Blue Lagoon Resources Inc. (BLLG:CSE; BLAGF:OTCQB; 7BL:FSE) celebrated its Dome Mountain mine inauguration event in Smithers, British Columbia on July 9, 2025, welcoming over 100 attendees including representatives from Crescat Capital and Nicola Mining Inc. (NIM:TSX.V; HUSIF:OTCQB; HLIA:FSE). Throughout our two-day visit, we engaged with numerous company personnel, advisors, service providers, financial representatives, and key investors. Recognizing that mineral extraction is an exceptionally challenging industry, we conducted extensive conversations with various contractors and staff members to gain insights into the operational risks and methodologies. Following these interactions, discussions, and an on-site tour of the Dome Mountain gold facility, we developed significant confidence in Blue Lagoon's ability to execute its operational restart, generate revenue streams, and expand output.

Since November 2024, Income Growth Advisors acquired multiple million shares of this precious metals enterprise, influenced partly by established investment firms Crescat Capital and Nicola Mining purchasing Blue Lagoon shares at premium valuations, the company securing its operational permit in February, and the promising nature of its Dome Mountain asset. Based on our site inspection, we now firmly believe Blue Lagoon possesses a highly qualified and seasoned team capable of transforming the Dome Mountain Gold project into a rapidly expanding, cash-generating gold resource. Its expansion potential was confirmed by two of the most credentialed miners and geological experts present who expressed belief that the company's land holdings could potentially contain 2 to 3 million ounces of gold.

If Blue Lagoon successfully executes its mining restart and grows the alkaline gold Dome Mountain geology into a district scale gold property like the Buritica Gold Mine in Columbia or the Porgera project in Papua New Guinea, Blue Lagoon's long term prospects could be enormous. On July 11, Crescat Capital released its own YouTube update regarding Blue Lagoon where Quinton Hennigh, PhD reiterated his enthusiasm for the company's alkaline gold geology's potential and the mining team's professionalism stating "my gut says they will kill it." With effective implementation, we anticipate Blue Lagoon Resources could deliver tenfold returns over the next three years and potentially much more based on its substantial resource potential.

Strategic Overview: Technical Assessment and Valuation

Blue Lagoon Resources operates as a Canadian junior mining enterprise experiencing a valuation adjustment as it evolves from a gold exploration company to an active producer. This transition typically results in a five to tenfold valuation increase according to renowned hedge fund manager John Paulson, who disclosed on June 4, 2025 that he deployed $800 million alongside Nova Gold Resources Inc. (NG:NYSE) to acquire Barrick Mining Corp.'s (ABX:TSX; B:NYSE) $1 billion Donlin gold project in Alaska in May 2025. The Donlin venture represents a massive multibillion-dollar undertaking requiring years of engineering, permitting and financing before experiencing that five to tenfold valuation shift. By contrast, Blue Lagoon has secured permits, arranged financing, and stands weeks away from initial operational revenue.

Blue Lagoon previously reached $1.40/share in 2020 as an exploration company and currently trades at $0.445/share with a market value of $53.7 million. In January 2020, gold and mining equities demonstrated strength, driving BLAGF shares to $1.40/share based on perceived resource value. As Blue Lagoon transforms into an operational producer, the company's valuation should adjust upward as it begins generating income and cash flows that should complement the market's 2020 valuation assessment.

Since 2020, the company has conducted exploration and developed its resource with backing from Crescat Capital and geologist Quinton Hennigh, PhD. During this period, Blue Lagoon has expanded its share count and invested $30 million in exploration and development. Dome Mountain has undergone over a century of resource development efforts by various entities including Timmons and Noranda, with total development expenditures exceeding $80 million since 1985. CEO Rana Vig believes this historical investment and anticipated future revenue streams should support continuous company growth without requiring additional dilutive and time-consuming capital fundraising.

We consider the Dome Mountain resource potentially world-class and district-scale. The chart referenced shows BLAGF shares peaked at $1.40/share in 2020 based on resource prospects, while currently trading at $0.445/share despite significant advancement toward production operations.

Mining activities are expected to accelerate with the finalization of the MBBR reactor within four weeks. Extraction activities should commence with 1500 tons of material stockpiled before transporting 1000 tons to Nichola Mining in Merritt BC, 900 kilometers distant. We project 100 to 500 ounces of gold sales during the third quarter and commercial ore production of 100 tons daily increasing toward 150 tons daily in the fourth quarter. Based on company guidance of 15,000 ounces of production in the initial year, we estimate 3 thousand ounces of gold production in the fourth quarter of 2025. These fourth quarter financial results should be announced in March, 2026.

Assuming $1500/oz. gross profit, Blue Lagoon's 2025 fourth quarter and first complete quarter of production should generate gross earnings of $4,500,000 or $18,000,000 annualized. (Blue Lagoon trades at 2.9 times 2026 gross profit.) The enterprise aims to increase production to 150 tons daily (55,000 tons annually) and subsequently apply to expand production to 75,000 tons annually (208 tons daily) in 2026.

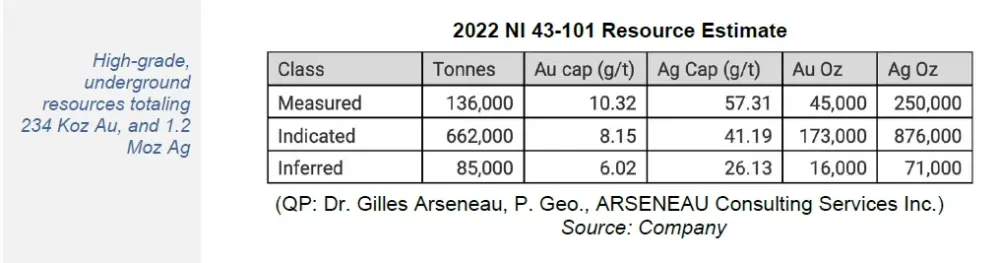

Blue Lagoon plans to expand its resource and intends to allocate approximately 25% of its cash flow toward infill drilling (within or near existing mine operations) to enhance vein identification and production optimization. Blue Lagoon will also direct 25% of cash flow toward exploration drilling, enabling quantification of what they believe could amount to 1 million ounces of gold in the 10% of property already examined. The company's operational lifespan is estimated at 15 years based on 15,000 oz./yr. production and the 2022 NI 43-101 resource assessment (shown below) indicating 218,000 ounces of Measured and Indicated gold, reaching 234,000 ounces when including inferred resources. (Calculation: 15,000 oz./yr. x 15 years = 225,000 oz.)

Infill and exploration drilling should yield additional vein discoveries to enhance Measured and Indicated Resource estimates over the next three years to one million ounces. Resource expansion to one million ounces would necessitate operational lifespan extension and drive production growth toward 40-60,000 ounces annually. Resource expansion will elevate Blue Lagoon's valuation.

The company anticipates expanding its mining permit to incorporate the Argillite vein in coming months and increase its production authorization from 55,000 tons annually to 75,000 tons annually. Production from the Argillite site should increase total gold concentration from 9 grams per ton toward 11 grams per ton since Argillite exploratory drilling indicates 14 grams per ton. As volume reaches 75,000 tons annually (208 tons daily) and gold concentration surpasses 9 grams per tonne, 2026 should demonstrate robust cash flow expansion throughout the year.

Corporate Ownership Structure

President and CEO Rana Vig, founding shareholders, and family members control approximately 13% of Blue Lagoon's shares.

Crescat Capital Management holds just under 10%. We initially focused on Blue Lagoon because Crescat had been deeply involved in site exploration during 2021 with their distinguished geologist Quinton Hennigh, PhD. With Crescat acquiring shares at C$0.70/share, C$0.52/share, C$0.38/share, C$0.18/share, and participating in this year's financings, we feel assured regarding the resource potential.

Nicola Mining owns 6%. Nicola Mining serves as Blue Lagoon's ore processor. Nicola previously processed 5000 tons of material in 2021 and remitted $1.6 million to Blue Lagoon for that production when gold traded at $1800/ounce. Nicola's investment reinforced our confidence in the likely output from the Dome operation. Beyond Nicola's $1mm investment in January 2025, they provided funding tranches this year and extended a $2 million credit facility to Blue Lagoon. Peter Espig, Nicola's CEO, informed me that both he and his spouse maintained personal shareholdings alongside Nicola Mining. Peter Espig holds credentials as a Fulbright Scholar, former Goldman Sachs derivatives trader and investment banker, private equity professional, and competed as a professional football player in Japan.

Phoenix Gold Fund maintains a 6% position.

Recent Insider Activity

During 2025's first half, Blue Lagoon Resources secured $4.9 million through several equity offerings with consistent participation from both Crescat Capital and Nicola Mining. These firms possess unique insight into the Dome Mountain gold project. Crescat actively participated in initial drilling and investment activities in 2021 and 2022. In 2021, Nicola Mining processed 5000 tons of Blue Lagoon material.

During the second quarter, Blue Lagoon CEO Rana Vig requested recent financing participants to exercise certain options or warrants to supplement the company's financial reserves. During this process, we believe Crescat Capital Management slightly exceeded its preferred 10% ownership threshold where regulatory requirements become particularly burdensome. This prompted Crescat to divest 831,028 shares on July 7 and 8, reducing its holdings to just below 10%.

Development Milestones Toward Commercial Production

Several significant events will occur providing development and production updates that we will monitor:

- MBBR (Moving Bed Biofilm Reactor) activation mid-August.

- Initial extraction and ore removal, August and September.

- Material accumulation and shipments to Nicola Mining in September.

- Q3 financial disclosure November 2026.

- Initial revenue recognition and first cash generation.

- Argillite vein operational approval.

- Infill and exploration activities commence in Q1 2026.

- Dome Mountain resource assessment updates. Last formal NI 43-101 evaluation completed in 2022.

- Q4 financial disclosure March 2026.

- Expanded production authorization from 55,000 TPY to 75,000 TPY.

Fundamental Research Corp. (FRC) Analysis and Income Growth Advisors, LLC (IGA) Perspective

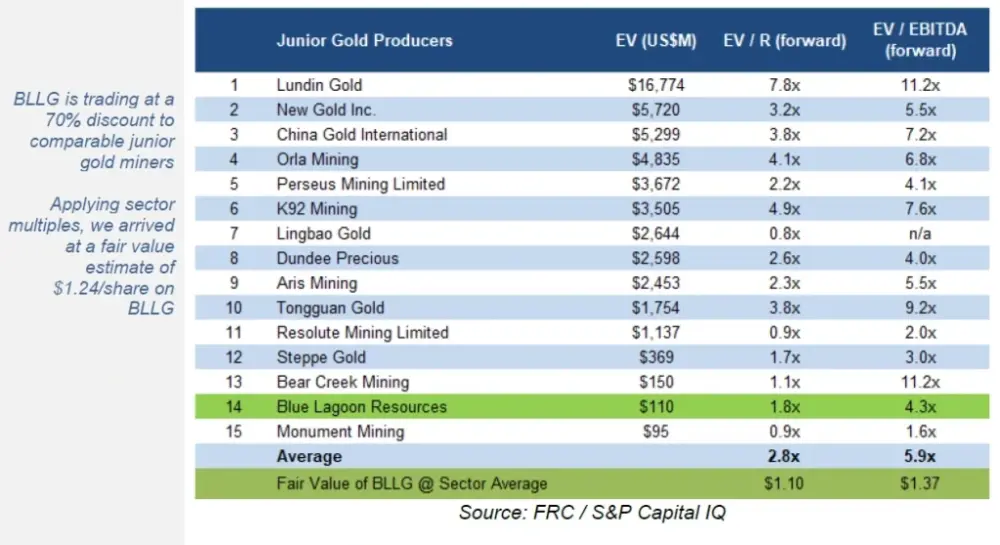

Fundamental Research Corp's Sid Rajeev, CFA published a Blue Lagoon research report on July 7, 2025 issuing a Buy recommendation with a fair value assessment of CA$1.11/share. BLLG closed at CA$0.60/share July 25, 2025 suggesting a 46% discount to FRC's fair value estimate.

We engaged with Sid Rajeev during the mine inauguration and subsequently to better comprehend his valuation methodology. In our assessment, FRC underestimates Blue Lagoon's value and potential due to conservative assumptions. FRC has produced over 700 reports covering resource companies since 2003, and while we question certain valuation inputs, his report excellently describes the resource and provides industry comparisons.

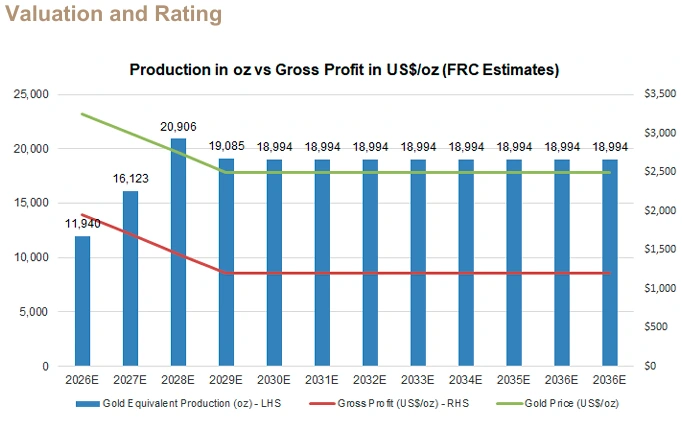

Below appears FRC's projection of production and anticipated gross profit:

Income Growth Advisors LLC. identifies four areas where FRC underestimates Blue Lagoon's fair market value or potential:

- The chart illustrates 11,940 ounces of gold produced in 2026. This production forecast falls below Blue Lagoon's stated guidance of 15,000 gold ounces. Rajeev explained that Nicola Mining maintains 200 TPY processing capacity with various clients, prompting FRC to assume 100 TPY production. Addressing the report's production assumption, Peter Espig, Nicola Mining's CEO, informed me they've submitted an application to triple their production capacity.

- We consider FRC's gold price projections overly conservative. FRC assumes $2,500/ounce for 12 of the 15 year operational forecast. By comparison, gold currently trades at $3339/ounce. FRC's projected gross profits and discounted cash flow model may undervalue the company by 20% due to this price assumption.

Furthermore, prominent hedge fund manager John Paulson anticipates gold reaching $5000/ounce by 2028. Dr. Edward Yardeni and Doubleline CEO Jeffrey Gundlach offer similarly optimistic gold price outlooks.

While commodity markets exhibit extreme volatility and prediction challenges, we favor using current pricing with an upward trajectory. Mr. Rajeev indicated his model employs proprietary gold valuation methodology involving M2 money supply. Regarding his approach, FRC presents a reasonable base case or downside valuation. IGA believes we're experiencing a gold bull market driven by paradigm shifts in international commerce, monetary policy, and global commodity cycles.

- IGA forecasts stronger production growth than FRC. Blue Lagoon has indicated plans to request increased production authorization to 75,000 tons annually. Additionally, Blue Lagoon aims to boost production to 20,000 ounces/year. At 75,000 tons annually divided by 360 operational days yields 208 tons daily. With Argillite vein approval at 14 grams per ton, we estimate 11g/t × 75,000 tons of ore production will yield 29,464 gold ounces in 2027.

- Finally, this property's potential scale remains unrecognized in current valuations. Crescat Capital holds nearly 10% ownership and their distinguished geologist Quinton Hennigh described Blue Lagoon as possessing something quite substantial and exceptional. (time 4:32) "Am I saying Blue Lagoon definitely has something like Porgera (Papua New Guinea 32 million ounces of gold)? No. I am not going to stick my neck out like that." However, Quinton personally suggested to me a potential for 2 to 3 million ounces, an assessment shared by Blue Lagoon's mining committee Chairman, Yannis Tsitos. Determining Blue Lagoon's properties' full potential requires years, but we wouldn't be surprised if larger entities pursue these resources later in the gold cycle.

Financial Projections and Cash Flow

FRC employs a complex model involving an assumed 70:30 cash flow distribution with Nicola Mining. Until viewing reported earnings, we prefer FRC's comparative valuation metrics:

FRC utilizes approximately $1300/oz cost estimates covering mining, milling and transportation. Mr. Rajeev indicated transportation costs represent $450/ounce while mining, milling, and SG&A total roughly $850/ounce. Though agreement specifics remain confidential, FRC believes Nicola Mining and Blue Lagoon Resources maintain a 30%/70% profit arrangement yielding net cash flows of $21mm/yr in 2026.

Currently, Blue Lagoon (BLAGF), with $53.7million market value, trades at U.S. share price of $0.445/share representing 2.5 times FRC's projected net cash flow. This compares favorably against FRC's industry average EV/EBITDA(Cash Flow) multiple of 5.9x.

Income Growth Advisors LLC. (IGA) applies different assumptions and projections yielding alternative price targets based on extensive discussions and confidence gained during Mine Opening Ceremonies on July 8 and 9th.

Market Capitalization to estimated 2027 Revenues: Assuming $4000/ounce gold prices with Blue Lagoon producing 29,466 gold ounces in 2027, gross revenues at $4000/oz gold (× 29,466ozs) equal $117,864,000. Net Revenues will reach $117,864,000 × 70% = $82,504,800.

Applying a market cap to revenue multiple of four, we project market capitalization reaching $330,019,200 (4 × $82,504,800) or $2.04/share by late 2026.

Market Capitalization to estimated Net Forward Cash Flow (EBITDA): Assuming $1300/ounce expenses based on FRC estimates, then 2027 Gross cash flow at ($4000/oz. – $1300/oz.) × 29,466 oz. = $79,658,200.

With a profit distribution of 30% Nicola and 70% Blue Lagoon, gold at $4000/ounce, expenses at $1300/oz and 29,466 gold ounces in 2027, estimated 2027 Net cash flow = $55,760,740 = $79,658,200 × 70%.

At 7 times 2027 net cash flow, Blue Lagoon should achieve market capitalization of $390,325,180 by year-end 2026. Assuming fully diluted share count of 161,103,417 shares by late 2026, suggests $2.42/share for BLAGF. FRC industry average multiple stands at 5.9.

Junior Gold Mining Sector Valuation Gap: We believe the VanEck Junior Gold Miner ETF (GDXJ) demonstrates the significant valuation discount relative to historical junior gold miner valuations. The referenced chart showing VanEck Junior Gold Miners ETF (GDXJ) reveals that since November 2009, gold appreciated 191%, yet Junior Gold Miner (GDXJ) ETF declined 36%.

From its December 2010 peak, GDXJ dropped 56%, while gold increased 125%. Regulatory, environmental, and remediation expenses have impacted gold mining sector profitability since 2011, creating a cyclical downturn.

After 14 years, with enhanced environmental standards and moderating regulatory requirements, the junior gold mining sector now approaches parity with gold prices, driven by increasing profitability.

Additionally, due to geopolitical uncertainties, global trade volatility, and inflation concerns, central banks are accumulating gold reserves, having doubled their holdings since 2015, supporting a gold bull market potentially lasting years.

Blue Lagoon Leadership Team Assessment

The connections established during our visit reinforced our confidence that Blue Lagoon possesses the expertise and experience necessary to sustain profitable growth for decades.

During our stay, we participated in two breakfasts, two lunches and two dinners with the team plus two vehicle round trips between the Dome Mine and our Smithers accommodations. These extended interactions provided numerous one-on-one conversations that strengthened our confidence in the leadership. As the sole investment manager and CFA present, and as President of Optima Process Systems, Inc., I posed numerous questions which team members addressed willingly, offering profound insights into this promising early-stage gold producer. Below are profiles of several key individuals we encountered:

Steve Cutler, Founder and President of Roughstock Mining Services serves as Blue Lagoon's Principal Mining Consultant. During a 75-minute drive to the facility, Steve elaborated on narrow vein mining methodologies, addressing my concerns about mine collapses — a scenario he considered highly unlikely. Cutler previously served as Director of Projects at Stillwater, acquired for $2.2 billion by Sebanye in 2017.

He "helped design and manage a number of underground mines using transverse, and longitudinal long hole mining, overhand and underhand cut and fill, and a large variety of other bulk and narrow vein underground mining methods. He has held supervisory positions in a capacity over technical design of underground mine development and stopping since 2000."

Peter Botjos, P. Eng, Strategic Advisor to Blue Lagoon, brings over 50 years of mining industry experience. Peter has revitalized 19 previous operations, with Blue Lagoon representing his 20th such project. He collaborated with an organization that expanded production from 200,000 oz/year to 2 million gold oz. annually. Peter instilled confidence regarding the team's capability to scale Blue Lagoon into a world-class operation should their properties demonstrate the district-scale potential Quentin Hennigh mentioned.

Yannis Tsitos, Blue Lagoon's Mining Committee Chair, contributes over 35 years of mining industry expertise, including 19 years with BHP Billiton. Yanni and I discussed mining's importance to manufacturing processes, business strategies, and confirmed a 2 to 3 million ounce gold potential for Blue Lagoon. "Mr. Tsitos sits on several company boards, has contributed to four deposit discoveries, and has published multiple articles in exploration and mining publications."

William Cronk, P.Geo, Chief Geologist has provided extensive perspective on Blue Lagoon's prospects. He collaborated with Rana since 2019, advancing the project to its current development-stage status. He conducted our facility tour and even transported my son and me to view a nearby glacier 15 minutes away. Bill offered insights regarding crucial development planning required before extraction begins, highlighting locations with most promising new vein opportunities.

Lorie Farrell, Senior Project Geologist, works closely with Bill Cronk. Lorie engaged with me during breakfast, describing her leadership role managing licensing and regulatory processes essential to Blue Lagoon's operations.

Sid Rajeev, CFA, Vice President and Head of Research at Fundamental Research Corp. received compensation for analyzing Blue Lagoon. Following our Smithers meeting, I followed up regarding his analytical methodology. He demonstrated professionalism and helpfulness, though his approach differs from New York hedge fund managers or investment advisors. With his assistance, I gained understanding of his baseline model and rationale for assumptions that underestimate Blue Lagoon Resources' potential. Rajeev presents conservative baseline scenarios, while my responsibility involves identifying undervalued market opportunities like Blue Lagoon Resources, Inc.

Michael White, President and CEO IBK Capital Corp. served as the investment banker initially funding Blue Lagoon Resources. I inquired about mining valuations based on in-ground resources, his mining facility exposure, and impressions regarding Dome Mountain. Per-ounce valuation metrics vary considerably and generally provide unreliable valuation indicators. Mike had toured 12-15 mining operations and expressed admiration for the operational safety standards and structural integrity of the mine walls.

Wayne Kindrat, Cobra Mining & Excavating serves as principal mining contractor for the Dome Mountain Project. Wayne resides in Smithers and has worked intermittently at the location for 30 years, including previous employment under his father at Dome Mountain. Quinton Hennigh identified Wayne as the natural project leader, noting most successful operations feature leadership with "a long deep familiarity with the mine."

Roy Edvardsen, Mine Manager, equipped our group for the facility tour. We completed safety protocols, carried emergency breathing apparatus, and utilized numbered identification tags ensuring nobody remained unaccounted for inside the mine. Edvardsen and the organization maintain stringent operational standards.

Peter Espig, President and CEO of Nicola Mining maintains close partnership with Blue Lagoon through milling agreements and processed a 5000 ton sample in 2021, followed by several equity investments and recent $2 million credit extension to BLAGF. With background as former Goldman Sachs Investment Banker, Fulbright Scholar and private equity professional, Peter maintains close relationships with Blue Lagoon and expresses confidence in their prospects.

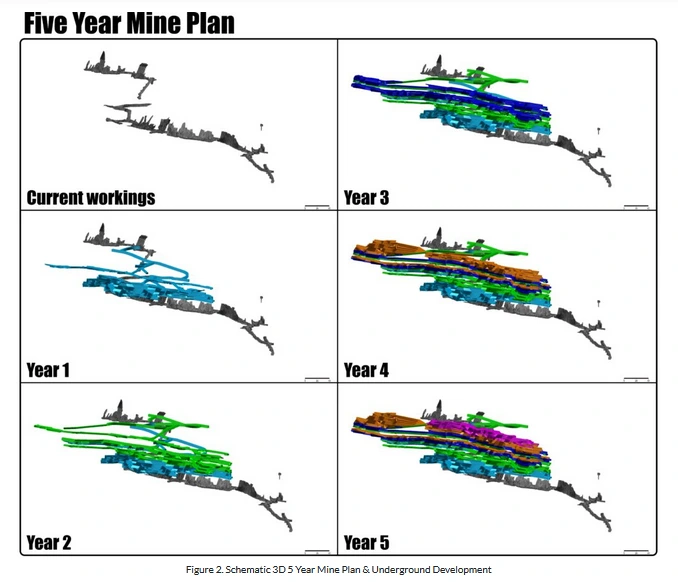

Dome Mountain Gold Development Strategy

The enterprise maintains a 5-year operational blueprint reflecting thoughtful long-term planning as illustrated in the 3D AI mining visualizations below.

The 10% of Dome Mountain currently explored contains 15 veins. As revenue increases, the company will conduct economic modeling for each vein identifying optimal drilling locations. This approach will maximize cash generation while expanding the resource's Measured and Indicated precious metals potential.

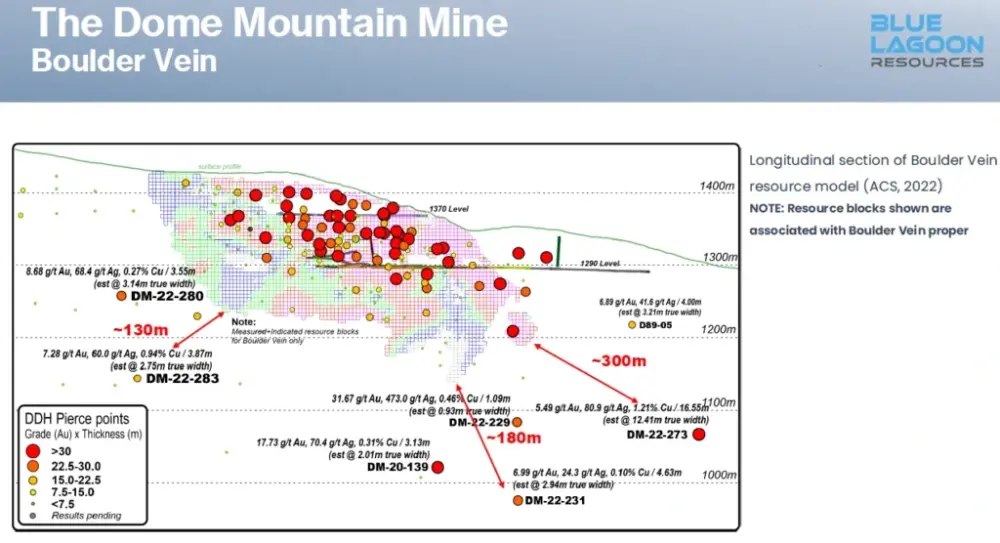

The referenced chart displays intercepts and gold concentrations marked by red indicators. Management and consultants project identifying 1 million measurable ounces within three years.

Looking further ahead, the company will evaluate strategies for their Pellair Gold Project and Big Onion properties. Most significantly, Blue Lagoon Resources can begin investigating the remaining 90% of their holdings to determine the full resource potential.

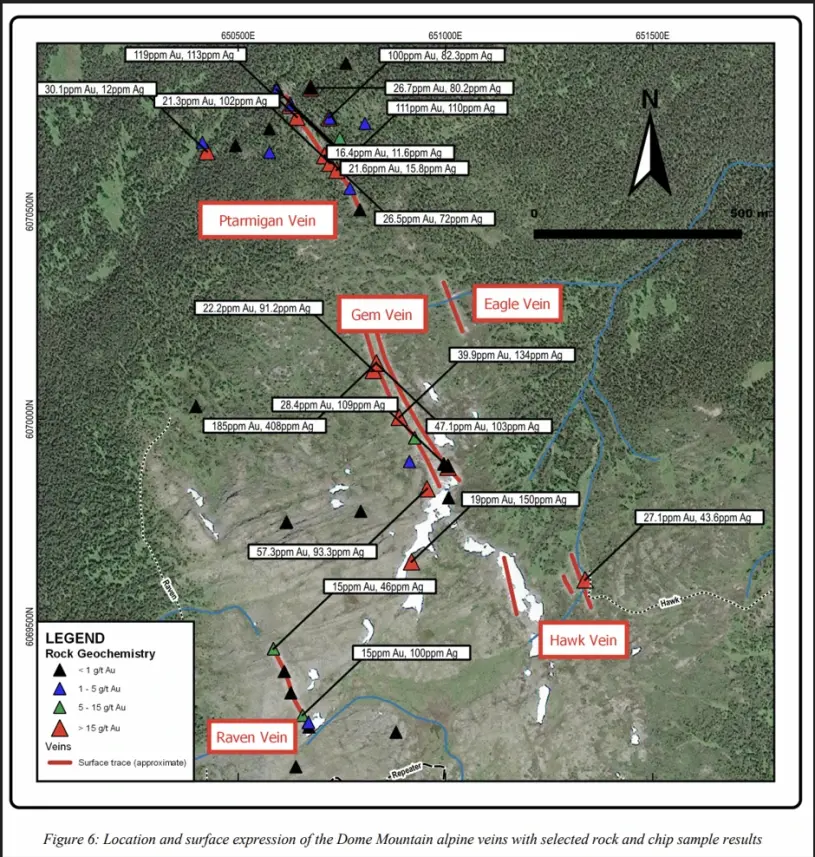

Another chart displays additional veins and gold concentrations. Note the red triangles indicating greater than 15 grams gold per ton and projected veins Blue Lagoon intends to develop in coming months and years.

Technical Trading Analysis

BLAGF and BLLG shares have declined (from $0.64 to $0.445) 30% and (from $0.81 to $0.60) 26% from recent peaks. Shares have also increased tenfold from 2024 lows, while remaining 70% below 2020 highs. As an illiquid emerging growth enterprise with micro-capitalization status, share price volatility exceeds that of established large-capitalization corporations.

The stock appears to be consolidating following its substantial 500% licensing-driven appreciation. Shares appear to have found support and forming a "cup with handle" pattern while markets await MBBR (Moving Bed Biofilm Reactor) commissioning, initial extraction activities, and ore production in late August and September.

Our fundamental assessment indicates Blue Lagoon represents an attractive undervalued gold producer warranting purchase. Long-term investors should utilize current weakness to establish positions without driving share prices higher. Market makers and short sellers may pressure share prices to eliminate weak positions, traders, and impatient retail participants. We view this as a constructive consolidation, similar to the post-mining license approval consolidation from February 6 through April 2. Investors need patience to accumulate during weakness, rather than liquidating during temporary downturns.

Our chart highlights key developments since November 14, when the company received draft mining license approval. We anticipate share price appreciation once the company begins reporting initial operational metrics.

Despite challenging liquidity for institutional investors, speculative retail participants should establish modest positions for long-term holding. Prospects appear favorable that Blue Lagoon will maintain above-average growth for extended periods.

The investment community often notes that "time in the market" rather than "market timing" generates superior returns. This principle has been demonstrated by Warren Buffett and Peter Lynch alongside our most successful clients' experiences. Blue Lagoon potentially represents an exceptional long-term investment. The company's existing resource could support elevated growth rates for years if not decades. We project Blue Lagoon could expand 60-100% annually over the next three years before continuing robust growth rates thereafter.

Blue Lagoon's mining authorization provides a defensible long-term competitive advantage to develop a potentially substantial gold resource. Dome Mountain represents a high-grade gold asset with potential for 2 to 3 million gold ounces that, with additional exploration, could achieve world-class status. Finally, the team we encountered demonstrates extensive experience and specialized skills for narrow vein mining operations. Consequently, we believe this speculative $53 million market capitalization gold producer could represent a generational wealth opportunity capable of delivering compound returns over decades.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Blue Lagoon Resources.

- Tyson Halsey: I, or members of my immediate household or family, own securities of: Blue Lagoon Resources. My company has a financial relationship with: None. My company, Income Growth Advisors, LLC, has purchased Blue Lagoon Resources Inc., mentioned in this article for my investment management clients. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Income Growth Advisors Disclaimer

The information expressed on our website is based upon the interpretation of available data. The data being presented was obtained or derived from sources believed to be accurate, but Tyson Halsey and Income Growth Advisors, LLC

(IGA) cannot and does not guarantee the accuracy of these sources which may be incomplete and/or condensed. The data and information presented is provided for informational purposes only, and is not offered as a basis for trading in securities nor is it offered for that purpose.

Nothing contained herein should be construed as a recommendation to buy or sell any securities.