markets.

Consider BlackRock, Inc.'s (BLK:NYSE) activities. They've already allocated $2 billion toward their tokenized Treasury fund. Notably, they didn't build this on Solana (SOL) by SOL Strategies Inc. (HODL:CSE; CYFRF:OTCQB), or another venture-backed blockchain. They selected Ethereum.

BlackRock's head of digital assets, Robbie Mitchnick, stated: "There was no question that the blockchain we would start our tokenization on would be Ethereum."

This declaration speaks volumes about Ethereum's position.

What potential price targets exist for ETH?

Stephen explains:

I anticipate ETH could reasonably reach $10,000 during this market cycle. When it exceeds its previous record high of $4,800, that will signal the beginning of a substantial rally.

However, the truly exceptional opportunities exist among smaller, more volatile crypto ventures that can benefit from ETH's success during altcoin season.

You see, once ETH establishes a breakout pattern, capital typically flows toward higher-risk investments. This means altcoins — particularly small-cap tokens — can experience dramatic appreciation.

If you're looking to learn more about the opportunity in crypto and other big disruptions in the market today, consider joining The Jolt. It's Stephen's twice-weekly investing letter, where he shares his unfiltered insights so you can take advantage of the trends shaping our world. Go here for details.

| Want to be the first to know about interesting Cryptocurrency / Blockchain investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Chris Reilly: I, or members of my immediate household or family, own securities of: Ethereum. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.