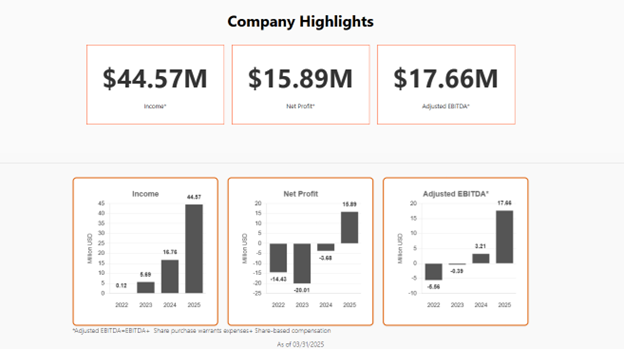

Metalpha Technology Holding Ltd. (MATH:NASDAQ; D92:FSE) represents one of the most underappreciated high-potential investments in cryptocurrency finance as it approaches its FY2025 financial disclosure. With its distinctive derivatives-centered business framework that prospers during market expansions and contractions alike, MATH has silently engineered a remarkable financial transformation — expanding its income threefold compared to the previous year while pivoting to substantial profitability. As an enterprise supported by Bitmain and Antalpha, it enjoys strategic benefits in cost-effective Bitcoin procurement, institutional product distribution networks, and regulatory adherence. The yearly statement showed complete fiscal period earnings of $44.57 million alongside $15.89 million in profit — suggesting a corporate valuation of $365 million at a 23 P/E multiple, or a projected share value exceeding $9 (representing a 2.25X increase from present trading levels).

This configuration presents MATH as an unusual asymmetrical opportunity: it gains from Bitcoin's upward cycle through volatility-driven derivative demand, yet remains fundamentally protected from downside risk via recurring revenue streams and balance-sheet durability. With a $5M stock repurchase initiative, technical price pattern breakthrough underway, and institutional embrace of cryptocurrency accelerating, MATH could be approaching a transition from an obscure small-cap security to an essential institutional holding.

Metalpha Corporate Overview

Metalpha Technology Holding Limited operates as an under-recognized equity poised for considerable expansion. Unlike conventional Bitcoin mining enterprises or exchange-oriented cryptocurrency investments, Metalpha functions as a digital asset wealth management organization specializing in sophisticated derivatives. This arrangement enables Metalpha to succeed regardless of market direction, creating a unique and compelling investment proposition within the cryptocurrency sector.

Despite growing influence in the digital asset domain and demonstrated capacity to generate income in fluctuating markets, Metalpha remains relatively anonymous. Many investors recognize prominent Bitcoin-related securities like MicroStrategy (NASDAQ: MSTR) and Marathon Digital Holdings (NASDAQ: MARA), but Metalpha offers a differentiated and more enduring operational approach.

Throughout the past year, Metalpha has delivered exceptional financial performance, achieving profitability initially and expanding its income fourfold. Yet despite impressive fundamental indicators, the stock continues to be considerably undervalued relative to other Bitcoin-associated equities. This analysis examines what distinguishes MATH as an extraordinary investment, contrasts it with industry leaders like MSTR and MARA, and explores why it might represent one of the premier Bitcoin-related opportunities available today.

A Bitcoin Investment That Doesn't Depend on BTC

One of Metalpha's most appealing characteristics is its indirect relationship to Bitcoin price movements, unlike traditional mining operations or holding companies. Rather than merely accumulating Bitcoin as a treasury asset, Metalpha profits by offering structured derivative instruments to institutional investors. Regardless of Bitcoin's directional trend, Metalpha can produce robust income streams.

Furthermore, Metalpha's strategic alliance with Bitmain, the global leader in Bitcoin mining equipment manufacturing, allows it to generate BTC internally — essentially acquiring Bitcoin at wholesale rates with a 20% discount. This represents a significant advantage enabling the company to access BTC at reduced costs while boosting profitability.

Derivatives and structured products constitute fundamental elements of developed financial marketplaces, and Metalpha's expertise in Bitcoin derivatives provides it with a notable competitive edge. Unlike mining operations, which must sell their BTC holdings to fund operational expenses, Metalpha's business framework generates sustainable and recurring income from institutional clients seeking exposure to digital assets without direct volatility exposure.

The Expansion of Institutional Crypto Derivatives

Institutional investors depend on derivatives to mitigate risks and optimize allocations in traditional financial markets. As cryptocurrency and blockchain sectors continue to mature, derivatives increasingly become vital components of digital asset investing. Hedging downside risk while maintaining upside potential makes crypto derivatives attractive to hedge funds, family offices, and affluent investors alike.

Metalpha is capitalizing on this trend by providing an array of highly customized crypto derivatives, enabling investors to engage with Bitcoin and other digital assets in a more sophisticated and controlled manner. With regulatory clarity improving across major jurisdictions, institutional adoption of these financial instruments should continue expanding, positioning Metalpha as a significant participant in digital asset wealth management.

Regulatory Environment and Compliance Advantages

A major challenge confronting the crypto market today involves regulatory uncertainty. However, Metalpha has established itself as a globally compliant, institutional-caliber platform by proactively securing necessary regulatory approvals while operating within clearly defined legal frameworks.

Metalpha's wholly owned subsidiary, LSQ Capital Ltd, maintains Type 1 (virtual assets), Type 4 (securities), and Type 9 (asset management) licenses under the Hong Kong Securities and Futures Commission (SFC). This provides institutional investors confidence that Metalpha adheres to strict compliance protocols, ensuring transparency and proper risk management.

As global oversight of crypto firms intensifies, Metalpha's compliance-first approach provides an advantage over competitors operating in regulatory gray areas. As jurisdictions like Hong Kong, the UAE, and the EU continue refining crypto regulations, Metalpha is strategically positioned to benefit from institutional capital flows that require fully compliant investment vehicles from inception.

Performance: Breakthrough Period With Additional Growth Anticipated

Metalpha's financial transformation has been remarkable. After experiencing a $3.68 million loss last year, MATH now shows a profit of nearly $16 million as of March 2025, with adjusted EBITDA of $17.66 million.

Metalpha's steady financial improvement over two years highlights its scalable business framework, expanding profit margins, and growing institutional adoption of its structured derivative offerings. The company has constructed a robust platform capable of serving institutional investors with tailored digital asset investment solutions.

These figures also indicate that Metalpha has reached an inflection point, transitioning from a niche participant into a significant force in the crypto financial services industry. Its recent profitability demonstrates that the firm is executing its vision while remaining undiscovered by most market participants.

Beyond strong revenue and profitability growth, Metalpha's Board of Directors has authorized a $5 million share repurchase program spanning the next 36 months. This signals management's confidence in the company's long-term trajectory and commitment to delivering tangible shareholder value.

Share buybacks often indicate that management believes its stock is undervalued, and considering Metalpha's recent financial performance, this could support MATH price appreciation while reducing the float (number of outstanding shares).

Metalpha's Distinctive Edge in a Competitive Landscape

While numerous crypto institutions offer various trading and investment services, Metalpha has established a specialized niche by concentrating on structured derivatives customized for institutional clients. This high degree of specialization distinguishes it from retail-focused exchanges like Coinbase Global Inc. (COIN:NASDAQ) or Binance.

Metalpha's principal competitive advantages include:

- Institutional investor focus: Unlike retail-oriented platforms, Metalpha designs investment solutions specifically tailored to hedge funds, family offices, and high-net-worth individuals seeking custom alternatives and derivatives.

- Robust strategic partnerships: Support from industry leaders like Bitmain and collaborations with prominent firms like Zodia Markets provide Metalpha a unique competitive advantage in both market access and liquidity.

- Risk management expertise: Traditional crypto investment vehicles face extreme volatility, but Metalpha's derivatives-based strategies allow clients to reduce directional risks while maintaining exposure to digital assets.

As the crypto market matures, more institutions will require sophisticated crypto investment vehicles and tools. Metalpha is already ahead of competitors, positioned as a premier provider of customized digital asset solutions for the next wave of institutional adoption.

Strategic Support From Bitmain and Antalpha

One of Metalpha's greatest advantages comes from backing by industry giants Bitmain and Antalpha Platform Holding (ANTA:NASDAQ). These partnerships provide Metalpha with a unique market advantage few competitors can match.

Bitmain, the world's foremost manufacturer of Bitcoin mining hardware, holds a 38.6% stake in Metalpha. This key strategic relationship allows Metalpha to structure derivative products that directly benefit from Bitmain's dominance in the BTC mining supply chain. Metalpha gains access to liquidity and business opportunities unavailable to independent crypto financial services firms.

Another major MATH shareholder, Antalpha Technologies, also plays a crucial role in Metalpha operations by contributing institutional expertise and capital efficiency. Antalpha has experience working with crypto mining firms and digital asset holders to optimize allocations, making it a valuable partner in expanding Metalpha's wealth management solutions.

As global crypto markets continue evolving, strategic support from industry leaders means that Metalpha can adapt and expand rapidly, creating long-term value for investors.

New Additions To Metalpha's Leadership Team

Naturally, Metalpha wouldn't have secured these key partnerships without the firm's elite management. With extensive expertise in both traditional finance and digital assets, Metalpha's leadership team comprises institutional veterans, crypto pioneers, and mining executives.

Leading this powerhouse is Adrian Wang, Metalpha's Founder and CEO, a distinguished former Wall Street executive with extensive experience in structured finance, derivatives, and digital asset management. Wang previously held important positions at leading financial institutions, providing him the expertise needed to connect traditional and crypto markets.

In July 2025, Metalpha strengthened its institutional bench by appointing Monique Chan as CEO of LSQ Capital, the firm's Hong Kong-based subsidiary licensed by the Securities and Futures Commission (SFC). A 30-year banking veteran, Chan previously served in leadership roles as Asia Head of the Rothschild Group, CEO of HSBC Private Bank HK, and Vice Chair Asia at Bank J. Safra Sarasin. Her arrival underscores Metalpha's commitment to building a digital asset–friendly family office platform for ultra-high-net-worth clients.

Other key Metalpha executives include former investment bankers, hedge fund managers, and blockchain specialists from Goldman Sachs, Morgan Stanley, Société Générale, UBS, and Columbia Business School — ensuring the firm's leadership combines financial discipline with Web3 innovation.

The combined expertise of Metalpha's executive team enables the company to skillfully navigate global regulatory challenges, design innovative and competitive crypto derivatives, and attract prominent institutional and UHNW clientele across Asia and beyond.

Middle East Expansion Creates Significant Opportunity

Metalpha isn't only capitalizing on Western crypto markets — it's also establishing significant presence in emerging digital asset markets throughout the Middle East.

By expanding into the United Arab Emirates (UAE) through joint ventures with Gewan Holding and Zodia Markets, Metalpha is establishing itself in one of the world's fastest-growing digital asset hubs. Dubai and the UAE have rapidly become one of the world's most crypto-friendly regulatory environments, creating an immediate growth opportunity for Metalpha.

Meanwhile, nearby Abu Dhabi's crypto-friendly regulations and increasing institutional capital also make it an ideal gateway for Metalpha's structured products to reach new high-net-worth clients.

The Broader Context of Crypto Derivatives

Cryptocurrency markets have evolved dramatically over the past decade, transitioning from a speculative, retail-driven ecosystem to one shaped by institutional participants. A major catalyst has been the emergence of crypto (particularly BTC) derivatives. Similar to traditional financial markets, derivatives provide traders and investors tools to hedge risk, enhance liquidity, and manage exposure.

Metalpha stands at the forefront of this transition, offering custom structured products that help institutional investors navigate the inherent volatility of digital assets. By enabling exposure to Bitcoin and other cryptocurrencies without requiring direct ownership, Metalpha makes digital assets more accessible and manageable for institutions concerned about regulatory and custody risks.

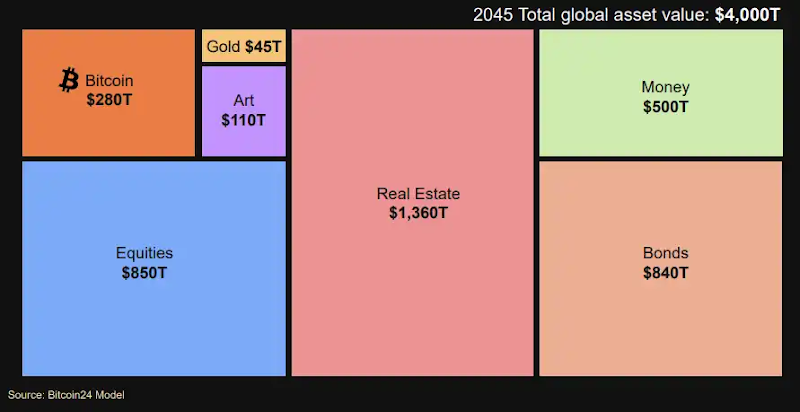

As Bitcoin ETF inflows increase (e.g., NASDAQ: IBIT), proposals for digital strategic reserves gain support, and regulatory clarity improves, demand for derivative-based BTC investment strategies will only grow. Metalpha can capitalize on this trend by providing the sophisticated financial infrastructure needed for crypto's next phase of mainstream adoption.

Bitcoin's Macro Catalysts and Metalpha's Long-Term Prospects

The Bull Scenario: How BTC's Recovery Could Benefit MATH

While Metalpha's strength lies in generating revenue during both market expansions and contractions, powerful new catalysts are emerging, including the realistic possibility of a BTC price surge to new all-time highs over the next 12–24 months.

Standard Chartered has reinforced its $200,000+ BTC forecast, which it believes will be driven by ETF inflows, institutional allocation shifts, and macroeconomic instability. BitQuant has suggested that BTC could exceed $250,000 in 2025 alone, particularly if geopolitical turmoil or continued fiat debasement accelerates demand for digital assets. Other speculative price models, including gold comparisons, forecast long-term BTC prices from $400,000 to $1 million.

For Metalpha, this bullish environment could serve as a massive price catalyst. Here's why:

- Increasing Institutional Demand Drives Volume: As BTC prices climb, more institutional investors will seek hedging tools and yield-generating strategies to manage their exposure. This aligns directly with Metalpha's core strength: developing structured derivatives for institutions. If BTC's market cap doubles or triples, this could translate to exponential growth in demand for Metalpha's offerings.

- BTC Volatility Fuels MATH Revenue: Rising prices mean higher implied volatility, which is crucial for pricing derivatives. Higher volatility drives revenue for Metalpha, which profits from premiums and custom options structuring. As BTC approaches new all-time highs, Metalpha's yield-enhancing products are likely to become increasingly attractive to sophisticated investors.

- Repricing Across BTC-Linked Equities: In previous bull markets, companies with even minimal Bitcoin exposure saw substantial returns, leading to analyst reratings. With its deep involvement in institutional crypto markets and Bitmain-backed operations, Metalpha is likely to participate in this broader rerating, especially as investors seek differentiated opportunities beyond frequently traded tickers like MSTR and COIN.

- Strategic Advantages from Bitmain and Antalpha: A rising Bitcoin market benefits all participants — but Metalpha's partnerships with mining giant Bitmain and capital allocator Antalpha position the company to benefit disproportionately from the upcoming rerating wave. As asset flows increase, Metalpha will gain access to discounted BTC and a wider distribution network for its derivatives products.

- Return to Historical Peaks — And Beyond: With MATH still trading well below its all-time intraday high of approximately $15, a strong Bitcoin rally could stimulate investor interest and technical momentum. Even a conservative reversion to the 50% Fibonacci retracement would represent a nearly 3x return. In a genuine bull scenario, where Metalpha continues to post exceptional earnings during a booming BTC market, the upside potential is compelling.

In summary, while Metalpha doesn't require Bitcoin appreciation to succeed, the anticipated increase in BTC's price could serve as accelerant for MATH. For investors seeking leveraged exposure to the next Bitcoin bull cycle — but with additional protection from recurring revenue and institutional utility — Metalpha may offer one of the most asymmetric opportunities available.

The Future: Institutional BTC Adoption Patterns

Taking a broader perspective, Metalpha represents more than a short-term play on crypto's resurgence. This is a company well-positioned for sustained growth. The convergence of institutional capital, sophisticated financial products, and an evolving regulatory environment creates ideal conditions for Metalpha to flourish.

As the global financial ecosystem increasingly incorporates digital assets, Metalpha has a genuine opportunity to become a significant global presence in BTC and crypto wealth management.

This firm isn't merely riding the wave of institutional BTC adoption — it's actively expanding its offerings to meet the stringent requirements of sophisticated investors.

Metalpha is expected to introduce new derivative structures designed for Bitcoin ETF holders, hedge funds, and global family offices. And as regulatory clarity continues improving, Metalpha is well-positioned to extend its operations beyond Asia and the Middle East into Western markets.

Valuation Disparity: How Metalpha (MATH) Compares

Despite its rapid revenue growth and profitability, Metalpha remains significantly undervalued compared to industry peers:

- MicroStrategy Inc. (MSTR:NASDAQ): Market cap of $89 billion; holds 439,000 BTC

- Marathon Digital Holdings Inc. (MARA:NASDAQ): Market cap of $10 billion; holds 44,394 BTC

- Metaplanet Inc. (3350:TYO; MTPLF:OTCMKTS): 4,800% year-over-year growth; holds 7,800 BTC

- Metalpha Technology Holding Ltd. (MATH:NASDAQ; D92:FSE): Market cap of just $161 million, with higher revenue growth and a profitable business model.

Simply stated, the market continues pricing MATH as if it were a speculative microcap, despite strong fundamentals and strategic partnerships. With a 23 P/E earnings multiple, Metalpha could easily be worth 2.25x its current valuation.

Antalpha (ANTA): MATH's Partner Microstock

The Metalpha narrative would be incomplete without discussing Antalpha. On May 14, ANTA debuted on Nasdaq, raising approximately $49 million at $12.80 per share. Notably, Antalpha serves as Bitmain's primary financing partner, with contractual right-of-first-refusal on all customer loans.

Antalpha owns roughly a quarter of Metalpha's float, with other Bitmain-affiliated entities holding nearly a third. Consequently, any enthusiasm surrounding ANTA could impact MATH. Additionally, Antalpha's prospectus reads like a post-halving wish list for Bitcoin miners:

- Impressive balance sheet: A $1.6 billion loan portfolio, 97% collateralized with BTC or ASIC equipment (see Antalpha's Form F-1 filing).

- Growth that demands attention: Antalpha's 2024 revenues increased 321% to $47.5 million, while net income transformed from negative to a $4.4 million profit.

- Geographic advantage: Approximately 75% of credit exposure is in Asia, where Bitcoin miners are aggressively upgrading mining operations following April's block-reward halving.

At its current share price, ANTA is valued at roughly 5–6x trailing sales, a moderate multiple for a capital-light lender with deep vertical integration into Bitmain's hardware pipeline. With BTC approaching new all-time highs and macro catalysts building for a new bull cycle, ANTA could benefit from increasing mining demand, credit appetite, and investor enthusiasm.

Antalpha's business model is streamlined and efficient: Bitmain sells an S-series mining rig, Antalpha finances the buyer, and Bitmain effectively captures margin twice — once on hardware, once through affiliated lending economics.

Antalpha's IPO filing also suggests extending this approach to AI-GPU financing — a market worth $18 billion in 2023 and projected to expand beyond $110 billion by 2031. This substantially exceeds the $9 billion ASIC miner space Antalpha currently serves, which is only forecast to reach $27 billion by 2031.

Interestingly, much of Antalpha's Bitcoin-backed lending is underwritten by Northstar, a capital provider now held in an irrevocable trust whose sole beneficiary is Bitmain co-founder Jihan Wu.

Essentially, Bitmain generates demand, Northstar supplies capital, and Wu-aligned entities like Antalpha and Metalpha benefit on both sides of the transaction — securing credit flow, hardware sales, and strategic upside in a self-reinforcing cycle.

Market Response to MATH's Potential

Following its FY2025 earnings report, MATH experienced a sharp rally, reflecting investor enthusiasm for its nearly 3x higher YoY revenues and substantial swing to profitability.

Here's what the weekly candlestick chart looked like by July 31, 2025:

As illustrated on this weekly chart, MATH is rapidly approaching a multi-year high of approximately $5.00, and the current price action exceeds the 50-, 100-, and 200-week moving averages. MATH has broken above the lowest Fibonacci retracement level (below 23.6%), making the next logical price target around $6.00 per share.

What This Means For Investment Consideration

In essence, Metalpha's strong financial performance is finally gaining market recognition, with its stock breaking out of a multi-year downtrend. The current price action suggests:

- Growing institutional interest as the company's fundamentals rapidly improve and continue attracting attention.

- Technical confirmation of a new uptrend, supporting the notion that Metalpha may be entering a sustained bull phase aligned with the BTC summer and end-of-year cycle.

- Potential for additional upside as the company's relative valuation remains very low compared to its potentially overvalued peers.

The impending bullish breakout, combined with Metalpha's strategic partnerships and robust earnings, presents a compelling case for continued momentum. Investors seeking early-stage exposure to an ascending crypto financial services firm may find MATH at a pivotal turning point.

Notably, MATH's all-time high (ATH) was slightly above $15. That represents a nearly 4x return at the current share price, even if MATH only retests its previous ATH.

Quick stat sheet: ANTA & MATH comparison

For those focused on fundamentals who prefer quantitative data, here are the key metrics likely to frame any valuation of ANTA or revaluation of MATH:

| Antalpha | Metalpha |

|---|---|

| Latest period | FY 2024 |

| Revenue | US $47.5M |

| Net income | US $4.4M |

| Market Cap | 289M |

| Core product | BTC-secured loans & platform fees |

The Pivot: BTC to MATH Before Crypto Winter

ANTA's post-IPO decline to its debut price range is characteristic of new stock debuts. However, sister company Metalpha's current share price presents an interesting opportunity as MATH positions itself as a leveraged Bitcoin play.

MATH shares correlate with BTC, but they have stronger fundamentals beyond price action and direction of the underlying asset. This gives MATH an advantage during downturns, as it isn't entirely subject to Bitcoin's market fluctuations.

Looking forward, after the anticipated crypto summer of 2025, experts predict a significant crypto winter that will alter market sentiment. And as BTC prices become more volatile, Metalpha stands to benefit from strategic reallocation.

As MATH's business model provides a more robust foundation for long-term growth, its performance in coming months will likely distinguish it from Bitcoin's price fluctuations.

Price Targets for MATH: A Valuation Chain Reaction

With ANTA trading around 5–6x trailing sales, investors may soon recalibrate assumptions for MATH, particularly considering Bitmain's consolidated ecosystem and the substantial ownership stake held between a Bitmain affiliate and Antalpha.

Let's apply this same logic to MATH's year-end: $44.57 million in revenue and $15.89 million in net income.

Implied Valuation Scenarios for MATH

If public market sentiment assigns Metalpha even a conservative 23 P/E ratio — below Antalpha's impressive 66 P/E ratio — it could justify a $365 million valuation, or approximately $9.13 per share.

That represents a notable gap from MATH's current trading price, especially given:

- Relative profit advantage: MATH's over 30% net margin exceeds Antalpha's 9%, offering a cleaner fee-based income profile.

- Liquidity catalysts: MATH's higher float and volume could make it more accessible for institutions tracking ANTA post-IPO.

- Technical breakouts: TradingView has already identified MATH a "Strong Buy" as it surpassed major resistance levels.

If Antalpha successfully extends its financing template beyond ASIC miners to GPU-backed credit, expanding its total addressable market (TAM) and valuation multiples, it could further elevate perceived value for Metalpha's yield-generation platform, especially if there's product co-development or structured-product bundling.

The Bull Scenario: MATH Matching Its Peers

Considering Bitcoin-related stocks typically trade at significantly higher P/E ratios than conventional stocks (average 23 P/E), with Microstrategy trading at a 51 P/E and Antalpha trading at a 66 P/E, we can envision some very optimistic scenarios.

| Revenue (FY2025) | Net Income (30% Margin) | P/E Ratio | Market Cap | Implied Share Price (38.37M shares) |

|---|---|---|---|---|

| $44.57M | $15.89M | 20x | $317.8M | $8.28 |

| 40x | $635.6M | $16.56 | ||

| 60x | $953.4M | $24.84 |

We're examining a base scenario where MATH more than doubles from previous levels and, if it matches the P/E ratio of peer ANTA, we could see a 6x multiple.

Risks worth considering

Naturally, Antalpha's IPO and its potential positive impact on MATH only matter if it withstands scrutiny. Despite its promise, Antalpha's success story could be undermined by three identifiable risk factors:

- Regional concentration: 77% of Antalpha's loans are with Asian borrowers, so a sudden policy change or liquidity shortage in the region could impact asset quality first.

- Related-party funding: Antalpha's BTC-margin book depends heavily on the Northstar trust, which concentrates counterparty risk with a single affiliate.

- Bitcoin drawdowns: A sharp decline in BTC prices would reduce loan-to-value cushions for Antalpha while diminishing derivative demand for Metalpha.

The Market Underestimates Metalpha

With its modest market capitalization, strong earnings growth, and derivative-driven business model capable of generating profits regardless of BTC price movements, Metalpha (NASDAQ: MATH) represents a hidden opportunity in the crypto investment landscape.

As the next Bitcoin bull market accelerates, Metalpha stock could become one of the primary beneficiaries. MATH remains among the most undervalued BTC-related equities available, and as more investors recognize its potential, significant revaluation seems probable.

Investors seeking a high-upside, institutional-caliber crypto opportunity should consider adding MATH to their watchlists before broader market awareness develops.

You can view more from me here.

| Want to be the first to know about interesting Cryptocurrency / Blockchain investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Metalpha Technology Holdings Ltd.

- Sergei Stetsenko: I, or members of my immediate household or family, own securities of: Metalpha Technology Holdings Ltd. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for CRG.AI

This article is for informational purposes only and should not be considered financial or investment advice. The content reflects the author's views based on publicly available information but does not constitute a recommendation to buy or sell any securities. Cryptocurrency and equity investments carry risks, including market volatility and potential loss of capital. Investors should conduct their own research and consult a professional financial advisor before making any investment decisions. Past performance is not indicative of future results.

CRG.AI is not operated by a licensed broker, a dealer, or a registered investment adviser. This content is for informational purposes only and is not intended to be investment advice. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer by CRG.AI or any third party service provider to buy or sell any securities or other financial instruments. All content in this article is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in this article constitutes professional and/or financial advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. CRG.AI is not a fiduciary by virtue of any persons use of or access to this content.

Disclosure & Disclaimer Statement

Ownership Disclosure

As of the date this content is published, I, the owner/operator of this website: www.crg.ai hold a long position in the publicly traded securities of Metalpha Technology Holding Ltd. (NASDAQ: MATH). I may buy or sell shares at any time without notice.

No Compensation for Report

The report linked or posted on this website regarding Metalpha Technology Holding Ltd. (NASDAQ: MATH) was not commissioned, purchased, or solicited by me or this website. I did not receive any form of direct or indirect compensation—monetary or otherwise—for publishing or sharing this report. I am merely reposting or referencing it for informational and educational purposes.

Third-Party Content Disclaimer

This report was authored by a third party not affiliated with this website. I make no warranties or representations as to the accuracy, completeness, or reliability of the information, forward-looking statements, or opinions contained within. Readers are encouraged to verify all claims independently and consider the source of the report.

Investment Risk & No Investment Advice

The information presented on this website, including this report, is provided strictly for informational purposes and does not constitute an offer to buy or sell any securities. It should not be construed as personalized investment advice or a recommendation to make any specific investment decision. Investing in securities is inherently risky and may result in the loss of your entire investment.

Compliance with SEC Rule 17(b)

In accordance with Section 17(b) of the Securities Act of 1933, while I have not been compensated by any third party to distribute or promote this report, I am disclosing my ownership in the security mentioned. I am committed to full transparency regarding any and all positions held or compensation received related to any content posted on this website.

Forward-Looking Statements Warning

Any statements contained in the report that are not historical facts may be forward-looking statements as defined under federal securities laws. Such statements may involve risks and uncertainties that could cause actual results to differ materially. Readers should not place undue reliance on forward-looking statements and are encouraged to consult with a qualified investment advisor or legal counsel before making investment decisions.

Contact for Questions

For questions or concerns regarding this disclosure, please contact: Sergei Stetsenko, CEO www.crg.ai [email protected]