In the gold mining world, it's rare to have two near-identical standouts in the same family.

For NexGold Mining Corp. (NEXG:TSX.V; NXGCF:OTCQX; TRC1:FSE), the Goliath Gold Complex in northwestern Ontario and the Goldboro Gold Project in Nova Scotia are like twins — both strong, capable, and poised for success.

But as every parent knows, when two siblings are equally gifted, one still gets to take the first step.

For NexGold, that decision is coming soon.

Company Overview

NexGold Mining Corp. is emerging as one of Canada's most compelling near-term mid-tier gold developers. Formed through a recent merger, the company now controls two advanced-stage gold projects, each with over 3 million ounces of mineral resources across all categories, and a clear strategy to move from developer to producer in the shortest possible timeline. With a seasoned leadership team, strong financial backing from high-profile investors, including Frank Giustra, and both projects advancing through permitting, NexGold offers investors a rare combination of scale, jurisdictional safety, and near-term catalysts.

Formed through the merger of NexGold Mining Corp. (which was the result of a merger between Treasury Metals Inc. and Blackwolf Copper and Gold Ltd.) and Signal Gold Inc., NexGold has emerged as one of Canada's most compelling near-term mid-tier gold developers. The company now controls over 60,000 hectares in proven mining jurisdictions, anchored by two advanced-stage, 100%-owned projects.

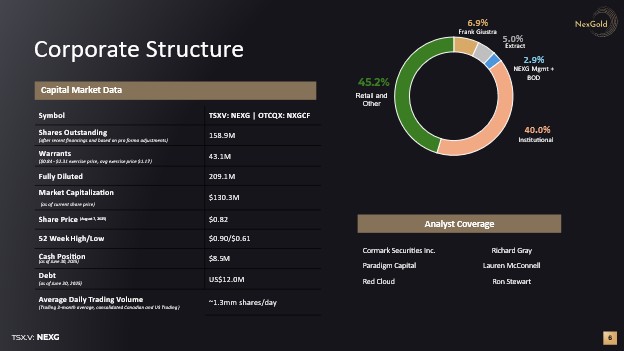

The company's market capitalization is over CA$130M, with 40% institutional ownership, and approximately CA$8.5M in cash on hand.

The Road to Production

NexGold's strategy is straightforward: build smaller, financeable mines capable of ~100,000 ounces per year, creating sustainable long-term production while minimizing capital risk.

Both projects are designed with robust IRRs and capital costs under CA$400M, allowing flexibility in project sequencing.

Flagship Projects: The "Twins"

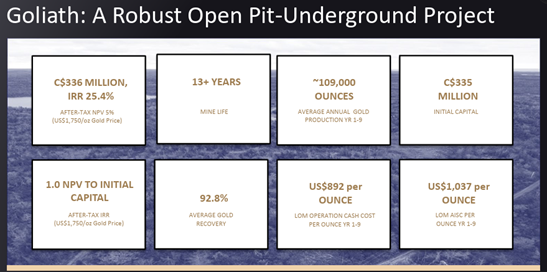

Goliath Gold Complex, Ontario:

Located in a region with excellent infrastructure, Goliath has secured federal environmental approval and is advancing First Nations agreements and final provincial permitting.

A feasibility study, expected in H2 2025, targets construction of a mine producing 100,000 ounces annually over 10+ years, at an estimated build cost between CA$350 and CA$400M.

- PFS NPV5% (post-tax): CA$336M at US$1,750/oz gold

- PFS IRR: 25.4%

- PFS Mine Life: 13+ years

- PFS Production Profile: 91,000 oz/year

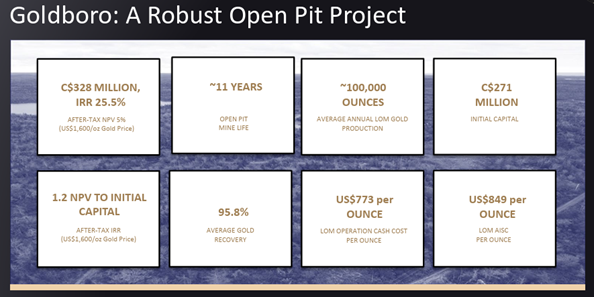

Goldboro Gold Project, Nova Scotia:

Situated in Nova Scotia's historic gold belt, Goldboro offers both open-pit and underground potential. It has environmental approval and a mutual benefits agreement with the Mi'kmaq First Nations.

An updated feasibility study is expected to reflect current gold prices and cost inputs, with a projected build cost of between CA$350-CA$400M.

- FS NPV5% (post-tax): CA$328M at US$1,600/oz gold

- FS IRR: 25.5%

- FS Mine Life: 11+ years

- FS Production Profile: 100,000 oz/year

Technical Analysis

The chart for NexGold, dated August 8, 2025, shows a textbook basing pattern after a prolonged decline from 2022. Over the last 18 months, price action has shifted from lower lows to a steady pattern of higher lows, supported by a rising trendline.

Rising bullish volume confirms accumulation, with recent price action challenging the CA$0.78–CA$0.80 breakout zone, a level that also coincides with the downtrend line from early 2023. The emerging "small head and shoulder" formation inside a larger triangle, adds to the bullish setup, and with moving averages beginning to turn upward and a potential golden cross in play.

Price targets are clearly defined at CA$ $1.20, CA$$1.50, CA$$2.20, and a longer-term "big picture" target of CA$$4.50. Momentum indicators, including RSI and MACD, are trending positively, reinforcing the potential for a sustained breakout.

From a technical analysis perspective, the stock is transitioning from accumulation to early uptrend, historically a high-reward phase

The Decision Ahead

Management has stated that, at first, only one project will advance to construction. The choice will be guided by updated feasibility studies, permitting timelines, and capital efficiency. Whichever project gets the nod will lead NexGold into production, with the other fully permitted and ready to follow.

Key Catalysts to Watch in the News

New Feasibility Study for Goliath in the coming months and Feasibility Study Update Update for Goldboro early next year.

Permitting Milestones: Final authorizations for Goliath; provincial permitting for Goldboro.

First Nations Agreements: Progress in Ontario towards IBAs and continued collaboration in Nova Scotia to implement the existing MBA.

Drilling Results: Drilling at both sites targeting mineral resource expansion and exploration.

Conclusion

NexGold holds two high-return, near-construction gold projects totaling over 6 million ounces in Canada. With a strong treasury, a proven leadership team, and a chart signaling bullish momentum, the company is positioned to become a mid-tier gold producer within the next development cycle.

The coming decision on which "twin" goes first could be a defining moment for the company, and a catalyst for its share price. We rate NexGold as a Strong Speculative Buy at current levels of CA$0.78 and US$0.57.

Investors can learn more at: NexGold Mining Corp.

NexGold Mining Corp. (NEXG:TSX.V; NXGCF:OTCQX; TRC1:FSE) closed for trading at CA$ 0.77 and US$0.57 on August 14, 2025

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- NexGold Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports,US$2,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NexGold Mining Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.