One small 60-cent equity controls 73% of the planet's first digitally extracted gold tokens — and it's creating wealth every 60 days.

Bitcoin revolutionized everything. It demonstrated humanity was prepared to exit fiat currency — to accumulate wealth beyond government and banking control.

However, it carried significant flaws:

- It's supported by nothing tangible

- It fluctuates dramatically

- And it consumes more electricity than entire nations

That was just the prototype.

Now arrives the masterwork: NatGold Digital Ltd. represents the next stage — a digitally extracted token anchored by actual gold, geologically confirmed and untapped, remaining underground.

It combines Bitcoin's rarity and accessibility with gold's concrete value and reliability.

- No physical excavation — the gold remains earthbound

- No vault expenses, no intermediaries

- No contamination or ecological damage

- Just authentic gold, digitally secured, globally exchangeable, and spearheading a $30 Trillion transformation

NatGold emerges as the world's pioneering digitally mined commodity . . . propelled by groundbreaking tokenization technology . . .

A fully regulated, blockchain-protected system for activating trillions in mineral assets — without disturbing nature:

Each NatGold token is:

- Anchored by verified, subterranean gold reserves — not conjecture

- Created without excavation, waiting, or environmental harm

- Usable and expandable like Bitcoin

- Connected to gold — history's most dependable wealth repository

This represents sound currency — modernized, tokenized, and unleashed.

Yet most investors remain unaware what NatGold Digital — the enterprise behind the token — actually developed.

NatGold Digital didn't merely produce a superior asset. It reimagined the entire concept of gold extraction . . .

No excavators. No mountains flattened. No ecological impact. No decades-long waiting.

Just authenticated geological information — digitally transformed into tokens on a rapid, 60-day schedule.

- Safeguarded by 11 patent applications

- Constructed on infrastructure trusted by financial giants including BNY Mellon, Visa, and HSBC.

NatGold embodies the financial reset investors have anticipated.

It is crafted to circumvent Wall Street and engineered to supersede fiat — government-issued paper currency that devalues with each printing. Plus, NatGold activates $20 trillion in constrained mineral wealth without disturbing ecosystems.

But not every gold deposit qualifies. Only those meeting NatGold Digital's rigorous, 6-step verification process become NatGold - digitally created, scientifically validated, and monetized without extraction.

Circle produced USDC — a token backed by U.S. debt — and Wall Street pursued it to a 796% increase in 18 days. That represented digitized debt. This represents digitized gold.

Supported by nature. Confirmed by science. Monetized without physical mining.

But here's the crucial detail:

NatGold Digital remains private. And only ONE public corporation controls the gold flowing into production . . . Earning 73% of every token generated — without lifting a shovel.

This 60-cent stock isn't a mining operation. It's the exclusive provider of certified NatGold resources - gold deposits satisfying NatGold's strict tokenization criteria and powering the entire ecosystem.

Because NatGold didn't just improve gold; it reimagined how it's extracted.

And this represents the most leveraged and undervalued method to access that innovation — before Wall Street discovers it.

There is one public company energizing the NatGold Production. This isn't conventional mining. There's no drilling. No destruction. No fossil-fueled machinery.

NatGold rewrote the playbook — and constructed something superior:

- Supported by verified, subterranean gold

- Protected by 11 pending patents

- Developed by a former Chief of Staff at the SEC (now a current member of President Trump's digital asset transition team) and executives from Barrick, BHP, and Freeport-McMoran

- Powered by identical infrastructure trusted by Visa, BNP Paribas, and BNY Mellon

- Designed to transform trillions in buried gold into digital tokens — without disturbing nature

Each NatGold token is:

- Backed 1:1 by subterranean gold, verified under identical geological standards used by regulators, exchanges, and international banks to evaluate billion-dollar reserves

- Valued at its Baseline Intrinsic Value — the authentic, verified value of underground gold before hype, speculation, or premiums

- Digitally extracted — meaning no diesel-powered equipment, no environmental disruption, no delays, no intermediaries

The gold remains buried. The wealth comes to you. Directly from nature's vault — into your wallet.

Gold represents the world's most trusted wealth storage. And it's now breaking records above $3,500 as confidence in fiat deteriorates.

Yet over $5 trillion in gold resources has remained dormant for decades — Trapped beneath a broken system of endless permits, lawsuits, delays, and destruction. And countless trillions more remain unaccounted for.

NatGold transforms everything. It unlocks the value of proven, unmined gold resources — and delivers it globally — without breaking ground.

What previously required decades now takes 60 days — with no earth moved. No diesel consumed. No ecosystems harmed.

Not just gold without the hardship — gold without the wait. The gold stays underground. The value flows to you — instantly, cleanly, digitally.

A token you can possess, exchange, and utilize just like Bitcoin . . . Only this time, it's not backed by blind faith. It's backed by gold — the most trusted asset in history.

What Makes This Moment So Significant?

Only select gold projects qualify for NatGold's tokenization system.

But just one company holds the exclusive, front-of-line supply agreement, fast-tracked through 2030. That company is NatBridge Resources Ltd. (NATB:CSE; NATBF:OTC; GI80:FSE).

This 60-cent stock is NatGold's sole public partner — with a contractual express route to the NatGold production, guaranteeing its deposits get tokenized first, every time.

Every 60 days:

- Its certified geological data feeds production

- Thousands of tokens are created

- And it captures 73% of every token produced — without lifting a shovel

Why 73%?

Because NatGold provides the production facility. This company provides the gold. It supplies the most valuable input in the entire system: Certified, geologically verified gold — the foundation every token is built upon.

That's why it gets paid first. And most.

- NatGold Digital retains 20%

- NatBridge earns 73%

And because it doesn't operate billion-dollar mines, hire crews, or move an ounce of earth . . . its margins exceed 98%. No CapEx. No labor. No environmental liability. Just certified gold → tokenized like clockwork → with software-level economics.

It was designed from inception to scale . . . No mining. No delays. No dilution. Just certified data in . . . digital gold out. With 98%+ margins.

Here's how it works: This company acquires tokenization-ready gold deposits — assets meeting the strict geological standards required for NatGold Production.

And every 45 to 60 days:

- Deposits undergo validation

- Tokens are produced

- Value is monetized — and distributed with software-level efficiency

No billion-dollar mines. No 20-year waits. Just certified geology transformed into programmable, tradeable wealth. It compresses decades of gold resource monetization into a single quarter.

What Could Be Better?

Any external project wanting access to the NatGold ecosystem . . . Must go through this company — or wait behind it.

That means:

- It gets paid on its own deposits

- It gets paid when others partner

- It earns a growing, compounding royalty stream across the entire system

A self-funding system — built to scale.

And currently, it controls the rights to supply the first 2.5 million tokens — representing up to $4.4 billion in verified gold, already in motion . . . and heading straight to its bottom line.

That $4 billion isn't speculation — It's calculated using Baseline Intrinsic Value: The real, geologically verified value of underground gold, before premiums, hype or speculation.

- $2,432 per token — and increasing.

Compare that to Bitcoin . . . It surpassed $100,000 per coin — backed by nothing but code and blind faith.

Now imagine what NatGold could be worth:

Backed by real gold

Engineered to scale

Built for the future ahead

And this 60-cent stock? It's the only publicly traded way to access the production.

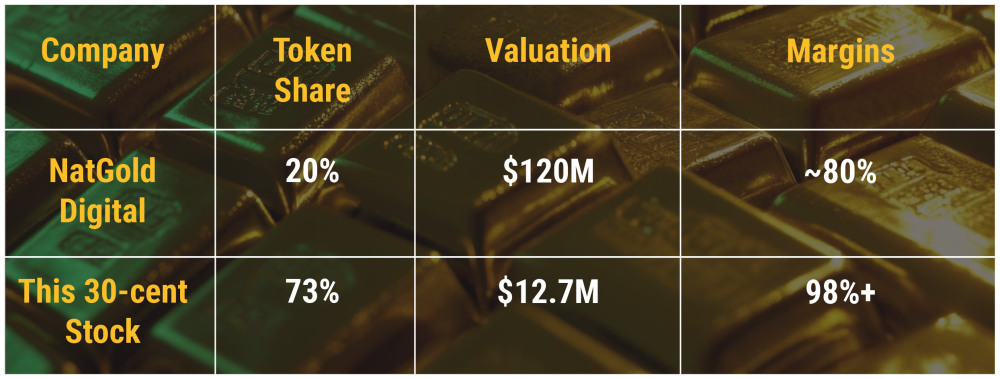

It Has 3.5x the Token Share at 1/10 the Valuation

NatGold Digital — the production facility itself — recently raised capital at $2.50 per share, giving it a $120 million valuation.

But it only keeps 20% of each token produced. This public company keeps 73% — more than 3.5 times the token share . . .

Yet it trades at just $12.7 million.

This isn't just undervalued. It's structurally mispriced.

Because while it's already monetizing $4.4 billion in verified gold through the first 2.5 million tokens . . . Its total market cap remains just $31.4 million.

That's a 140-to-1 disconnect between the value it's unlocking — and what the public markets think it's worth.

And when Wall Street discovers this? That gap won't persist.

| Want to be the first to know about interesting Special Situations and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NatGold Digital Ltd. and NatBridge Resources Ltd.

- Brian Hicks: I, or members of my immediate household or family, own securities of: NatGold Digital Ltd. and NatBridge Resources Ltd. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.