Occasionally, a stock chart starts to reflect the story that's been quietly building behind the scenes. Vanguard Mining Corp. (UUU:CSE; RECHF:OTC; SL51:FWB) may be approaching that point.

With a fully diluted market cap of just over $9.1 million, the company is advancing exploration-stage uranium assets — its primary focus — in Paraguay and the United States, and a secondary gold-copper project at Brussels Creek (BC) in British Columbia.

These projects target minerals central to the global energy transition, and the company's portfolio spans tier-one jurisdictions with an emphasis on secure and ethical supply chains.

Why Uranium Matters

Uranium is increasingly recognized as a cornerstone of the modern energy economy. As the world grapples with decarbonization, nuclear energy is gaining traction as a reliable, low-emission power source. Uranium fuels over 400 nuclear reactors globally, with dozens more under construction, especially in Asia.

Its role extends beyond clean electricity; uranium is also essential in producing medical isotopes used in cancer detection and treatment. With demand projected to rise by over 35% by 2030 and a supply deficit already forming, uranium is fast becoming a strategic mineral, not just for energy security, but for human health and global stability.

About Vanguard Mining

Vanguard is a Canadian mineral exploration company targeting high-impact discoveries in metals critical to electrification and nuclear energy. The flagship uranium project is in the Paraná Basin of Paraguay, directly adjacent to Uranium Energy Corp.'s (UEC:NYSE AMERICAN) Yuty Project. In Canada, Vanguard also holds the Brussels Creek Project in British Columbia, a district long known for its porphyry copper potential.

The company's exploration approach is disciplined, technical, and opportunistic, with a particular emphasis on uranium assets that could serve the coming supply squeeze in the nuclear fuel cycle. Between its South American and Canadian projects, Vanguard is positioning itself as a diversified explorer focused on scale and relevance in the clean energy era.

Leadership and Advisory Team

CEO David Greenway brings two decades of experience in building and financing public companies in the resource sector. His track record of identifying early-stage opportunities and guiding them through growth phases has been instrumental in laying the foundation for Vanguard's current portfolio.

CFO & Corporate Secretary Richard Robins offers deep experience in both finance and public markets, having guided companies through successful TSX and CSE listings. His previous roles at TD Bank and Citibank speak to a high level of financial discipline.

Technical oversight comes from an experienced board and advisory team that includes Qualified Person Johan Shearer, a well-known geologist and project manager, and Larry Segerstrom, a bilingual engineer and economic geologist with over 38 years of copper-gold experience.

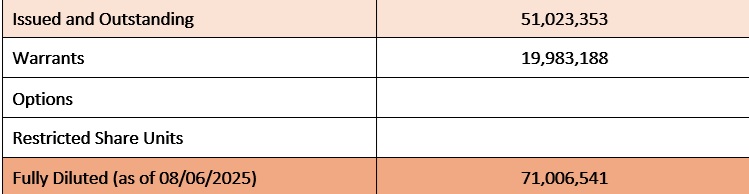

Share Structure

As of August 2025, Vanguard has 51.02 million shares issued and outstanding, with 71.0 million fully diluted.

With a share price of CA$0.17 at the time of writing and a 52-week high of CA$0.25, the stock is trading near the lower end of its range.

There are no outstanding options or restricted share units, which means dilution risk is currently limited to warrants.

Technical Chart: A Classic Base Forming

The daily chart shows a long, quiet bottoming pattern throughout 2024 and early 2025, but that has begun to change.

A clear series of higher lows has formed in the first half of 2025, with increasing volume, a telltale sign that accumulation is underway.

Resistance sits just under the CA$0.22 level, where the stock has bumped against former breakdown levels from early 2024. A sustained close above this area would confirm a breakout and open the door for a technical re-rating.

If momentum continues, the next levels to watch are:

- Target 1: CA$0.32

- Target 2: CA$0.50

- Target 3: CA$0.90

- Big Picture Target: CA$1.50

MACD has turned positive, RSI is climbing, and volume spikes are becoming more frequent, all pointing to growing interest. From a chartist's perspective, this setup is one of the more constructive breakouts in the Canadian microcap exploration space right now.

Conclusion

With a tight share structure, experienced management, exposure to uranium and copper in proven jurisdictions, and a compelling chart setup, Vanguard Mining checks several boxes for speculative investors preparing for the next phase of the commodity cycle. We are issuing a Speculative Buy rating at current prices.

It’s still early, but the groundwork is in place. As always, investors should conduct their own due diligence, but from where we sit, Vanguard Mining deserves a place in risk-oriented portfolios for those looking for a low entry point

Learn more at the company's website here.

Vanguard Mining Corp. (UUU:CSE; RECHF:OTC; SL51:FWB) closed for trading at CA$0.17, US$0.1233 on August 7, 2025.

| Want to be the first to know about interesting Uranium and Copper investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Vangaurd Mining Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Vangaurd Mining Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.