With a Fed meet, tariff tax deadline, jobs report, and a key inflation report (PCE) all in this week's pipeline, investors need clarity at a time when it seems impossible to get it.

To get that clarity for winning market action, savvy gold bugs have to look beyond the cloud of these reports and events . . . and focus on key action zones for gold.

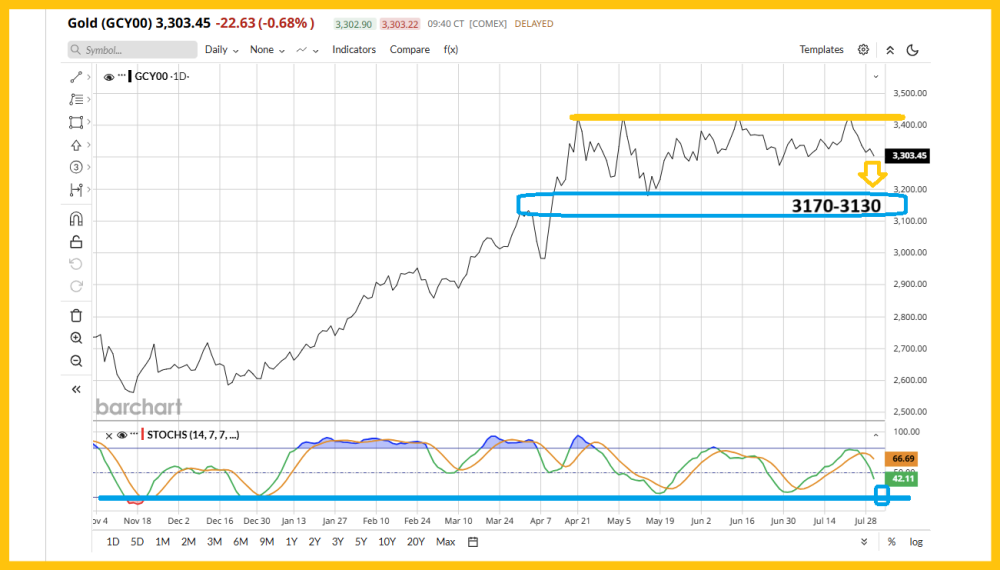

Here's a look at two of those zones on a line chart:

The 3170-3130 appears to be a value zone for bullion buyers and mine stock enthusiasts alike.

The 3440 area is an obvious launchpad if there's a breakout above it and the target of the current consolidation is about $3800.

Here's an interesting SGDJ (Sprott junior miners ETF) chart:

The $49-$48 zone is OK for gambler buys. For investors, the $43-$40 zone offers solid value… and it likely corresponds with $3170-$3130 for gold.

Miners in the GDXJ and SGDJ ETFs tend to follow gold, as do the ETFs themselves.

Here's a look at one of the larger SGDJ components, K92 Mining Inc. (KNT:TSX.V; KNTNF:OTCMKTS):

While it's unknown whether K92 will trade near $9 or whether gold will be around $3170 if that occurs . . . if the scenario does occur investors can buy fairly aggressively.

A move just back to the $12 high would be a 30% move from the buy zone. That's "small potatoes" for a tiny CDNX stock, but for a "junior-intermediate" like K92, it's a substantial gain. . .

And it's a gain that likely occurs in only a 1-2months time frame.

Speaking of the CDNX, here's a look at the daily chart:

Typically, Stochastics (14,7,7 series) tends to go to a sell signal first on the daily chart, then MACD, and finally the TRIX.

The CDNX has staged a very powerful rally in 2025, and a pause would be healthy. My suggestion is to "cool it" on the CDNX stocks for now (but only very temporarily), and focus on the slightly more established GDXJ/SGDJ stocks, and do it basis key buy zones for gold.

Many individual CDNX component stocks have staged "ten bagger" moves (1000%) . . . and more.

A rest is well-deserved.

Here's a look at the GDXJ ETF:

The $67-$65 zone is very similar to the $49-$48 zone for SGDJ; it's a buy zone for gamblers and "nibblers".

The $58-$57 zone is for investors, and it may correlate with the magnificent $3170-$3130 buy zone for gold!

Special Offer for Streetwise Readers: Please send me an Email to [email protected] and I'll send you my free "GDXJ: Key Components For Upside Play!" report. Winning buy and sell tactics are included for eager investors! I write my junior resource stocks newsletter 2-3 times a week, and at just $199/12mths it's an investor favourite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I'll get you onboard. Thank-you.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

mportant Disclosures:

- Stewart Thomson: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?