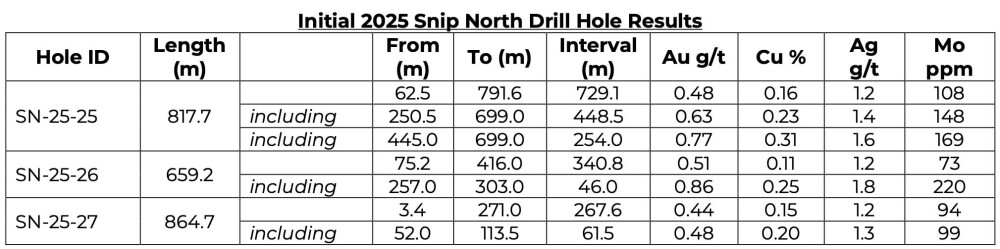

Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) announced that the initial results from the first three holes drilled this summer at the Snip North target have confirmed the presence of a copper-gold porphyry deposit of significant size and consistency.

These holes are part of a 12,000-meter drilling program aimed at expanding zones of intense potassic alteration and associated mineralization discovered in 2024, the company said in a release. Each of the first three holes successfully extended the mineralized footprint of Snip North at its Iskut project in British Columbia's Golden Triangle, intersecting broad intervals of porphyry-style mineralization with notable copper and gold grades.

"We are very excited by the early results from this year's program," said Chairman and Chief Executive Officer Rudi Fronk. "Our drilling is designed to achieve a density of pierce points needed for a maiden resource from a mineralized zone that so far measures approximately 1,700x600x600 meters, with the aim of announcing a resource estimation for Snip North early next year."

Hole SN-25-25 expanded mineralization up dip and south from the 2024 drilling, the company said. Multiple generations of veining and mineralization were encountered throughout the drill hole, Seabridge said. Alteration and veining exhibit distinct zonation, including potassic and phyllic alteration of the wall rock. Coarser-grained sandstone and volcaniclastic units are more intensely altered and mineralized than finer-grained siltstones. From 62 to 790 meters, continuous mineralization is produced by ubiquitous quartz–carbonate–sulfide and quartz–sulfide veins hosting pyrite and chalcopyrite.

Hole SN-25-26 was designed to extend mineralization from 2024 along strike and to the north. Potassic alteration, characteristic of the central part of Snip North, is intersected throughout the hole, associated with quartz-sulfide-biotite and quartz-carbonate-sulfide veins. Numerous carbonate-rich stratigraphic units in this hole show complete magnetite-pyrite-chalcopyrite replacement.

Hole SN-25-27 was a step-out to the east, testing the strike extension of intense potassic alteration. The hole quickly intersected a replacement-style quartz-magnetite-chalcopyrite breccia hosted in fine-grained siltstone, transitioning into discrete carbonate-sulfide-magnetite veins, the company said. This intense magnetite mineralization is accompanied by chalcopyrite and biotite. Carbonate-sulfide-magnetite veins associated with secondary biotite are intersected throughout the mineralized interval from surface to 280 meters.

Discovery Gave Co. 'Clear Focus'

Seabridge Gold Inc. has been drilling since this spring at Iskut, located just 30 kilometers by air from its massive KSM gold-copper project in British Columbia's Golden Triangle.

The program is using three helicopter-portable drill rigs, aiming to complete approximately 12,000 meters of core drilling to advance the Snip North discovery towards a maiden resource estimation, as stated in a company release.

Jason Williams of Wealth Daily called Seabridge "something unique in the mining industry" in a piece on Streetwise Reports on August 7.

The CA$15 million campaign is fully funded and focuses on delineating the copper-gold porphyry mineralization identified during the 2024 drilling season.

"Last year's discovery at Snip North has given us clear direction on where to focus to deliver new resources in this year's program," Fronk said at the time. "That's our first priority. We are also targeting the source intrusion for this prospective resource which we expect to be rooted in a district-scale structural trend, named the Bronson Trend, containing newly recognized additional porphyry targets."

The systems at Iskut are comparable in size to the company's nearby KSM deposits, which have extensive strike lengths and significant width and depth dimensions. "We are optimistic that this year's work will confirm our view of the potential for an entire porphyry district which we had in mind when we acquired the Iskut project in 2016," Fronk added.

Analysts: Another KSM?

Jason Williams of Wealth Daily called Seabridge "something unique in the mining industry" in a piece on Streetwise Reports on August 7.

"It doesn't actually extract gold. It simply owns vast quantities — exceeding 88 million ounces (Moz) of measured and indicated gold and over 65 Moz inferred just within its primary KSM project in British Columbia. This approach, combined with disciplined financial management, provides it with the highest gold ounces per share of any publicly traded company globally."

Williams added, "Despite never having produced an ounce, the market still assigns substantial value to those reserves. Why? Because in an environment starved for major gold discoveries, simply controlling the resource can suffice."

Willliams noted that when gold prices increase, companies like Seabridge benefit "without needing to operate a single piece of equipment."

In an updated research note on the company on August 12, Cantor Fitzgerald Analyst Mike Kozak noted that the intervals reported in the release are step-outs from the initial 2024 discovery drill program at Snip North, indicating a substantial, near-surface, and seemingly continuous gold-copper porphyry.

"Seabridge intends on completing a maiden MRE at Snip North in early 2026," Kozak noted. "Based on the drilling to date, a maiden resource of +1.5 Bt (billion tonnes) @ ~0.45 g/t Au (grams per tonne gold) and ~0.15% Cu (copper), containing ~20 Moz Au and ~5 Blb (billion pounds) Cu is potentially achievable (Cantor estimate) but subject to additional exploration results from the current 12,000-meter drill program."

Kozak kept the firm's Buy rating with a one-year price target of CA$46.

Analyst Taylor Combaluzier with Red Cloud Securities also called the results "positive."

"All three holes successfully extended mineralization and returned broad intersections of porphyry-style mineralization with good grades," noted Combaluzier, who maintained Red Cloud's Buy rating with a price target of CA$56.95 per share, a 146% return on August 13 when he wrote the update. " We also note that Seabridge remains on track to execute on one of its top objectives of delineating a maiden MRE at Snip North by Q1/26."

According to Analyst Michael Siperco with RBC Capital Markets, also on August 13, "The key catalyst for Seabridge remains finding a senior partner to advance the large-scale KSM project toward a feasibility study and a construction decision, with a process currently underway (pending affirmation of substantially started status, hearing scheduled for September)."

Seabridge has reported advancing discussions with several potential partners for the project.

However, Siperco noted the rest of the company's portfolio (including advanced projects Iskut and Courageous Lake) offer growing optionality and potential as sources of eventual funding (beyond 2025).

"Early work is continuing at KSM (CA$150 million planned in 2025 and funded), which we view as a world-class gold/copper project with strong leverage to higher metal prices," he wrote.

The Catalyst: Miners Experiencing 'Some Time in the Sunshine'

UBS is giving a favorable assessment of gold mining stocks, according to Bill McColl writing August 13 for Investopedia. In a note to clients, analysts mentioned that miners are currently experiencing "some time in the sunshine," and after a "poor track record in recent years," they are beginning to regain investor confidence and trust.

According to the report, UBS highlighted that although gold prices have been relatively stable over the past three months, the VanEck Gold Miners ETF has outperformed gold by 15%, and it has surpassed gold by more than 40% year-to-date.

The analysts suggested that if gold prices remain stable, gold mining companies might increase stock buybacks this year, accelerate organic growth projects, and potentially engage in more mergers and acquisitions. However, despite their optimism, they noted that they have "become more selective, shifting preference from 'relatively expensive outperformers' to some of the 'cheaper turnaround stories.'"

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT)

Florian Grummes told Jeremy Szafron of Kitco News on July 29 that the bigger breakout is coming, and patient investors will be rewarded.

"We're in a crack-up boom overall," said Grummes, managing director of Midas Touch Consulting, in an interview with Kitco News. "That means everything will move higher because they destroy the purchasing power of your fiat money — whether it's the euro, the dollar, or the Canadian dollar."

Ownership and Share Structure

Refinitiv provided a breakdown of the company's ownership and share structure, where management and insiders own approximately 3% of the company. According to Refinitiv, CEO and Chairman Rudi P. Fronk owns 1.25%.

Refinitiv reports that institutions own about 52% of the company. Friedberg Mercantile Group Ltd. owns 16.08%, Van Eck Associates Corp. owns 2.96%, Kopernik Global Investors L.L.C. owns 7.3%, and Paulson & Co. Inc. owns 2.06%.

According to Refinitiv, there are about 100.54 million shares outstanding, while the company has a market cap of CA$2.33 billion and trades in a 52-week range of CA$13.44 and CA$28.39.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Seabridge Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.